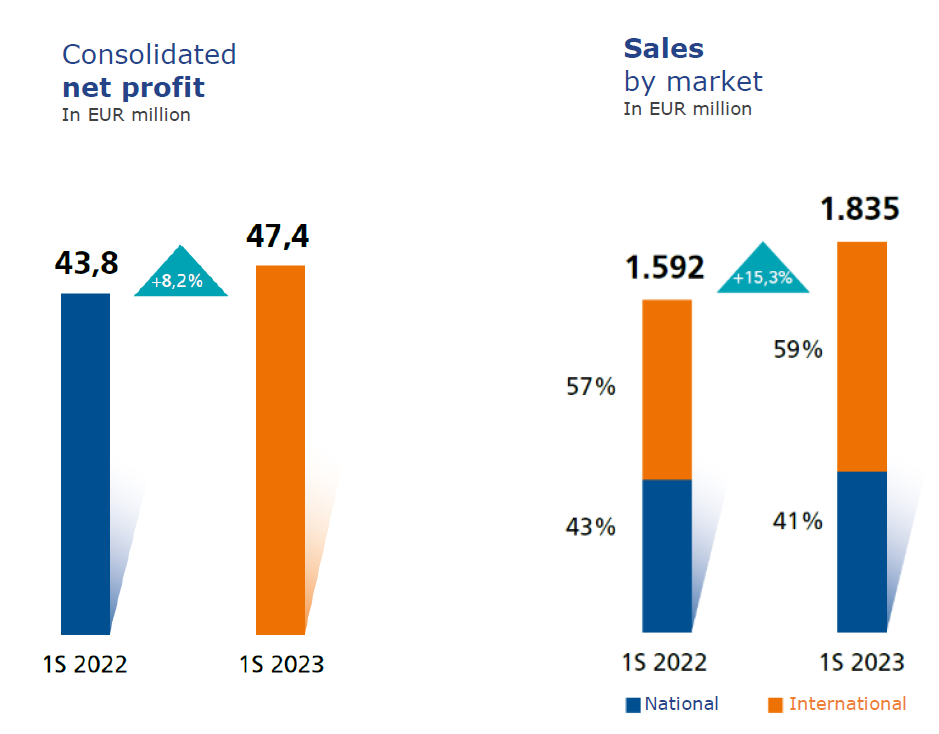

The Elecnor Group has ended the first semester of 2023 with a consolidated net profit of EUR 47.4 million, which represents an improvement of 8.2% in relation to the EUR 43.8 million in the same period of the previous year, thereby maintaining the strong momentum of the previous quarter. All the Group’s lines of business have made satisfactory contributions to this good result.

As of 30 June 2023, the Group’s consolidated sales stood at EUR 1,835.3 million, which shows an increase of 15.3% in relation to the first semester of 2022. Both the domestic market (accounting for 41% of the total) and the international market (59%) have recorded a remarkable increase of 10.3% and 19.1% respectively. EBITDA has reached EUR 176 million, a 20.8% increase on the figure for the same period in the previous year.

The positive trend in all the Group’s main indicators has been made possible, on the one hand, by the activities related to Sustainable Projects and, on the other, the growth in the turnover of the Essential Services which the Group carries out in the United States of America and in European countries, especially in Spain and Italy.

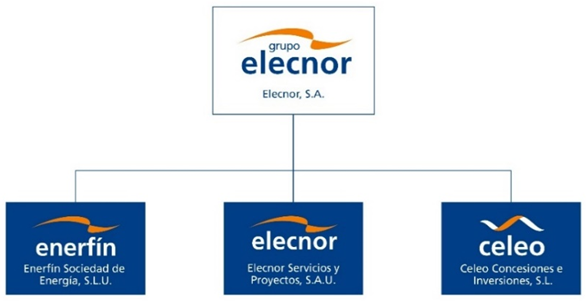

The Group manages its activities relating to essential service, sustainable projects, renewable energy and infrastructures through Elecnor, Enerfín and Celeo, companies that reinforce and complement each other.

Elecnor (Essential Services and Sustainable Projects)

The turnover, which is EUR 1,809.3 million, has risen by 21.4% in the first six months of the year, while the attributable consolidated net profit is up 15%, standing at EUR 47.4 million.

In the domestic market, the pattern of growth in activity has continued due to the essential services performed in the sectors of electricity, telecommunications, water, gas, and energy transport and distribution, fields where Elecnor provides an essential service to all the utilities. It is worth noting the maintenance activity carried out for both the public and private sectors. Furthermore, during this period, within the activity of sustainable projects, both construction work on wind and solar photovoltaic power farms and work related to self-consumption and energy efficiency have also contributed to the growth of the Group’s figures for Revenue and Profit.

In the international market, the positive evolution of turnover is mainly down to the sustainable projects that the Group carries out in Australia, Brazil and Chile (particularly in renewable energy and electric power transmission lines). Sales and results have also been boosted by the construction of solar photovoltaic power plants in Colombia, the Dominican Republic and Ghana, wind farms in Brazil, hydroelectric power stations in Cameroon, substations in Mozambique, Cameroon and Gambia, and power transmission lines in Zambia, among others. Also of note is the activity relating to essential services in the North American subsidiaries (Hawkeye, Belco and Energy Services).

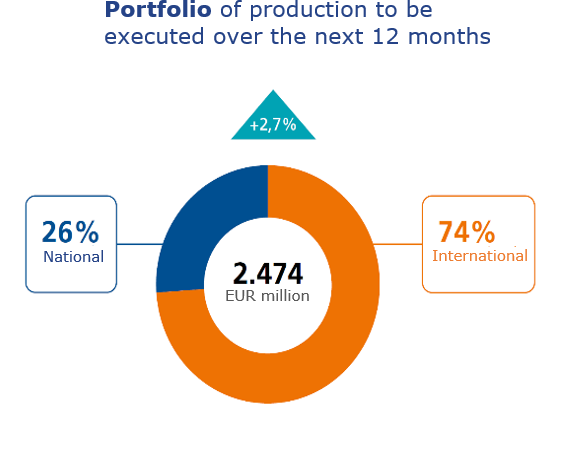

Elecnor’s portfolio of signed contracts still to be executed as of 30 June, and whose execution is planned to happen in the next 12 months, amounts to EUR 2,474.1 million (compared to EUR 2,408.4 million at the end of 2022, thereby maintaining the upwards trend). The international market accounts for 74% of this figure and 26% comes from the domestic market. The domestic market portfolio is made up of contracts for activities relating to essential services, as well as sustainable projects for the construction of renewable energy power plants. The international portfolio has increased both in European countries (Italy and the United Kingdom), where activities relating to services are conducted, and in other countries (mainly Australia, the United States and Brazil) where contracts have been awarded for major projects involving the construction of renewable energy power plants and power transmission.

Enerfín

This company has stakes in 1,734 MW (1,552 MW at the end of last year) of wind energy both in use and under construction in Spain, Brazil, Canada and Colombia. Furthermore, it has a project portfolio that currently exceeds 10 GW, after boosting its pipeline in all the geographical areas where it is present: Spain, Brazil, Colombia, Canada, United States and Australia.

Enerfín has increased its assets with the construction of a solar photovoltaic power plant in Colombia called Portón del Sol, one of the most important plants in the country. The plant has a generation capacity of 129 MWp, its construction will take approximately a year and a half, and it is expected to be operational in the last quarter of 2023. A solar photovoltaic power plant is also being constructed in Brazil, Solar Serrita, with a generation capacity of 68 MWp, which will hopefully be operational in the last quarter of 2024. In Canada, construction of the Winnifred wind farm began in 2023, with a generation capacity of 136 MW, which is expected to be operational in the last quarter of 2024. In Spain, construction of the Ribeira Navarra Wind Farm Complex began in 2022 (139.2 MW) composed of four wind farms (24 wind turbines each with a capacity of 5.8 MW), which is expected to be operational between August and December, 2023; additionally, 2023 saw the start of the construction of the Cernégula wind farm (46 MW) in Burgos, which is expected to be operational in the last quarter of 2024.

Enerfín ends the first six months of the year with sales of EUR 88.4 million, 16.1% below the same period in 2022. As for the consolidated net profit, this stands at EUR 7.7 million compared to the EUR 11.1 million in the first semester of last year. The subsidiary has not equalled last year’s figures due to the high energy prices in Spain during the first semester of 2022. By contrast, in the first six months of 2023, the production of electrical energy attributed to Spain, Brazil and Canada (1,037 GWh) exceeded the generation of this same period in the previous year (1,010 GWh).

Celeo

This company runs 7,284 km (vs. 6,891 km at the end of 2022) of electricity power transmission lines in Chile, Brazil and Peru, and has stakes in 345 MW of renewable energy (photovoltaic and thermosolar) in Spain and Brazil. The combination of assets in operation managed by the company (which is jointly owned and managed with APG, one of the largest pension funds in the world) comes to about EUR 5,924 million at last year end.

During this first semester, the company reported a turnover of EUR 143.2 million (+0.9%) and an consolidated net profit of EUR 13.7 million (+72.2%). Celeo is consolidated in the Group accounts/Financial Statements by means of the Equity Method, so consequently it does not contribute to the consolidated sales figure. In this first semester, Celeo contributed 5.9 million euros (vs. 4.1 million euros in 1H22) to the Elecnor Group’s consolidated net profit, after applying the percentage of ownership and the corresponding accounting adjustments.

The Transmission Networks business of Celeo has performed well, as it was boosted by the increase in price indexes that affect the sales rates applicable to power transmission lines, which had a particular impact on the Brazilian projects. In turn, the Thermosolar power plants that Celeo manages in Spain have achieved greater production than in the same period last year.

Forecast for 2023

In view of the above, and based on the good performance of the company during the first semester, the Elecnor Group expects that it will continue this trend of improvements for the rest of 2023, in absolute and percentage values of its figures in all the main lines of the income statement (sales and results), exactly as it has been doing year after year for the last decade.

According to Rafael Martín de Bustamante, CEO of the Elecnor Group, “although we find ourselves in an uncertain global economic scenario, with high levels of inflation and debt, which is producing downward revisions of the prospects for growth for next year, at the Elecnor Group we have every confidence in the good work of our professionals and we hope to maintain the positive tendency of our results from previous years over the coming periods.”

“The reason for our optimism is that the Elecnor Group is at the epicentre of three key macro trends that are boosting its development and value creation in the medium and long term: environmental and social sustainability, the energy transition and electrification of the economy, and the urbanisation and digitalisation of society”, adds Martín de Bustamante.

A sustainable value. ESG Commitment