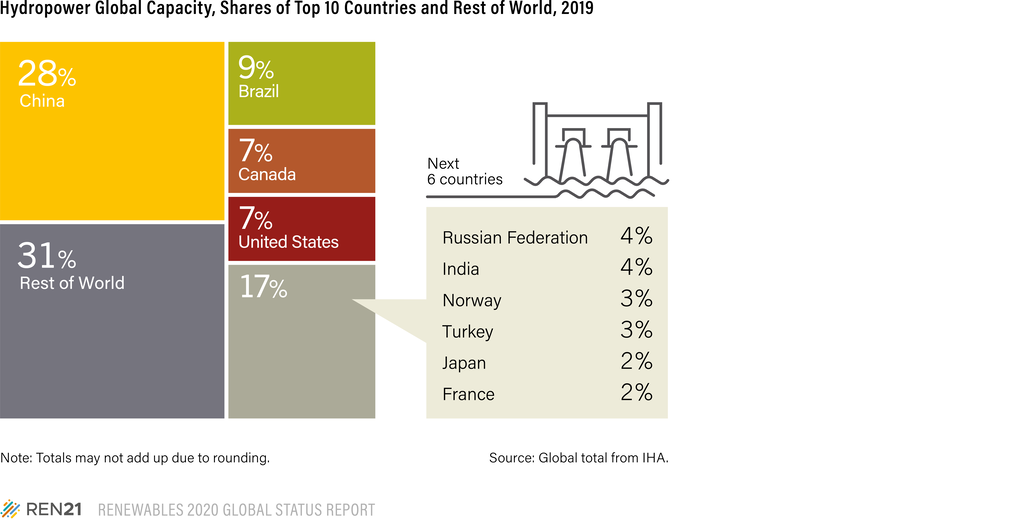

The global hydropower market, as measured in annual capacity installations, contracted in 2018, continuing a multi-year trend of deceleration. New capacity was an estimated 15.6 GW, raising total global installed capacity to around 1,150 GW. The ranking of the top 10 countries for total capacity shifts only over long time frames and remained (in order) China, Brazil, Canada, the United States, the Russian Federation, India, Norway, Turkey, Japan and France, which together represented more than two-thirds of global capacity at year’s end.

Hydropower generation around the world varies from year to year, affected not only by changes in installed capacity but even more by shifts in weather patterns and other local operating conditions. In 2019, global generation was an estimated 4,306 TWh, an increase of 2.3% from 2018, or around 15.9% of the world’s total electricity generation.

Brazil took the lead in commissioning new hydropower capacity in 2019, followed by four countries in Asia: China, Lao PDR, Bhutan and Tajikistan. This marked the first year since at least 2004 in which China did not maintain a wide-margin lead over all other countries for new hydropower completions. Global pumped storage capacity (which is counted separately from hydropower capacity) increased about 0.2% (0.3 GW) during the year, with almost all of this in a single installation in China.

Brazil’s project completions totalled 4.95 GW – nearly one-third of global additions and the largest annual increment since 2016 – for a year-end installed capacity of 109 GW. The lion’s share of the additions was the final six 611 MW turbines added to the Belo Monte plant, completing this 11.2 GW facility. By year’s end, Belo Monte was the fourth largest hydropower plant in the world and represented 7% of Brazil’s generation capacity. At 418 TWh, Brazil’s hydropower output was essentially unchanged from 2018, providing 70.5% of electricity supply in the country.

Despite Brazil’s apparently robust market in 2019, the country’s incremental hydropower development is increasingly constrained by available resources. Only around 12 GW (23%) of the remaining greenfield capacity potential (of unit size larger than 30 MW) lies in areas that are not restricted for ecological or social reasons. That remaining potential is further constrained by socio-political limitations as well as the environmental costs associated with development, which are estimated to be about an order of magnitude larger than what is typical for wind power and solar PV in Brazil. While hydropower’s still-dominant contribution to Brazil’s electricity mix is in gradual decline, the combined contribution of wind energy and solar photovoltaic is growing rapidly, rising from 8.8% in 2018 to 10.3% in 2019.

A number of projects were completed across other parts of Latin America. For example, Chile completed three small facilities in 2019, adding 38 MW, for a year-end total of 6.7 GW. Another nine projects totalling 0.8 GW were expected to reach completion by the end of 2020, including the 531 MW Alto Maipo complex. Chile’s generation from hydropower contracted more than 11% in 2019, providing around 27% of the electricity supply.

Peru added 132 MW of hydropower to its grid, mostly in the form of recommissioned capacity such as the 82 MW Callahuanca plant. The Callahuanca plant dates back to 1938, but the structure was damaged by landslides in 2017 and became inoperable. In 2019, Peru generated 30.2 TWh from hydropower, or around 57% of its total electricity supply.

In Bolivia, the second unit (69 MW) at the San Jose complex was completed, following the commissioning of the plant’s first (55 MW) unit in 2018. The country is experiencing a relative oversupply of capacity (3 GW against a peak demand of 1.8 GW in 2019), which the current government blames on a lack of system planning in years past. Nonetheless, portions of the country do not have adequate electricity supply due to lack of transmission capability. At the end of 2019, Bolivia had 735 MW of hydropower capacity, providing 34% of its electricity supply.

More hydropower capacity was added across Asia than in any other region during 2019, with several countries bringing plants online. China led the region for newly installed capacity, but for the first time in many years the country did not lead the world by a wide margin; instead, it trailed Brazil to rank second globally. China added 3.87 GW (excluding pumped storage) in 2019, about half the additions of 2018, for a year-end total of 326.1 GW. China’s total completed hydropower projects during the year represented investment of CNY 81.4 billion (USD 11.6 billion), an increase of 16.3% over 2018.

While China’s hydropower capacity grew 1.2%, generation increased 5.7% to 1,302 TWh in 2019. Even so, hydropower is having trouble keeping up with rising demand. Annual capacity additions have declined somewhat in recent years, both in absolute terms and as a share of overall electricity demand. During the five-year period 2014-2019, China’s hydropower capacity grew 15%, and due to higher capacity utilisation hydropower generation grew nearly 23%. Meanwhile, overall electricity demand rose over 30%.

As with Brazil, China foresees growing challenges to incremental hydropower development. At the end of 2019, an additional 52 GW was under development, with estimated further potential of 110-120 GW. However, the bulk of that potential lies in Tibet in the far south-west (as well as in Sichuan and Yunnan), far from major load centres in the country’s east. A shortage of transmission capacity, increasingly complex environmental limitations and rising relative costs (both absolute and relative to other renewables) all converge as major challenges to further hydropower development in China.

To the south, landlocked Lao PDR is harnessing its hydropower resources for both local demand and export to neighbours. In 2019, the country ranked third globally for newly installed capacity. Several large projects were completed, representing 1.9 GW of generating capacity, bringing the country’s year-end total to 7.2 GW. The largest of the new plants is the 1.3 GW Xayaburi facility. Other Lao PDR projects completed in 2019 included the 260 MW Don Sahong and the 290 MW Nam Ngiep 1 hydropower plants, both of which are intended to generate electricity for export. Nam Ngiep’s main dam site of 272 MW will produce electricity for export to Thailand, while a secondary 18 MW power station will generate electricity for local use.

In Lao PDR and other countries downstream along the Mekong River, the extremely low water flows – with parts of the river drying to a trickle even during the wettest season – have raised questions about the impacts of hydropower projects on the water economy of the Mekong delta. In the case of the Xayaburi plant, operators have maintained that because the facility’s run-of-the-river barrage design does not rely on a large reservoir, it permits natural river flows and therefore does not contribute to the conditions downstream. In early 2020, the Mekong River Commission launched a multi-national pilot project to monitor transboundary environmental impacts from the Xayaburi and Don Sahong projects – including effects on hydrology, sedimentation, water quality, aquatic ecology and fisheries – to inform potential measures to mitigate impacts from existing and future hydropower projects on the river.

Hydropower output in neighbouring Vietnam also was constrained by dry conditions during the year. With reservoir flows declining 20-50%, generation fell more than 18% from January through October relative to the same period in 2018. With no immediate relief in sight and rapidly growing electricity demand, the country’s priority is to balance the need for electricity generation against other demands on the limited supply of water. As part of this effort, Vietnam signed an agreement for the output of another Lao PDR hydropower plant that is scheduled to be completed by 2022. Vietnam also added 80 MW of its own hydropower capacity in 2019, for a total of 16.8 GW.

In the Kingdom of Bhutan, another landlocked country, an additional 720 MW of hydropower came online in 2019, bringing the country to rank fourth for new installations. The four 180 MW units of the Mangdechu project commissioned during the year increased the total capacity 45%, to 2.3 GW. In addition, further renovation work was completed at the 336 MW Chhukha plant in southwestern Bhutan.

Tajikistan followed for annual additions with completion of the second of six 600 MW turbines planned at the Rogun facility, bringing total hydropower capacity to 6.4 GW. The country hopes the plant will generate substantial revenues from electricity exports to neighbouring countries while also helping to alleviate local power shortages. However, the costly project is believed to place significant strain on state resources during construction. If the dam rises to the planned 335 metres, it will be one of the world’s tallest, breaking the record of the neighbouring 300-metre Nurek dam, also in Tajikistan and along the Vakhsh River.

To the west, Turkey added 0.2 GW of capacity in 2019, for a year-end total of 28.5 GW, which is a little less than one-third of the country’s overall generating capacity. Due to improved hydrological conditions, hydropower generation increased by nearly half to 88.8 TWh – a new record – providing around 30% of the country’s total electricity supply. Filling of the 1.2 GW Ilisu dam on the Tigris River resumed in mid-2019 despite unresolved concerns about potential water shortages in downstream Iran and Iraq and the imminent submersion of Turkey’s ancient city of Hasankeyf.

India saw only modest expansion of its hydropower assets in 2019 (154 MW), with all added capacity from units less than 25 MW in size, raising the total to 45.3 GW. India’s electricity generation from hydropower surged 15.9% during 2019 to nearly 162 TWh.

In March 2019, India finalised a decision to re-designate all hydropower assets larger than 25 MW as being renewable energy capacity, a change in accounting rules that advances India towards its commitment under the Paris climate agreement to meet 40% of its electricity from renewable sources by 2030. The change also may improve prospects for new large projects that now could qualify for certain renewable energy incentives and preferential financing terms (green bonds). In July, after years of delays and being rejected by a government advisory committee on the grounds of excessive ecological and social costs, the proposed 2.88 GW Dibang hydropower project in Arunachal Pradesh received renewed government support.

Japan (which added no new capacity in 2019), Europe and North America together represent a significant portion of existing global hydropower capacity, but these are relatively mature markets that have shown limited capacity growth in recent years, especially compared to other Asian and Latin American markets. Across Europe, a number of small plants came online in several countries, with the Russian Federation accounting for the region’s largest increase in capacity.

The Russian Federation added 0.5 GW of hydropower capacity in 2019, through new construction and rehabilitation of existing facilities, for a total of 48.5 GW. Among notable projects completed were the 320 MW Nizhe-Bureyskaya plant in the eastern Amur region and a 143 MW unit at the Ust-Srednekanskaya facility, which will provide much-needed electricity to the Magadan region of the Russian Far East, where demand grew 13% in 2018. The latter project has suffered long delays since its conception decades ago. Total hydropower generation in the Russian Federation in 2019 was over 190 TWh, representing 17.6% of all supply.

The United States continued to rank fourth in hydropower capacity in 2019, even as net installed capacity contracted by 126 MW to 79.7 GW. Two small hydropower units were added in 2019 (totalling less than 10 MW), while several units were retired. At year’s end, the country had a little over 100 MW of capacity under construction, all in small units of 18 MW or less. US hydropower generation contracted (down 6.4%) for the second year running, to 274 TWh.

Across the African continent, several countries completed projects for a total of 0.9 GW added in 2019. Most of this came online in Angola, Ethiopia and Uganda. Angola’s plans for rapid expansion of hydropower capacity advanced during the year with the completion of the fifth 338 MW turbine at the Laúca station, bringing the country’s total to 3.4 GW. The 2.07 GW facility was expected to be completed and in commercial operation in 2020.

In Ethiopia, the 254 MW Genale Dawa 3 hydropower plant was completed after 10 years of construction, having been delayed by problems arising from resettlement of residents living near the dam. Majority financed and built by Chinese firms, the project completion coincided with the Ethiopian government affirming its commitment to energy sector partnerships with Chinese entities, including a major transmission interconnection with Kenya that is under way, funded by the African Development Bank (AfDB) and the World Bank.

Uganda’s total power capacity increased more than 18% (and hydropower rose 33%) with the commissioning of the 183 MW Isimba hydropower station on the Victoria Nile (Upper White Nile). The government-sponsored project, which received 85% of its funding from the Export-Import Bank of China, aims to increase electrification, spur industrial activity, accelerate economic growth and allow for the export of electricity to neighbouring countries. Meanwhile, completion of the 600 MW Karuma project downstream was delayed again on account of transmission constraints and other problems, including alleged cost overruns by the developer, Sinohydro. In total, Uganda added 260 MW in 2019, bringing total capacity to just over 1 GW.

Several small hydropower projects also contributed to Africa’s hydropower capacity. These include the 8.2 MW Ruo-Ndiza plant in Malawi, the 0.64 MW Kasanjiku plant in Zambia (the first mini-hydropower station of the local rural electrification authority) and the 0.45 MW Rubagabaga plant in Rwanda. The Rwandan facility aimed not only to power the local mini-grid, but to improve local livelihoods more broadly.

Ghana also plans to utilise small hydropower plants to reinforce electricity supply. In 2019, the country completed the first 45 kW phase of its Tsatsadu micro-hydro project. This run-of-river facility requires no impoundmentv but diverts a portion of the river through a penstockvi for electricity generation. In Uganda, development funds were secured for a 14 MW run-of-river facility on the Kagera River, and in Burundi the AfDB issued a grant in support of a 9 MW solar-hydro hybrid project. Burundi’s planned hybrid system is expected to modulate energy supply between dry and wet seasons and to mitigate power shortfalls caused by climate change.

Pumped storage capacity did not increase much in 2019, with a single 300 MW facility completed in China and a 3 MW facility built in Greece. Total installed capacity at year’s end was 158 GW.

However, significant new capacity was being planned, in part to support growth in variable renewable electricity (VRE) from solar PV and wind power. Projects under development in 2019 aimed directly at facilitating the integration of VRE included facilities in Australia, the United Arab Emirates, the United States and Zimbabwe.

Australian projects that advanced in 2019 included the 2 GW Snowy 2.0 project in New South Wales and the 250 MW Kidston project in Queensland. The Snowy 2.0 project, which will be among the largest pumped storage facilities in the world, will provide 350 GWh (175 hours at full capacity) of electricity storage, or enough to supply 500,000 homes during peak demand. The Kidston project will be co-located with a solar PV facility (up to 320 MW) and will use two abandoned mining pits for upper and lower reservoirs.

Hydropower Industry

The hydropower industry continued to face a wide, interconnected web of challenges and opportunities that are evolving in a world of changing energy systems and priorities. Some are specific to the technical workings and economic considerations of the industry itself, while others pertain to hydropower’s relationship with other renewable energy sources, as well as environmental, social, climate and other sustainability imperatives.

Several inter-related themes of recent years continued to engage the industry in 2019, including the need for modernisation of ageing plants, market design that reflects the system benefits of hydropower and pumped storage, climate impact and resilience of hydropower facilities, and water resource management.

Refurbishment and modernisation (including digitalisation) of ageing hydropower facilities (mainly in Europe and North America) improves the efficiency of resource utilisation, plant operations and maintenance, and resource planning and management. In turn, such efforts help the hydropower infrastructure to support wider energy systems and, specifically, the integration of rising shares of VRE.

In the Russian Federation, modernisation of the hydropower fleet continues to be a priority. In addition to building new facilities, RusHydro (the country’s largest hydropower operator and the fourth largest in the world) has emphasised rehabilitation and upgrades of its older plants. Since the start of its modernisation and rehabilitation programme in 2011, RusHydro has added over 400 MW of capacity at existing facilities. In addition to capacity improvement, such efforts aim to increase operational efficiency, reliability and safety, in part through plant digitalisation.

The industry also is focused on encouraging electricity market design that reflects the value of hydropower and pumped storage for system flexibility to ensure that investment continues. In some markets, particularly those without compensation for capacity reserves or ancillary services, the narrowing spread between peak and off-peak energy prices (due in part to growth in zero marginal cost VRE) is undermining the profitability of both hydropower and pumped storage assets. Pumped storage plants in particular can break even only if the energy produced carries a sufficient premium relative to energy consumed. Long-term stability of policies and market structures is particularly important for the hydropower industry due to long project timelines and high upfront capital costs of projects.

Climate change also is posing increased risk to the industry, which is working to reduce both the impacts of a changing climate on hydropower output and the potential impacts of hydropower development on the global climate. Increasingly, the industry is incorporating climate variability and its impacts on hydrological conditions into project planning, design and operational plans. Incorporating other renewable energy technologies – such as solar PV and wind power – with hydropower projects is one option that the industry is adopting to reduce risk and support system resilience. At the same time, the industry is working to consider and manage the greenhouse gas impacts of hydropower projects, which are location dependent.

In 2019, industry leaders published guidelines to provide a practical approach to identify, assess and manage climate risks to hydropower projects and to provide international industry good practice on how to incorporate climate resilience into hydropower project planning, design and operation.

Another global focus of the industry is on sustainability in a broader sense, which requires an integrated approach to resource management that balances several priorities, including electricity generation, maintaining water quality, supply of water for non-energy needs such as irrigation, flood control, sediment management and other impacts on communities and natural resources, all while maximising project benefits equitably.

As part of this effort, industry documents released in 2019 aimed to guide hydropower developers and operators to improve outcomes for their projects and other stakeholders on two additional topics: the sharing of socio-economic benefits of hydropower projects, and the management of potential impacts arising from associated erosion and sedimentation upstream and downstream of a hydropower project site.

Major hydropower technology providers in the world included Andritz Hydro (Austria), Bharat Heavy Electricals (India), Dongfang Electric (China), GE (United States), Harbin Electric (China), Hitachi Mitsubishi Hydro (Japan), Impsa (Argentina), Power Machines (Russian Federation), Toshiba (Japan) and Voith (Germany).

Operating results and outlook for some industry leaders remained mixed in 2019. GE reported losses in its hydropower segment, due in part to continued competitive pressure from other turbine manufacturers and other renewable energy technologies, and further reinforced by the global trend towards electricity auction mechanisms. The company’s hydropower operations continued to experience declines in the growth of orders and increased project costs. Andritz Hydro also reported a “subdued” global market and a decline in sales for the fourth year running (down 3% for the year), in line with a perennial decline in order intakes.

Voith Hydro reported a moderate recovery in the hydropower market during 2019. Modernisation projects and service on existing facilities dominated business in the Americas and Europe, while predominantly new construction was being planned and tendered in Asia and Africa. Voith advanced the development of a high-performance pump turbine during the year, which led to securing a contract for six reversible turbines for the 2 GW Snowy 2.0 project in Australia.

In 2019, the European Commission and 19 partners in industry, academia and research launched an EUR 18 million (USD 20.2 million) initiative to demonstrate how modern hydropower systems can provide the flexibility and power grid services required to integrate larger shares of variable solar and wind power into the electricity supply. The project will test enhanced variable- and fixed-speed hydropower turbine systems and other related solutions, concluding in 2023 with a roadmap and recommendations for governments, regulators and industry.

ren21.net