Wind power is enjoying a prime period in the United States, with record low technology costs spurring strong investment, as local production of components helps projects avoid the worst impacts of Trump’s trade war with China that has hit the solar market hard.

The Wind Technologies Market Report commissioned by the US Department of Energy, has detailed how the combined installed wind energy capacity in the US surged towards 100,000MW in 2018, generating US$11 billion worth of investment in new projects.

The report was prepared by researchers from the Lawrence Berkeley National Laboratory, who were encouraged by the record low prices achieved by wind projects and the competitiveness of wind power with established electricity sources in the US market.

“Wind energy prices – particularly in the central United States, and supported by federal tax incentives – are at all-time lows, with utilities and corporate buyers selecting wind as a low-cost option,” senior scientist at Berkeley Lab Ryan Wiser said.

Solar energy projects, which have been heavily reliant on panels procured from dominant Chinese manufacturers, have been caught in the Trump Administration’s trade war with China, copping tariffs as high as 30% on panels imported into the US.

The DoE report found that wind projects were generally able to achieve high proportions of local content in wind turbine assemblies, including up to 90% of nacelles and towers, and up to 70% of blades and hubs being manufactured within the US.

US based GE commands the largest market share in the US wind energy market at 40%, followed by Danish company Vestas. With the market less reliant on Chinese suppliers, this has allowed wind projects to avoid the import tariffs imposed on components through Trump’s trade war.

Overall, the wind energy sector supports the employment of more than 114,000 people in the United States.

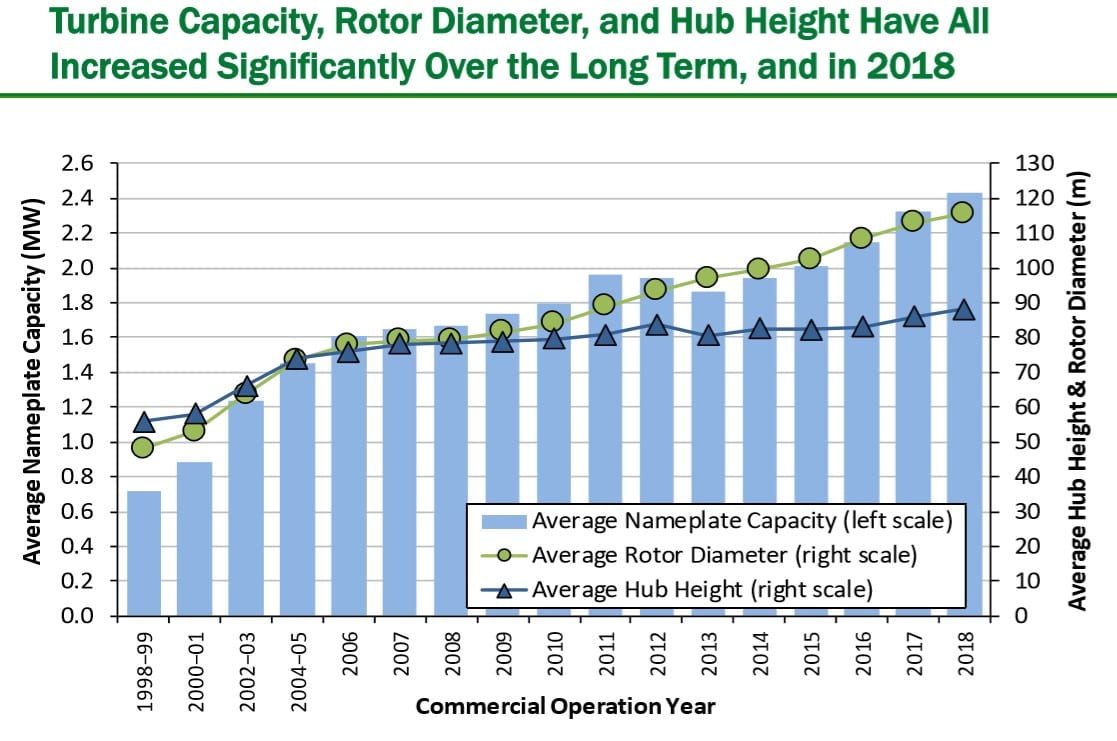

The continued and dramatic cost reductions are still being achieved in the American wind energy sector, through an embrace of bigger and taller wind turbine designs, which have on average doubled in height over the last 20 years and seen blade lengths grow by more than 50 per cent.

The DoE estimates that the cost of installed wind power has fallen to an average of US$1,470 per kW, driven by a 40 per cent reduction in costs since 2010.

In the United States, new wind farms represented 21% of all new capacity additions in the electricity market, and now supplies around 6.5% of the US electricity supply.

However, mirroring the Australian situation, there are a number of US states that are leading the adoption of wind energy and have substantially higher levels of wind energy penetration. Kansas, Iowa and Oklahoma, have wind energy penetrations above 30%, showing that conservative politics is not necessarily incompatible with strong adoption of renewables.

Texas also led the states with the highest new wind capacity additions, with an additional 2,359MW of wind power installed in 2018. Wind power represented the third fasted growing source of electricity generation in the US, behind solar and gas.

On a levelised cost basis, wind power is still reaching record lows in the United States, with the average price of new power purchase agreements dropping below 2 cents per kWh for the second year in a row.

Netting off the benefits of the federal tax credit and other tax incentives would see prices increase by around 1.5 cents per kWh, which reflects the national average unsubsidised cost of $36 per MWh calculated by the DoE.

The was also a wide range of estimates for the ‘market value’ of wind generation, reflecting the average market price of electricity generated by wind farms. Wind energy value was rated as high as $41 per MWh in the New England region, and as low as $17 per MWh in the Southwest where wind penetration was highest (23.9%).

These cost reductions have allowed new wind projects to outcompete and new coal generation developments, and it is other sources of renewable power, notably large-scale solar projects, that are providing the greatest competition in the US market.

The emergence of commercially viable large-scale renewable energy projects has been helped through Obama-era tax credits, that provide a concession on the amount of tax payable to the Federal government. However, these tax credits are expected to expire at the end of next year, with Democrats fighting for an extension to the credits, hoping that a deal can be struck as part of wider negotiations with Republicans.

The credit is expected to be extended, but likely for only an additional five years, with the DoE anticipating that the installation of new wind projects may begin to slow after the expiry of an extended tax credit in 20025.

“Energy analysts project that annual wind power capacity additions will continue at a rapid clip for the next couple years, before declining, driven by the five-year extension of the PTC and the progressive reduction in the value of the credit over time,” the report says.

Michael Mazengarb Michael Mazengarb is a journalist with RenewEconomy, based in Sydney. Before joining RenewEconomy, Michael worked in the renewable energy sector for more than a decade.