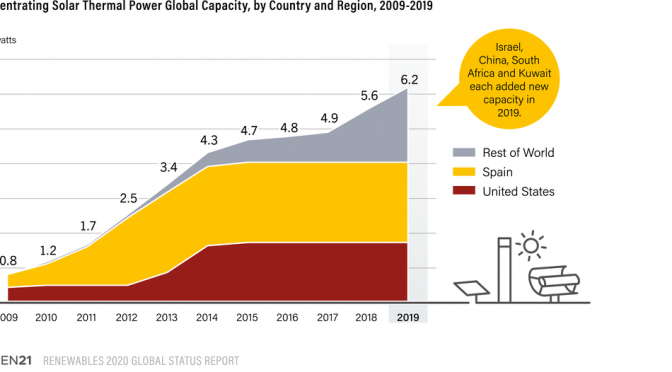

Global Concentrated Solar Power capacity grew 11% in 2019 to 6.2 GW, with 600 MW of capacity coming online. Although this was well below the average annual increase (24%) of the past decade, Concentrating Solar Power continued to spread to new markets, including France, Israel and Kuwait.

China and South Africa also brought new plants into service. For the first time, as much tower capacity as parabolic trough capacity was completed during 2019.

At year’s end, an estimated 21 GWh of thermal energy storage (TES) was operating in conjunction with Concentrated Solar Power plants across five continents. Nearly all commercial CSP under construction – located in Asia, the Middle East and Latin America – will include TES.

The solar thermal industry has become more geographically diverse, both in the locations of commercial plants and in the origins of developers, investors and contractors. Levelised costs of energy from Concentrated Solar Power continued to decline during 2018 and 2019, with CSP increasingly being built alongside both solar PV and wind power to lower costs and increase capacity value. R&D activities during the year focused on further improving CSP economics and on addressing environmental impacts.

Global solar thermal capacity grew 11% in 2019 to 6.2 GW, with 600 MW of capacity coming online. This was down from the 700 MW commissioned in 2018 and well below the average annual increase (24%) of the past decade.

However, CSP continued to spread to new markets, and more than 1.1 GW of additional capacity was under construction at year’s end.

Five countries brought new CSP plants into operation during the year: Israel led the market in new additions, followed by China, South Africa, Kuwait and France. Israel, Kuwait and France saw the implementation of their first commercial CSP capacity.

For the fourth consecutive year, all new CSP capacity came online outside of Spain and the United States, the two leading countries for cumulative capacity since the technology was first

commercialised in the 1980s.

For the first time, as much tower capacity as parabolic trough capacity was completed in 2019. Each of these technologies represented around 45% of total additions, and linear Fresnel plants accounted for the remaining 10%. However, parabolic trough plants continue to represent the majority of total global installed capacity. At year’s end, the plants under construction worldwide included just under 0.9 GW of trough systems, just

under 0.3 GW of tower systems and a 14 MW Fresnel system.

With the exception of two hybrid CSP-natural gas plants, all of these plants will include thermal energy storage (TES).

Israel added more CSP capacity than any other country in 2019, bringing online 242 MW, including the 121 MW Megalim tower plant (no TES) and the 121 MW Negev parabolic trough plant with molten salt storage (4.5 hours; 495 MWh). The projects are Israel’s first two commercial CSP facilities and the country’s largest renewable energy plants of any type. The Megalim project also includes the world’s tallest solar tower, at 240 metres high.

China followed with a total of 200 MW of capacity completed in four CSP plants of 50 MW each, all with molten salt TES.The projects include the Dacheng Dunhuang Fresnel plant (13 hours; 650 MWh), the Power Qinghai Gonghe tower plant (6 hours; 300 MWh), the CPECC Hami tower plant (8 hours; 400 MWh) and the Luneng Haixi tower plant (12 hours; 600 MWh).

The first three of the new plants are among 20 CSP “demonstration” plants that were announced by China’s National Energy Administration in 2017; 5 of the plants were operational at the end of 2019. The plants completed during the year brought the country’s total CSP capacity to 420 MW. At year’s end, China had an additional 250 MW of both parabolic trough and tower capacity under construction, in parallel with 2.4 GWh of TES.

In South Africa, the 100 MW Kathu parabolic trough plant (4.5 hours; 450 MWh) entered commercial operations, bringing the country’s total installed CSP capacity to 500 MW.

An additional 100 MW of tower capacity was approaching construction during 2019. However, further development of the South African CSP sector was in doubt following the release in

late 2019 of the country’s Integrated Resource Plan (IRP), which makes no capacity allocations for CSP before 2030.

Kuwait brought its first CSP capacity online with the opening of the 50 MW Shagaya parabolic trough plant (9 hours; 450 MWh).

This is the first phase of a planned 3 GW renewable energy park that will incorporate multiple renewable energy technologies, including wind power and solar PV.

The Shagaya plant is part of a growing market in the Middle East and North Africa (MENA) region, where 15 plants totalling almost 1.8 GW accounted for nearly 30% of global capacity in operation at the end of 2019.

Capacity in the region is expected to increase significantly with completion of the Noor 1 Energy project under construction in the United Arab Emirates. The Noor 1 project will include 700 MW of CSP capacity, consisting of three 200 MW parabolic trough plants and a 100 MW tower plant, coupled with 15 hours of storage capacity.

The smallest CSP plant to reach commercial operations in 2019 was the 9 MW eLLO Fresnel plant (4 hours; 36 MWh), the first commercial CSP facility in France. Although no other commercial CSP projects were being built in Europe during the year, a Chinese consortium was selected for the engineering, procurement and construction of a 52 MW (5 hours; 260 MWh) tower project on the Greek island of Crete; the project is planned for operation in 2020.

In addition, construction continued on the 110 MW Cerro Dominador project in Chile (17.5 hours TES). Construction began in 2014 and has been hampered by delays, but the plant was expected to be operational in 2020. Despite significant past

CSP development activity, Cerro Dominador remains the only CSP plant in Chile to have passed the development phase and entered construction.

For cumulative capacity in operation, Spain remained the global leader with 2.3 GW at the end of 2019, followed by the United States with just over 1.7 GW. With no new capacity additions in six years, Spain’s share of global CSP capacity in operation declined from a high of nearly 80% in 2012 to just under 40% by the end of 2019.

The United States, which has added no new CSP capacity since 2015, was home to just under 30% of global CSP capacity by the end of 2019.34 Neither country had new facilities under construction at year’s end, although the Spanish government announced plans to increase installed capacity 5 GW by 2030.

All of the commercial CSP capacity under construction by the end of 2019 was in Asia (China and India), the Middle East (United Arab Emirates and Saudi Arabia) and Latin America (Chile).

The pipeline of CSP projects under construction reached around 1.1 GW, with the United Arab Emirates accounting for more than 60% of this capacity.

Nearly all of these projects will include thermal energy storage, which improves plant economics and increases system benefits – such as providing relatively dispatchable electricity and grid flexibility – which can support the integration of higher shares of variable renewable electricity in power systems.

At the end of 2019, an estimated 21 GWhi of TES, based almost entirely on molten salts, was operating in conjunction with CSP plants across five continents.

Of the 23 CSP plants completed globally since the end of 2014, only two do not incorporate TES: an ISCC facility in Saudi Arabia and the Megalim plant in Israel.

ren21.net