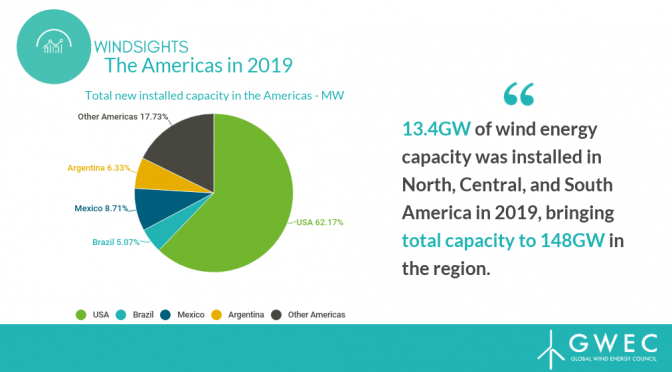

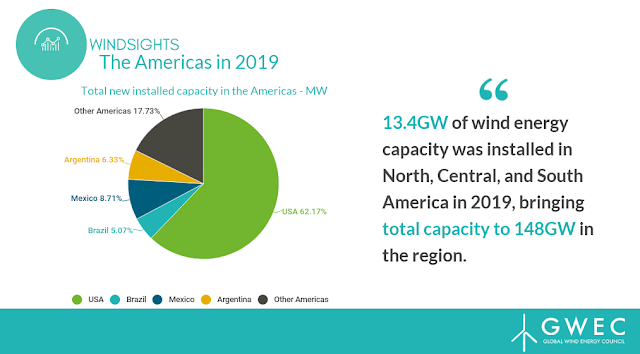

North, Central, and South America and the Caribbean installed 13,427 MW of wind energy capacity in 2019, an increase of 12 per cent from 2018’s wind turbines installations.

Total installed wind farm capacity in North, Central, and South America and the Caribbean is now over 148GW, thereby tripling the wind power capacity in the region over the past 10 years.

The surge for wind power in the Americas is expected to continue with GWEC forecasting over 220GW new capacity between 2020 to 2024.

Regulatory and political instability in key Latin American markets for wind power along with the US-China trade war will be major challenges for further accelerating wind power growth in the Americas.

The latest data released by the Global Wind Energy Council (GWEC) shows North, Central and South America and the Caribbean installed 13,427MW capacity of onshore wind power in 2019, an increase of 12 per cent on the previous year which saw 11,892MW installed.

In North America (Canada and USA), new capacity additions grew by nearly 18 per cent compared to 2018. In Central and South America and the Caribbean, new capacity additions decreased by 5 per cent compared to 2018. Overall, this means that the region has tripled its wind power installations since 2010, showing the immense progress made by wind energy as leading power source in the Americas.

In North America, the US saw an installation rush last year with nearly 10 GW installed. This was driven primarily by the Production Tax Credit (PTC) phase out and is expected to continue driving installations in 2020, while the recently approved one-year PTC extension is likely to create a new installation rush in 2024. In Central and South America and the Caribbean, strong growth has occurred in key markets such as Mexico, Argentina and Brazil. However, the outlook for wind power in the next two to three years in some of these markets – namely Argentina and Brazil – is threatened by regulatory and political challenges.

Key insights from the data include:

- Leading countries in the region for 2019 include: US (9,143W), Mexico (1,284MW), Argentina (931 MW), and Brazil (745MW)

- The US installed its third largest volume of onshore wind in 2019 at 9GW, just behind its previous records of 10GW in 2009 and 13GW in 2012, reaching a total of over 105 GW.

- The offshore market in the US is progressing, with first large-scale installations expected in 2022-2023 and more than 10GW expected to be built by 2026. Brazil is also looking to tap into the offshore market, and has the potential to deploy as much as 700GW of offshore wind, according to a roadmap for offshore wind released by the country’s Energy Research Office (EPE) in January 2020.

Ben Backwell, CEO of GWEC, said: “It is encouraging to see that installation levels for wind energy in the Americas are continuing to rise. However, policymakers need to be doing more to accelerate these volumes and take advantage of the full potential wind power has to offer. Meanwhile, the ongoing trade war between the US and China continues to constitute a threat for the industry, as tariffs on steel and aluminium, which make up about 90 per cent of wind turbines, put price pressure on the US supply chain and risk increasing wind power projects by as much as 10 per cent”.

Ramón Fiestas, Chair of GWEC’s Latin America Committee, said: “Latin America has massive potential for wind energy, and we have seen many countries in the region emerge in recent years as renewable energy leaders through auctions which have delivered wind energy at some of the most competitive prices globally. New markets such as Colombia, which successfully executed its first renewable energy auction in 2019, and existing ones like Chile, which saw a record year installing 526MW, show that there is still great untapped potential in the region. Yet, with the cancelling of planned auctions and changes to the clean energy credits scheme in Mexico in 2019 as well as political and economic shifts in Argentina leading to uncertainty for future auctions, these key markets risk losing the momentum which they have worked so hard to create and missing out on a massive opportunity to transform their energy systems to cleaner and cheaper wind power”.