A growing trend is reshaping many of the nation’s largest corporations, and the renewables industry is at the center of it. It began with tech giants like Google, Facebook, Apple and Amazon, but has continued with a diversity of firms including Ikea, M&M Mars, General Motors, SC Johnson, Honda, Whirlpool and others.

These companies are making real investments in renewable energy because they make good business sense. Their actions are not driven by simple publicity or branding, but by business strategies that anticipate long-term market changes, and future years will prove these firms’ foresight.

More than a decade ago, many brand-conscious companies began “green power purchasing” programs, often buying renewable energy credits (RECs) to demonstrate their commitment to sustainability. While these actions were a laudable first step, RECs are merely derivatives, and purchasing them on a short-term basis rarely put new renewables on the grid or displaced carbon pollution.

In contrast, the long-term contracts signed by the aforementioned companies are real, measurable and additional. They put green power to work. It’s not just a PR move.

In this space, Google is the leader. The search giant has signed five, long-term power-purchase agreements with wind farms in Iowa, Texas, Oklahoma and Sweden to provide 585 megawatts of wind energy to its data centers, and has developed other supply agreements for over 450 MW of new wind in Oklahoma and Iowa.

In addition, the company has made over $1.5 billion in direct investment in clean energy wind and solar projects. Their investments in wind energy include funding $75 million in the Panhandle 2 wind farm, and $200 million in the 161 megawatt Spinning Spur wind farm, both in Texas. In Iowa, Google has invested $75 million in the Rippey Wind farm. The $38.8 million Peace Garden wind farm in North Dakota was Google’s first investment in a utility-scale renewable energy project. Google also invested $100 million in the Shepherd’s Flat wind farm in Oregon and $157 million in the Alta Wind Energy Center in Southern California. Rumor has it the behemoth company is searching for more deals.

Not to be left out of its social circle, Facebook has contracted to buy 162 MW of wind power from MidAmerican Energy projects in Iowa, and Amazon Web Services recently jumped into the mix with the purchase of 150MW of prime Indiana wind from Pattern Energy. Microsoft excels in this arena too, purchasing 175 MW of wind from an EDF wind farm in Illinois last year.

But it’s not just the tech sector. Last year, IKEA assembled the capital to purchase the 98-MW Hoopeston Wind Farm in Illinois, making the company more than just an off-taker, but the owner of a major US wind farm. Earlier in the year, Mars Corporation (maker of M&Ms, Snickers, Wrigley’s Gum, Lifesavers and Uncle Ben’s) signed a sweet, long-term offtake deal for the REC output of a Texas wind farm.

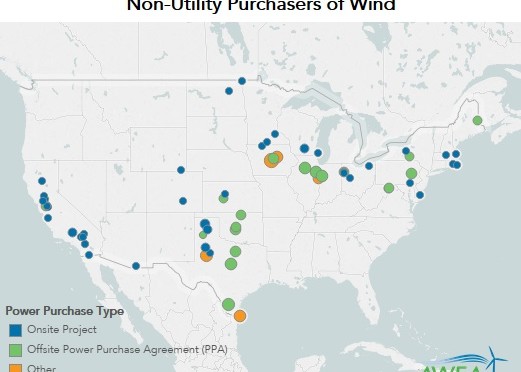

Other Midwest companies have chosen to build on-site wind generation. SC Johnson put the wind in Windex when it built two utility-scale turbines at their facility in Racine, Wisconsin, and Whirlpool is creating clean jobs from a 5-turbine installation at its dishwasher manufacturing plant in Findlay, Ohio.

In the auto sector, Honda had the insight to install two turbines at their plant in Russells Point, Ohio. General Motors is also cruising toward real sustainability, and has made a commitment to reach 125 megawatts of renewable energy use in their global operations. The company signed a deal to power its Detroit-Hamtramck plant with municipal waste in 2013, and last year built a 2.2MW solar facility at its Lordstown plant.

These corporate purchasers are becoming a new demand driver for the renewable energy sector; and there are three primary reasons fueling the trend:

- Economics. It’s just good business. For a large power consumer, locking in low, stable rates over a long time period is a hedge against future price increases and helps drive a return on investment for shareholders.

- Principles. The leadership of these companies believes in being good stewards of our earth. They believe in preserving and protecting our environment and want to walk the walk.

- Image. Let’s face it: PR still plays a role here. These firms are brand-conscious, and part of their brand is sustainability. But these firms put their money where their mouth is.

These moves are long-term commitments worth hundreds of millions. Smart businesses don’t spend that kind of money on vapid marketing. These are business decisions.

These companies are embracing renewables, to control costs, manage risk, and support their sustainability objectives. This has created a new business niche for companies like Altenex LLC, which has entered the match-making business for these large customers, developing market-based solutions for finding renewable energy projects that can meet the power requirements and future energy mix objectives of the growing number of large-scale corporate purchasers.

This is a cross-post from Wind on the Wires.