The UK continues to scale up its renewable generation capacity, with the technology hitting various key milestones of late. For instance, the end of 2023 saw wind generation achieve a new national record with 21.8GW generated between 8:00 and 8:30 on the 21 December. As such, wind energy managed to secure a 56% stake in GB’s energy mix.

Indeed, one could assume GB is beginning to get used to wind generation records being broken. Between October and December 2022, the nation broke its wind generation record three times. Adding the fact that wind also generated more electricity than gas in Q1 2023, its clear to see that the nation’s expertise on the technology is causing a surge in generation and could well lead to further records being set across the forthcoming year.

However, one might be forgiven for thinking this increase in wind generation capacity would result in a decrease in energy bills for UK consumers.

It is quite right that an increase in renewable generation is a positive factor for GB, particularly on the path to zero emissions and increasing energy security. But the vast sums being pumped into the technology must be matched with investment in grid infrastructure. Indeed, with the UK targeting 50GW of offshore wind by 2030, this investment must be scaled immediately.

But how could curtailment incur additional costs for consumers? According to research conducted by think tank Carbon Tracker and released in July 2023, bottlenecks that exist across the GB grid mean that wind generation assets are paid to switch-off on windy days to be replaced with by other technologies such as gas-fired plants.

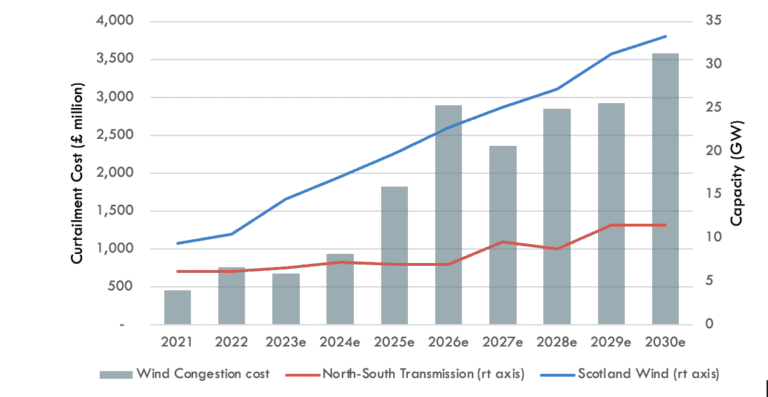

The price to turn these wind generation assets off can be lofty with Carbon Tracker estimating that, with the current level of investment projected for grid infrastructure, annual energy bills could increase by nearly £200 by 2030 – a huge contrast to the positivity surrounding the 50GW offshore wind target.

One area that showcases the impact wind curtailment is having on the UK market is the B6 Scotland-England border. By 2030, Scotland is aiming to have at least 11GW of offshore wind capacity and 20GW of onshore wind capacity. This could cause implications due to the transmission system between the neighbouring countries, meaning that a maximum of 6GW can be transmitted across border; this has often resulted in wind congestion. This issue will continue to affect the GB grid unless new capacity is added – something that is currently being explored through a number of initiatives.

It is also worth noting that National Grid ESO chose Piclo to run a Local Constraint Market (LCM) around the B6 boundary to ease grid constraints, back in December 2022.

Drawing attention to this, Carbon Tracker detailed that, at the time of publishing in July 2023, Scotland had 10GW of wind farms with much of this power exported to England. However, due to the 6GW grid bottleneck on windy days, this generation was curtailed leading to gas stations being fired up adding more costs to energy bills. You can find a graph detailing the curtailment cost below:

Adding to this argument is a report released by Lane Clark & Peacock (LCP) and commissioned by Drax, which outlined that the cost of curtailing wind generation in 2021 hit a record high, costing Britain £507 million, up from £299 million in 2020, bringing the total price of curtailing wind over the two year period to £806 million. Add to this the energy and cost-of-living crises and this curtailment adds additional financial pressure on millions of customers across the country.

Scaling grid infrastructure is vital to avoid curtailment

One of the biggest discussion points – and one that has been explored extensively on Current± – is the topic of grid infrastructure. As mentioned throughout this article, scaling grid infrastructure investment is as important as allocating funds to generation projects. According to a report released by the International Energy Agency (IEA), globally, we need approximately 80 million kilometres of global electric grids to be operational by 2040 to effectively incorporate the projected surge in renewable energy and facilitate the decarbonisation of the power sector.

Now, it’s crucial to understand some of the challenges associated with building new grid infrastructure, especially in the GB market. First of all, the costs are vast for developing the necessary investment needed to facilitate the nation’s energy transition. According to National Grid ESO, developing a grid sufficient for net zero by 2030 could be a £54 billion undertaking – a target that will require collaboration from across the industry to achieve. Failure to do so could cause further curtailment and impact GBs net zero journey.

Another key obstacle to consider when developing grid infrastructure is the time taken to make it operational. In what was considered a “landmark report” in August 2023, Nick Winser, the UK’s electricity networks commissioner, detailed that the “current length of time taken to build new electricity transmission from identification of need to commissioning was 12 to 14 years. Large wind farms are built in half this time”. This staggering timescale is an obstacle that must be rectified for Britain to even have a chance of achieving net zero and ensure the various 2030 targets for renewable generation do not go to waste.

Indeed, this timescale showcases the main issue when factoring in 2030 generation targets, which is now just a mere six years away. If many of these large-scale infrastructure projects require at most 14 years to develop, then immediate actions must be applied to halve these times. To point the government and industry in the right direction, Winser laid out 18 recommendations to reduce costs and timeframes – points which have already been put into practice such as the establishment of a Future System Operator (FSO).

Geopolitics and international affairs have also impacted the rollout of grid infrastructure. Due to the invasion of Ukraine by Russia, global markets have been severely disrupted with many witnessing soaring prices for energy, shortages of critical materials, semiconductors and other components – all of which are roadblocks to the energy transition.

The IEA detailed within a report that copper and aluminium are the principal materials for the manufacturing of cables and lines. It is worth noting that, due to a superior conductivity-to-weight-ratio, aluminium is often used for overhead power lines whereas copper is being increasingly used for underground and subsea cables. A breakdown of both copper and aluminium costs can be found below:

https://flo.uri.sh/visualisation/16409610/embed#?secret=T4vZGyCze1 Image: Solar Media.

As seen on the graph, both these critical materials have seen a rise in costs since 2020 with copper observing substantially higher prices than those in 2016. The result has led to inflated costs for developing large-sale infrastructure projects – something that has already impacted the offshore wind industry in the UK and led to the cancellation of once permitted projects.

Due to inflated costs for grid infrastructure, higher levels of investment are required to procure materials to develop the grid. As such, many companies have turned their attention to other means to reduce curtailment on the grid, one of which being battery energy storage systems (BESS).

An opportunity for battery energy storage

Although the current picture painted in this article appears negative, there is a unique opportunity for battery energy storage to play a role in assisting grid infrastructure upgrades.

Writing for Current± in an exclusive guest blog, Matthew Boulton, director of solar, storage and private wire at EDF Renewables UK, explained that the part energy storage is expected to have in the energy transition is often underestimated with batteries expected to play a “crucial role” in providing the necessary flexibility to the grid.

Instead of the need to curtail wind resources when it is windy, if sufficient battery storage is connected to the grid, this energy could be released instead of firing up gas power plants and additional wind resources could be used to charge up batteries. The result would mean a minimal impact on energy bills to consumers as opposed to the current course of action.

The importance of battery energy storage in the UK energy system is being realised by various organisations including National Grid ESO. In November, ESO unveiled plans to accelerate the connection of up to 10GW of battery energy storge projects across Wales and England. Doing so sends a clear signal to investors and project developers that the technology will become a staple of the energy transition.

It should also be noted that grid infrastructure upgrades, which, as we have previously discussed, can be very costly, could be mitigated through the use of battery energy storage. This opens up other opportunities for capital to be allocated to different renewable technologies such as solar.

With 2023 having seen steps in the right direction for battery storage, 2024 must see further policies developed and enforced to support and incentivise the development of battery storage and long duration energy storage. Failure to do so could put the UKs net zero prospects in jeopardy.