Brazil finally entered the solar power sector on Friday, granting contracts for the construction of 31 solar plants as it tries to diversify its sources of generation amid an energy crisis caused by the worst drought in eight decades.

Wind energy developers won contracts to sell 769 megawatts in installed capacity, at an average price of 142.34 reais a megawatt-hour, below the ceiling price of 144 reais. Developers registered 626 proposed wind farms and eight biogas projects for the auction. There were no bids for biomass energy.

“Wind power is usually the big winner in the auctions,” said Helena Chung, a Sao Paulo-based analyst for Bloomberg New Energy Finance.

Brazil has set a goal of having 3.5 gigawatts of solar capacity in operation by 2023, producing about 1.8 percent of the country’s energy.

Solar developers agreed to sell electricity at an average price of 215,12 reais ($87) a megawatt-hour, after starting at a maximum price of 262 reais. In Brazil’s energy auctions, the government sets a ceiling price and developers bid down the price at which they are willing to sell power. The lowest bids win contracts.

Brazil’s energy regulator, Aneel, concluded its first exclusive solar power auction on Friday, clinching 20-year energy supply contracts with companies that will invest 4.14 billion reais ($1.67 billion) and start to feed the national grid in 2017.

The 31 solar parks, the first large-scale solar projects to be constructed in Brazil, will have a combined installed capacity of 1,048 megawatts (MW). Market expectations were for projected total awards of 500 MW.

“This auction is a mark, not only because it signals the entrance of solar power in the Brazilian energy mix, but because it was one of the most competitive to date,” said Mauricio Tolmasquim, head of the government’s energy research company, EPE.

The auction lasted more than eight hours. The final price for solar power came at around 220 reais ($89) per megawatt-hour, against an initial price of 262 reais ($106), an 18 percent discount.

“This is one of the lowest prices for solar energy in the world,” Tolmasquim said.

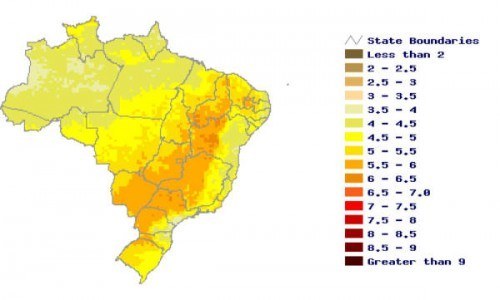

According to Tolmasquim, costs were reduced because of the strong solar radiation factor in Brazil and because many solar parks would be installed in areas that already have wind farms, reducing the amount developers would spend on land and transmission lines.

In Brazil’s power auctions, the government sets a maximum price for the megawatt-hour and companies bid down the price at which they are willing to sell energy. Companies that offer the lowest prices win the contracts.

Solar power developers have participated in previous auctions, but because they were competing against cheaper sources, such as wind and hydroelectric plants, they never succeeded in winning contracts.

This time, the government allocated a specific amount of energy to be produced by solar parks, trying to spur development of a local industry and in the long term reduce costs for projects, as it did with wind power some years ago.

Currently, wind power companies win most of the contracts in the regular auctions, with prices per megawatt-hour that are lower than thermal projects fueled by coal or natural gas.

Brazil’s power system has traditionally been composed by a network of large hydro power plants, but almost three years of well below-average rains have depleted reservoirs and sent the country scrambling to diversify its energy matrix.

An expensive, fossil-fueled emergency network of thermal power plants has shored up supply, but at the cost of tarnishing the country’s reputation as a renewable energy producer and consumer.

The government has been criticized by environmental groups for taking so long to enlist solar power in its energy matrix, because of Brazil’s excellent potential for solar.