Of the overall wind additions last year, 90% were onshore and 11 GW was offshore, of which 7.6 GW in China. Mingyang doubled its annual offshore installations to almost 3 GW to rank first in offshore wind in 2023.

In terms of markets, mainland China accounted for two thirds of global installations, distantly followed by the US, which added 7.2 GW. The EU countries built a record 15.3 GW, up 16% from 2022, while Brazil emerged as the largest Latin American market, doubling its additions to 5 GW.

Wood Mackenzie said recently that wind turbine orders globally reached a new record of 155 GW in 2023.

The higher installations were driven by a boom in China, while new additions elsewhere increased only 8% compared to 2022, the research provider said. “There are signs that growth will accelerate, though. A surge in US turbine orders shows the early impact of the new subsidies in the country’s Inflation Reduction Act, while a boom in project approvals in countries like Germany suggests that Europe’s permitting reform is working,” added Oliver Metcalfe, head of wind research at BloombergNEF .

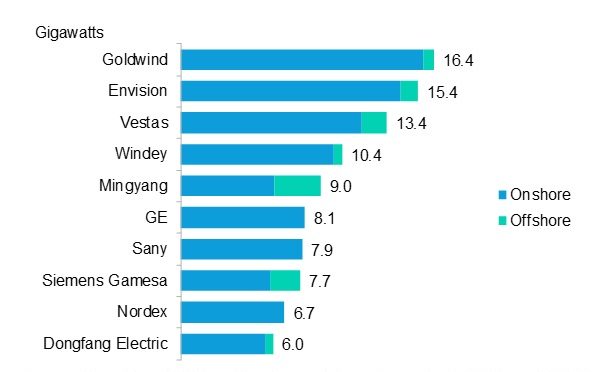

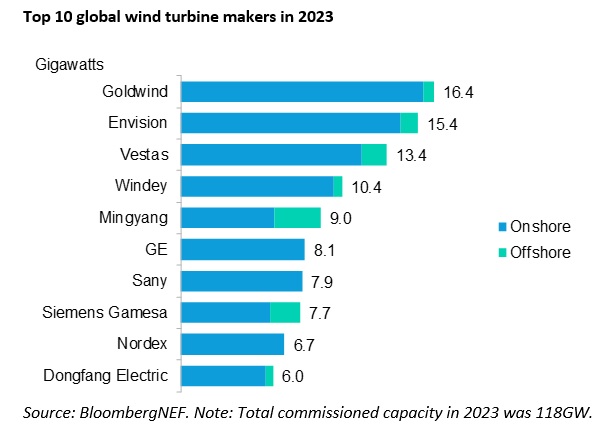

The top five for wind turbine makers was dominated by Chinese manufacturers. Xinjiang Goldwind Science & Technology (SHE:002202) retained the top spot with 16.4 GW of projects commissioned last year. Envision Energy rose to second place with 15.4 GW, while Denmark’s Vestas Wind Systems A/S (CPH:VWS) ranked third with 13.4 GW. Windey and Mingyang rounded off the top five. US turbine maker GE, which was third in 2022, dropped to sixth place in 2023 amid a slowdown in its home market.

“It’s no surprise that Chinese turbine makers dominate the top five in our ranking, as buildout of gigawatt-scale wind projects and an end to pandemic restrictions sent installations soaring last year,” said Cristian Dinca, wind analyst at BloombergNEF and lead author of its 2023 Global Wind Turbine Market Shares report.

While Chinese players still rely heavily on their domestic market, they are also growing their footprint in foreign markets. Chinese firms commissioned 1.7 GW of wind projects in 20 overseas markets last year, including five EU countries. According to BNEF, Chinese-made wind turbines supplied outside mainland China are 20% cheaper than those of US and European manufacturers.

Of the overall wind additions last year, 90% were onshore and 11 GW was offshore, of which 7.6 GW in China. Mingyang doubled its annual offshore installations to almost 3 GW to rank first in offshore wind in 2023.

In terms of markets, mainland China accounted for two thirds of global installations, distantly followed by the US, which added 7.2 GW. The EU countries built a record 15.3 GW, up 16% from 2022, while Brazil emerged as the largest Latin American market, doubling its additions to 5 GW.

Wood Mackenzie recently said that wind turbine orders globally reached a new record of 155 GW in 2023 was dominated by Chinese manufacturers. Xinjiang Goldwind Science & Technology (SHE:002202) maintained the top spot with 16.4 GW of projects commissioned last year. Envision Energy moved up to second place with 15.4 GW, while Denmark’s Vestas Wind Systems A/S (CPH:VWS) took third place with 13.4 GW. Windey and Mingyang rounded out the top five. US turbine maker GE, which was in third place in 2022, fell to sixth place in 2023 amid a slowdown in its domestic market.

“It’s no surprise that Chinese turbine manufacturers dominate the top five in our ranking, as the construction of gigawatt-scale wind projects and the end of pandemic restrictions caused installations to skyrocket last year,” said Cristian Dinca, BloombergNEF wind analyst and lead author of its report. Global Wind Turbine Market Share Report 2023.

While Chinese players still rely heavily on their domestic market, they are also increasing their presence in foreign markets. Chinese companies last year commissioned 1.7 GW of wind projects in 20 overseas markets, including five EU countries. According to BNEF, Chinese-made wind turbines supplied outside mainland China are 20% cheaper than those from American and European manufacturers.