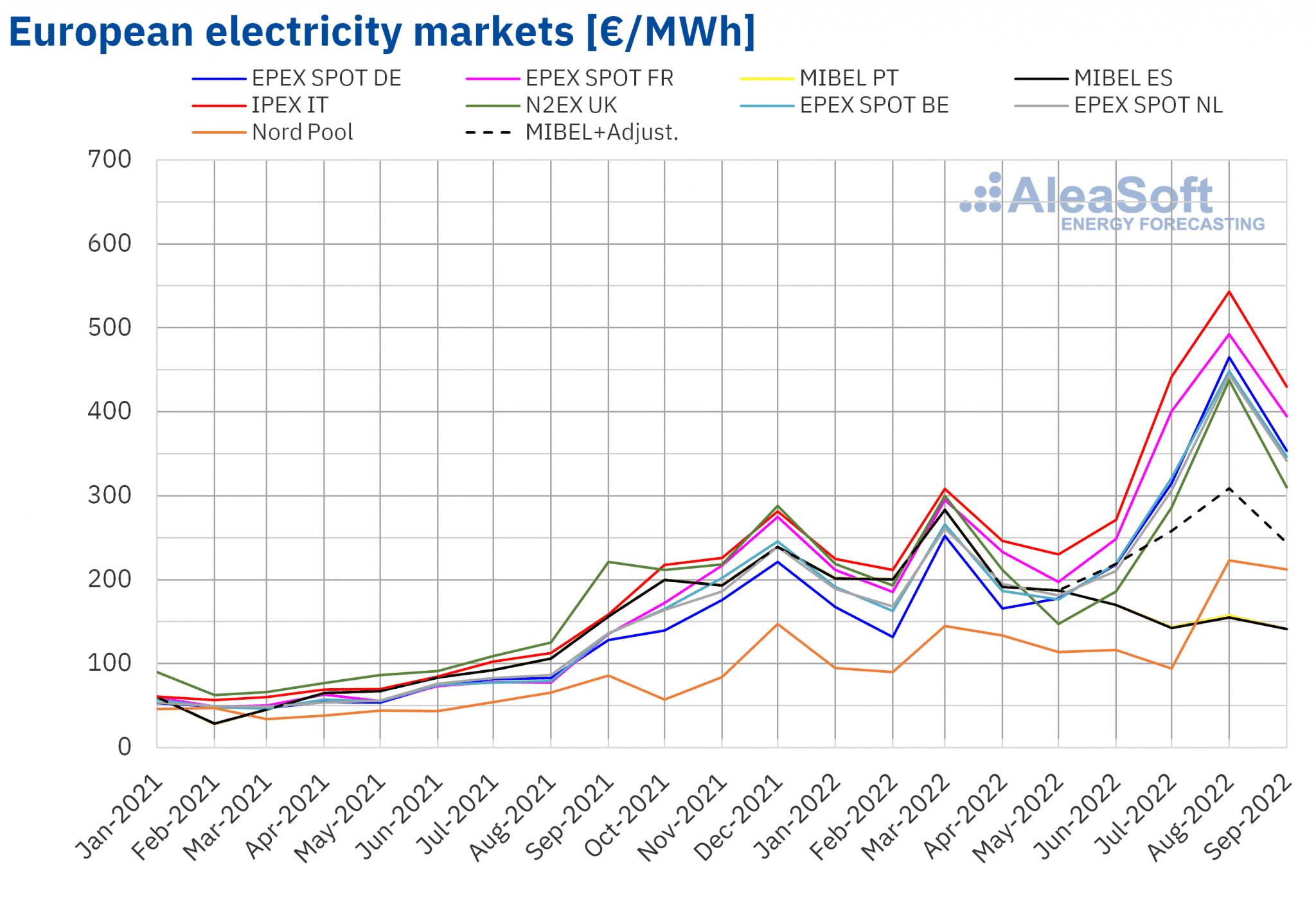

In the third quarter of 2022, prices of all analysed European electricity markets increased. The high gas and CO2 emission rights prices caused the quarterly averages to exceed €345/MWh in almost all European electricity markets. These prices are the highest registered so far in the European electricity markets.

European electricity markets

In the third quarter of 2022, the quarterly average price was above €345/MWh in almost all European electricity markets analysed at AleaSoft Energy Forecasting. The exceptions were the MIBEL market of Spain and Portugal and the Nord Pool market of the Nordic countries, with averages of €146.26/MWh, €147.51/MWh and €175.99/MWh, respectively. In contrast, the highest quarterly average price, of €472.03/MWh, was that of the IPEX market of Italy, followed by that of the EPEX SPOT market of France, of €429.73/MWh. In the rest of the markets, the averages were between €345.01/MWh of the N2EX market of the United Kingdom and €378.18/MWh of the EPEX SPOT market of Germany.

On the other hand, MIBEL market prices were the lowest due to the application of the cap on the gas price in this market during the third quarter of 2022. But a part of the consumers paid a higher price as compensation for this limitation in gas prices. The quarterly average of this price was €270.51/MWh in Spain, exceeding the maximum quarterly price of the Spanish electricity market, of €229.36/MWh, reached in the first quarter of 2022.

Compared to the second quarter of 2022, in the third quarter average prices increased in almost all European electricity markets analysed at AleaSoft Energy Forecasting. The exception was the MIBEL market of Spain and Portugal, with decreases in market prices without taking into account the compensation paid by some consumers of 20% and 19% respectively, precisely as a consequence of the Iberian exceptionality. On the other hand, the largest rise in prices, of 102%, was registered in the German market, while the smallest increase was that of the Nord Pool market, of 45%. The rest of the markets had price increases between 86% of the Dutch market and 92% of the Belgian market.

If average prices of the third quarter of 2022 are compared with those registered in the same quarter of 2021, prices increased in all markets. The highest price rise was that of the French market, of 345%, while the smallest increases were those of the Spanish and Portuguese markets, of 24% and 25% respectively. In the rest of the markets, price increases were between 128% of the British market and 289% of the German market.

With these price rises, in the third quarter of 2022, quarterly average prices reached historical highs in all analysed markets, except in the Iberian market, although as mentioned above, in this market if the compensation that some consumers pay due to the gas cap is taken into account, prices of the last completed quarter also represented a historical record. However, despite the quarterly increases, monthly prices fell in all analysed European electricity markets in the month of September 2022, after reaching historical maximum values in August. That month, the average gas price reached a historical maximum value of €235.22/MWh, exerting its upward influence on prices.

In the analysed period, quarterly prices of TTF gas in the spot market and of CO2 emission rights were high, reaching €198.71/MWh and €79.68/t respectively. This led to the increase in prices in European electricity markets.

Compared to the previous quarter, in addition to the 101% increase in gas prices, the general decrease in wind energy production and the drop in solar energy production in the markets of Germany, Italy and Spain also contributed to the increases registered in the electricity markets.

When comparing with the same quarter of the previous year, the rise in gas price was 320%. CO2 emission rights prices also increased in this case, by 40%. The effect of these strong increases on European electricity markets prices could not be offset by the general increase in solar energy production and the increase in wind energy production in almost all markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

AleaSoft Energy Forecasting is celebrating its XXIII anniversary this October. During all these years, the company has been providing its clients with a wide range of products and services in the field of the forecasting of demand, renewable energy production and electricity and gas markets prices. Within the field of renewable energies, the forecasting of wind energy, solar photovoltaic energy, solar thermoelectric energy, cogeneration and hydroelectric production are included. In this month of celebration, a personalised special promotion of long?term price curve forecasting reports is being offered for some European electricity markets.