Wind energy has emerged as one of the most economical ways to add new generating capacity.

Yet, while falling prices are helping to move wind power into new markets and driving up sales, the highly competitive environment is causing a decrease in the number of wind turbine manufacturers.

The global transition from FITs to more-competitive mechanisms, such as auctions and tenders, has resulted in intense price competition that is squeezing the entire value chain and challenging wind turbine manufacturers and wind farm developers alike.

Further, wind

power’s success is coming with new challenges, including some

inadequately planned projects resulting from poorly designed and

executed tenders, as well as limitations of power systems

and markets that were designed for centralised, large-scale fossil power.

The

industry is meeting these challenges with ongoing technology advances

(including larger wind turbines) that are increasing energy production

per wind turbine, improving plant efficiency and output, and reducing

the levelised cost of electricity from wind energy.

Auctions and

tenders were held in more than 15 countries, and a total of 17.8 GW of

wind farm capacity contracts (14.5 GW onshore and 3.3 GW offshore) were

allocated in 2018.

It was another year of highly competitive auctions, although there was a slowdown in the decline in bid levels and equipment prices relative to the previous two years.

Average winning bid levelsi for onshore wind energy were close to USD 20 per MWh (down from around USD 30 per MWh in 2017) in several countries – including Brazil, India and Saudi Arabia.

In Europe, tenders in Denmark, Greece and Poland saw extremely low prices (for example, in Denmark, EUR 21.5 (USD 24.6) per MWh) due to a strong pipeline of permitted wind farm projects.

By contrast, France and Germany both held onshore wind power tenders that were under-subscribed, with France’s second tender of the year bringing in only 118 MW of the 500 MW on offer (due to legal uncertainty regarding permitting authorisations), and Germany’s bid prices increased during the year (due to frequent rule changes and permitting challenges).

Germany saw some “zero-subsidy” bids for offshore auctions (capacity due online starting in 2024), and the Netherlands held successful “subsidy-free” tenders for offshore capacity (due online starting in 2023).

In

these cases, winning wind farm projects would receive only the wholesale

price of electricity and in-kind support, and no direct government

subsidies; however, zero-subsidy bids remain the exception.

In the US

state of Colorado, record-low PPA bids were set for stand-alone onshore

wind power projects (median price of USD 18.1 per MWh) as well as for

wind-storage hybrids (median price of USD 21 per MWh) for projects

scheduled to come online in 2023.

Contract prices for US offshore

wind energy fell 75% between the Block Island (Rhode Island) project in

2014 (USD 244 per MWh) and the 800 MW Vineyard Wind project in 2018.

In

response to the decline in bid prices over the past few years, several

governments and state-owned utilities (for example, in Chinese Taipei,

France and India) have sought to renegotiate wind energy purchase

agreement price levels (onshore and offshore) that were set under tender

contracts or PPAs.

These developments are a sign of the rapid

speed at which prices have fallen (without a similar decrease in costs

along the wind energy value chain); but there is also concern that they

risk undermining investor confidence and stalling domestic markets.

The

global shift to auctions has fundamentally altered the economics of the

wind industry, with orders based on government timelines and developers

pushed to compete harder to win projects. These changes have

accelerated a race to the bottom on price, which forces equipment makers

to adapt quickly or lose out on contracts.

As prices fall (often faster than costs) and as increased competition squeezes the margins for wind turbine manufacturers, even some of the biggest manufacturers are seeing smaller profits, despite increasing unit sales, and are seeking ways to cut costs further in both operations and wind turbine production.

Those with the means are developing new revenue streams, moving into project development, acquiring new subsidiaries and expanding into new services (such as O&M, where margins are higher) and even moving beyond their core business (into areas such as electric vehicle charging).

At the same time, many service providers are expanding into new areas, such as distribution of spare parts.

Severe

competition is causing further consolidation among wind turbine

manufacturers, and it pushed seven small turbine equipment manufacturers

out of the market in 2018.

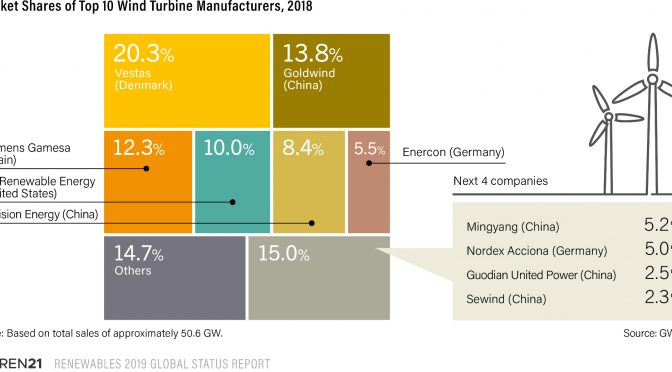

And while 37 manufacturers in 2018

delivered wind turbines to the global market, the top 10 companies

captured an 85% share (up from 80% in 2017 and 75% in 2016).

The top five manufacturers alone accounted for nearly two-thirds of the wind turbines delivered in 2018.

Vestas (Denmark) again led the pack, with more than one-fifth of the global market, due in part to the company’s wide geographic spread, with sales in 36 countries.

Vestas was followed by China-based Goldwind,

which traded spots with Siemens Gamesa (Spain), and by GE Renewable

Energy (United States) and Envision (China), which replaced Enercon

(Germany).

Of the top 10 wind turbine manufacturers, half are based

in China, although Chinese manufacturers continued to rely almost

entirely on their home market.

German-based Senvion, which ranked

ninth globally in 2017, filed for insolvency in early 2019, following

project delays, a shrinking home market, falling prices

and increased competition.

While

most wind turbine manufacturing takes place in China, the EU, India and

the United States, the manufacture of components (such as blades), the

assembly of wind turbines and the locations of company offices are

spreading to be close to growing wind energy markets – including

Argentina, Australia and the Russian Federation – as companies seek to

reduce transport costs and to access new sources of revenue.

For

example, Argentina’s Newsan partnered with Vestas to convert an existing

manufacturing facility in Buenos Aires into an assembly plant for wind

turbines.

Major manufacturers, including GE Renewable Energy and

Siemens Gamesa, are focused increasingly on the repowering market

segment.

Historically, repowering has involved the replacement of old wind turbines with fewer, larger, taller, and moreefficient and reliable machines at the same site, but increasingly operators are switching even relatively new machines for larger and upgraded wind turbines (including software improvements) or are replacing specific components, such as blades (partial repowering).

Such partial repowering can extend turbine lifetime while greatly increasing a wind farm’s performance.

Siemens

Gamesa, for example, makes blade tip extensions to improve the output

of existing turbines in lower-wind areas and has developed upgrades to

make the company’s turbines more aerodynamic.

Nearly every major turbine manufacturer offers various upgrading services.

During

2018, repowering took place at several of Europe’s onshore wind farms

where turbines were decommissioned, even though there are no government

programmes for repowering.

By one estimate, 460 MW of Europe’s capacity was repowered, mostly in Germany but also

in Austria, France, Portugal and Spain.

In

the United States, the extension of federal tax credits – enabling

project owners to extend turbine lifetime, increase output and reduce

O&M costs, while also qualifying for another decade of credits –

has incentivised (partial) repowering of existing assets.

An estimated 1.2 GW of US capacity was partially repowered and 0.1 GW was replaced during 2018.

Turbine

manufacturers are speeding the pace of innovation to reduce their

machines’ LCOE in order to compete, particularly in offshore wind

auctions, and to help manage wind energy’s integration into

electricity grids.

Technology

advances continue to be made in several types of wind turbines (to

match available wind resources), which are customised to meet various

conditions, as well as in tower and blade materials, logistics and

transport to move ever-larger wind turbines and components, and digital

and other advanced technologies for designing, operating and maintaining

wind farms – all advances that can help improve efficiencies and drive

down costs.

During 2018, GE Renewable Energy launched a new system

that uses thermal imaging and acoustic spectral analysis to check for

defects in blades, and MHI Vestas launched a set of next generation

smart tools for design assessment, turbine monitoring and real-time

decision making.

Manufacturers continued to announce new turbine models for specific markets, both onshore and offshore.

Most large manufacturers are focusing on tested and well-proven turbine platforms that provide flexibility and that enable them to more easily develop turbines for specific markets while minimising costs.

In

early 2019, for example, Vestas introduced a single turbine platform

that can produce customised solutions for low, medium and high wind

speed conditions.

To address the increasing need to balance energy

supply with grid demand, turbine manufacturers and project developers

continued to develop hybrid projects, combining wind power with other

renewable technologies as well as storage systems.

In several countries, aggregators are combining portfolios of wind power with solar PV and other renewable technologies.

Developers

also are increasingly looking to hedge against the variability of wind

(and solar) energy, purchasing insurance to insure their revenue and

attract better financing. In 2018, investment manager Nephila Holdings

Ltd (Bermuda) and insurance giant Allianz SE (Germany) joined together

to offer a new insurance policy to wind farm developers. The risk is

spread across a global portfolio of renewable energy projects.

The

general trend continued towards larger machines –including longer

blades, larger rotor size and higher hub heights– as turbine

manufacturers aimed to boost output and to gain or maintain market

share. The average size of turbines delivered to market in 2018 was 2%

larger than in 2017, at 2.45 MW.

By country, the largest averages

were seen in the United Kingdom (nearly 4 MW), Germany and Denmark

(nearly 3.8 MW) and Canada (3.3 MW), with averages exceeding 2 MW in all

other established markets.

Significant differences in average

turbine ratings can occur within regions; on land in Europe, for

example, differences result from regulatory restrictions on height, age

of projects and/or wind speeds.

Offshore, developers are taking advantage of larger turbines as soon as they become available.

Larger turbines mean that fewer foundations, converters, cables and other resources are required for the same output; this translates into faster project development, reduced risk, lower grid-connection and O&M costs, and overall greater yield.

The size of turbines as well as projects has increased rapidly in order to reduce costs through

scale and standardisation.

Across

Europe, the average per-unit capacity of newly installed wind turbines

offshore was 6.8 MW in 2018, 15% larger than the average in 2017; the

largest wind turbines installed in 2018 were 8.8 MW machines connected

off the UK coast.

Turbines are set to get only bigger, with several major manufacturers announcing machines of 10 MW and up, scheduled for sale and delivery starting in 2021.

This trend comes with new challenges related to design, manufacturing, logistics and installation.

The

offshore wind power industry also continued to make advances towards

the deployment of floating turbines, which offer the potential to expand

the areas where offshore wind energy is viable and economically

attractive because they can be placed where winds are strongest and most

consistent, rather than where the sea-floor topography is suitable.

Several

configurations for floating substructures continued to be developed and

demonstrated in 2018, with a few floating structures commissioned (in

the United Kingdom and France) during the year, including a new type of

substructure for France’s Floatgen Project.

Also in 2018, the

European Investment Bank granted a EUR 60 million (USD 68.7 million)

loan to a joint venture for construction of a 25 MW floating wind farm

in Portuguese waters, a vote of confidence for a technology that is

still in the early stages; the venture, Windfloat Atlantic, is the first

project-financed floating wind farm.

In addition, a consortium of

companies was selected to develop a project off the US coast of

northern California; and innogy SE (Germany), Shell (Netherlands) and

Steisdal Offshore Technologies (SOT, Denmark) partnered to build a

demonstration project off Norway using SOT’s modular floating foundation

concept, which can be fully industrialised and deployed without

installation vessels.

Turbine manufacturers are moving production

facilities to port areas to address transport challenges caused by ever

larger, heavier turbine components for offshore projects.

This has led to a variety of dedicated facilities and vessels for handling and transport, such as purpose-built roll-on/roll-off ships with extendable ramps controlled by hydraulic systems, and the offshore jack-up vessel with large capacity cranes to lift heavy nacelles.

Siemens Gamesa fully implemented its roll-on/roll-off concept in early 2018 and believes that this technology, which eliminates the need for cranes to move heavy components on and off of ships, can reduce logistics costs by 20%.

Increasingly, drones are being used in combination with

artificial intelligence to monitor and service turbines offshore and on

land to reduce costs, improve safety of workers and boost performance.

New

offshore markets still face challenges that Europe and China have

addressed, including developing supply chains and associated

infrastructure such as ports, rail links and installation vessels, as

well as technology for electrical connections.

But there are

efforts to change that. In Japan and the Republic of Korea, local

turbine suppliers are investing in the development of new, larger wind

turbines to advance a local offshore industry and supply chain, and, in

early 2019, Norway’s Equinor (formerly Statoil) and state-run Korea

National Oil Corporation agreed to jointly pursue commercial floating

offshore wind power off the Korean coast.

In the United States, major

energy, marine transport and other related businesses are competing to

participate in harnessing offshore wind energy at scale.

In 2018, for example, Siemens Gamesa and Denmark’s Ørsted signed a contract for the first offshore wind farm to be built in US federal waters (off Virginia), EDF (France) and Shell formed a joint venture to acquire a lease area (off New Jersey), and Equinor won a lease auction to build a 1 GW wind farm (off New York).

The marine transport company Reinauer Group (United States) formed a unit dedicated to supporting the US offshore wind industry, and Aeolus Energy Group (United States) announced plans to build a fleet of vessels capable of installing 10-12 MW wind turbines.

Interest also increased among US oil and gas

companies, many of which are exploring how they can play a role in the

offshore wind energy sector.

Even as the offshore industry has begun

to take off in many regions, contraction in the global market for

small-scale turbines has continued to have negative impacts on that

industry. The number of producers of small-scale machines in China and

the United States has declined sharply in recent years, with

manufacturers of small-scale wind turbines relying heavily on export

markets, which also are in decline.

In 2018, UK-based Gaia-Wind

entered liquidation, and US-based Northern Power Systems temporarily

suspended activities following the expiration of the FIT in Italy, the

company’s primary market.

In response to declining markets, manufacturers of small-scale wind turbines are exploring new business opportunities.

US-based United Wind partnered on an initiative that enables organic farmers in the United States to lease small-scale turbines with long-term fixed monthly electricity rates.

Some companies are promoting their expertise in providing electricity access in remote and rural areas in the developing world, while others are looking to energy storage and other options to expand or realign their business models.

https://ren21.filecloudonline.com/url/ysphuvhv4tyxcpm4

https://www.evwind.es/2019/06/18/renewables-now-supply-more-than-a-quarter-26-of-global-electricity/67622https://www.evwind.com/2019/06/18/energias-renovables-la-transformacion-del-sector-electrico-se-esta-acelerando/