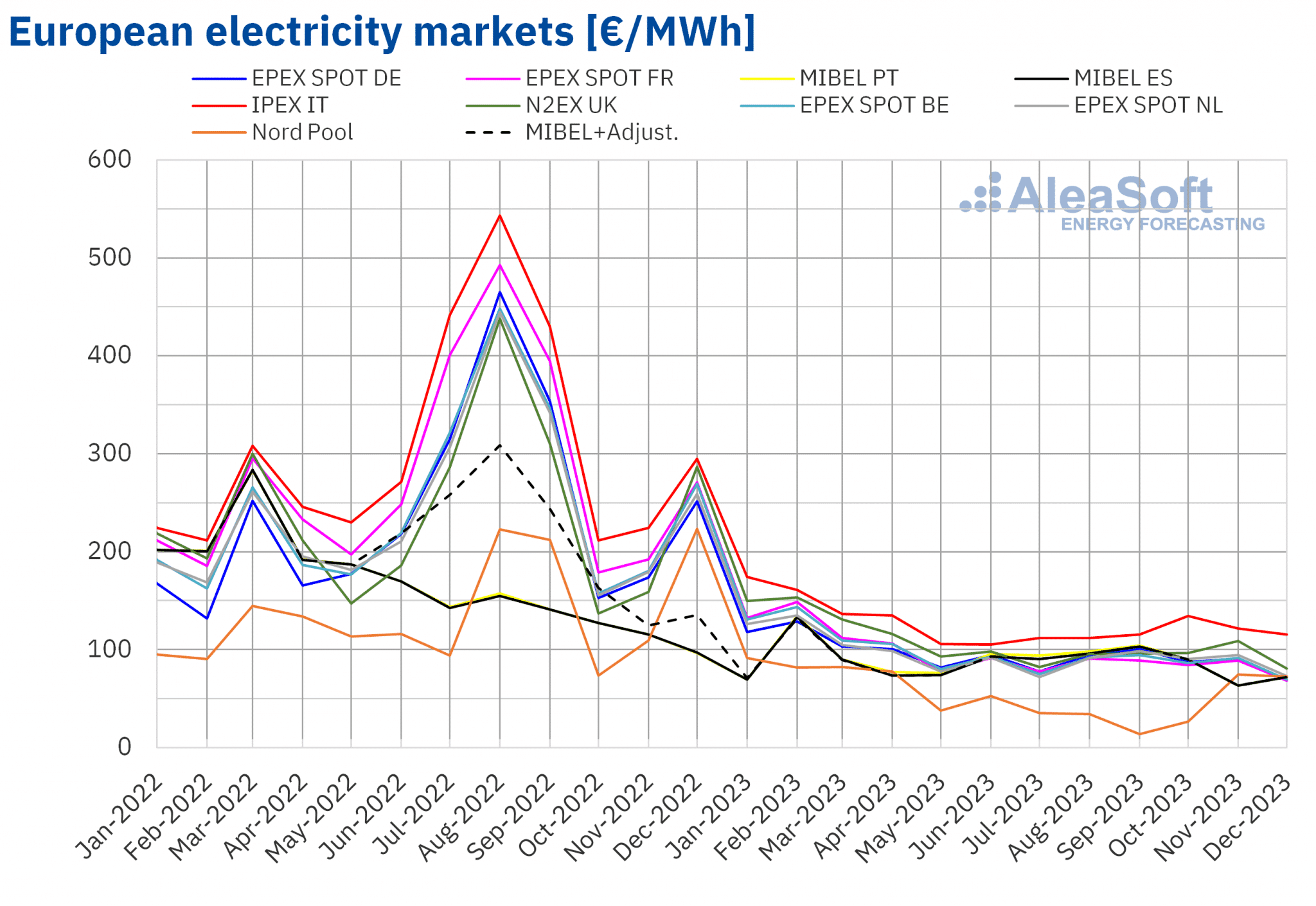

In 2023, annual electricity market prices fell to levels similar to those of 2021, being mostly below €100/MWh. The drop in gas prices, together with the reduction in demand and the increase in renewable energy generation with respect to 2022, led to the decrease in electricity market prices. During 2023, installed solar and wind energy capacity increased in most markets, thus favoring the increase in production using these technologies.

Solar photovoltaic, solar thermoelectric and wind energy production

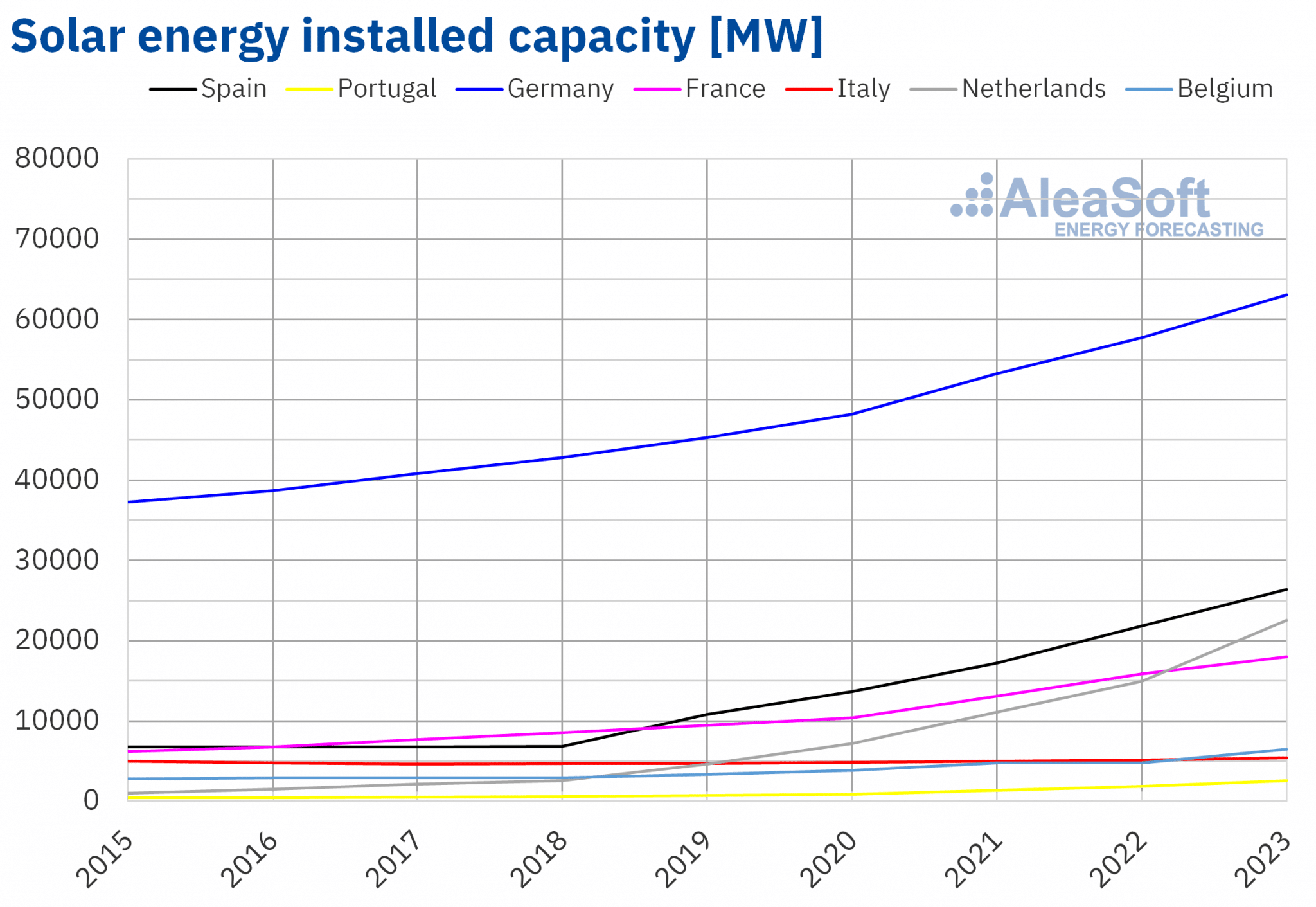

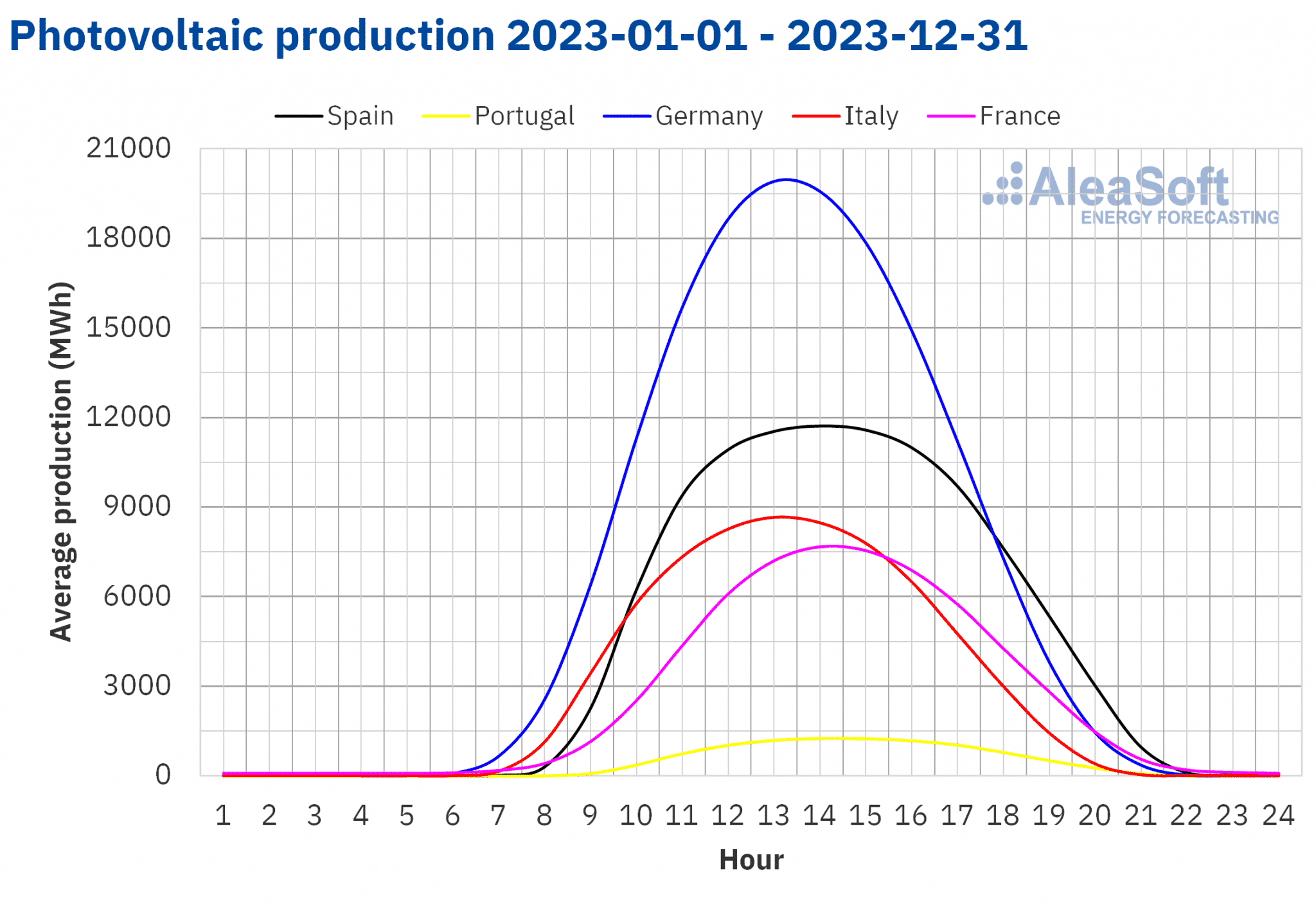

The 2023 data clearly reflect Europe’s efforts towards a green energy transition. All major European electricity markets registered an increase in installed solar energy capacity in 2023 compared to 2022. The Dutch market led in growth by adding 7679 MW to the system, which represented an increase of 51%. Only in Germany and Italy the installed solar capacity grew by less than 10%. According to REE data, 4582 MW were installed in Mainland Spain in 2023, representing an increase of 21%.

Source: Prepared by AleaSoft Energy Forecasting using data from REE, REN and ENTSO-E.

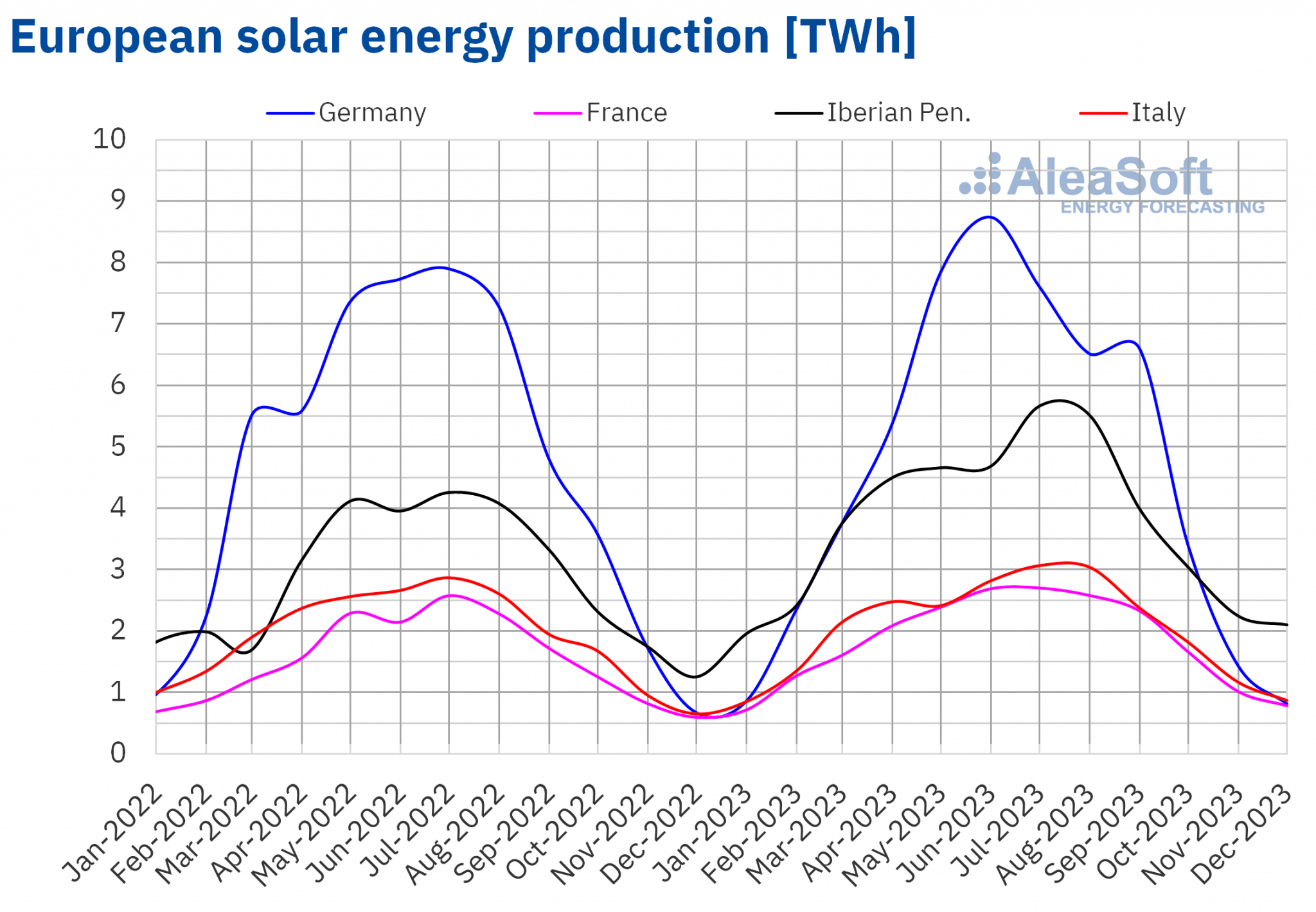

In most markets, increases in installed solar energy capacity resulted in higher annual production. In Portugal, solar energy production registered a year?on?year increase of 41%, while in Spain it grew by 31%. Italy had the smallest increase, up 8.3%. In the German market alone, solar energy production decreased by 0.1% compared to 2022, despite additional capacity.

With the exception of Germany, solar energy production in 2023 was historically the highest in all other markets analyzed at AleaSoft Energy Forecasting. In this context, Spain led the way with 41 TWh of solar energy generation in 2023.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

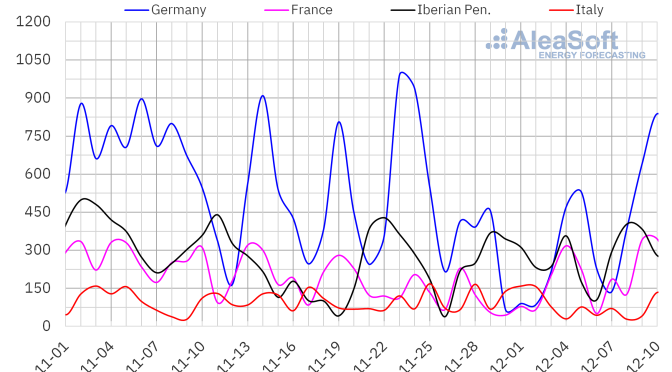

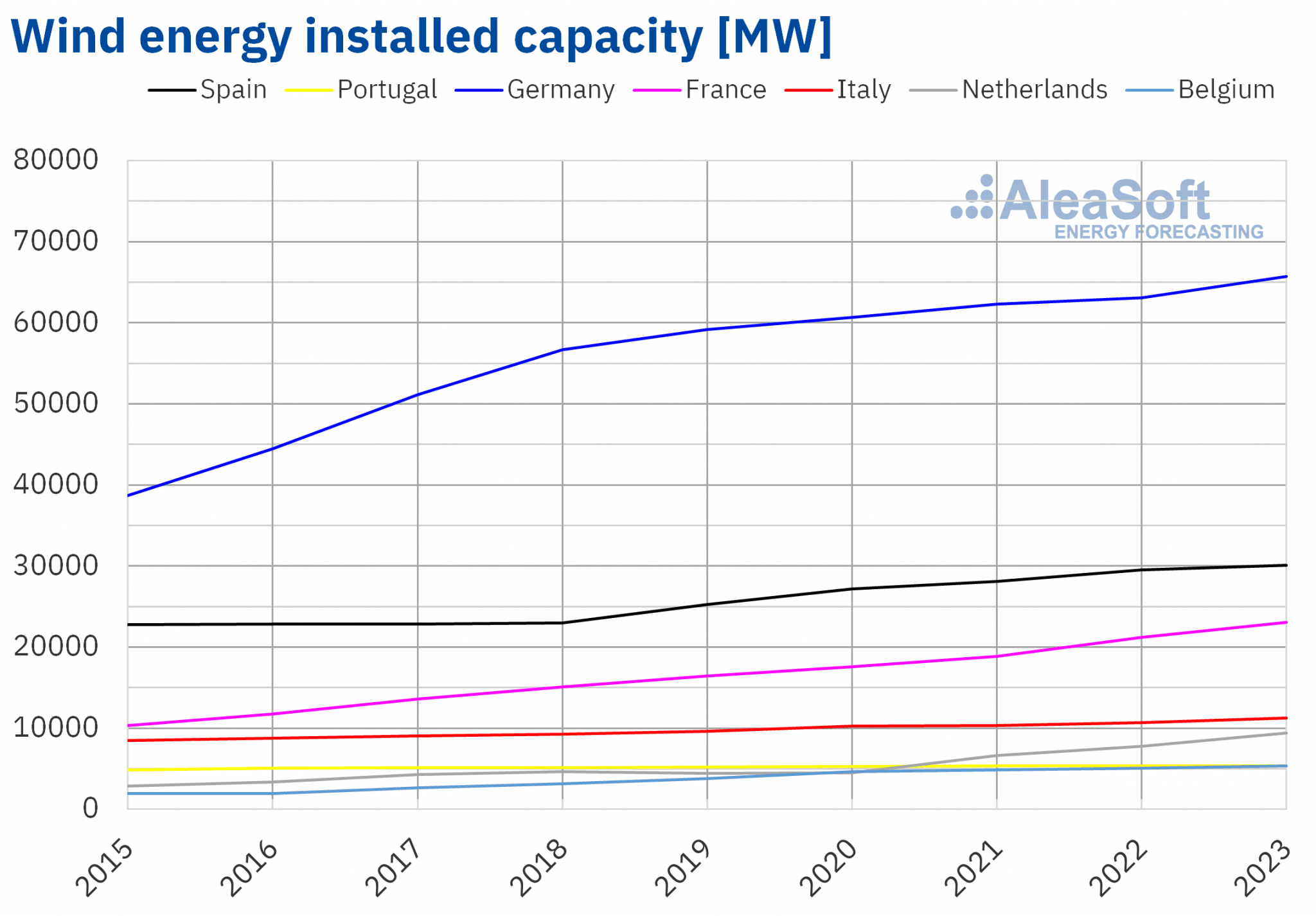

In the case of wind energy, installed capacity also increased in most major European electricity markets in 2023 compared to 2022. Once again, the Dutch market led with the highest growth, reaching 21%. The Spanish market had the smallest expansion, with an increase of 1.8%, adding 527 MW. There were no significant changes in installed wind energy capacity in the Portuguese market.

Source: Prepared by AleaSoft Energy Forecasting using data from REE, REN and ENTSO-E.

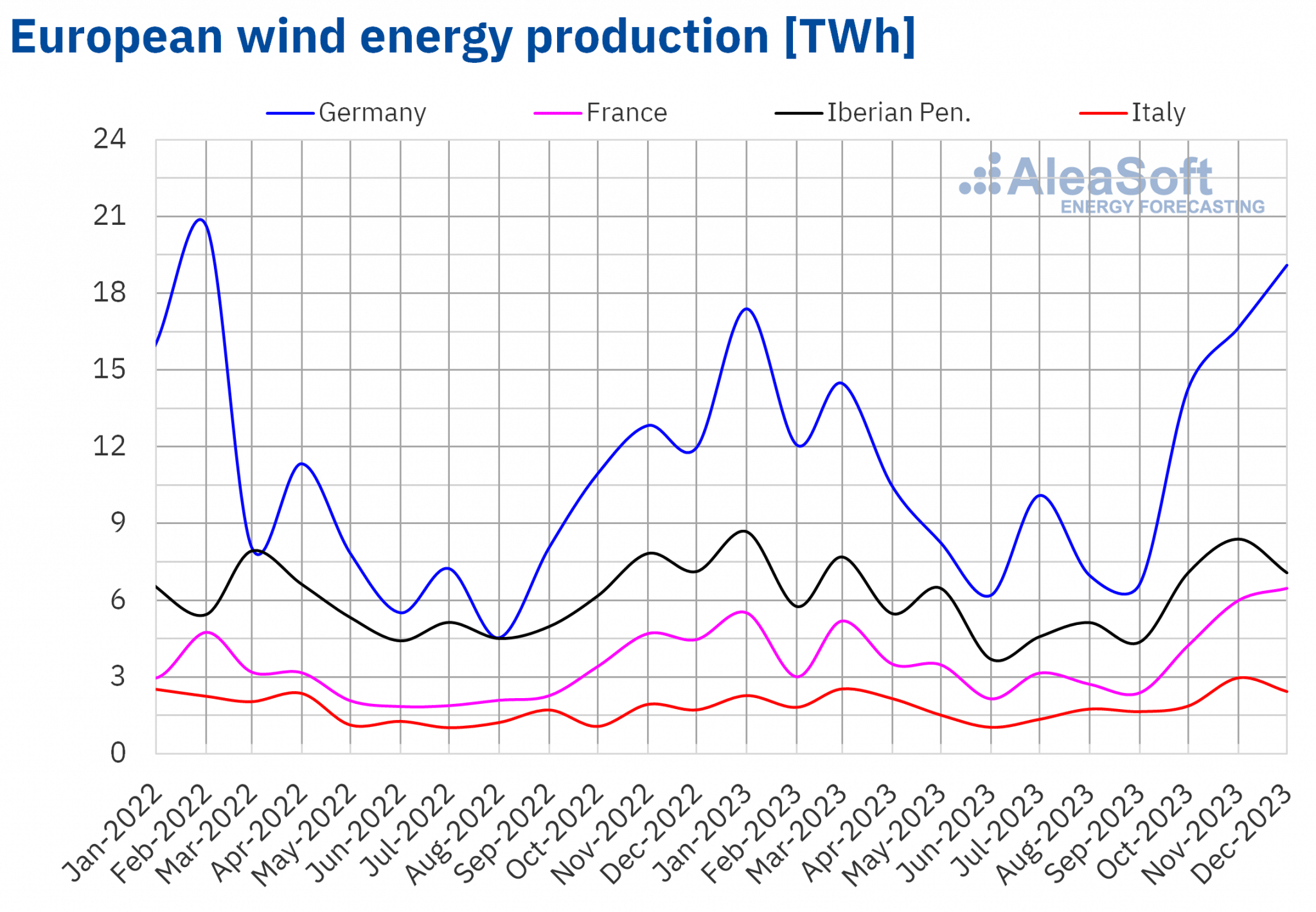

Year?on?year wind energy production increased in all major European electricity markets in 2023. In this case, France led with a 30% increase. The Spanish market registered the smallest increase, 2.5%, generating 61 TWh in 2023.

Except for Portugal, all remaining markets analyzed at AleaSoft Energy Forecasting set historically their highest wind energy production in 2023. Germany reached the highest record, with 143 TWh.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

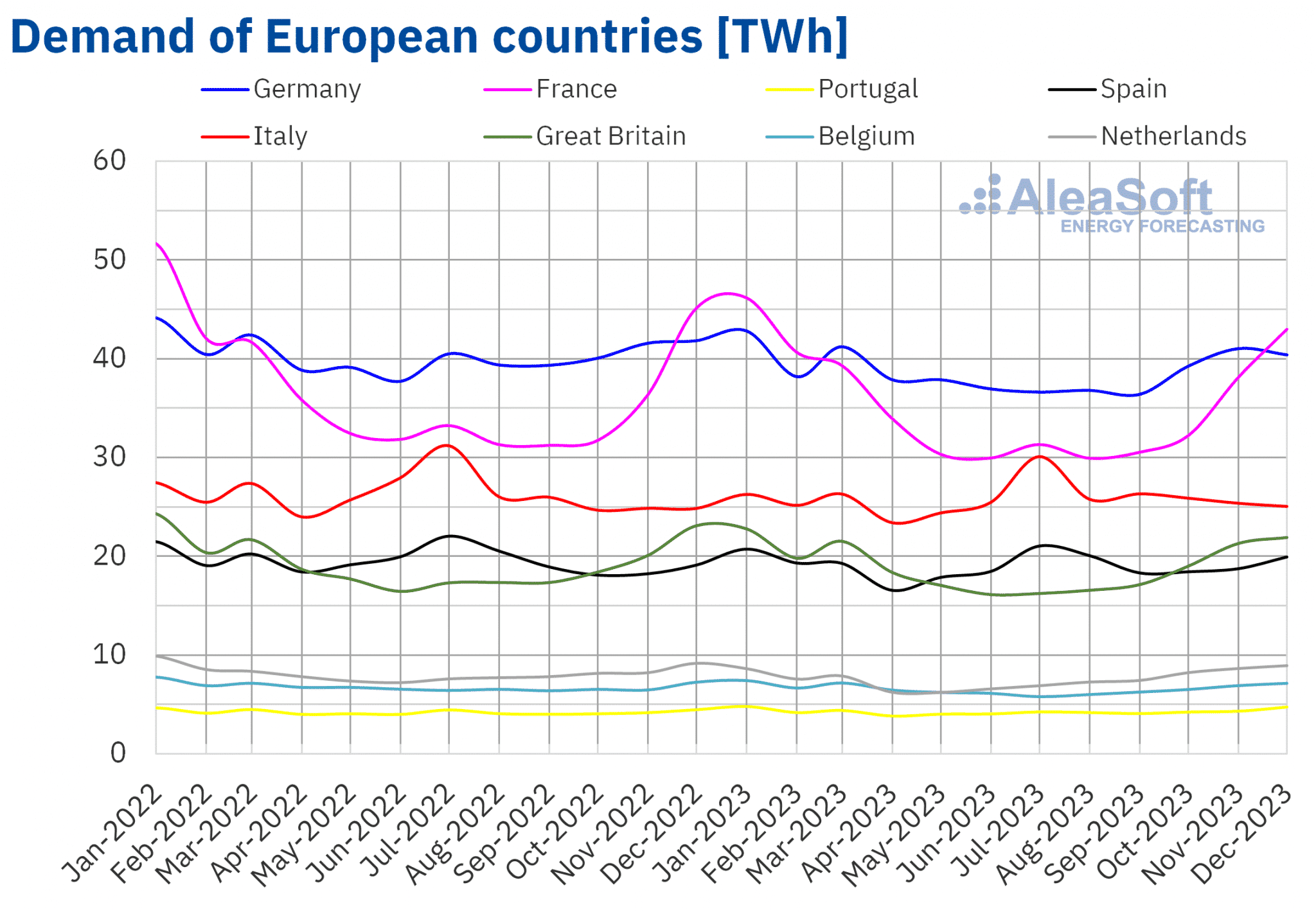

Electricity demand

In most analyzed European electricity markets, electricity demand in 2023 was lower than in 2022. The French market registered the largest decline of 4.3%, followed by Germany with a 4.1% drop. The Italian market registered the smallest drop in demand, 1.9%. The Portuguese market was the exception to this trend, with a 1.1% increase in demand in 2023 compared to 2022.

Average temperatures in 2023 had a heterogeneous behavior. Compared to 2022, the annual average temperature increased by 0.3 °C in Germany and by 0.2 °C in Portugal and the Netherlands. Conversely, average temperatures in 2023 in Spain, France and Great Britain were 0.1 °C lower than in 2022. No changes were observed in the average temperatures of Italy and Belgium.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

In 2023, the annual average price was below €100/MWh in most major European electricity markets. The exceptions were the N2EX market of the United Kingdom, with an average of €108.06/MWh, and the IPEX market of Italy, with €127.24/MWh. On the other hand, the lowest annual average price of €56.44/MWh was that of the Nord Pool market of the Nordic countries. In the rest of the European electricity markets analyzed at AleaSoft Energy Forecasting, the averages ranged from €87.10/MWh in MIBEL market of Spain to €97.27/MWh in EPEX SPOT market of Belgium.

When comparing average prices in 2023 with those registered in 2022, prices fell in all markets. The largest price drop, 65%, was in the French market, while the smallest decline, 47%, was in the Portuguese market. In the other markets, price declines ranged from 48% in the Spanish market to 60% in the German, Belgian and Dutch markets.

In addition, 2023 prices were also the lowest since 2020 in almost all analyzed markets. The exception was the Italian market. In this market, the 2021 average, €125.46/MWh, was slightly lower than the 2023 average.

In 2023, the significant drop in the average gas price compared to the previous year led to lower prices in the European electricity markets. Increased wind and solar energy production also contributed to the declines. In addition, electricity demand decreased compared to 2022 in almost all analyzed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

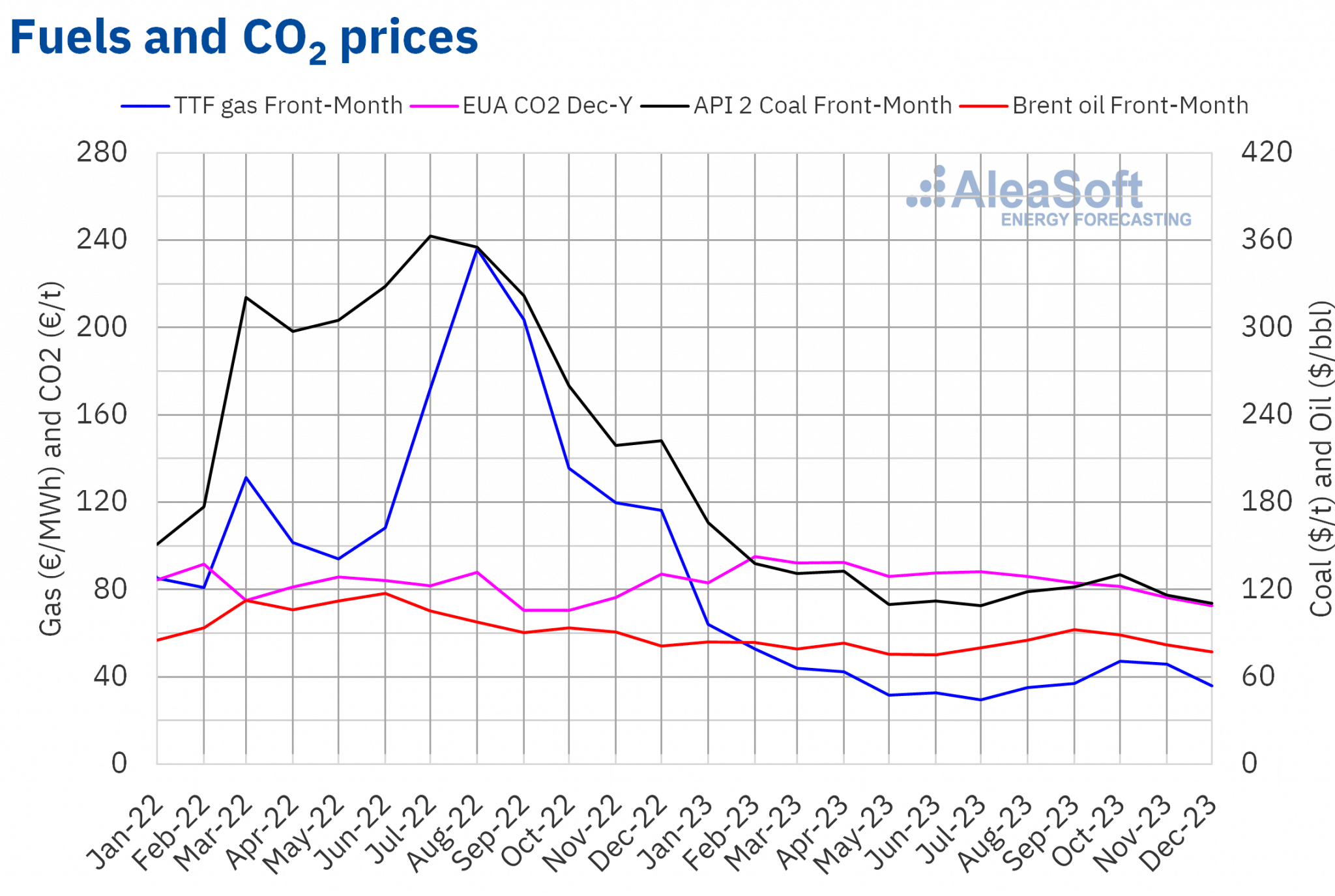

During 2023, settlement prices of Brent oil futures for the Front?Month in the ICE market averaged $82.18/bbl. This is a 17% decrease from the average Front?Month futures price of $99.05/bbl in the previous year.

In 2023, concerns about the evolution of the global economy exerted a downward influence on Brent oil futures prices, despite expectations of a recovery in demand in China. However, production cuts agreed by OPEC+, as well as additional cuts by Russia and Saudi Arabia, prevented further price declines.

As for TTF gas futures prices in the ICE market for the Front?Month, they also fell in 2023 compared to 2022. These futures reached an average price of €41.40/MWh in 2023. This average was 69% lower than that of the Front?Month futures traded in 2022, which was €133.19/MWh. It was also slightly lower than the 2021 average, which was €48.54/MWh.

In 2023, supply disruptions from Norway, labor disputes at Australian liquefied natural gas export plants, as well as instability in the Middle East, exerted an upward influence on prices. However, high levels of European reserves and abundant supplies of liquefied natural gas led to a decline in the annual average price of TTF gas futures in 2023.

As for CO2 emission rights futures prices in the EEX market for the December reference contract, they increased in 2023 compared to the previous year. These futures reached an annual average price of €85.26/t. This average was 4.8% higher than the 2022 average, of €81.35/t.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

AleaSoft Energy Forecasting and AleaGreen are organizing the next event in their monthly webinar series. The first 2024 webinar will take place on Thursday, January 18. In addition to analyzing the prospects for European energy markets in 2024, this edition will focus on the vision of the PPA market for the consumer in the current context. To this end, speakers from PwC Spain will participate in the webinar series for the fourth time.