Electricity demand fell in April in all European markets. Excluding 2020 demand, which was affected by COVID measures, Spain and Italy registered their lowest values in 20 and 6 years, respectively. Falling demand and gas prices, as well as a solar energy production that was the highest for a month of April in several markets favoured the decline in electricity markets prices, which in many cases were the lowest since the summer of 2021.

Concentrated Solar Power, photovoltaic wind energy production

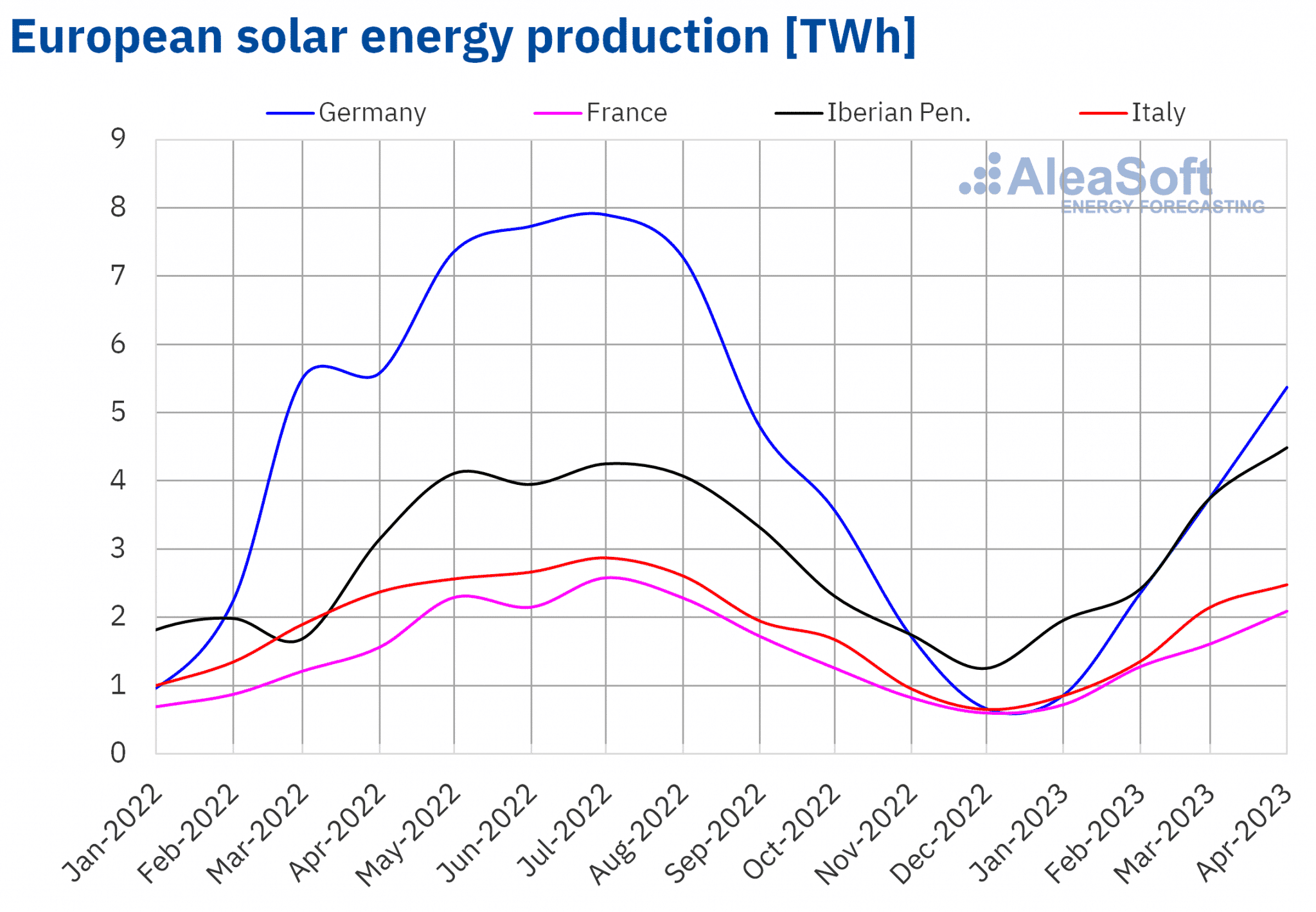

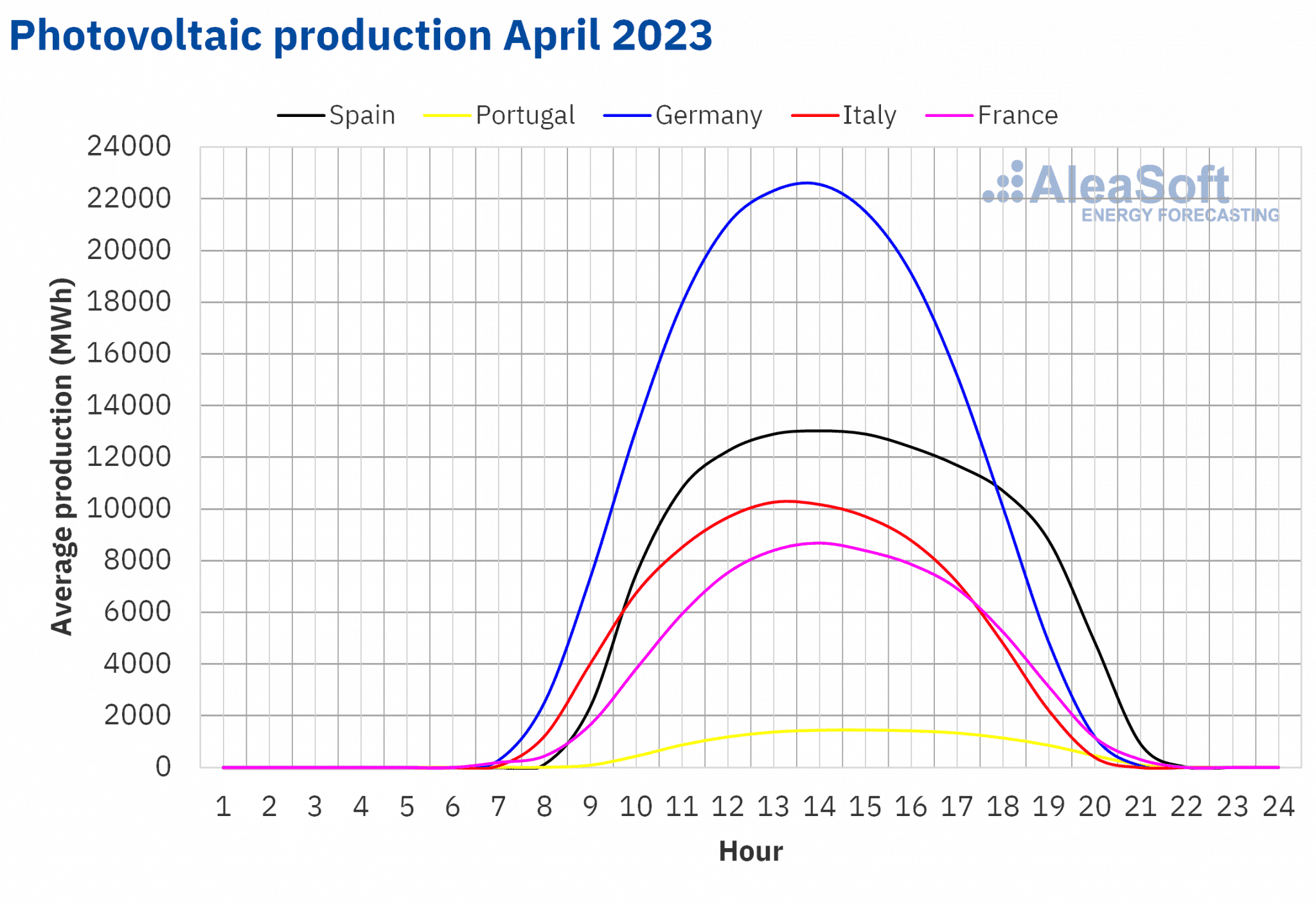

The solar energy production increased in April 2023 in year?on?year terms in all markets analysed at AleaSoft Energy Forecasting. The largest rise was that of Portugal, of 55%, while in the markets of France and Spain, the increases were 34% and 40%, respectively. On the other hand, in the market of Italy, the smallest increases in production were registered, of 4.5% and 5.3%, respectively. Also, solar energy production decreased a 3.8% in Germany compared to the previous year.

In the comparison with March 2023, the solar energy production for April increased in all analysed markets. In this case, the largest rise was that of Germany, of 48%. The increases in production in Portugal and France were also important, of 31% and 34%, respectively. On the other hand, the smallest increase, of 19%, was registered in the Spanish and Italian markets.

The solar photovoltaic energy production reached the highest value registered for a month of April in the Spanish, French, Italian and Portuguese markets. However, the highest production, of 5369 GWh, was reached in the German market. In the case of the Spanish market, the solar thermoelectric energy production, of 634 GWh, was also the highest registered in a month of April.

On the other hand, according to data of REN, in April 2023, the increase in solar photovoltaic energy capacity of Portugal compared to the installed capacity at the end of March was 7.0 MW.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

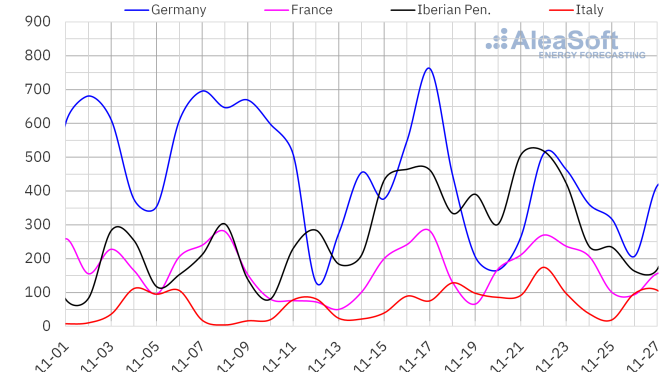

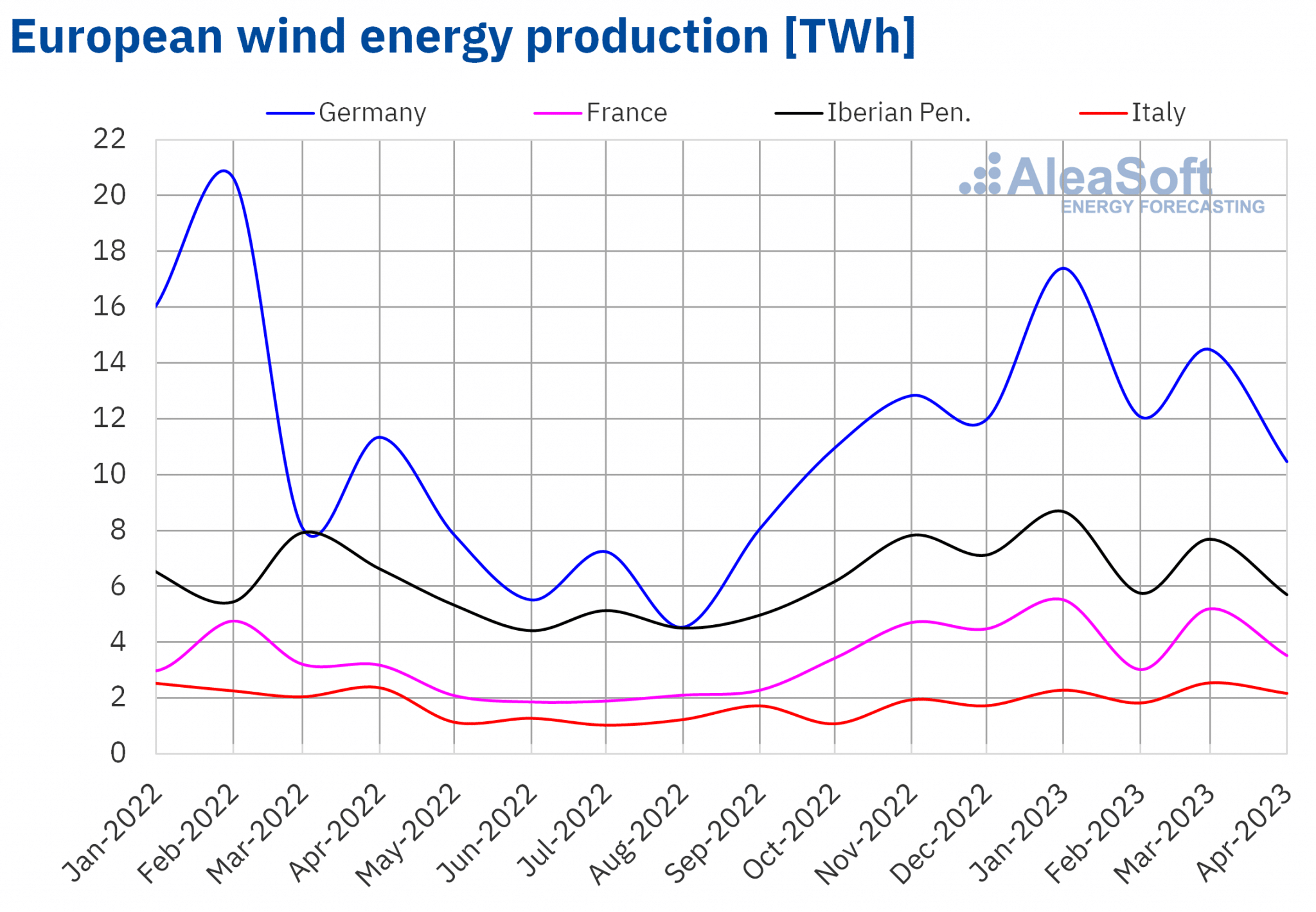

In the case of the wind energy production of April 2023, there was a significant year?on?year rise in the French market, of 11%. But in the rest of the markets analysed at AleaSoft Energy Forecasting there were decreases. The biggest drop, of 23%, was registered in the Portuguese market. In the rest of the markets the decreases were between 7.7%, of Germany, and 17% of Spain.

On the other hand, the production of April fell in all analysed European markets compared to that of the previous month. The smallest decrease, of 12%, was that of the Italian market. In the rest of the markets, the decreases were between 21% of the Portuguese market and 30% of the French and Spanish markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Electricity demand

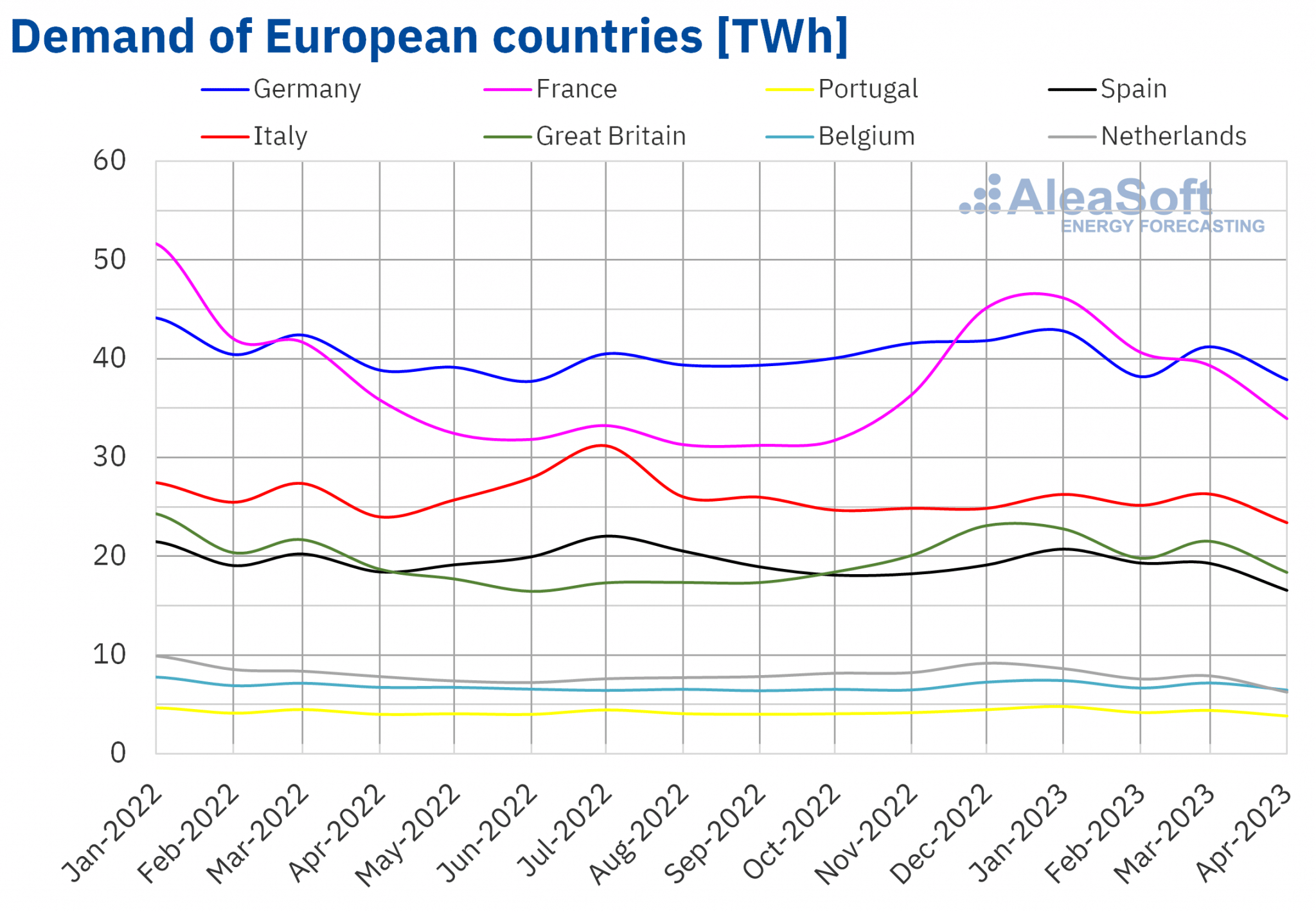

During the month of April 2023, year?on?year decreases in electricity demand were registered in all the European markets. The biggest drop, of 20%, was that of the Dutch market, followed by that of the Spanish market, of 10%. In the rest of the analysed markets, the year-on-year decreases in the electricity demand were between 1.7% of the British market and 5.3% of the French market.

Compared to March, 2023, the electricity demand also decreased in all analysed markets. The biggest drop compared to the previous month, of 18%, was also registered in Netherlands. In the rest of the markets, the decreases of the electricity demand were between 5.0% of the German market and 14% of the Spanish market.

The drop in electricity demand in April compared to the previous month was influenced by a slight increase in average temperatures and by Easter holidays. However, compared to April 2022, the average temperature was only higher in the Iberian Peninsula. The rise of 3.1 °C in the average temperature of Spain led to the year?on?year demand drop of this market being the second highest.

On the other hand, in Aril 2023, the electricity demand of Netherlands was the lowest at least since January 2015. In the Spanish and Italian markets, the lowest values since April and May 2020 were registered, respectively. If the demand registered in the months of 2020, with the measures to control COVID?19 pandemic, is not taken into account, in April 2023 the lowest demand in the last 20 years was registered in Spain, and the lowest one in six years in Italy. In the case of Portugal, the demand reached the lowest value since April 2021.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

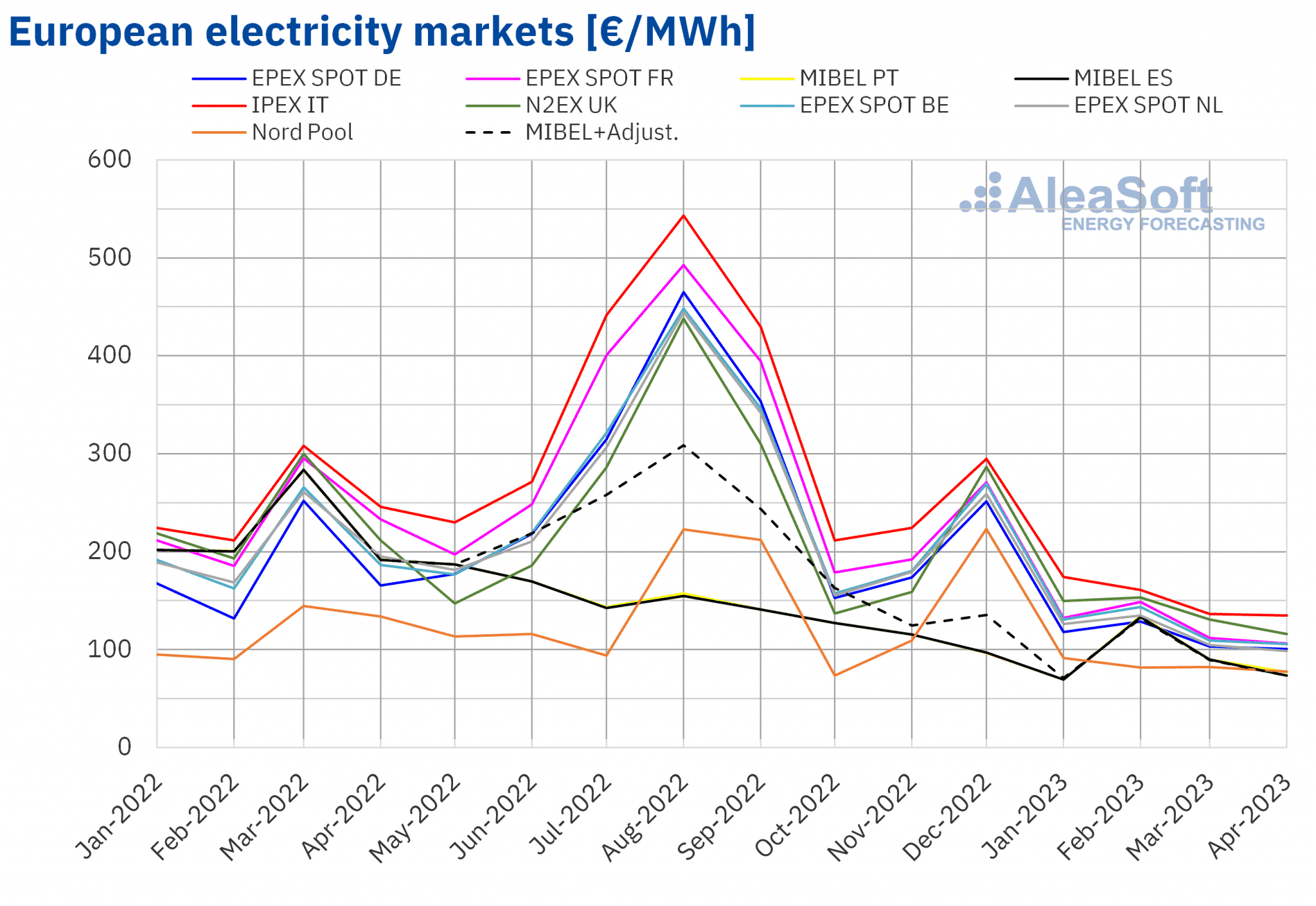

In April 2023, the monthly average price was below €110/MWh in most European electricity markets analysed at AleaSoft Energy Forecasting. The exceptions were the averages of the N2EX market of United Kingdom and the IPEX market of Italy, of €116.08/MWh and €134,97/MWh, respectively. On the other hand, the lowest monthly prices, of €73.73/MWh and €76.96/MWh, were registered in the MIBEL market of Spain and Portugal. In the rest of the markets, the average prices were between €77.87/MWh of the Noord Pool market of the Nordic countries and €106.36/MWh of the EPEX SPOT market of France.

Compared with March, in April the average prices decrease in all European electricity markets analysed at AleaSoft Energy Forecasting. The largest drops, of 18% and 15% were registered in the markets of Spain and Portugal, respectively. The rest of the markets registered price decreases between 1.0% of the Italian market and 11% of the British market.

If the average prices of April are compared with those registered in the same month of 2022, the prices also decreased in all markets. The largest falls were those of the Portuguese and Spanish markets, of 60% and 62%, respectively. In the rest of the markets, the decreases were between 39% of the German market and 54% of the French market.

As a consequence of the registered decreases, the average of April was the lowest since July 2021 in the British market. In Germany, France, Italy, Belgium and Netherlands, the price of April was the lowest since August 2021. In the case of the Nord Pool market, the lowest average since October 2022 was registered in April, while in the Spanish and Portuguese markets, the lowest prices since January 2023 were registered.

In April 2023, the decrease in the average gas prices, the drop in the demand and the increase of the solar energy production led to the decrease of prices in the European electricity markets, both respect to March 2023 and April 2022. In the case of the French market, the increase in the wind energy production with respect the previous month also favoured the drop in prices.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

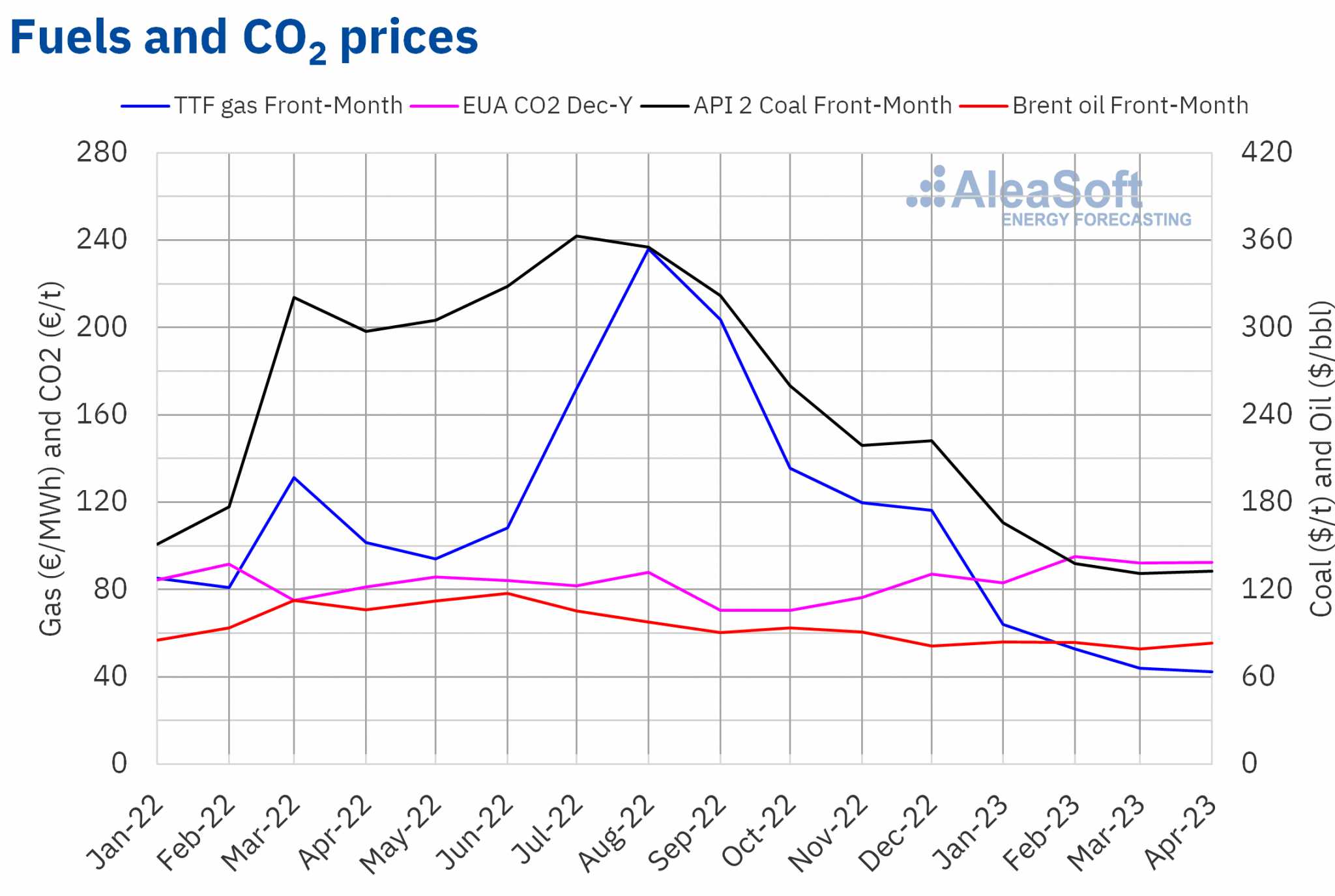

Brent oil futures for the Front?Month in the ICE market registered a monthly average price of $83.37/bbl in the month of April. This value was 5.3% higher than that reached by the Front?Month futures of March, of $79.21/bbl, but it was a 21% lower than that corresponding to the Front?Month futures traded in April 2022, of $105.92/bbl.

In the beginning of April, the OPEP+ announced production cuts from May on. This contributed the monthly price of April increasing compared to the previous month. This was also prompted by the publication of the International Energy Agency’s demand growth forecasts. However, in April, the Brent oil future prices continued to be influenced by the concerns about the development of economy. In addition, expectations of interest rate increases also exerted a downward influence on prices.

As for TTF gas futures in the ICE market for the Front?Month, the average value registered during the month of April for these futures was €42.21/MWh. Compared to that of the Front?Month futures traded in the month of March, of €44.03/MWh, the average fell by 4.1%. If compared with the Front?Month futures traded in April 2022, when the average price was €101.54/MWh, there was a 58% decrease.

As a consequence of the downward trend registered by these futures during the month of April, the monthly minimum settlement price, of €38.55/MWh, was reached on the April 26, which was the lowest since July 2021.

During the month of April 2023, demand levels and abundant supplies of liquefied natural gas by sea allowed European stocks to increase, supporting lower prices for TTF gas futures.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2023, they reached an average price in April of €92.47/t, 0.4% higher than the average of the previous month, of €92.08/t. If compared with the average of the month of April 2022 for the reference contract of December of that year, of €81.28/t, the average of April 2023 was 14% higher. Despite these increments, settlement prices stayed below €100/t. The highest settlement price in the month, of €97.44/t, was reached on April 11.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

The next webinar of the series of monthly webinars of AleaSoft Energy Forecasting and AleaGreen will be held on Thursday, May 11. The analysis table after the Spanish version of this webinar will count with the participation of Luis Atienza Serna, who was General Secretary of Energy and, later Minister of Agriculture, Fisheries and Food of the Government of Spain. He also presided over Red Eléctrica de España. The invited speaker will contribute with his vision of the future of the energy sector in Europe and South America, where he has also developed part of his professional career.

On the other hand, given the increment in wind and photovoltaic renewable energy production, the development of energy storage is essential to avoid curtailments and the cannibalisation of electricity market prices. The long-term price forecasts of AleaGreen allow the optimisation of hybrid systems of renewable energies, such as wind or photovoltaic energy, with energy storage systems, such as batteries. These long-term price forecasts for European electricity markets count with a 30-year horizon, hourly granularity and confidence bands.