PPA are booming as a tool in the energy transition. PPA allow renewable energy producers to guarantee the long?term sale of their production, facilitating financing. In turn, consumers ensure a supply at agreed prices, avoiding market volatility and demonstrating their commitment to the environment. Spain has brought solar PPA to lead in Europe. AleaGreen facilitates the search for counterparties to originate PPA.

PPA: the perfect tool for the energy transition

Bilateral agreements for the purchase of energy between a producer and a consumer or an electricity retailer (PPA, which stands for Power Purchase Agreement) have become very popular in recent years. Their recent and rapid growth is due to the fact that it is a tool that fits very well with the needs of both producers and consumers within the framework of the energy transition.

For developers of renewable energy projects, PPA are the way to ensure the sale of all or part of the energy they will produce for several years, typically between five and fifteen years, at a certain price or under a price structure which, despite being more or less flexible, limits exposure to the volatility of market prices. In this way they can ensure at least a minimum income flow, which in many cases allows them to obtain better financing conditions for the construction and start?up of the project.

For the so?called offtakers, consumers or retailers who will receive the contracted energy, a PPA allows them both to ensure an energy supply for several years at an agreed price, also mitigating their exposure to market volatility, and to be able to prove that the energy has a renewable origin. In this way, retailers can sell green energy to their customers and large consumers can achieve their sustainability goals and reduce their carbon footprint.

Evolution of PPA

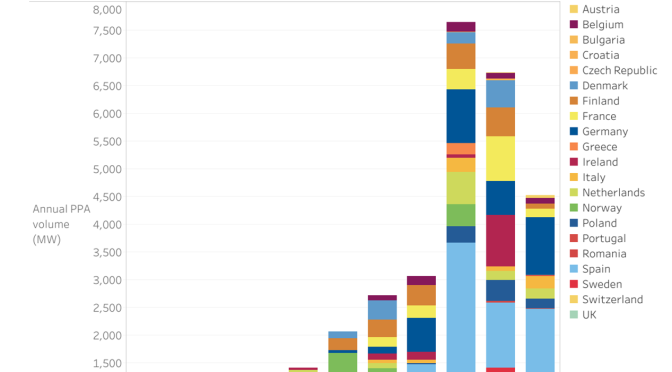

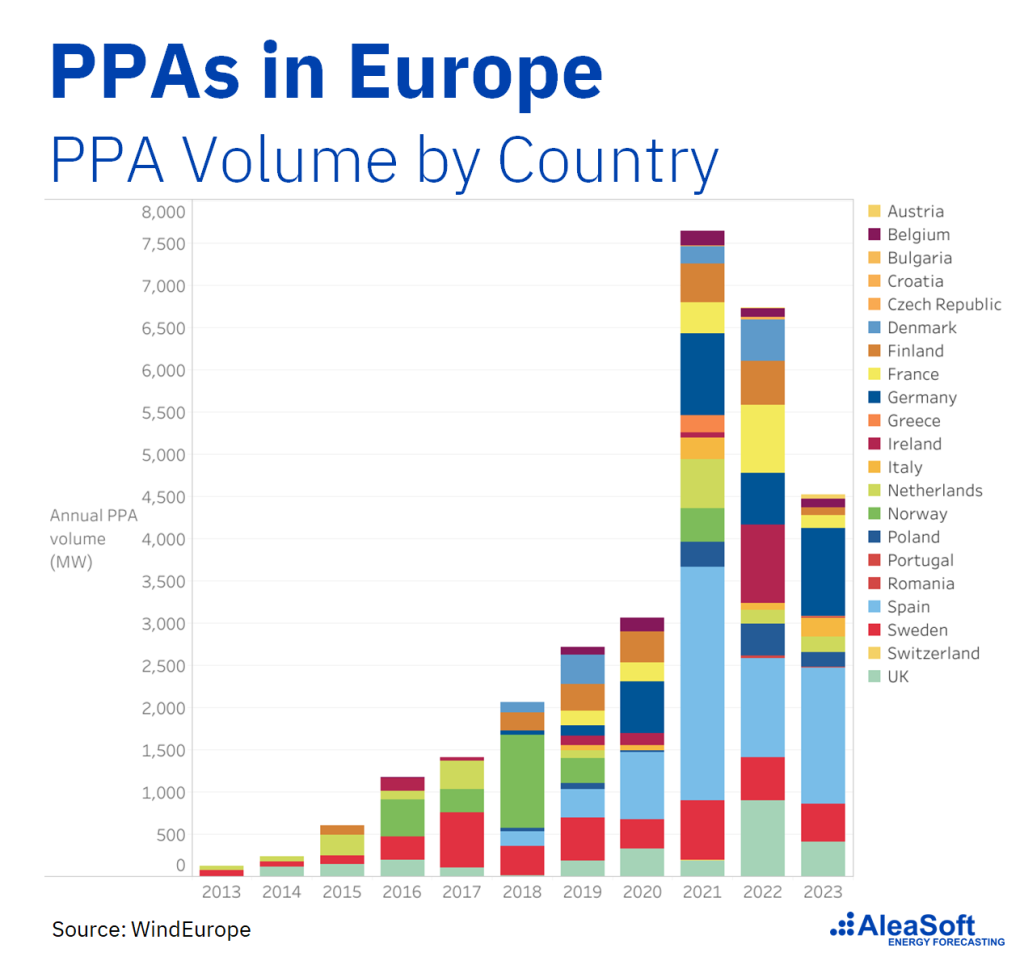

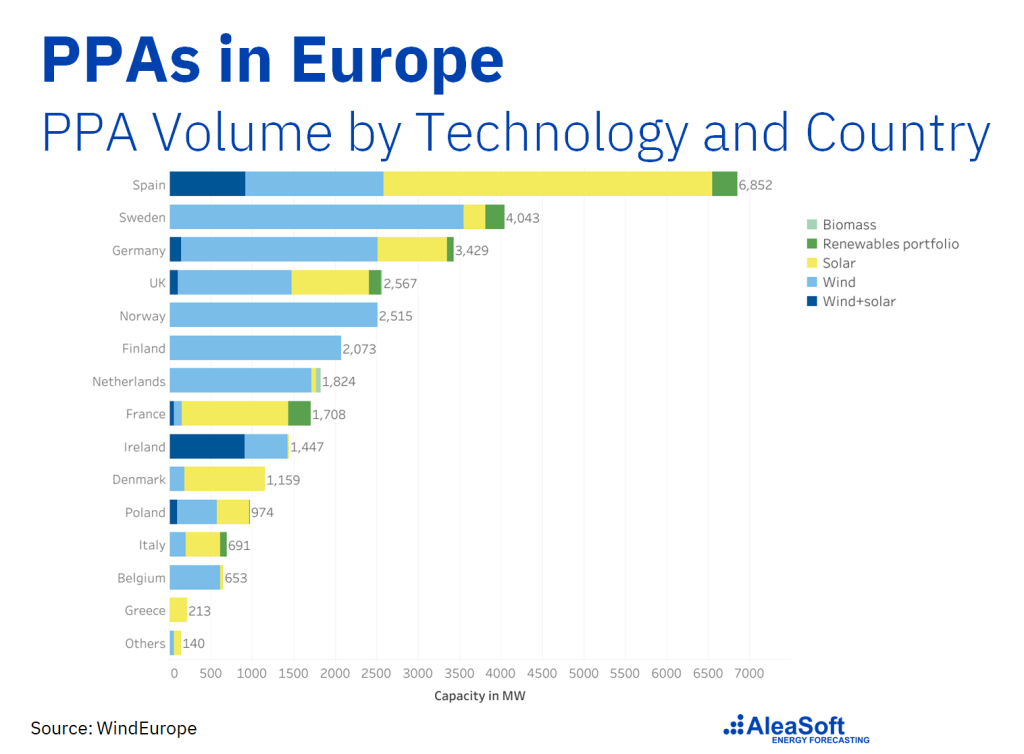

Although they appeared in the headlines of the specialised media in the last four or five years, PPA have a long history in many markets, especially in the American continent. In Europe, historically, PPA have been signed mainly in the Nordic countries (Sweden, Norway and Finland) and also in the United Kingdom and the Netherlands. All these countries, where there is abundant wind energy, dominated the PPA market in Europe.

Starting in 2019, the PPA outlook began to diversify and new markets appeared such as Spain, Poland, Germany and Denmark. Renewable energies began to grow rapidly in these countries and, thanks to them, the availability of projects willing to reach long?term agreements to sell their energy grew too.

The recent leadership of Spain and solar PPA

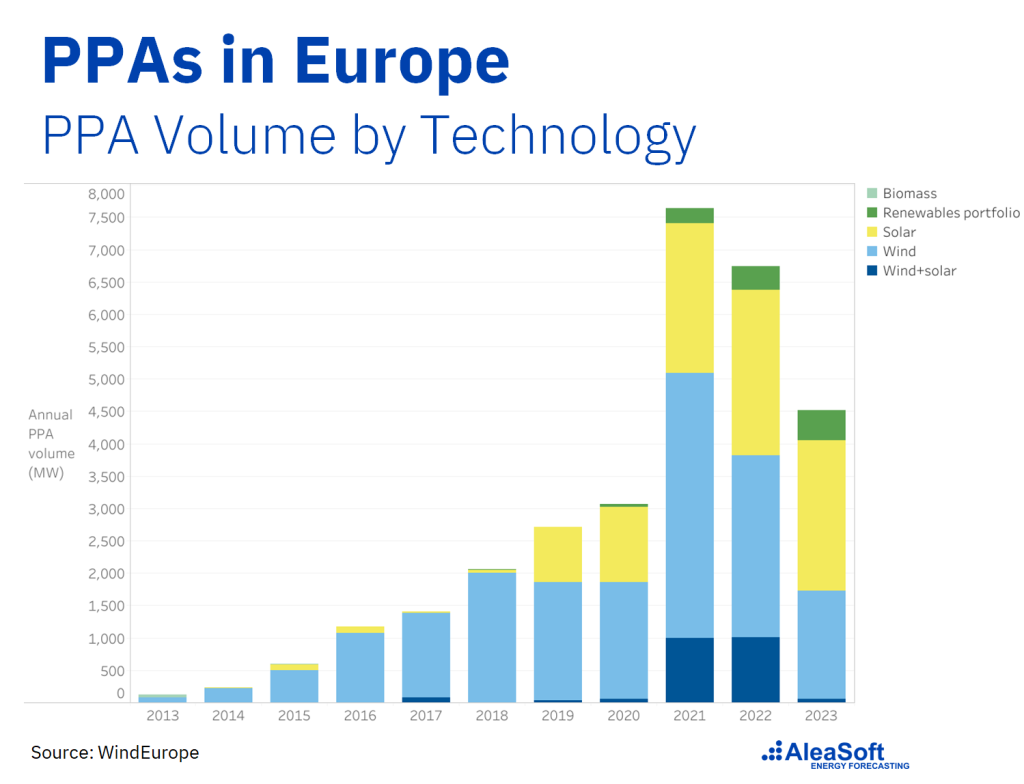

Due to the entry of new markets on the PPA map, the technologies with which these agreements are signed have also changed. In the new players, Spain, Germany, Denmark, Poland, but also France, Italy and Greece, the technology that is growing the most is solar photovoltaic energy. Thus, a large part of the new contracts are with photovoltaic plants. This has meant that, in recent years, most of new PPA are related to solar photovoltaic energy, displacing wind energy to second place.

More specifically, the fact that Spain currently leads the number and quantity of MW of PPA in Europe, and that in Spain the majority of PPA are solar, is what has led solar PPA to lead the ranking of technologies in Europe.

Price references for PPA

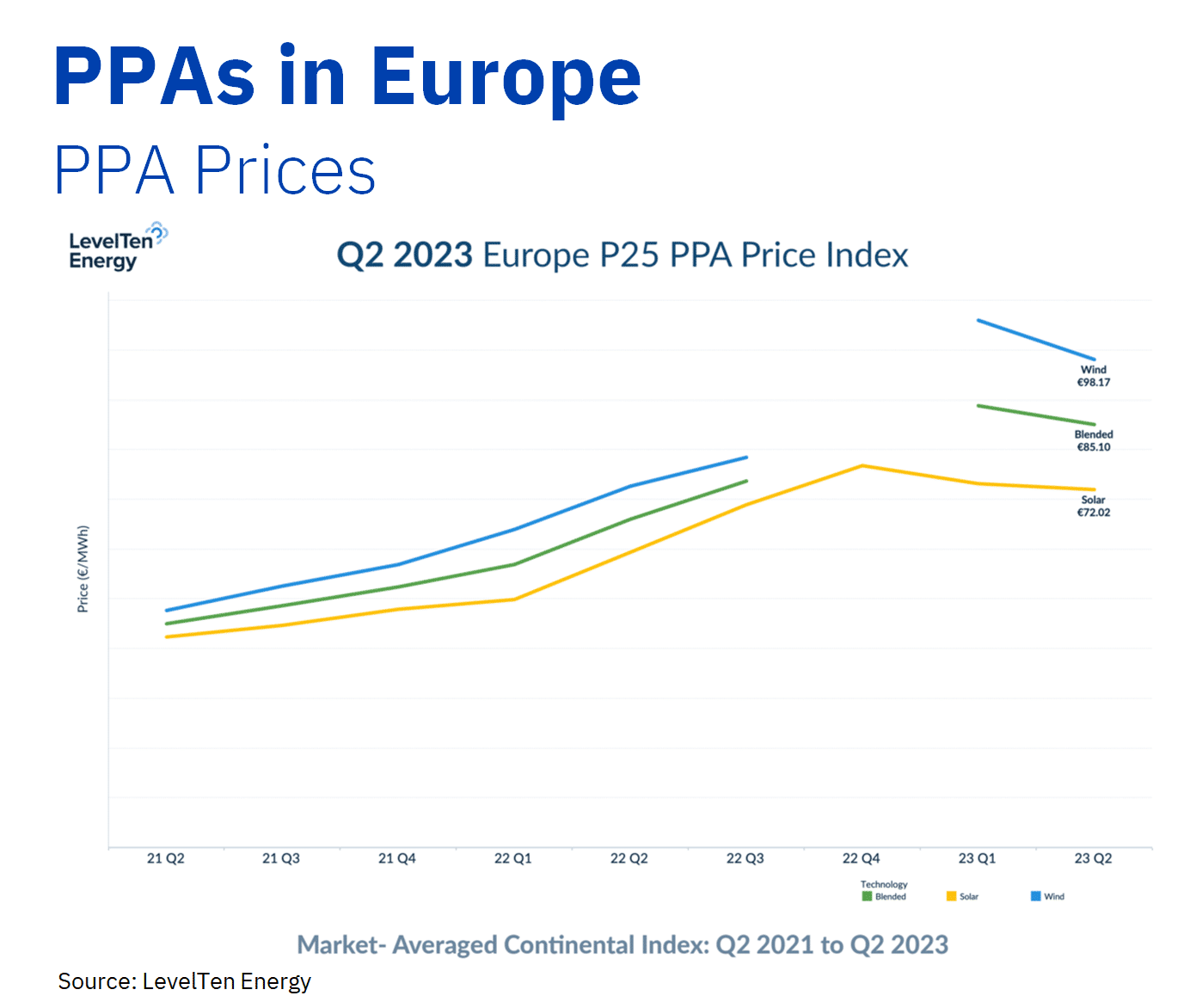

When agreeing on the price of the energy delivered in a PPA, the reference is the price of that energy in the wholesale market throughout the validity of the contract. From this reference, premiums or discounts are applied depending on the risk assumed by each party in the contract.

These market price expectations have marked the trend of PPA prices in recent years. In 2021, PPA prices began an upward trend as the 2022 energy price crisis approached. In the last quarter of 2022, at the worst of the crisis, PPA prices reached their historical maximum in Europe.

A reference that can be used to estimate the value of energy to be delivered in the future is electricity futures market prices. But the prices of these markets have too much volatility to be a reliable reference for prices five or fifteen years from now.

A more stable and reliable reference is long?term price forecasts. These forecasts provide stable price expectations and avoid futures market fluctuations, so long?term price forecasts are essential for all parties involved in signing a PPA. AleaGreen offers long?term forecasts necessary for large and electro?intensive consumers, sponsors, developers and investors in renewable energy.

By providing services to all parties involved in the negotiation and signing of a PPA, AleaGreen acts as a hub to connect producers and offtakers to originate and facilitate PPA. At a time when sustainability and environmental responsibility are fundamental priorities for companies, AleaGreen helps in the collaboration between renewable energy producers and offtakers, thus accelerating the change towards a more sustainable and environmentally friendly world.

To analyse PPA in the environment of renewable energy projects financing, Antonio Delgado Rigal, CEO of AleaSoft, will participate on October 5 in the analysis table titled ‘Have priorities changed in the analysis of financing risks?’ of the X Foro Solar organised by UNEF (Spanish Photovoltaic Union).

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

A new webinar of the monthly webinar series organised by AleaSoft Energy Forecasting and AleaGreen will be held on Thursday, October 19. On this occasion, there will be the participation, for the fourth time, of speakers from Deloitte to analyse the prospects of European energy markets for the winter 2023?2024, the financing of renewable energy projects and the importance of forecasting in audits and portfolio valuation.