The Americas have seen a surge of interest and activity directed towards the energy transition over the past 12 months. While a common goal of a net zero future is shared from north to south, individual countries are approaching the task in ways that suit their own unique circumstances.

In our latest quarterly Energy transition update: Americas, subscribers can access analysis of major market trends affecting the energy transition in the US, Canada and Latin America. Read on for a brief overview of three key themes.

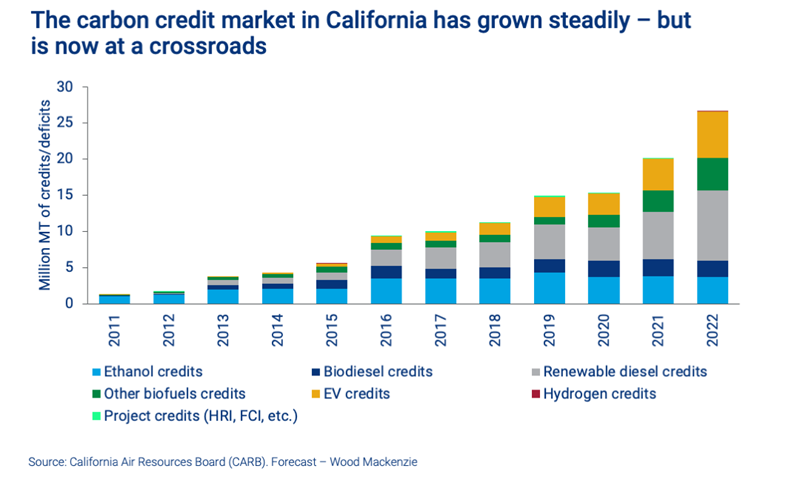

1. Can California tighten its carbon credit market?

Launched in 2011, the California Air Resource Board’s Low Carbon Fuel Standard (LCFS) created a credit system to encourage investment in low-carbon transport. Carbon intensity (CI) standards were defined for more than 600 fuels and carbon abatement technologies. Credits and deficits can be generated depending on whether a fuel’s CI is higher or lower than an annual benchmark.

Between 2015 and 2020 high demand saw credit prices surge from US$25 per tonne to US$200 per tonne. As a result, investment in liquid and gas biofuels and electric vehicle (EV) infrastructure soared. However, as new projects have become operational and supply increased, prices fell to five-year lows in early 2023.

Low LCFS credit prices threaten the viability of low-carbon hydrogen and carbon capture, utilisation and storage (CCUS) projects, and could also limit the impact of the Inflation Reduction Act (IRA). New LCFS guidance due in Q3 2023 will therefore need to address the issue.

What to watch: CARB’s updated LCFS guidance, expected in Q3 2023.

2. Can Canada position itself as a major supplier of critical minerals?

In the wake of Covid-19 and the conflict in Ukraine, diversifying the global supply chain and ensuring future energy security is now top of mind for governments and businesses. This is causing a major paradigm shift in market dynamics for battery raw materials, as well impacting the market for nuclear fuel.

As the world’s fifth largest supplier of graphite and nickel, and a key supplier of uranium, Canada is well-positioned to benefit from a shift away from China and Russia as suppliers of these key energy transition resources.

To maximise the opportunity, in late 2022 Canada launched its Critical Minerals Strategy. This includes a 30% tax credit for mineral exploration applicable to nickel, lithium, cobalt, graphite, copper, rare earths, vanadium and uranium. The Strategy was boosted in Canada’s 2023 budget by the announcement of an aligned 30% Clean Technology Manufacturing Investment Tax Credit.

Together, these incentives signal Canada’s seriousness about scaling its minerals supply chain. However, to be successful it will need to get both the big mining companies and indigenous groups onboard.

What to watch: The next wave of Canadian post-budget project announcements.

3. Can Colombia find the right balance in its net zero strategy?

In Colombia, recently elected president Gustavo Petro has shifted the country’s priorities from oil production and exploration to pursuing a lower carbon future. However, we believe that to reach net zero, Colombia will need to strike a balance between upstream, refining and new energies.

Around 80% of vehicles in Colombia are petrol-powered and GDP per-capita is one of the lowest in the region. High interest rates, limited grid infrastructure investments and a large secondary market are all barriers to EV uptake.

E-fuels manufactured from green hydrogen will therefore be a critical element of Colombia’s decarbonisation. If it can attract the necessary investment, Colombia’s wind and solar potential can enable an expansion of green hydrogen supply: the power grid could reach 5 GW for solar and 3 GW for wind by 2030 on a cumulative basis, according to our Lens Power platform.

However, e-fuels will be a relatively small part of the transport market and domestic oil and gas production will play a role in the journey to net zero.

By finding the right balance, we believe Colombia could lead Latin America through the energy transition.

What to watch: the pace of additional e-fuels capacity in and around Cartagena and evolving policy towards upstream, exploration and refining.

We’ll be tracking these issues, and more, closely. Find out more about our global energy transition research.

David Brown

Director, Energy Transition Practice