As the cost of wind energy has dropped by more than half in just five years, there has been a steady increase in U.S. businesses, governmental agencies, and universities making direct investments in wind power to lock in low prices and reduce their carbon footprints.

“Successful brands and businesses increasingly see low-cost wind power as a great value,” said American Wind Energy Association (AWEA) CEO Tom Kiernan. “We’re seeing an expanding market for corporate purchasers that value wind both because it is clean and offers stable electricity prices.”

Corporations are attracted by wind’s unique ability to hedge against rising prices for other fuels, just as utilities buy fixed-price wind energy to protect their consumers against volatility in the price of other fuels.

“Over 23 percent of the wind power contracts signed in 2014 were with corporate buyers and other non-utility groups,” said Emily Williams, Deputy Director, Industry Data and Analysis for AWEA. “This trend is a meaningful source of new demand for wind power. The private and public sectors are saying ‘we value wind power, and we want more of it.’”

New analysis on the rising corporate and non-utility purchaser trend will be featured in AWEA’s 2014 U.S. Wind Industry Annual Market Report, set for release on April 15, in Houston, Texas. The upcoming annual report will provide a comprehensive update on the state of the U.S. wind market, including the latest wind industry job numbers, investment figures, state-by-state comparisons, market rankings and more.

In the past year, major corporations like Amazon, Dow Chemical, and Yahoo! entered into their first power purchase agreements (PPAs) for wind-generated electricity, while tech companies Google and Microsoft continue to sign new contracts.

Outside of the corporate sector, the U.S. General Services Administration and Cornell University joined a growing list of agencies and universities purchasing wind power that already includes Oklahoma State University, the Ohio State University, and the U.S. Air Force. In total, over 1,770 MW of wind PPAs were signed in 2014 by commercial and industrial, governmental, and educational institutions.

Corporate investment in renewable energy is occurring both on- and off-site, and through both direct ownership and long-term purchase agreements. Some of the highlights of 2014:

- IKEA purchased a 98-MW Illinois wind farm and a 165-MW Texas wind farm

- Facebook and Google signed contracts directly with the utility MidAmerican Energy for up to 547 MW of Iowa wind-sourced energy

- Mars signed a long-term agreement for the renewable energy certificates from a 200-MW Texas wind project that is currently under construction

- Anheuser-Busch has a California brewery powered by two on-site turbines

For almost all other energy sources, increasing fuel costs can cause major and often sudden increases in electricity costs. Purchasing wind energy helps to diversify the energy portfolio and hedge against that risk, much like a fixed-rate mortgage protects homeowners from interest rate fluctuations versus an adjustable-rate mortgage.

Purchasing clean, renewable wind power also helps many companies and non-utility purchasers achieve internal environmental and clean power targets. U.S. companies, universities and others have increasingly identified reducing their overall contribution to carbon pollution as a high priority, and one that is popular with their customers.

“This project will add to the power grid in a sustainable way and ensure that we become less dependent on fossil fuels,” said U.S. General Services Administration (GSA) Administrator Dan Tangherlini about the GSA’s 2014 investment in wind. “We are proud of our progress toward meeting the federal government’s renewable energy goals, and look forward to taking advantage of future opportunities that will help us with this effort.”

These investments also benefit the broader U.S. economy as well. American wind power supports well-paying jobs makes over $180 million dollars a year in lease payments to landowners, and revitalizes local economies across the country. “We look for projects like Spinning Spur [Texas wind farm] because, in addition to creating more renewable energy and strengthening the local economy,” Google said about one of its major investments in wind.

Non-utility purchasers have explained many reasons for investing in wind power:

- Google: “Because energy is a large operating expense at Google, it is beneficial to power the data centers with low-cost wind power,” – Gary Demasi, Director of Operations, Energy and Data-center location strategy, Google

- Microsoft: “The Pilot Hill Wind Project is important to Microsoft because it helps solidify our commitment to taking significant action to shape our energy future by developing clean, low-cost sources to meet our energy needs…Microsoft is focused on transforming the energy supply chain for cloud services from the power plant to the chip. Long term commitments like Pilot Hill help ensure a cleaner grid to supply energy to our datacenters.” – Brian Janous, Director of Energy Strategy, Microsoft

- Yahoo!: “At Yahoo, we’re committed to being an environmentally responsible company…Driving the development of cleaner and renewable sources of power is an important piece of our sustainability strategy… We take care in ensuring that we are an engaged member of the communities in which we live and work. This partnership is a fantastic opportunity to improve Yahoo’s energy sustainability while contributing to the community in Rush County and across the region.” – Chris Page, Global Director, Energy and Sustainability Strategy, Yahoo!

- Dow Chemical: “Dow is always looking for win-win solutions – good for the environment and good for business. By entering into this agreement, Dow is taking a serious approach to our future energy needs in Texas and cost-competitive wind energy is a great opportunity.” – Jim Fitterling, Vice Chairman of Business Operations, Dow

- IKEA: “The US has amazing wind and sun resources that will never run out. We are delighted to make this investment – it is great for jobs, great for energy security, and great for our business. Importantly, it’s great for the future of our climate.” – Steve Howard, Chief Sustainability Officer, IKEA

- Wal-Mart: “If we can buy renewable energy for less, we can operate for less – and we can pass on the savings and a cleaner energy future to our customers and their communities.” David Ozment, Director of Energy, Wal-Mart

- The Ohio State University: “Our partnership with Iberdrola Renewables and Blue Creek Wind Farm underscores our long-held commitment to sustainability and to the economic future of our state…Together, we will make Ohio State a national leader in sustainability, while investing in renewable energy produced right here in Ohio.” – E. Gordon Gee, President of Ohio State University

- Cornell University: “Wind is a very reliable source of renewable energy and contributes zero carbon into the atmosphere while generating electricity. As we use more wind, we reduce our dependence on carbon-produced electricity. This is a major step toward Cornell becoming a carbon neutral campus.” – KyuJung Whang, Vice President for Facilities Services, Cornell University

- Harvard University: “Universities play an essential role in confronting the global challenges presented by climate change and sustainability…The research being undertaken at Harvard will have worldwide influence, but the Harvard community is also committed to searching for ways to reduce its environmental impact through changes in individual and institutional behavior, like purchasing wind power and other renewable energy, and the use of innovative technologies.” – Drew Faust, President, Harvard University

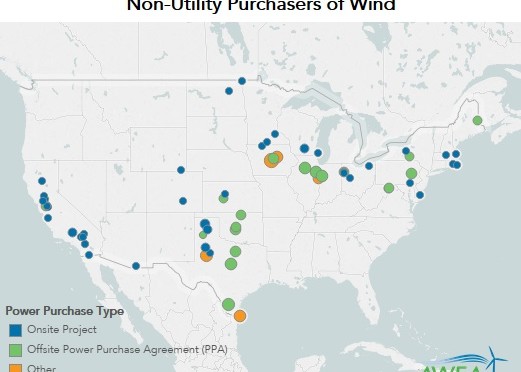

AWEA has developed an interactive map that provides details about the recent wave of non-utility purchases.