The profile of electricity exchanges between the Iberian Peninsula and France shows interesting results. The Iberian exception represented a profound disruption in the pattern of exchanges between the Iberian and French markets. The analysis of exchanges by months of the year shows that there is still capacity to export more photovoltaic energy to France in the summer months, which removes the fear of a recurrent situation of curtailments and price cannibalization in the coming years.

Electricity flows between electricity markets that are interconnected in the same direction as the price gradient between the markets. The market with a lower matching price exports energy to the market with a higher price. Thus, energy exchanges between two markets reflect the price differences between them.

Electricity exchanges between the Iberian Peninsula and France

The Iberian Peninsula is connected to the rest of the European continent with an electricity exchange capacity of about 3 GW. This interconnection capacity, compared with the generation capacity installed in Spain and Portugal, and with the peninsular demand peaks, turn the Iberian electricity market into an energy island.

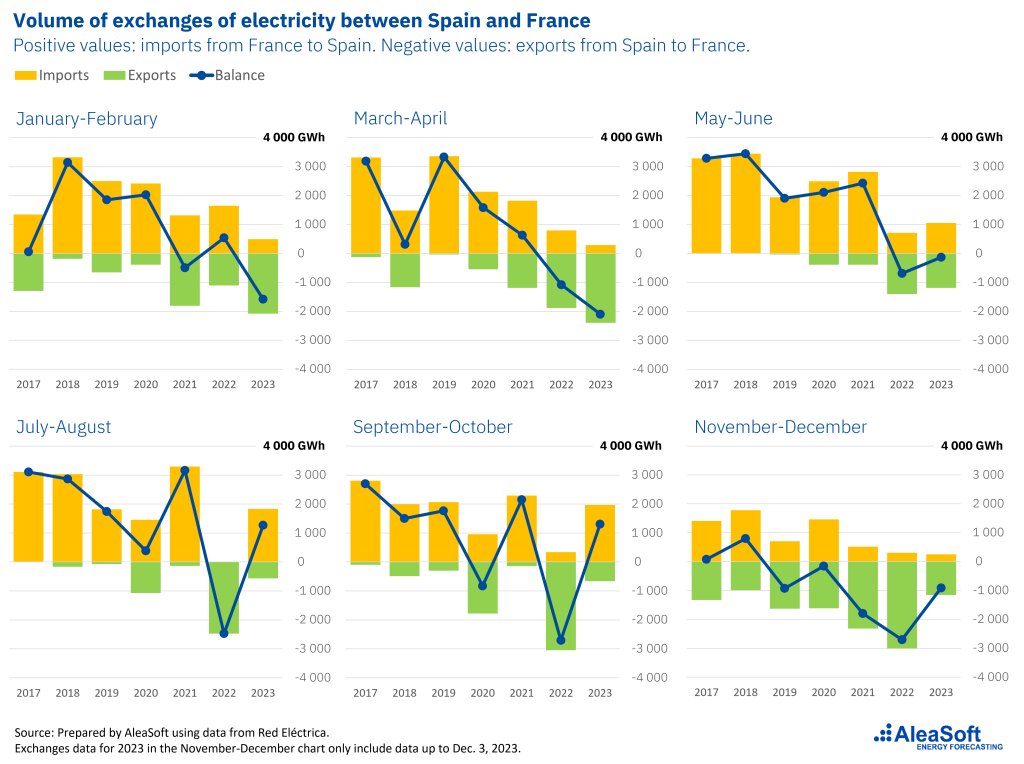

The graph shows the evolution in recent years of the hourly profile of electricity exchanges between the Iberian market and the French electricity market. Negative values indicate an export balance for the Iberian Peninsula and an import balance for France. Positive values indicate an import balance for the Iberian market and an export balance for the French market.

One of the aspects that stands out more clearly from the analysis of the data in the graph is the impact of the Iberian exception on the balance of exchanges in the second half of 2022. When the production cost adjustment mechanism to reduce the price of electricity in the wholesale market came into force, on June 15, 2022, the matching price in the Iberian electricity market became significantly lower than in the rest of European markets. As a result, the price in the French market was higher than in the Iberian market at virtually all hours of the day.

The Iberian exception was effectively applied until February 2023. Thereafter, gas prices have been below the reference price and the adjustment mechanism has not been applied. Thus, from mid?June 2022 to February 2023, the balance of exchanges between France and Spain was clearly in favor of exports for Spain, with an average of around 2 GW at all hours of the day.

The evolution of the Iberian electricity market from an importer to a net exporter is a strategic issue for the energy independence of the Iberian Peninsula given its status of energy island.

Solar photovoltaic energy, renewable energy curtailments and exports to France

A key issue of particular concern in the energy transition is the rise of renewable energy and the possibility of renewable energy curtailments and price cannibalization. It is widely believed that energy storage and international interconnections will be the keys to avoid these problems.

Storage allows storing energy and interconnections allow exporting energy in times of excess production and low prices, solving both curtailments and price cannibalization.

Analyzing the profiles of exchanges with France as of March 2023, when the Iberian exception no longer applies, very interesting conclusions can be drawn. In March and April, there is a clear export profile for Spain, especially during daylight hours. A clear consequence of the low prices registered in spring due to low demand and high photovoltaic and wind energy production.

It is interesting to see how for the summer months, between May and October, with higher solar radiation, the profile ceases to be exporting for Spain. Moreover, the hours with the highest exports are not the hours with the highest solar radiation, as one might expect, given that these are the hours with the lowest prices. In fact, between July and October 2023, the balance is importing for Spain during the hours of sunshine.

Paradoxically, in November 2023, with fewer hours of sunshine, less solar radiation and less photovoltaic energy, the balance during the central hours of the day has become exporting. A profile similar to the one that can be observed for January and February 2022.

The explanation for this phenomenon of the Iberian market of exporting less when there is more photovoltaic energy is explained by the price difference between the markets, caused in part by solar photovoltaic energy and latitude. During the summer months, in the central hours of the day, photovoltaic energy production in Germany can exceed twice the solar energy production of the entire Iberian Peninsula. The German electricity market is strongly coupled to the French market, and both set a clear trend for prices in all markets in Central Europe.

During the winter months, on the contrary, photovoltaic energy production on the Iberian Peninsula far exceeds that of both France and Germany. With higher solar energy production, coupled with lower demand due to less extreme winter temperatures, the Iberian market is able to offer lower prices during sunshine hours and maintain an export balance to the center of the continent.

More room to export renewable energy

With an import balance for the Iberian Peninsula when more photovoltaic energy is generated, the expected increase in renewable energy in the coming years does not seem to pose a serious problem of overproduction. With more renewable energy and more competitive prices, there is still room to export more energy.

With more energy exported, price cannibalization is also less concerning. Prices will fall, but as long as energy can be exported, France will absorb the excess energy that would cause them to fall even further.

By 2030, exchange capacity between Spain and France is expected to grow by more than 5 GW. With increased export capacity, the chances of both recurrent low prices and energy curtailments are reduced.

More and more energy exports

If, in addition to the profile of exchanges, the volume of exchanged energy is analyzed, the conclusion is clear. For the Iberian market, the trend in recent years has been to export more and more electricity to France. The increase of renewable energy in the Iberian Peninsula, mainly solar photovoltaic and wind energy, has led to a decrease in prices compared to the French market. The situation has also been favored by the recurrent problems with nuclear energy in France in recent years, which has led to several episodes of high prices in the French market.