European electricity markets prices fell in the second week of June. In most, the weekly average was below €190/MWh. In addition, negative prices were registered in several markets. Wind and solar energy production increased in almost all markets compared to the previous week, and gas and CO2 prices fell, a combination that favoured declines in electricity markets. Electricity futures prices also fell in most of the markets.

Photovoltaic and solar thermal energy production and wind energy production

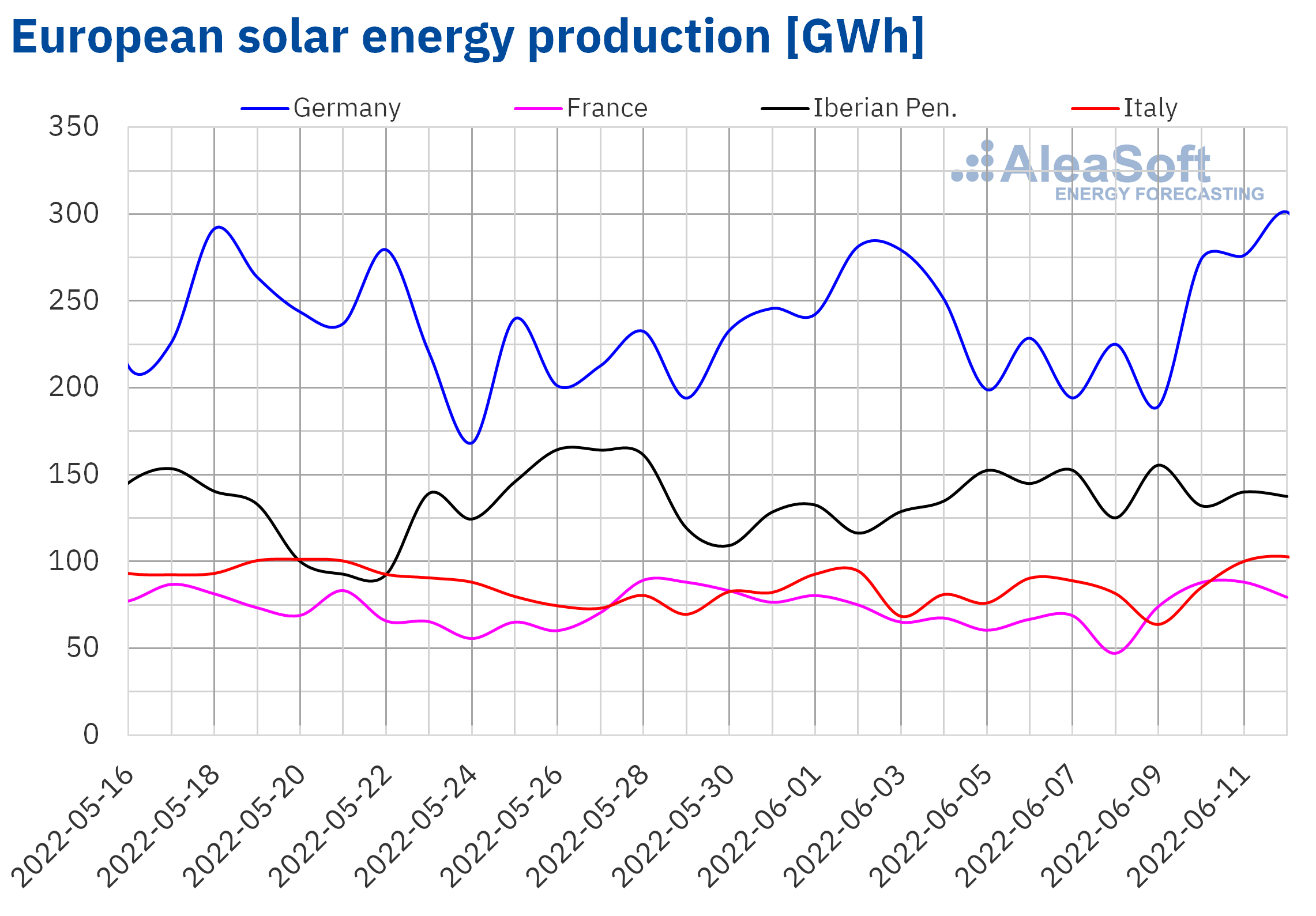

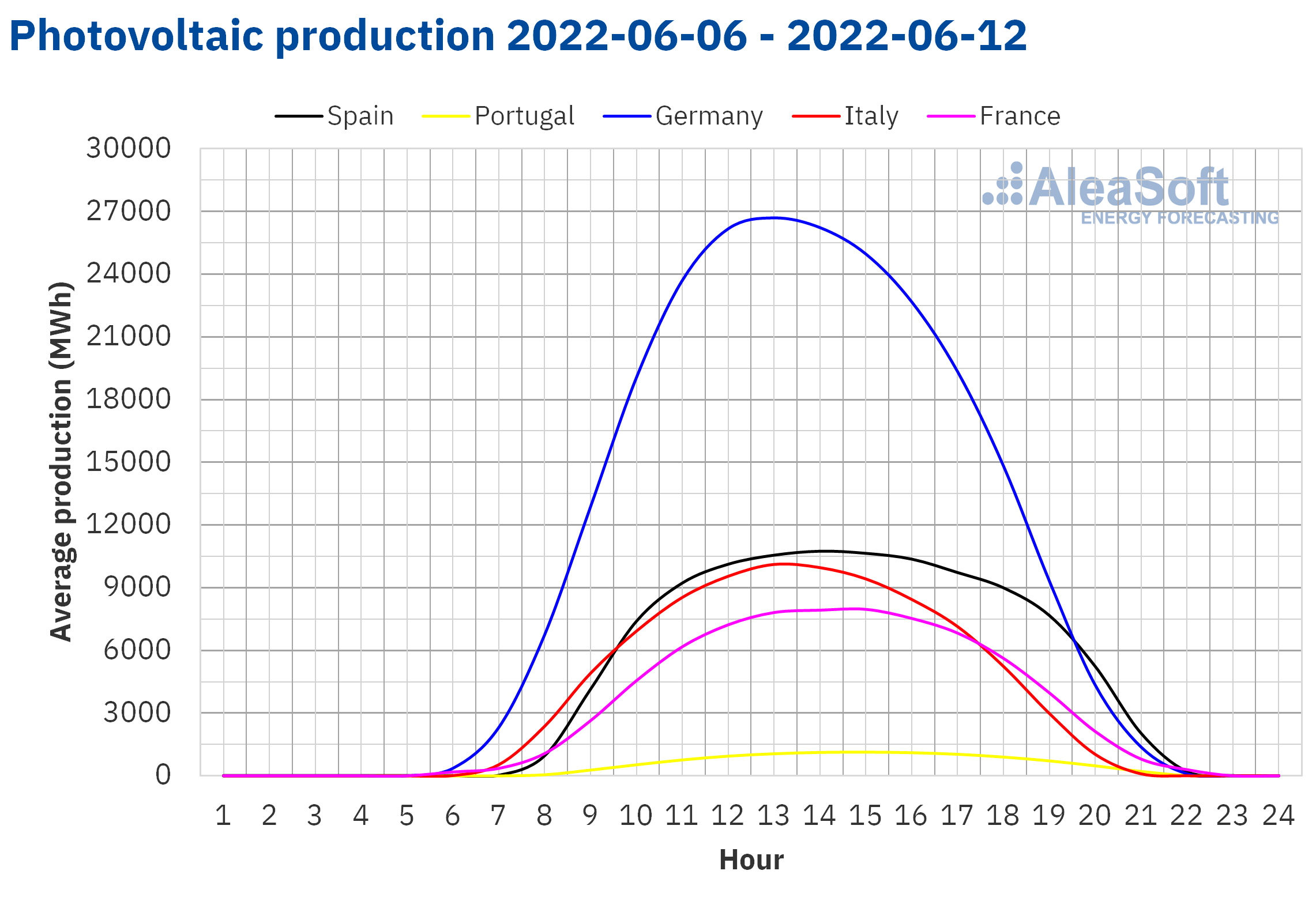

During the week that began on June 6, the solar energy production increased in most of the markets analysed at AleaSoft Energy Forecasting compared to the previous week. The largest increase was 28% and was registered in the Portuguese market, where daily production values remained close to the historical maximum, of 11 GWh, for almost the entire week. In the Spanish market, the production increased by 8.3%, while in the Italian market it increased by 6.0%. In the markets of France and Germany the variations were lower, 0.8% and ?2.5% respectively.

For the week of June 13, the AleaSoft Energy Forecasting’s forecasts indicate an increase in solar energy production in the German and Italian markets, while it is expected to decrease in the Spanish market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

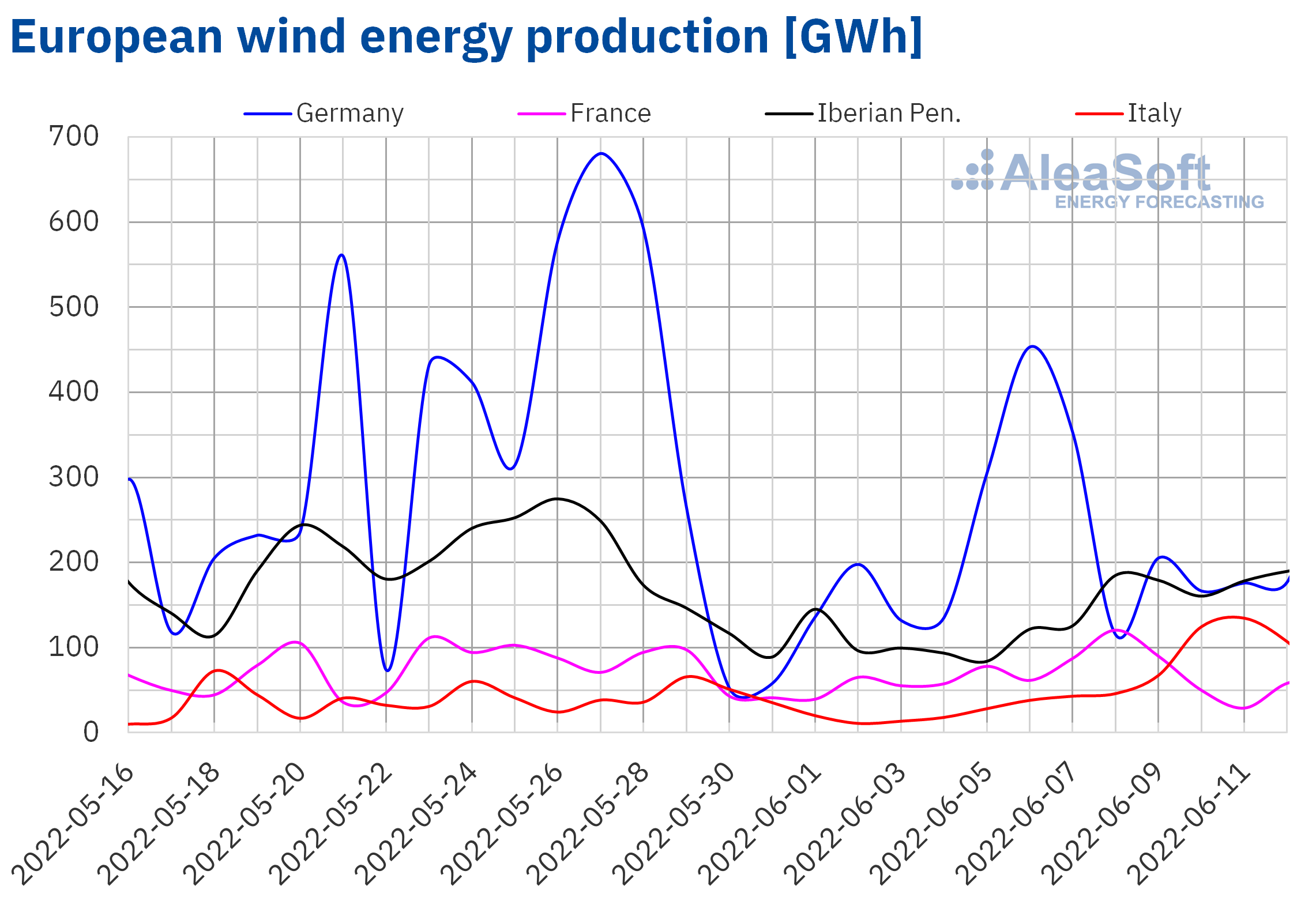

The second week of June ended with a general increase in wind energy production compared to the previous week, in the European markets analysed at AleaSoft Energy Forecasting. The largest increase was reached in the Italian market and it was 216%, after a week, the first of the month, of low production with this technology. In the German market the increase was 62%, in the Iberian Peninsula 57% and in the French market 31%.

For the third week of June, the AleaSoft Energy Forecasting’s forecasts expect a general decrease in wind energy production in the analysed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

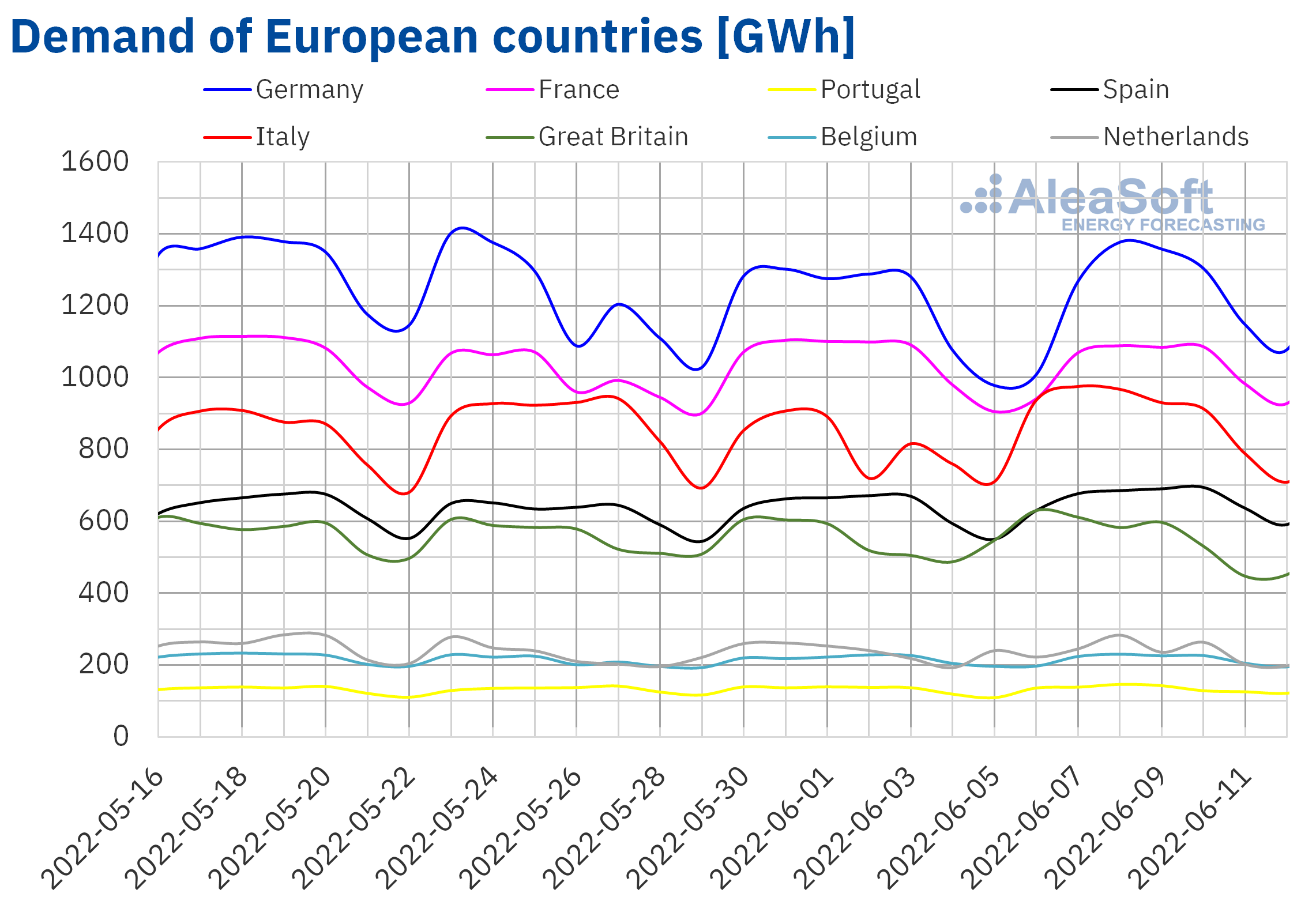

Electricity demand

During the week of June 6, the electricity demand behaved heterogeneously in the analysed European markets. In the markets of Italy, Spain, Portugal and Germany the demand increased. The Italian market was the one with the largest increase in demand, 10%, due to the recovery in labour after the holiday of June 2, Republic Day, which was celebrated in the previous week. In the German market, the demand increased by 0.7% despite the national holiday of June 6 corresponding to Pentecost. The same happened in the Portuguese market, where the demand rose by 2.3% despite the national holiday of June 10, Portugal Day. In the Spanish market the increase in demand was 3.5%. Most of the increases in demand were favoured by the increase in average temperatures during the week that ended in a large part of the analysed markets, with the exception of Italy where average temperatures remained similar.

On the other hand, in the markets of France, the Netherlands, Belgium and Great Britain, the demand behaved downwards. In the case of France, the Netherlands and Belgium, where the demand fell by 2.3%, 1.0% and 0.8% respectively, it was due to the national holiday of Pentecost celebrated on June 6. The British market was the one with the smallest decrease, 0.3%.

For the week of June 13, average temperatures are expected to continue to rise in most of the analysed European markets. In the case of the demand, the AleaSoft Energy Forecasting’s forecasts estimate that it will increase in all markets except Great Britain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

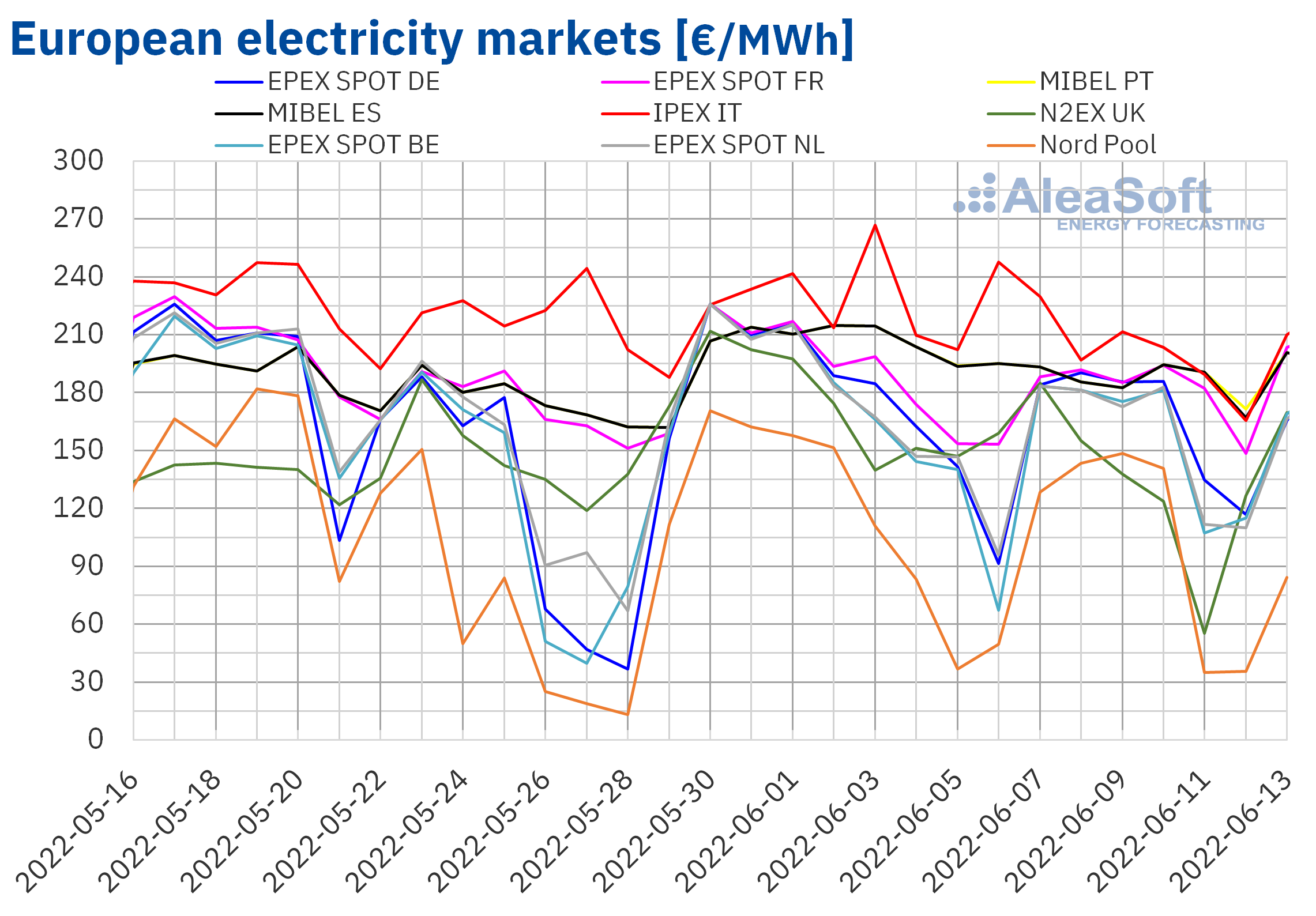

European electricity markets

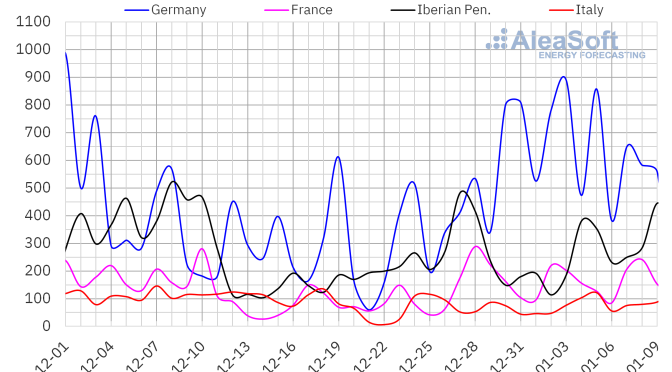

In the week of June 6, the prices of all European electricity markets analysed at AleaSoft Energy Forecasting decreased compared to the previous week. The largest drop was that of the N2EX market of the United Kingdom, of 23%. On the other hand, the smallest decrease, of 9.4%, was that of the IPEX market of Italy, followed by the 9.5% decrease of the EPEX SPOT market of France. In the rest of the markets, the price drops were between 10% of the MIBEL market of Spain and Portugal and 22% of the Nord Pool market of the Nordic countries.

In the second week of June, the average prices were lower than €190/MWh in almost all analysed electricity markets. The exception was the Italian market with a weekly average of €206.27/MWh. On the other hand, the lowest weekly average, of €97.36/MWh, was registered in the Nord Pool market. In the rest of the markets, prices were between €134.59/MWh of the British market and €187.54/MWh of the Portuguese market.

Regarding hourly prices, in the second week of June negative prices were registered in several markets. On June 6, 11 and 12 there were a total of seventeen hours with negative prices in the Belgian market and twelve hours in the Dutch market. On Monday, June 6, three hours with prices below zero were also registered in the German market. While in the case of the British market, it was on June 11 when three hours with negative prices were registered, something that did not happen in that market since the beginning of the year.

During the week of June 6, the general increase in wind energy production and the increase in solar energy production in most markets favoured the decrease in European electricity markets prices. Gas and CO2 prices also decreased, contributing to this behaviour.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the week of June 13 European electricity markets prices might increase influenced by the decrease in wind energy production and the increase in demand in most markets. However, the entry into operation of Royal Decree?law 10/2022 on June 14, which caps gas prices used as a reference in the Iberian market, might favour a drop in prices in this market.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

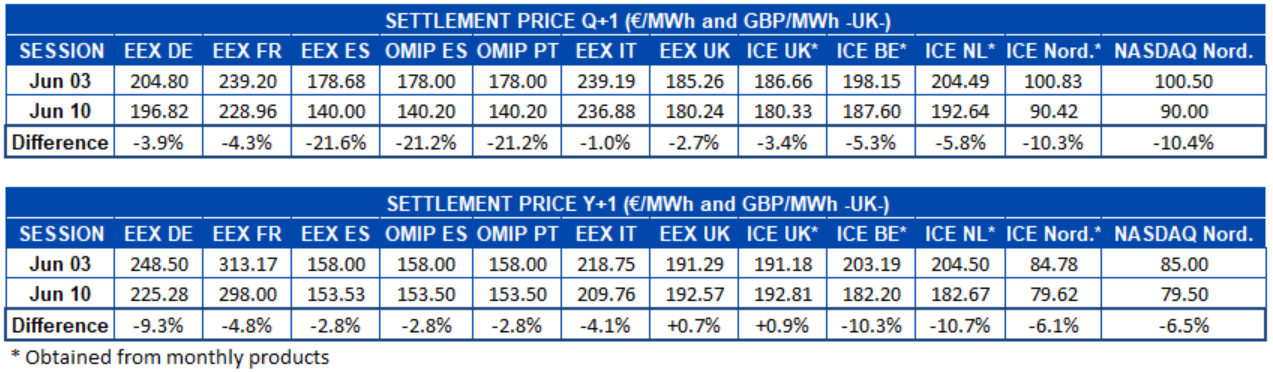

Electricity futures

Electricity futures prices for the third quarter of 2022 registered decreases between the sessions of June 3 and 10 in all markets analysed at AleaSoft Energy Forecasting. The decreases were between 1.0% registered in the EEX market of Italy and 22% that was marked in the EEX market of Spain.

Regarding electricity futures prices for the next year 2023, the behaviour was different. Although the majority behaviour was also downward, in the United Kingdom prices rose, both in the EEX market and in the ICE market, by 0.7% and 0.9% respectively. In the rest of the markets, the decreases were between 2.8% marked in the OMIP market of Spain and Portugal for both cases and the EEX market of Spain, and 11% registered in the ICE market of the Netherlands.

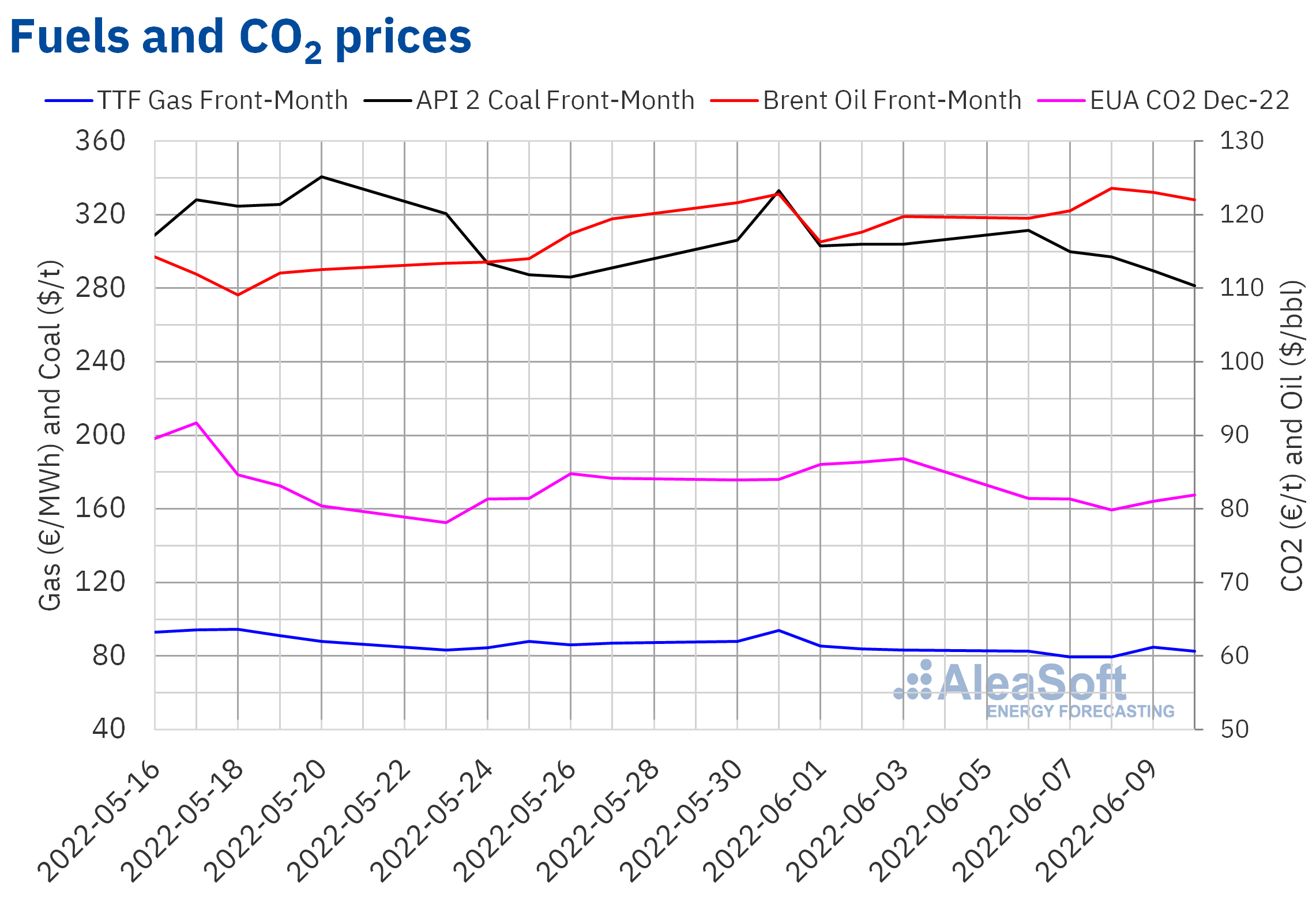

Brent, fuels and CO2

Brent oil futures for the Front?Month in the ICE market, on Monday, June 6, registered a settlement price of $119.51/bbl, 1.8% lower than that of the previous Monday. But on Tuesday and Wednesday prices increased. As a consequence, on Wednesday, June 8, the weekly maximum settlement price, of $123.58/bbl, was reached. This price was 6.3% higher than that of the same day of the previous week and the highest since March 8. Subsequently, prices fell again and on Friday, June 10, the settlement price was $122.01/bbl.

In the second week of June, doubts about the ability of some OPEC member countries to increase their production levels as planned and expectations about the recovery of the demand in China allowed prices to rise until reaching the maximum of Wednesday, June 8. However, new lockdowns were imposed in China on Thursday and the affected areas were expanded on Friday. Furthermore, in the latter part of the second week of June, news of inflation data in the United States and concerns about the effects of the economic situation on demand also contributed to price declines. On the other hand, the recent beginning of a wage agreement in the Norwegian oil and gas sector prevented a strike from starting on Sunday, June 12, which might have affected production levels of this country.

As for settlement prices of TTF gas futures in the ICE market for the Front?Month, during the week of June 6 they remained below €85/MWh. On Wednesday, June 8, the weekly minimum settlement price, of €79.41/MWh, was registered, which was 7.2% lower than that of the previous Wednesday. However, on Thursday, June 9, prices increased by 6.9% compared to the previous day and the maximum settlement price of the week, of €84.88/MWh, was reached. This settlement price was 1.1% higher than that of the previous Thursday. But on Friday the settlement price fell again to €82.46/MWh.

Supply levels allowed prices to be lower on most days of the second week of June than on the same days of the previous week. The price increase of Thursday was influenced by the news of the closure of a plant in the United States from which liquefied natural gas was exported due to a fire.

Regarding settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2022, the second week of June remained below €82/t. This week all days had settlement prices lower than those of the same days of the previous week. The minimum settlement price of the week, of €79.82/t, was registered on Wednesday, June 8. This price was 7.3% lower than that of the same day of the previous week and the lowest since May 23. The rest of the days of the week, settlement prices exceeded €81/t. The weekly maximum settlement price, of €81.87/t, was reached on Friday, June 10, but this price was still 5.8% lower than that of the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

On June 9, the 23rd edition of the monthly webinars of AleaSoft Energy Forecasting and AleaGreen took place, with the participation of guest speakers from Engie Spain. The webinar analysed the evolution of the European energy markets in recent weeks and the prospects in the mid? and long?term. In addition, the renewable energy projects financing and the PPA market were analysed. As for regulatory novelties, the cost adjustment mechanism in the wholesale electricity market published in Royal Decree?law 10/2022, which will come into operation on June 14, played a major role. This RDL 10/2022 establishes a cap on gas price that will be taken as a reference for sale offers of combined cycle gas turbines and cogeneration in the Iberian market. Price forecasts for the Iberian electricity market of AleaSoft Energy Forecasting and AleaGreen already take into account the RDL 10/2022 effects in all horizons. Interested people can request the recording of the webinar.

In the next webinar of AleaSoft Energy Forecasting and AleaGreen, the vision of the future of green hydrogen will be analysed, due to the importance that this renewable gas will have in the energy transition. The webinar will feature the participation of Africa Castro, Business Development at H2B2, a company specialised in green hydrogen. The webinar will take place on July 14 and the usual analysis of the evolution and perspectives of the European energy markets will also be carried out.