Offshore Wind Drives 30+ Vessel Orders, Boosts Domestic Manufacturing, and Plans to Power Equivalent of over 20 Million Homes.

The American Clean Power Association (ACP) today released a comprehensive report on the U.S. offshore wind market, revealing a rapidly growing pipeline of projects across 32 leases totaling 51,377 MW of expected capacity – enough electricity to power the equivalent of more than 20 million homes. Additionally, offshore wind project development, construction and operations are expected to support up to 83,000 American jobs by 2030, with industry investment set to deliver up to $25 billion per year in economic output, according to an ACP report from 2020.

Although the U.S. currently lags behind China and the U.K. in terms of installed offshore wind capacity, the increasing number of projects in development signals significant progress in a sector poised to play a critical role in creating an energy system powered by clean energy.

John Hensley, ACP’s VP of Research & Analytics commented, “American offshore wind power is vital to accelerating the deployment of clean energy and the industry is stepping up to the plate to invest. The rapid growth in the U.S. offshore wind pipeline reflects strong federal and state government commitment to clean energy expansion and the industry’s response to those goals. These projects have the potential to create tens of thousands of jobs, reduce our nation’s dependence on foreign energy, provide coastal cities with reliable clean power, and help the U.S. meet its emissions reduction goals.”

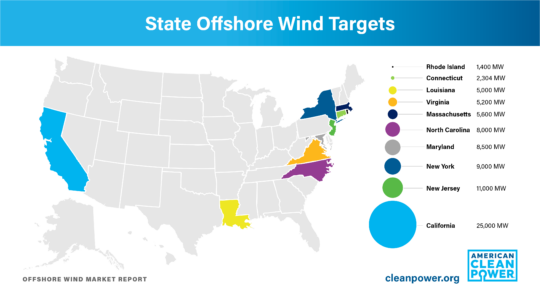

The Offshore Wind Market Report underscores the crucial role that states are playing in driving U.S. offshore wind procurement. East coast states, like New York and New Jersey, have set procurement targets totaling over 51,000 MW. In total, ten states have combined offshore wind targets of over 81,000 MW.

The new report emphasizes the economic impact of offshore wind on domestic shipbuilding, with more than 30 new vessels currently on order or under construction to support the industry.

The domestic supply chain for offshore wind is also set for significant growth, with fourteen facilities announced or under construction. Investment announcements for major offshore wind components exceed $1.7 billion, and with three state solicitations pending, more supply chain investments are anticipated, bolstering the sector’s expansion.

Despite these encouraging trends, project costs are rising due to supply chain disruptions, commodity price increases, macroeconomic inflationary pressures, and higher interest rates. Rising steel prices in particular pose challenges for offshore wind developers, as steel represents a significant portion of project material costs. Lengthy and unclear permitting and regulatory timelines make these issues worse. Resolution of these permitting and siting challenges, alongside improving economic conditions, would strengthen the economic viability of offshore wind projects.

Hensley added, “While the U.S. offshore wind industry is making tremendous strides, it’s essential to address these challenges to ensure the long-term economic viability of these projects. A strong, collaborative approach between industry stakeholders and government bodies will help us tackle obstacles – like clarifying permitting processes – and realize the full potential of offshore wind as a key component of our clean energy future.”

Key Takeaways from the Report:

- U.S. Offshore Wind Pipeline: 42 MW currently online, 51,377 MW in development pipeline across 32 leases.

- East Coast dominates with 84% of the pipeline, accounting for 43,115 MW.

- Early development projects represent 33,875 MW, while advanced development projects account for 16,564 MW.

- Leading States: Ten states have combined offshore wind procurement targets of over 81,000 MW.

- New York leads with 4,362 MW of capacity in the pipeline, followed by New Jersey with 3,758 MW.

- Revenue: 2022 BOEM lease sales generated nearly $5.4 billion in federal revenue.

- Prices were highest in the February 2022 New York Bight auction, averaging $8,313/acre, but were lower in Carolina Long Bay and California.

- Manufacturing: Offshore wind is driving domestic shipbuilding and a growing domestic supply chain, with over 30 vessels on order or under construction.

- Headwinds: Project costs are increasing due to supply chain disruptions, commodity price increases, and inflation, with steel prices as a notable concern.

- Lengthy permitting and regulatory timelines exacerbate these issues.

The Offshore Wind Market Report is accessible here.