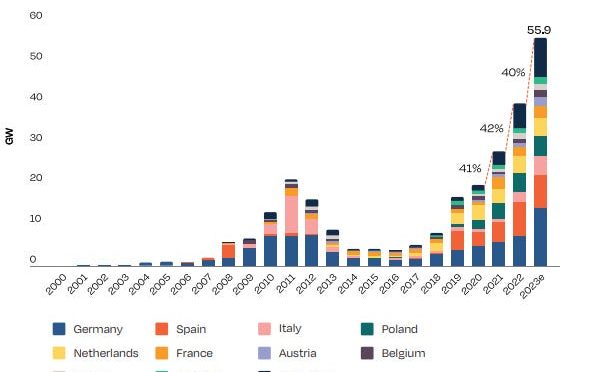

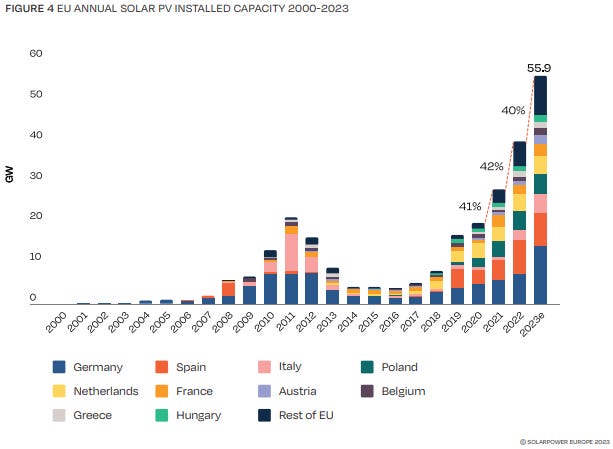

2023 marks another record year for solar PV in the EU, with 55.9 GW installed across the 27 Member States, showing a 40% growth from 2022 and a doubling of the market in just two years. This is the third year in a row that the EU market breaks its previous record, as well as the third year in a row with annual growth rates of at least 40%. This sustained growth can be seen as a continuation of the market dynamics taking place in 2022, when Member States acknowledged solar power as an environmentally friendly, cost-effective, and unparalleled rapid solution to diminish their reliance on Russian fossil fuels. The first months of 2023 were still under the full effects of the energy crisis, with elevated electricity price acting as a shock for citizens, businesses and policymakers.

How much power has each country installed during the period from 2000 to 2023?

Germany is now back as the largest solar market, installing 14.1 GW and surpassing Italy’s 12-year-old record of 9.3 GW in 2012. Spain follows with 8.2 GW, while Italy entered the top 3 for the first time in a long while, installing 4.8 GW through the year. Poland (4.6 GW) and the Netherlands (4.1 GW) close out the top 5, with France dropping out due to Italy’s ascent. In 2023, 20 Member States achieved their best solar year, and 25 installed more solar than the previous year. Market diversification is also growing stronger, with 14 countries exceeding 1 GW of annual installations in 2023, up from 10 in 2022.

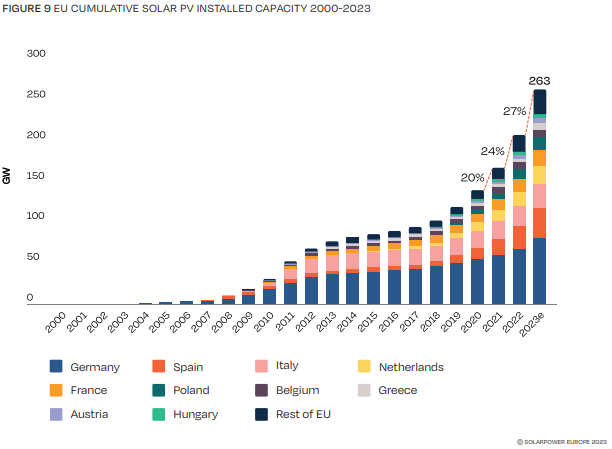

The total EU solar PV fleet now amounts to 263 GW, up 27% from the 207 GW in 2022.

Germany continues to be the largest contributor with 82 GW, trailed by Spain at 36 GW and Italy with 29.5 GW. While Germany leads both the EU annual market and total capacity ranking, the Netherlands retains its top spot in installed PV capacity per capita, reaching 1,280 W/capita in 2023 and improving by over 250 W/capita in a single year. Germany is nearing the 1 kW threshold, at 985 W/capita.

Looking ahead over the next 4 years, our prospects continue to show double-digit growth every year, but at somewhat lower levels than anticipated last year and considerably below the 40% annual increase experienced in recent years, due to changing market conditions. Over the course of 2023, prices have dropped significantly to record lows, driven by an increase in global production. While this is positive news for installations, the current conditions make for an extremely difficult business case for local manufacturers and have triggered trade discussions that could potentially impede solar deployment.

As per our Medium Scenario, solar will continue its upward trajectory in 2024, reaching 62 GW with an 11% annual increase. This moderate growth rate is impacted by a decrease in residential demand, which surged in the preceding 2 years due to the energy crisis. Simultaneously, legislative improvements are expected to take 1 or 2 years or more before impacts on largescale utility plant developments might become apparent. Our research shows rooftop solar to dominate the market, though gradually declining over the coming 4 years; the energy crisis has created awareness among homeowners and businesses for solar as an effective solution to control their energy bills.

Looking ahead to 2025, we project a 19% growth rate, resulting in 73.8 GW of installations for the year, followed by 84.2 GW in 2026 and 93.1 GW in 2027. Under our High Scenario, the market has the potential to surpass 100 GW as early as 2026. But much more relevant seems our Low Scenario this time, which is characterised by the recently emerged threat of trade defence measures and additional challenges, and hardly sees any growth compared to today’s levels with 58.7 GW by 2027. This is below the average of around 70 GW that solar is expected to deploy every year from now to 2030 to reach the REPower EU and solar strategy goals.

Our solar National Energy and Climate Plans (NECP) analysis has been updated, based on the new draft NECP published by EU Member States through the course of 2023. As of the editorial deadline of this report, 22 Member States have submitted a new draft NECP, while 5 updated plans are still missing. The increase in national solar ambition has lifted the aggregate NECP target by 76% to 591 GW by 2030 – a strong upswing that is, however, still significantly below the 750 GW REPowerEU target. By contrast, we anticipate 902 GW of solar capacity deployed in our Medium Scenario projection to 2030.

This report also provides further insights on grids and permitting challenges across EU Member States, the current state of European solar manufacturing, and detailed analyses of the 14 markets that reached the GW-scale in 2023, with the contribution of national solar and renewable associations.

Analysis by Pexapark

Solarletter