The US Overseas Private Investment Corporation (OPIC), a Washington-run development finance agency, is close to finalising a deal to invest US$400 million in a wind farm project in Zaporizhia in southeastern Ukraine.

This was revealed by the group’s new president, Ray Washburne, in a meeting last week with Ukrainian Prime Minister Volodymyr Groysman and Finance Minister Oleksandr Danyliuk. OPIC has also discussed insurance for US$250 million in funds to be used by Ukraine’s nuclear operator Energoatom to purchase US technology.

The US$1 billion EuroCape New Energy Ukraine project in Zaporizhia will nearly double the country’s wind power capacity. Once finished, it will be Europe’s largest onshore wind power plant, with a capacity of 500 MW generated by 3.3-MW turbines. The project also provides for the construction of an overhead transmission line that will connect the power plant to the 330-kV Melitopol substation, which will be modernised.

Ukraine’s state-owned power utility Ukrenergo warned in July that EuroCape was in danger of having its contract to supply electricity annulled because of delays. The project has been under way since 2008, when the company opened an office in Ukraine.

EuroCape New Energy said last year that the completion of the wind farm was slated for 2020. The company is based in Monaco and has wind generating facilities in France and Poland in addition to Ukraine.

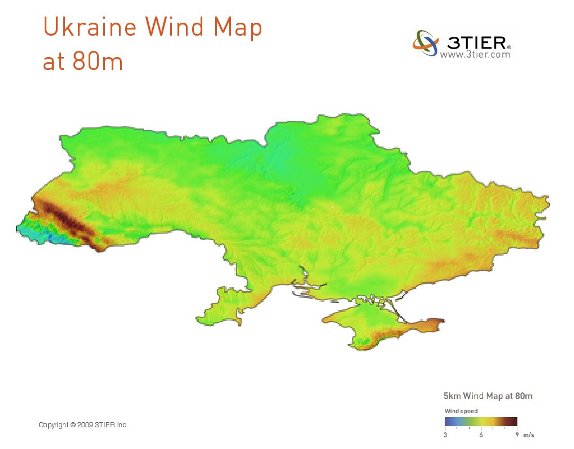

As of late last year, Ukraine’s installed wind capacity was 514 MW, according to the European Wind Association. This places it far ahead of fellow former Soviet states Russia and Belarus, which control 15.4 MW and 3.4 MW respectively. However, its capacity is dwarfed by that of neighbouring EU member state Poland, which has 5,100 MW.

Washburne, a Texas investor who was active in US President Donald Trump’s presidential campaign, received US Senate confirmation of his appointment at OPIC at the start of August. He arrived in Ukraine after spending a day in Kazakhstan, where he attended the EXPO International Fair on Future Energy. It was his first international trip in his new capacity.

“I came to Ukraine to show that we’re committed to the country,” Washburne said in The Kyiv Post. “We’ve got a full pipeline of deals that we’re looking at in everything from health to oil to gas to small business lending.”

Additionally, Washburne and Danyliuk discussed political risk insurance for breach of contract for capital markets on a US$250 million loan from Bank of America Merrill Lynch to Energoatom to build a central spent nuclear fuel storage facility.

The total cost of the project is US$410 million and it is anticipated to store about 169,000 tonnes of spent nuclear fuel per year, saving Energoatom US$50 million per year which it currently pays to Russia to take its waste. The US loan will go for procurement of storage, transfer and transportation canisters, engineering services, labour, and related equipment being supplied by US company Holtec International. A final decision on funding for this project will be made on September 14.

According to Ukranews.com, Energoatom and Holtec signed a contract in 2005 for 94 storage systems for a facility to be set up in the Chernobyl exclusion zone. The systems will be produced in Ukraine after the initial 94 are used.

OPIC has a budget of up to US$29 billion, but it is currently slated for defunding under the proposed 2018 US federal budget. A recent report by Republican members of the House of Representatives criticised it because “its investment decisions are heavily politicised, which means that many OPIC-financed projects, rather than help the least well off, end up enriching the politically connected.”

Set up during the Nixon administration in 1971, OPIC describes its functions as providing businesses with the tools to manage the risks associated with foreign direct investment, fostering economic development in emerging market countries and advancing US foreign policy and national security priorities.

It has a US$21.5 billion portfolio that consists of 668 projects in 160 countries. Its 14 previous Ukrainian projects are worth US$522 million, including a US$400 million liquidity facility granted earlier this year to guarantee a debt up to US$500 million provided by the IFC and EBRD to Naftohaz for natural gas purchases.