Gas and CO2 prices continued their downward trend in the fourth week of May, which led to a general downward trend in prices in European electricity markets and several negative hourly prices were registered, which reached -€400/MWh in Netherlands. The notable exception of the Iberian market, with a rise in prices, came from the fall in renewable energy production. During the week, records of solar photovoltaic energy production were reached in Germany, France and Italy.

Solar photovoltaic and thermoelectric energy production and wind energy production

In the week of May 22, solar photovoltaic energy production set a daily record in the markets of Germany and France. In the French market, a historical production of 100 GWh was reached on Friday, May 26, while in the German market, on May 27, a record production of 353 GWh was registered. In the Italian market, solar energy production registered a historical weekly record of 725 GWh, breaking the historical weekly record registered on the week of April 24, of 613 GWh.

Compared to the previous week, solar energy production increased in these three markets, being the Italian market the one with the largest increase, of 88%. In the German and French markets the increment in the production with this technology was 16% and 10%, respectively. On the other hand, in the markets of Spain and Portugal, after the records registered during the previous week, the solar energy production decreased by 23% and 17%, respectively.

For the week of May 29, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates that production will increase in Germany and Spain, but that it may drop in Italy

AleaSoft – Solar photovoltaic thermosolar energy production electricity EuropeSource: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

AleaSoft – Solar photovoltaic production profile EuropeSource: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

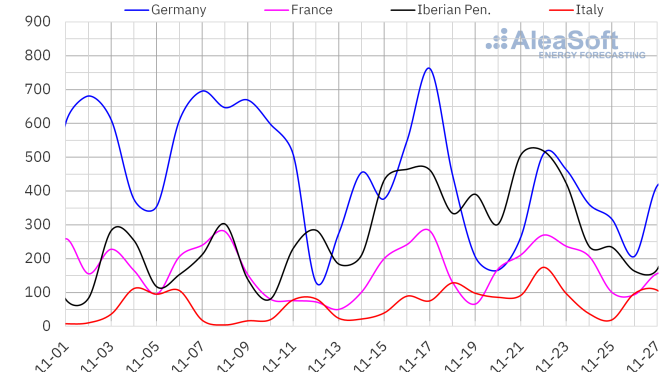

In the fourth week of May, the wind energy production decreased in all of the markets analysed at AleaSoft Energy Forecasting, respect to the previous week. The largest drop was registered in the Italian market, of 47%, followed by the fall of 37% in the Iberian Peninsula. In the German and French markets, the decreases were by 19% and 6.3%, respectively.

For the current week, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates that this downward trend will remain in all analysed markets.

AleaSoft – Wind energy production electricity EuropeSource: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

The fourth week of May finished with a rise in the electricity demand in most of the European electricity markets analysed compared to the previous week. The largest increment, of 3.5%, was registered in the markets of Portugal and Belgium, while in the Spanish market the smallest increment took place, of 0.1%. On the other hand, the markets of Great Britain and France registered decreases in demand of 5.1% and 1.0%, respectively. In the case of the markets of Germany, Belgium and Netherlands, the rise was due to the recovery of the demand after the holyday of May 18, Thursday of Ascension.

Regarding average temperatures, increases were registered compared to the previous week in almost all analysed markets. In the case of Great Britain and France, the rise in temperatures led to the drop in demand in these markets, despite the recovery of demand because of the holiday of May 18 in France.

For the week of May 29, according to the demand forecasting made by AleaSoft Energy Forecasting, the demand is expected to decrease in all the main European markets except in Portugal.

AleaSoft – Electricity demand European countriesSource: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

In the week of May 22, prices in most European electricity markets analysed at AleaSoft Energy Forecasting decreased compared to the previous week. The exception was the MIBEL market of Portugal and Spain, with increases of 64% and 70%, respectively. On the other hand, the largest drop in prices, of 39%, was that of the Nord Pool market of the Nordic countries, while the German, Belgian and French markets remained without large variations. In the rest of the markets, the prices decreased between 9.6% of the IPEX market of Italy and 13% of the EPEX SPOT market of the Netherlands.

In the fourth week of May, weekly prices stayed below €100/MWh in the European markets. The highest average price, of €93.29/MWh, was that of the Italian market. On the other hand, the lowest weekly average was that of the Nordic market, of €13.02/MWh. In the rest of the analysed markets, prices set between €62.40/MWh of the Dutch market and €62.40/MWh of the Portuguese market.

Regarding hourly prices, negative hourly prices were registered in the Dutch market in most of the days of the fourth week of May. On Saturday, May 27, negative hourly prices were also registered in the German, French and Nordic markets. Besides that on these markets, there were also negative hourly prices in the Belgian market on May 28 and 29.The lowest hourly price of the fourth week of May, of ?€400.00/MWh, was registered on Sunday, May 28, from 14:00 to 15:00, in the Dutch market and was the lowest of this market at least since April 2011. In the Nordic market, a new minimum historical record of -€12.93/MWh was reached on Sunday, May 28 from 12:00 to 15:00.

During the week of May 22, the decrease in the average price of gas and CO2 emission rights, as well as the increase in the solar energy production, led to a drop in the European electricity markets prices. However, the decrease in the wind energy production in markets such as the German or the French one partially compensated this downward trend and prices remained stable. On the other hand, in the case of the MIBEL market, the drop in wind energy production in the Iberian Peninsula contributed to an increase in prices in this market.

AleaSoft – solar panels

The AleaSoft Energy Forecasting’s price forecasting indicates that in the first week of June prices may continue to decrease in most of the European electricity markets, influenced by the decrease in demand. On the other hand, prices in the Iberian market may continue to rise, influenced by the low levels of wind energy production.

AleaSoft – European electricity market pricesSource: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

In the fourth week of May, settlement prices of Brent oil futures for the Front?Month in the ICE market stayed above $75/bbl. The weekly minimum settlement price, of $75.99/bbl, was registered on Monday, May 22, and already was 1.0% higher than that of the previous Monday. The increases continued till Wednesday, May 24, when the weekly maximum settlement price was reached, of $78.36/bbl, 1.8% higher than that of the previous Wednesday. On Thursday the settlement price decreased, but in the last session of the week, on Friday, May 26, it recovered till $76.95/bbl. This price was 1.8% higher than that of the previous Friday.

In the week of May 22, the US debt ceiling negotiations continued to influence Brent crude oil futures prices. Moreover, expectations about the upcoming OPEC+ meeting on June 4, as well as possible interest rate rises in the United States, also influenced prices and may continue to do so in the coming days.

As for TTF gas futures in the ICE market for the Front?Month, on Monday, May 22, they reached the weekly maximum settlement price, of €29.71/MWh, although this price was 8.1% lower than that of the previous Monday. During the fourth week of May, settlement prices decreased. As a consequence, on Friday, May 26, the weekly minimum settlement price of €24.52/MWh, was reached. This price was 19% lower than that of the previous Friday and the lowest since May 2021.

In the fourth week of May, the abundant supply of liquefied natural gas continued to exert its downward influence on TTF gas futures prices. Data releases on developments in the German economy and fears about the effects of these developments on demand also contributed to price declines.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2023, on Monday, May 22, they reached the weekly minimum settlement price, of €87.76/t, which was 0.9% higher than that of the previous Monday. However, this price was €2.12/t lower than that of the last session of the previous week. During the rest of the week, prices continued decreasing till registering the weekly minimum settlement price, of €82.30/t, on Friday, May 26. This price was 8.4% lower than that of the previous Friday and the lowest since January.

AleaSoft – Prices gas coal Brent oil CO2Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

The next webinar of the monthly webinar series of Aleasoft Energy Forecasting and AleaGreen will take place on June 8. This edition will have the participation of speakers from Engie Spain, contributing with their extensive experience to the analysis of the financing of renewable energy projects and PPA. In addition, the webinar will analyse the evolution of the energy markets in the coming months, as well as the main regulatory issues in the Spanish electricity sector.

On the other hand, the use of scientifically based probabilistic metrics is essential in long-term price forecasting for renewable energy projects, large consumers, financing, PPA or risk management. AleaSoft Energy Forecasting and AleaGreen’s long-term energy markets price forecasting service includes these metrics for reliable and quality forecasts.