European electricity markets prices rose due to the increase in demand.

In the third week of May, temperatures increased in Europe, in some cases reaching values among the highest in history for the month of May. This favoured the increase in demand in all markets and in prices in most cases. Solar energy production fell in most markets. In Germany, negative prices were registered in some hours of Saturday, May 21, which corresponded to a high wind energy production. Electricity and gas futures fell.

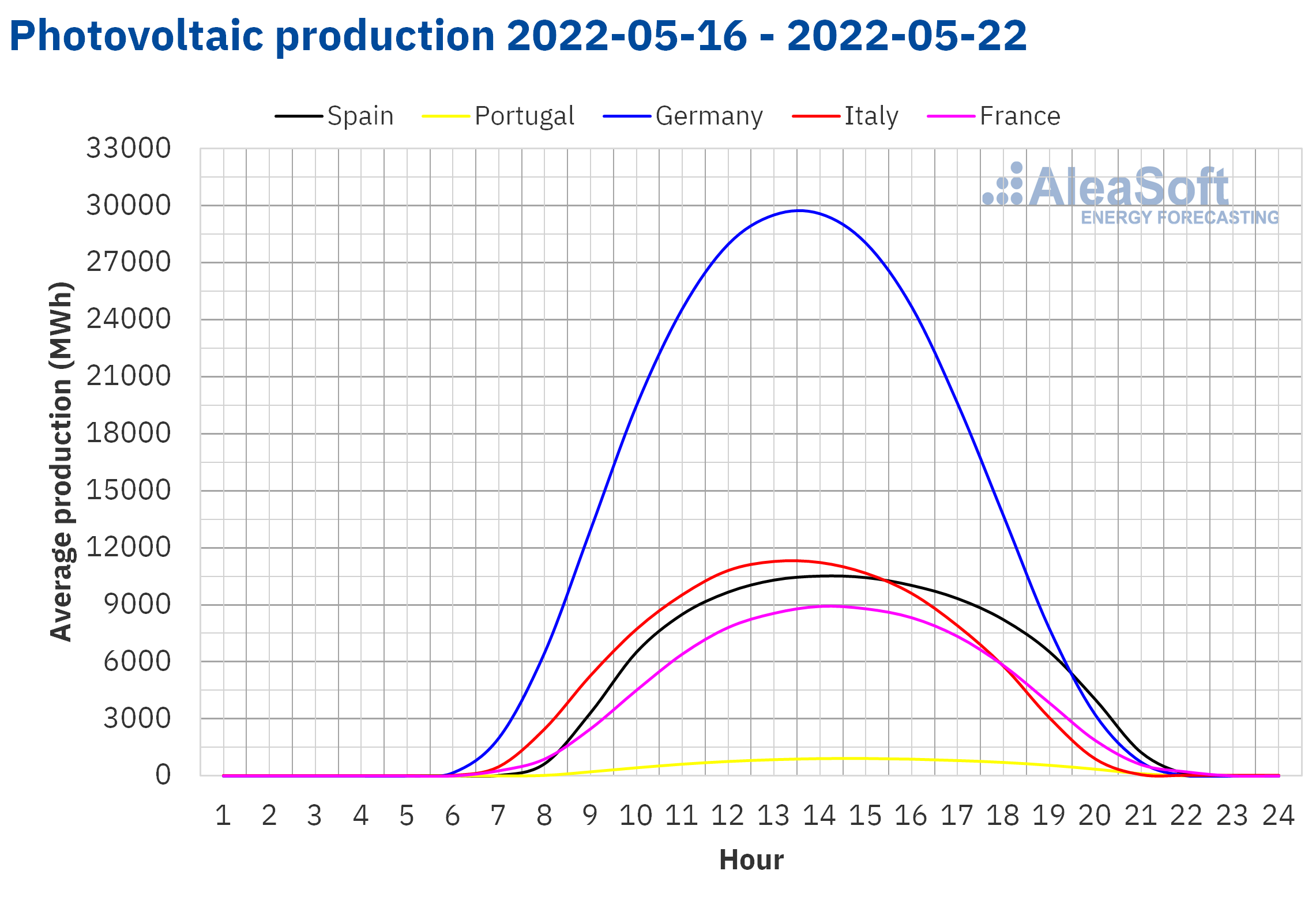

Photovoltaic and solar thermal energy production and wind energy production

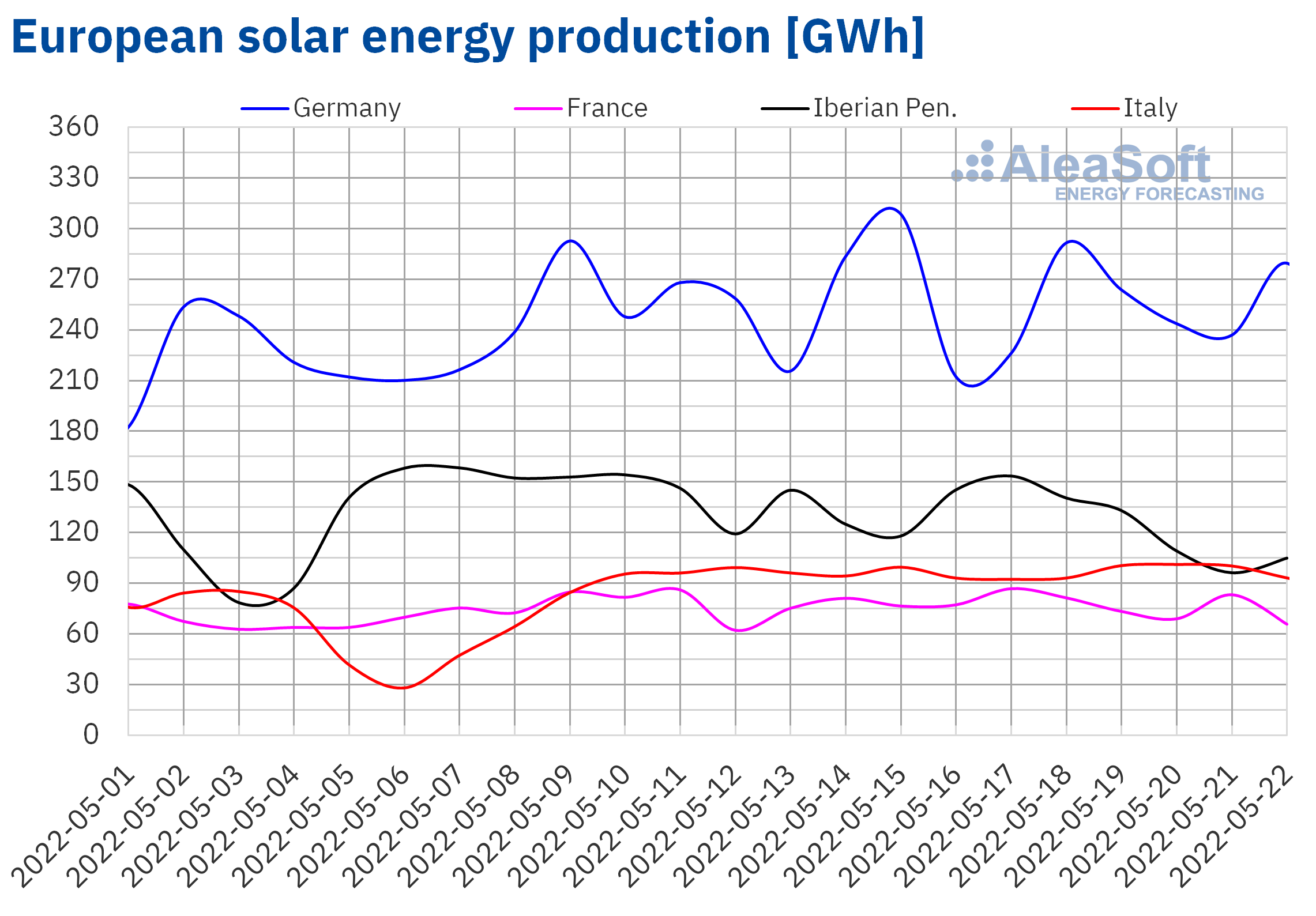

During the third week of May, the solar energy production fell in most European markets analysed at AleaSoft Energy Forecasting, compared to the previous week. The exception was the Italian market, where the production increased by 1.2%. The largest drop in solar energy production was registered in the Portuguese market and was 20%. In the rest of the markets the decrease was between 2.0% of the French market and 7.3% of the Spanish market.

For the last week of May, the AleaSoft Energy Forecasting’s forecasts indicate an increase in solar energy production in the German market, while a decrease is expected in the Spanish and Italian markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

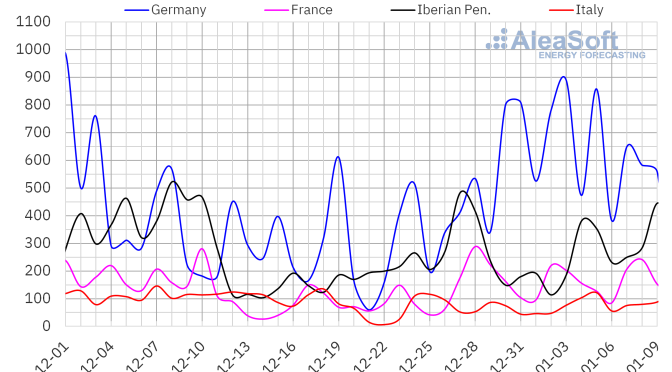

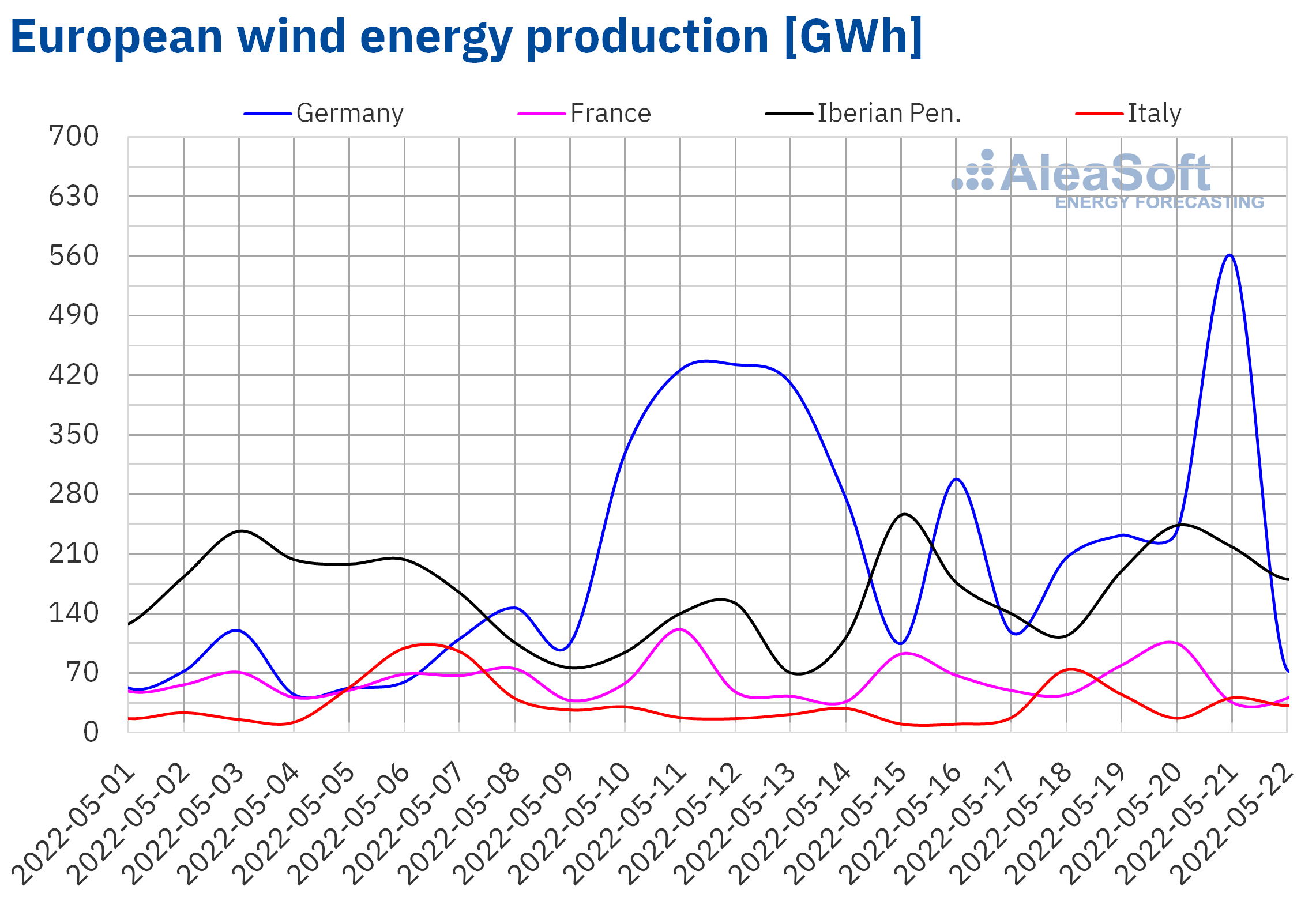

In the week of May 16 to 22, the wind energy production increased compared to the previous week in the markets of Italy, Portugal and Spain, by 56%, 53% and 38% respectively. However, in the markets of France and Germany, the production with this technology fell by 3.5% and 17% in each case. In the case of Germany, although the wind energy production decreased for the week as a whole compared to the previous week, on Saturday, May 21, the highest production since April 9, of 560 GWh, was registered.

For the week of May 23, the AleaSoft Energy Forecasting’s forecasts indicate an increase in wind energy production in all analysed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

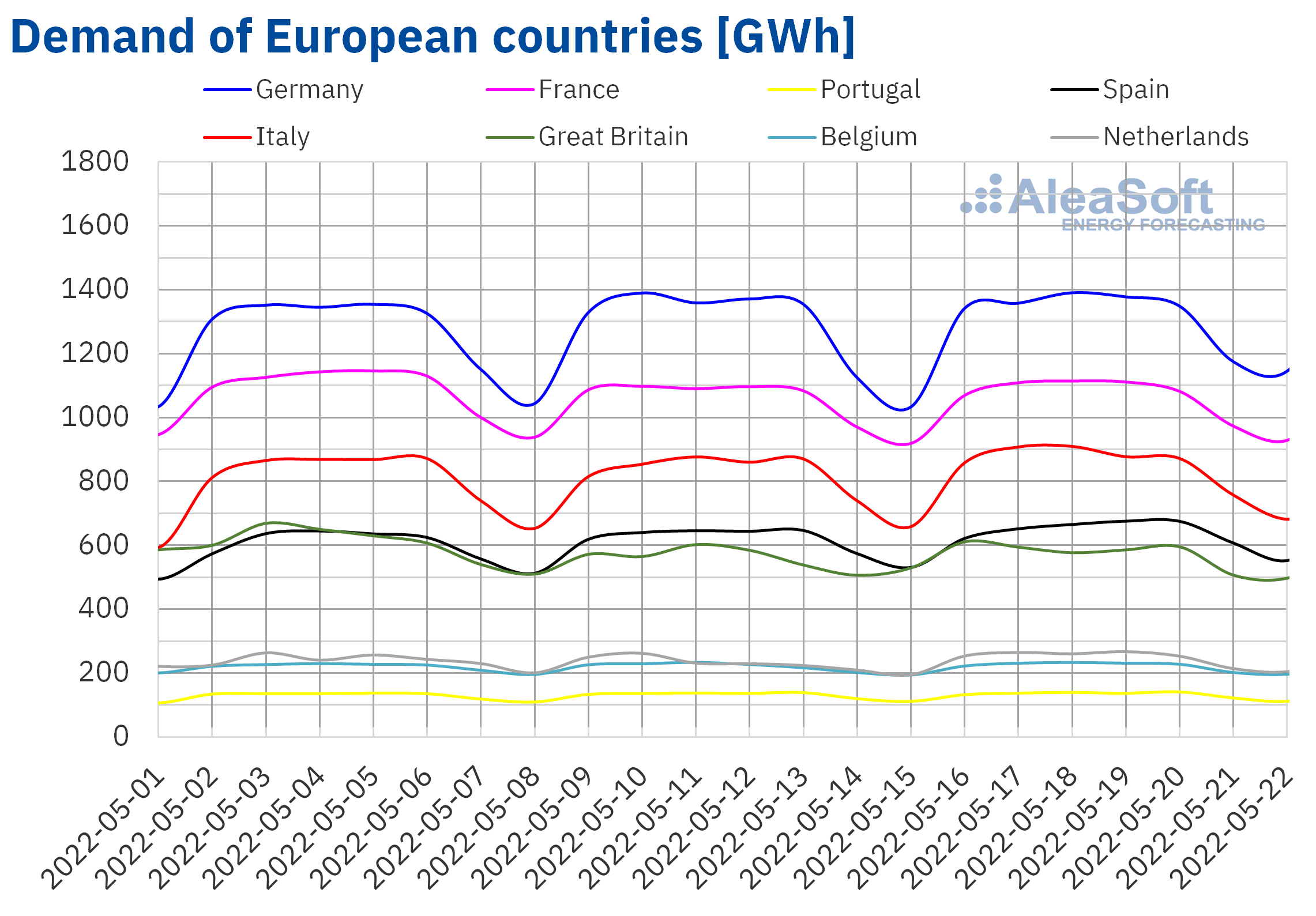

Electricity demand

During the third week of May, the electricity demand increased in all European markets analysed at AleaSoft Energy Forecasting compared to the previous week. The largest increase was registered in the market of the Netherlands, where the demand rose by 7.3%, followed by the recovery of the demand in the Spanish and Italian markets, of 3.4% and 3.3% in each case. The markets of France and Portugal were those with the lowest increases, of 0.6% and 0.7% respectively. In the rest of the markets, the rise in demand was between 1.0% of the Belgian market and 2.0% of the German market. The increase in demand, mainly in the countries in southern Europe, was favoured by the high temperatures reached as of Thursday, May 19, which were among the highest in history for a month of May.

For the week of May 23, the AleaSoft Energy Forecasting’s forecasts indicate that the demand will decrease in most analysed markets. In the case of Germany, France, Belgium and the Netherlands, the drop in demand will be mainly favoured by the holiday of Thursday, May 26, Ascension Day. However, in the markets of Portugal and Italy, the demand is expected to increase.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

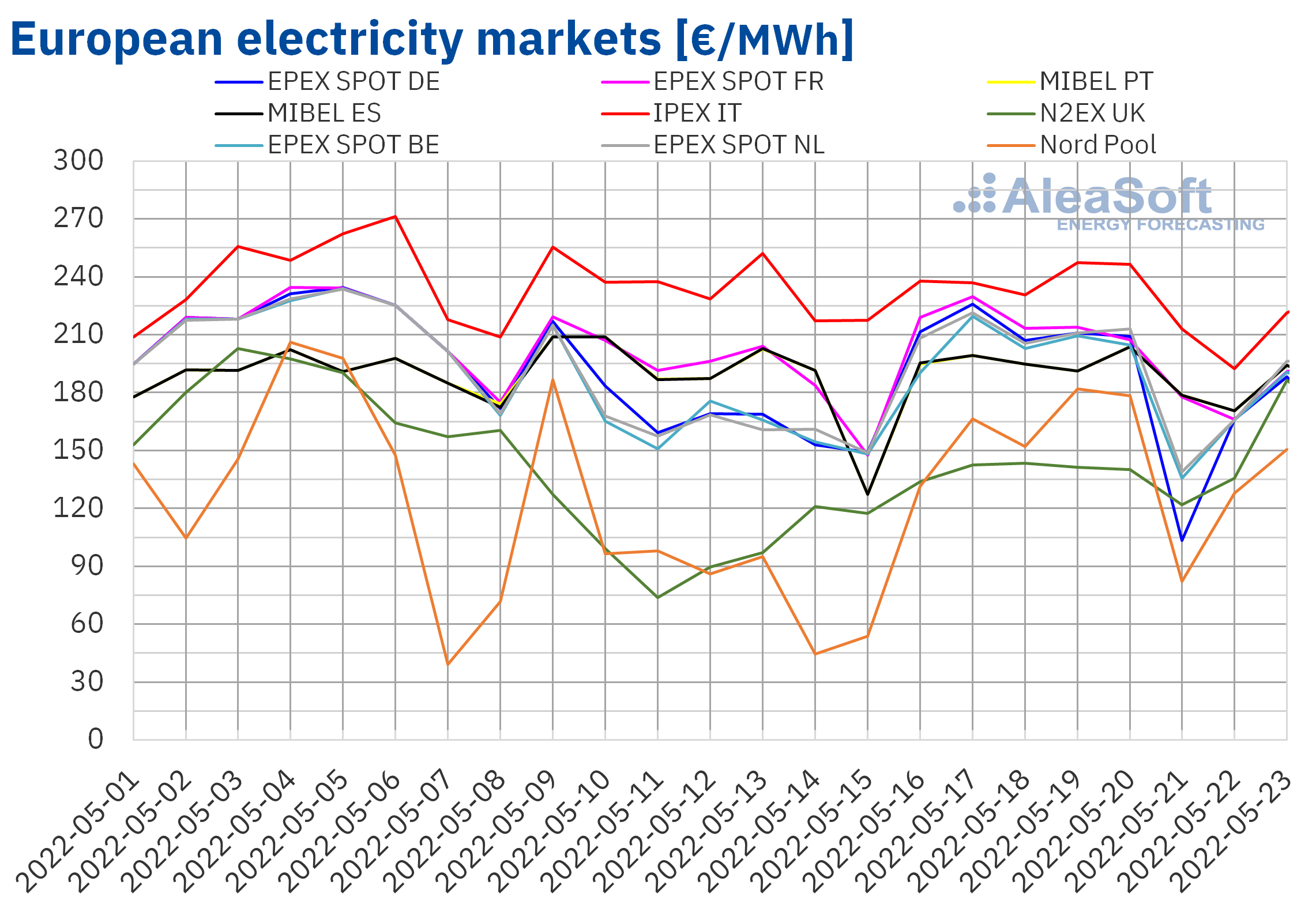

European electricity markets

In the week of May 16, prices of almost all European electricity markets analysed at AleaSoft Energy Forecasting increased compared to the previous week. The exception was the IPEX market of Italy with a decrease of 2.5%. On the other hand, the highest price rise was that of the Nord Pool market of the Nordic countries, of 54%, followed by that of the N2EX market of the United Kingdom, of 32%. On the contrary, the smallest increase, of 1.5%, was that of the MIBEL market of Spain and Portugal. In the rest of the markets, the price increases were between 5.8% of the EPEX SPOT market of France and 16% of the EPEX SPOT market of the Netherlands.

In the third week of May, despite the increases, the average prices continued to be below €195/MWh in almost all analysed electricity markets. The exceptions were the Italian market with a weekly average of €229.25/MWh and the French market with €203.90/MWh. On the other hand, the lowest weekly average, of €137.01/MWh, was registered in the N2EX market. In the rest of the markets, the prices were between €145.71/MWh of the Nord Pool market and €194.80/MWh of the Dutch market.

Regarding hourly prices, on Saturday, May 21, in the EPEX SPOT market of Germany, negative hourly prices were reached from 13:00 to 15:00. This did not happen in the German market since April 9 and corresponds to the increase in wind energy production registered that day in that market.

During the week of May 16, the general increase in demand and a slight recovery in gas prices in the spot market compared to the previous week favoured the rise in prices in the European electricity markets. In addition, the decrease in solar energy production in most analysed markets and the decrease in wind energy production in the German market for the week as a whole also contributed to this trend. However, the increase in wind energy production in the Iberian Peninsula allowed the lowest price increases to be registered in the MIBEL market. In the case of Italy, the increase in wind and solar renewable energy production contributed to the decrease in prices.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the week of May 23, prices might decrease in most European electricity markets influenced by the general increase in wind energy production and the decrease in demand in most markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

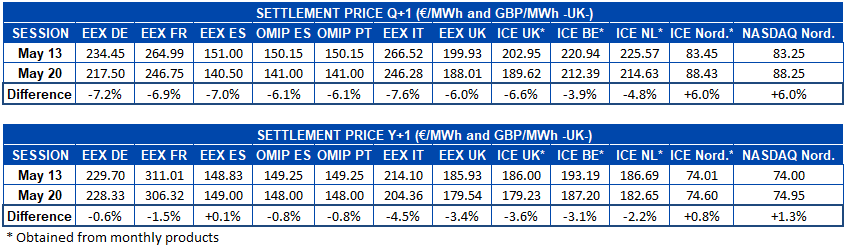

Electricity futures

Between the sessions of May 13 and 20, the settlement prices of the electricity futures for the next quarter registered declines in most of the main European markets. The exceptions were the ICE market of the Nordic countries and the NASDAQ market also of the same region, where increases of 6.0% were registered in both cases. In the rest of the markets, the decreases were between 3.9% registered in the ICE market of Belgium and 7.6% reached in the EEX market of Italy.

Regarding annual products, electricity futures prices for the year 2023 registered a performance similar to that of quarterly products. Prices also increased in the Nordic region, in this case to a lesser extent. The EEX market of Spain was added to the rises, with a discreet increase of 0.1%. However, the OMIP market of Spain and Portugal registered decreases of 0.8% for both countries. The largest drop occurred in the ICE market of Great Britain, with a decrease of 3.6%.

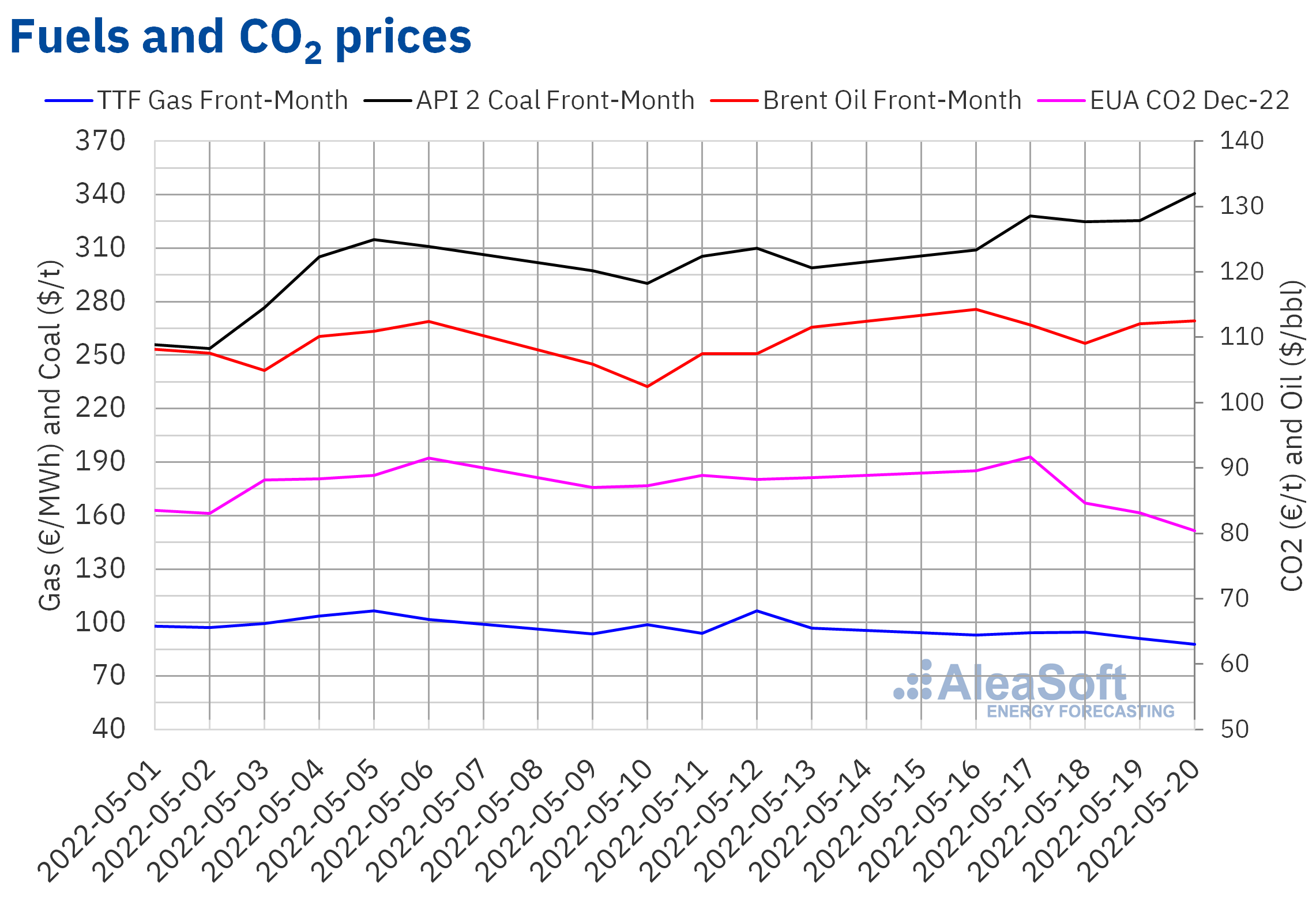

Brent, fuels and CO2

The settlement prices of Brent oil futures for the Front?Month in the ICE market remained above $110/bbl for almost the entire third week of May. The exception was Wednesday, May 18, when the minimum settlement price of the week, of $109.11/bbl, was registered. Instead, the maximum settlement price of the week, of $114.24/bbl, was reached on Monday, May 16. This price was 7.8% higher than that of the previous Monday.

While the demand recovers, the concern about OPEC+’s ability to meet agreed supply levels remains, favouring price increases. The expectations of an increase in mobility during the summer and the prospects for the recovery of the demand in China due to the improvement of the situation of the COVID?19 pandemic in Shanghai might contribute to the increase in prices.

As for the settlement prices of the TTF gas futures in the ICE market for the Front?Month, the entire third week of May remained below €95/MWh. Lower values than those of the same days of the previous week were registered every day except for Wednesday, May 18. That day the maximum settlement price of the week of €94.54/MWh was reached, which was 0.6% higher than that of the previous Wednesday. Subsequently, prices fell and on Friday, May 20, the minimum settlement price of the week, of €87.90/MWh, was registered. This price was 9.3% lower than that of the previous Friday and the lowest since February.

The stable gas flows allowed the TTF gas futures price to fall on average in the third week of May compared to the previous week, unlike what happened in the spot market. However, since Saturday, May 20, Finland stopped receiving gas from Russia, as had already happened in Bulgaria and Poland, because of refusing to pay for it in roubles.

Regarding CO2 emission rights futures prices in the EEX market for the reference contract of December 2022, they began the third week of May with increases. On Tuesday, May 17, the maximum settlement price of the week, of €91.72/t, was reached, which was 5.0% higher than that of the previous Tuesday and the highest since February. But, on Wednesday, May 18, prices fell 7.7% from the previous day and started a downward trend. As a consequence, on Friday, May 20, the minimum settlement price of the week of €80.39/t was registered, which was 9.2% lower than that of the previous Friday and the lowest since April 19.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

The 30?year price curves forecasting with hourly granularity of AleaGreen, the AleaSoft Energy Forecasting’s division specialised in long?term reports for European markets, already takes into account the effects of Royal Decree?law 10/2022, by which a production costs adjustment mechanism is temporarily established to reduce the electricity price in the wholesale market. The long?term forecasting with these characteristics is necessary for PPA, the renewable energy assets valuation and for the development of batteries.

In the next AleaSoft Energy Forecasting’s webinar, which will be held on June 9 with the participation of guest speakers from Engie Spain, the novelties in the regulation of the Spanish electricity sector, as well as in renewable energy projects financing and PPA, will be analysed, topics in which Engie Spain has first?hand information and knowledge. In addition, as usual in this series of monthly webinars, the evolution of the European energy markets and the prospects for the second half of 2022 will be analysed.