As every year, BloombergNEF has released its report “2023 Global Wind Turbine Market Shares” detailing the installation figures of wind turbines worldwide by manufacturer and their corresponding market shares. Please note, the figures refer to installations (indeed, they refer to commissioned turbines, i.e., those put into operation) and not orders. Just to clarify.

Here are some highlights, some of which are reported in the press, others are self-collected, and others are from this LinkedIn post by Cristian Bogdan, one of the analysts who participated in the study.

Global wind power installation in 2023 reached a new record with 118 GW. This was mainly due to significant growth in China.

Global wind power installation in 2023 reached a new record with 118 GW. This was mainly due to significant growth in China.

China accounted for two-thirds of the installations, while the United States was the second country with 7.2 GW installed.

China accounted for two-thirds of the installations, while the United States was the second country with 7.2 GW installed.

The Chinese domestic market is the largest but also the most fragmented, with over 12 local manufacturers and strong price competition.

The Chinese domestic market is the largest but also the most fragmented, with over 12 local manufacturers and strong price competition.

According to Bloomberg, the price of wind turbines from Chinese manufacturers in markets outside China is 20% lower than those from Western manufacturers.

According to Bloomberg, the price of wind turbines from Chinese manufacturers in markets outside China is 20% lower than those from Western manufacturers.

According to Bloomberg, European Union countries installed 15.3 GW, which is 0.8 GW less than the figure reported by Wind Europe (16.1 GW). You can find an analysis of the European market figures here.

According to Bloomberg, European Union countries installed 15.3 GW, which is 0.8 GW less than the figure reported by Wind Europe (16.1 GW). You can find an analysis of the European market figures here.

Around 98% of the installed capacity by Chinese manufacturers was in their domestic market, indicating that their international business is still minimal.

Around 98% of the installed capacity by Chinese manufacturers was in their domestic market, indicating that their international business is still minimal.

Nevertheless, according to Bloomberg, Chinese OEMs commissioned 1.7 GW in 20 foreign markets, including five EU member states.

Nevertheless, according to Bloomberg, Chinese OEMs commissioned 1.7 GW in 20 foreign markets, including five EU member states.

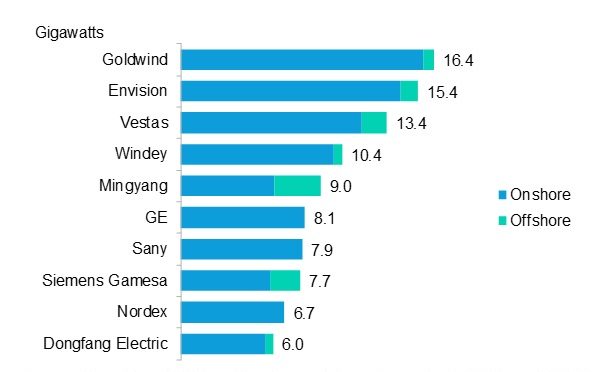

Goldwind repeated as the manufacturer with the highest number of installed GWs, reaching 16.4 GW, of which 95% were in China.

Goldwind repeated as the manufacturer with the highest number of installed GWs, reaching 16.4 GW, of which 95% were in China.

Envision has surpassed Vestas to claim the second position with 15.4 GW, primarily driven by growth in its domestic market.

Envision has surpassed Vestas to claim the second position with 15.4 GW, primarily driven by growth in its domestic market.

Vestas holds the third position with 13.4 GW and is the only European manufacturer among the top 5. This Danish manufacturer is the only European company in the Top 5.

Vestas holds the third position with 13.4 GW and is the only European manufacturer among the top 5. This Danish manufacturer is the only European company in the Top 5.

General Electric, which was third in 2022, falls to sixth place, mainly due to reduced installations in the United States, where it remains the number one supplier.

General Electric, which was third in 2022, falls to sixth place, mainly due to reduced installations in the United States, where it remains the number one supplier.

Windey, perhaps one of the lesser-known Chinese OEMs in the West in terms of impact, ranks fourth with 10.4 GW.

Windey, perhaps one of the lesser-known Chinese OEMs in the West in terms of impact, ranks fourth with 10.4 GW.

Nordex surpasses Siemens Gamesa in onshore installations, likely the first time this has happened since their respective mergers (Siemens-Gamesa and Nordex-Acciona).

Nordex surpasses Siemens Gamesa in onshore installations, likely the first time this has happened since their respective mergers (Siemens-Gamesa and Nordex-Acciona).

Of the total installations, 90% were onshore and 11 GW were offshore, of which 7.6 GW were in China. Mingyang installed 3 GW offshore, thus becoming the top player in offshore wind, a position typically held by Siemens Gamesa.

Of the total installations, 90% were onshore and 11 GW were offshore, of which 7.6 GW were in China. Mingyang installed 3 GW offshore, thus becoming the top player in offshore wind, a position typically held by Siemens Gamesa.

_

Vestas will sell a single unit of the V236-15.0 MW to be installed at the port of Thyborøn, Denmark

Vestas will sell a single unit of the V236-15.0 MW to be installed at the port of Thyborøn, Denmark

Vestas has received an order for a single unit of its offshore turbine V236-15.0 MW to be installed at the port of Thyborøn, in northwest Denmark.

Truth be told, this news has surprised me, as it’s very uncommon for a contract to be made for a single machine of these characteristics.

Moreover, this contract is also special because the turbine has been funded by 2,800 local shareholders, who also expect to turn it into a tourist attraction. Doing a rough calculation, it comes out to 7,000-10,000 euros per shareholder to have the turbine operational.

In summary, some Danes have chipped in to buy a V236. Quite an interesting move

The order, in addition to the wind turbine, includes a 20-year maintenance contract and an agreement allowing Vestas to use that turbine for testing and verification purposes. Vestas itself states on its website that this unit will assist in the final verification campaign before starting serial production and the installation of the first offshore projects, expected in 2025.

Delivery of the turbine is expected to begin in the first quarter of 2024, with final commissioning scheduled for the second quarter of 2024.

This is undoubtedly a significant move by Vestas, which can surely include many lessons learned from the Østerild prototype and test them before starting to deliver 100% commercial units. Additionally, instead of having to pay for a new prototype entirely, it has secured a customer to cover the costs.

This project/contract format somewhat reminds me of the N155/5.X prototype that Nordex has in Navarra and is owned by the German company RWE.

Another very interesting aspect is that the permitting process for the project by the municipality took only 264 days. Additionally, the local support from the citizens of Thyborøn has been overwhelmingly positive.

Vestas will sell a single unit of the V236-15.0 MW to be installed at the port of Thyborøn, Denmark

Vestas will sell a single unit of the V236-15.0 MW to be installed at the port of Thyborøn, Denmark