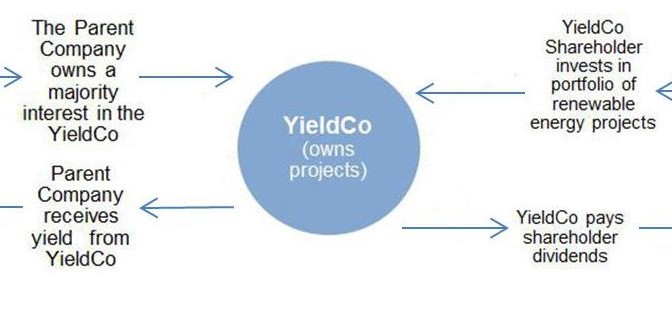

The clean energy industry has matured so much that you can now be an investor in wind and solar projects through so-called “YieldCos” that have gained popularity in recent years. By investing in YieldCos, you can help fund clean energy projects while benefiting from the long term cash flows they generate.

What is a YieldCo? As will be explained in today’s 10:30 a.m. session at the WINDPOWER 2015 Conference & Exhibition, a YieldCo (yield company) describes a company that puts together stable assets to recruit yield-oriented investors from public markets. This is similar to the how some retirement oriented investors view the dividend coupons from electric utility stocks. They have been especially popular for renewable energy projects since 2013. YieldCos function similarly to Master-Limited Partnerships in that they are designed to provide a dependable cash flow to investors.

You can now buy clean energy for your retirement plan. YieldCos are the only chance for many mom and pop investors to participate directly in clean energy projects. An investor can purchase the stock of solar or wind-only companies, but YieldCos are direct investments in projects and are perceived as less risky.

YieldCos with clean energy emerged as a group in 2013 — some of the YieldCos with U.S. clean energy assets are:

- TerraForm Power: SunEdison recently acquired First Wind; they sell projects once they’re completed to TerraForm, which went public in the summer of 2014.

- Pattern Energy Group Inc is an all-wind YieldCo that went public in September 2013

- NextEra Energy spun off some of their renewable energy assets (almost entirely wind) into a YieldCo in the summer of 2014.

- NRG Yield (natural gas, wind, solar) kicked off the trend by going public in July 2013

This is a sign of the maturity of the clean energy industry – there weren’t enough megawatts of clean energy in America before to do this. For a YieldCo to be viable, you need to have enough projects in the backlog to demonstrate to investors that you can maintain and grow these dividends. Now that wind energy is large-scale and solar is not far behind, there are clean energy YieldCos that could not have existed only a few years ago.

Investors are showing there’s an appetite for the long-term stability of clean energy projects. YieldCos are a relatively stable investment, providing low risk dividends for investors. These are lower-risk investments than purchasing stock in a clean energy company because they are completed projects with signed Power Purchase Agreements (PPAs) in place.

YieldCos provide a cheap way to raise capital, allowing companies to develop more clean energy projects “The yieldco is the cheapest equity you can find in the market,” Abengoa SA’s CEO said. “You’re going to see more and more.” That’s because it’s a public vehicle, it can raise money from any party — mom-and-pop investors, retirement funds, pension funds, etc. By definition, public markets will be the cheapest because no one is excluded.

YieldCos are vehicles for acquiring projects. Companies often develop projects, then sell them to the YieldCo. These assets deliver strong yields and also have strong growth potential because the equity acquired from public investors can be reinvested in new projects.

By spinning off their renewable power assets into a separate, high-yielding entity, companies are attracting two types of investors who may not have been interested otherwise: socially responsible investors and income investors.