The Spanish offshore wind power sector continues to await regulatory framework and the announcement of auctions that were expected to occur during 2023, but of which nothing has been heard. However, there are some updates.

According to Sandra Acosta’s article in El Periódico de la Energía, the regulations for the development of offshore wind power will be made public in the coming weeks. This was confirmed by Teresa Ribera, Minister for Ecological Transition and Demographic Challenge, in statements to Radio Televisión Canaria and has also been confirmed by El Periódico de la Energía citing sources from the Ministry.

In those same statements (which you can listen to here using English subtitles), Teresa Ribera also highlighted the interest of the Gran Canaria City Council in expediting the procedures and holding public auctions for the installation of offshore wind power in the waters of the island, indicating that the intention is for the first auction to take place in Gran Canaria.

As we have previously discussed, it makes sense for the Canary Islands to be the first to install Spain’s first offshore wind farm. Producing electricity is more expensive in the islands, so an offshore wind farm is more easily justifiable than on the mainland, where it could not compete with market prices.

As a reference, according to what I have been able to find, the average cost of producing a megawatt-hour with conventional power plants in Gran Canaria could be around €200/MWh (although with outdated data).

And how much does a MWh of floating wind cost? It is difficult to know. Especially after the supply chain turbulence of recent times.

As references, we have the €120/MWh that was mentioned in France in 2021 for an auction of 250 MW, the €240/MWh tariff of the Provence Grand Large pilot project (3 wind turbines, 25 MW), or the €168/MWh of the Portuguese WindFloat Atlantic pilot project (3 wind turbines, 25 MW). Also, as reported this week in El Periódico de la Energía citing industry sources, the price in Spain would be around €170-175/MWh.

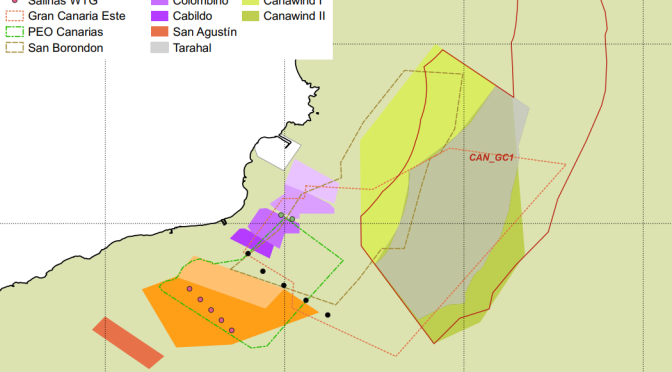

Of course, the POEM has an area identified in Gran Canaria, and more than 3,000 megawatts are proposed in projects on Gran Canaria alone, which will have to compete for a much smaller auction volume, as peak demand on the island is usually between 500 and 600 MW, with around 300 MW of base load.

Regarding the characteristics of the auction, what is known is that it will grant an economic regime (tariff, CfD, or similar), connection point, and maritime space, all in one. Other countries make these awards separately, but in Spain, it seems that they will go for everything at once.

I can think of two reasons for doing the auction this way:

- There is not enough available maritime space for developers to bid first for the maritime space and then for the connection point and/or the tariff. The best way to have real competition among developers is to award everything at once.

- Do everything faster. If Spain is already quite delayed with respect to its offshore wind power plans (between 1 and 3 GW by 2030), making the awards in stages would only delay the plans with probably little benefit.

And how much capacity will be auctioned? Good question, but if I had to bet money, I would say it will be around 200 or 300 megawatts; I would be surprised if it were much more. In the end, integrating a wind farm of that size into an islanded electrical network will have its challenges, although by then, the Chira Soria pumping station will probably be up and running.