Solar power projects participated in past energy auctions, but competed directly against cheaper power sources such as wind power and won no contracts to sell electricity.

Wind power leads the bid-round catalog with 626 proposals, followed by solar plants with 400, EPE said in a statement on Tuesday.

Solar energy developers in Brazil applied to sell power from 400 power plants in the country’s first national energy auction with a specific category for photovoltaic projects.

The solar power projects have 10.79 gigawatts of capacity, Brazil’s energy research agency Empresa de Pesquisa Energetica said today on its website.

Developers also registered 626 proposed wind farms and eight biogas projects for the Oct. 31 auction.

Brazil gets less than one percent of its electricity from solar power and the government wants to diversify its energy mix.

“We expect the government will buy 1 gigawatt of solar energy in the first auction,” said Pedro Vaquer, director of the Brazilian developer Solatio Energia.

Other solar developers that registered for the event include Solyes and Kroma Energia, from Brazil, Germany’s SoWiTec Projekt GmbH and Italy’s Enel Green Power SpA.

Solatio Energia registered 46 solar projects with 30 megawatts each. The company’s target is to win contracts for about half the capacity sold in the auctions.

Each 30-megawatt project will require about 150 million reais ($67.3 million) of investment. Vaquer expects the auction to have a ceiling price between 220 reais and 240 reais a megawatts-hour.

“We are not expecting a high profitability in the solar market in Brazil,” he said. “But it’s worth it to be here when the sector begins.

In Brazil’s power auctions, the government sets a ceiling price and developers bid down the rate at which they are willing to sell power. The lowest offers wins long-term contract to sell electricity.

In the Oct. 31 auction, developers will compete for 20-year contracts for power from solar plants of at least 5 megawatts. The projects must go into operation by October 2017.

Helena Chung, a Sao Paulo-based analyst for Bloomberg New Energy Finance, expects a ceiling price of more than 250 reais a megawatt-hour, with about 500 megawatts of solar capacity being purchased. The ceiling prices for the October auction haven’t been announced yet.

The northeastern state of Pernambuco held a local auction for solar power in December. Developers agreed to sell energy for an average of 228.63 reais a megawatt-hour, about 75 percent more than contracts that were awarded for wind power last month. The state agreed this month to purchase the solar energy after it was unable to find buyers.

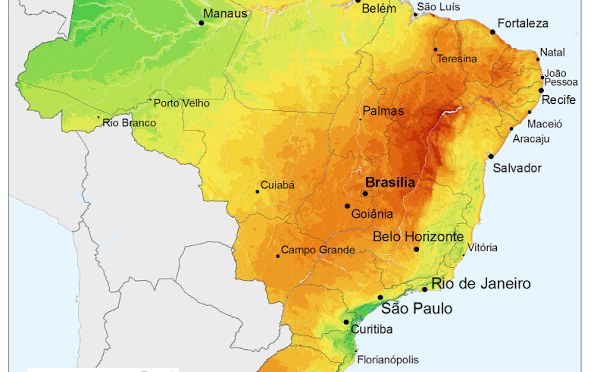

Brazil has strong sunlight, with an average irradiation rate that’s almost double that of Germany, the world leader in solar installed capacity, according to the U.S. National Renewable Energy Laboratory.

“Brazil has a very limited solar installed capacity, well below 100 megawatts, and given the high resource level, land availability, as well as the increasing energy demand, we think there is a large room for solar market development,” said Antonello Cammisecra, head of business development at Enel Green Power.

The government is boosting efforts to promote the use of solar power, said Mario Lima, executive director of sustainability at consulting company Ernst & Young LLP. The worst drought in decades is reducing water levels at the country’s hydropower dams.

“There is a sense of urgency for diversification, with the higher energy costs, declining efficiency of hydroelectrics and the energy consumption growth in the country,” Lima said. The country “has prioritized wind and hydropower generation.”