In the week of January 15, prices in the main European electricity markets decreased compared to the previous week. This represented a reversal of the upward trend registered in most markets over the last two weeks. Gas and CO2 prices continued the downward trend of recent weeks and wind energy production increased in general. In the week of January 22, prices will continue to fall in EPEX SPOT, but will rise in MIBEL, IPEX and N2EX.

Solar photovoltaic, solar thermoelectric and wind energy production

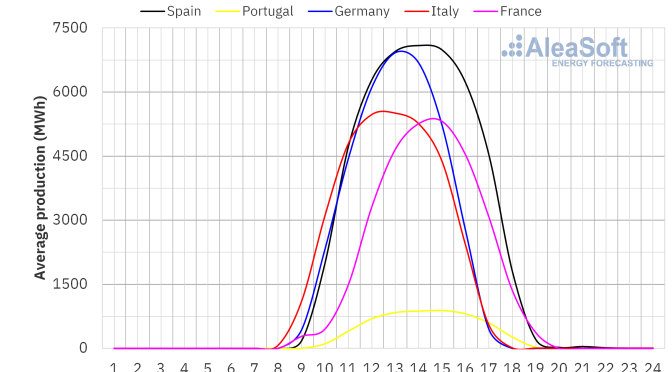

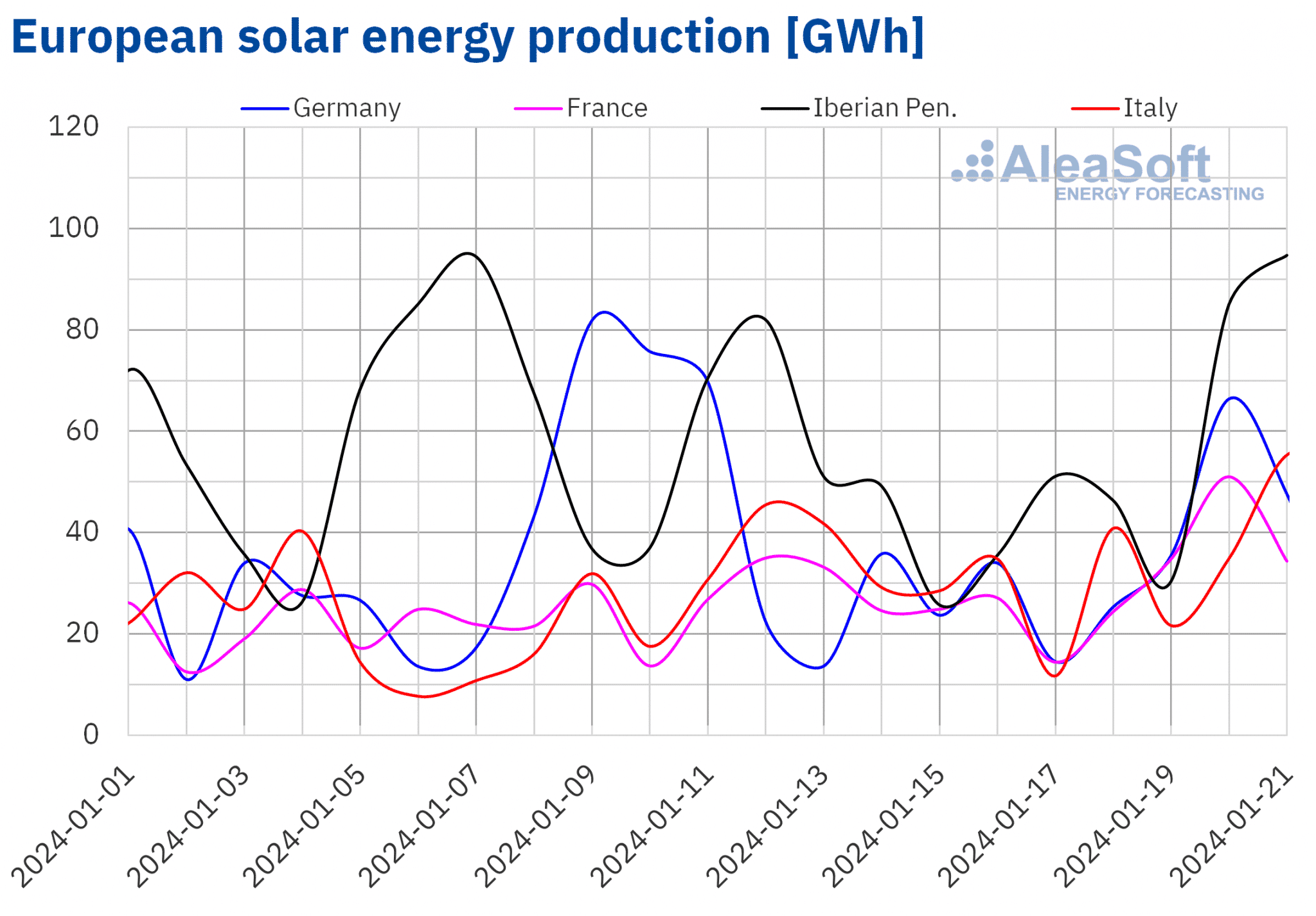

In the week of January 15, solar energy production increased in the Portuguese, French and Italian markets compared to the previous week, with increases of 31%, 14% and 7.2%, respectively. However, in the German market, solar energy production fell by 28% after the previous week’s increase. As for the Spanish market, it registered a 9.4% decrease.

As the days get longer, the increasing trend in solar energy production will continue. According to AleaSoft Energy Forecasting’s solar energy production forecasts for the week of January 21, solar energy production will increase in Italy and Spain, while it will decrease in Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

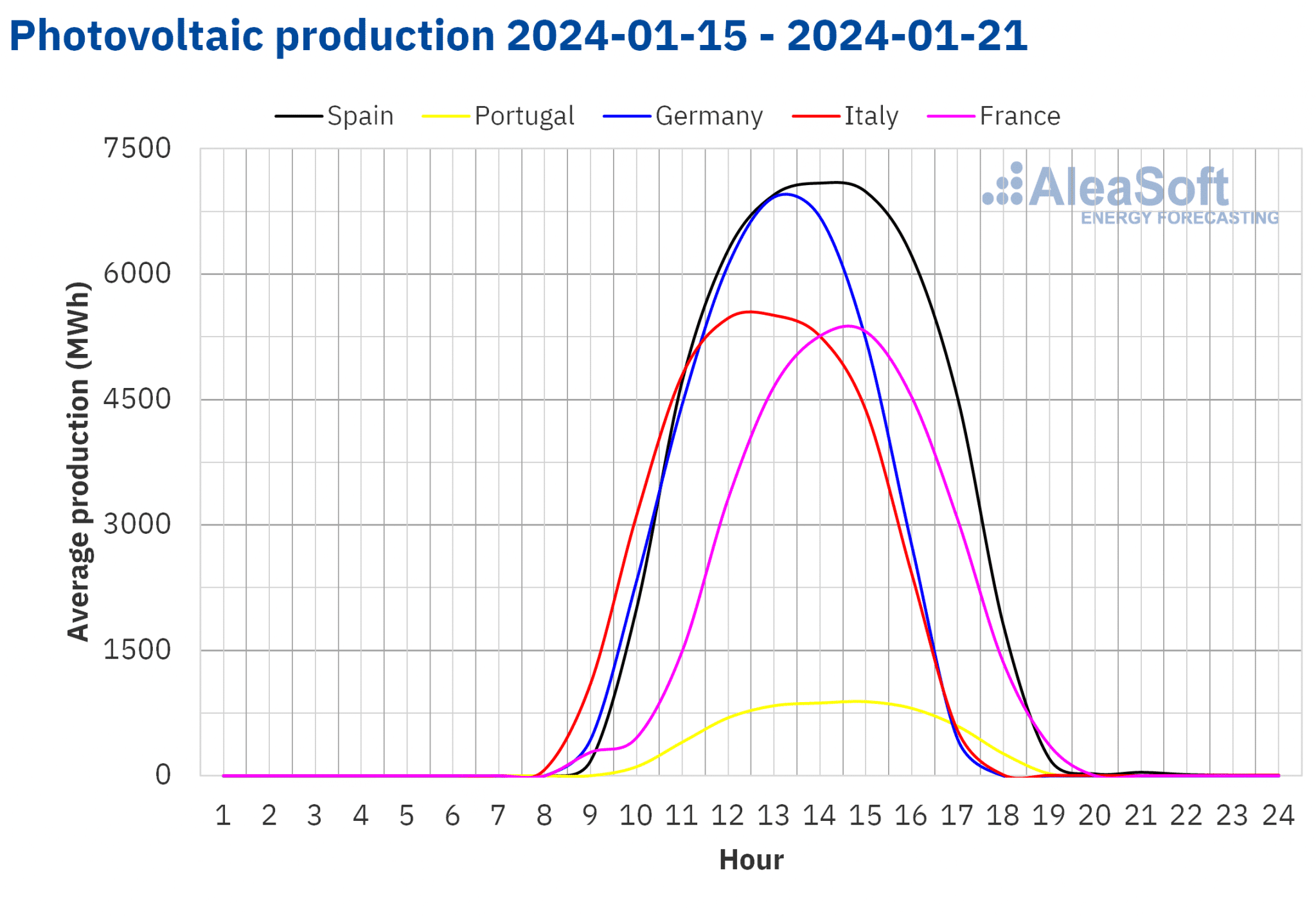

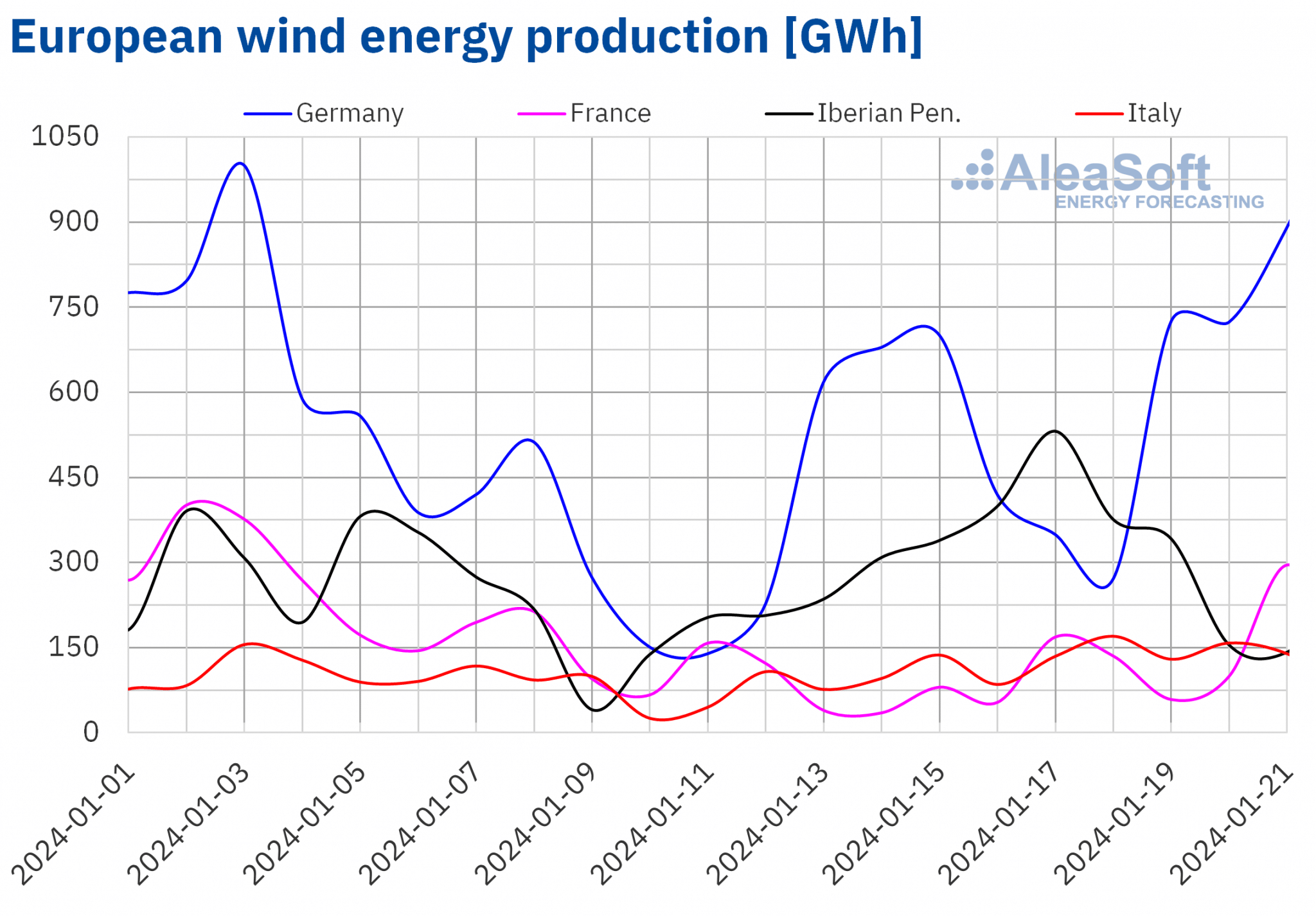

In the week of January 15, wind energy production increased in all major European electricity markets compared to the previous week. Percentage increases were in double digits and ranged from 22% in France to 80% in Spain. In addition, on January 17, the Spanish market generated 422 GWh from wind energy, thus reaching the highest daily value since early December 2021.

AleaSoft Energy Forecasting’s wind energy production forecasts for the week of January 21 indicate that the upward trend will persist in Germany and France, while they anticipate a decrease in production using this technology in Italy and the Iberian Peninsula.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

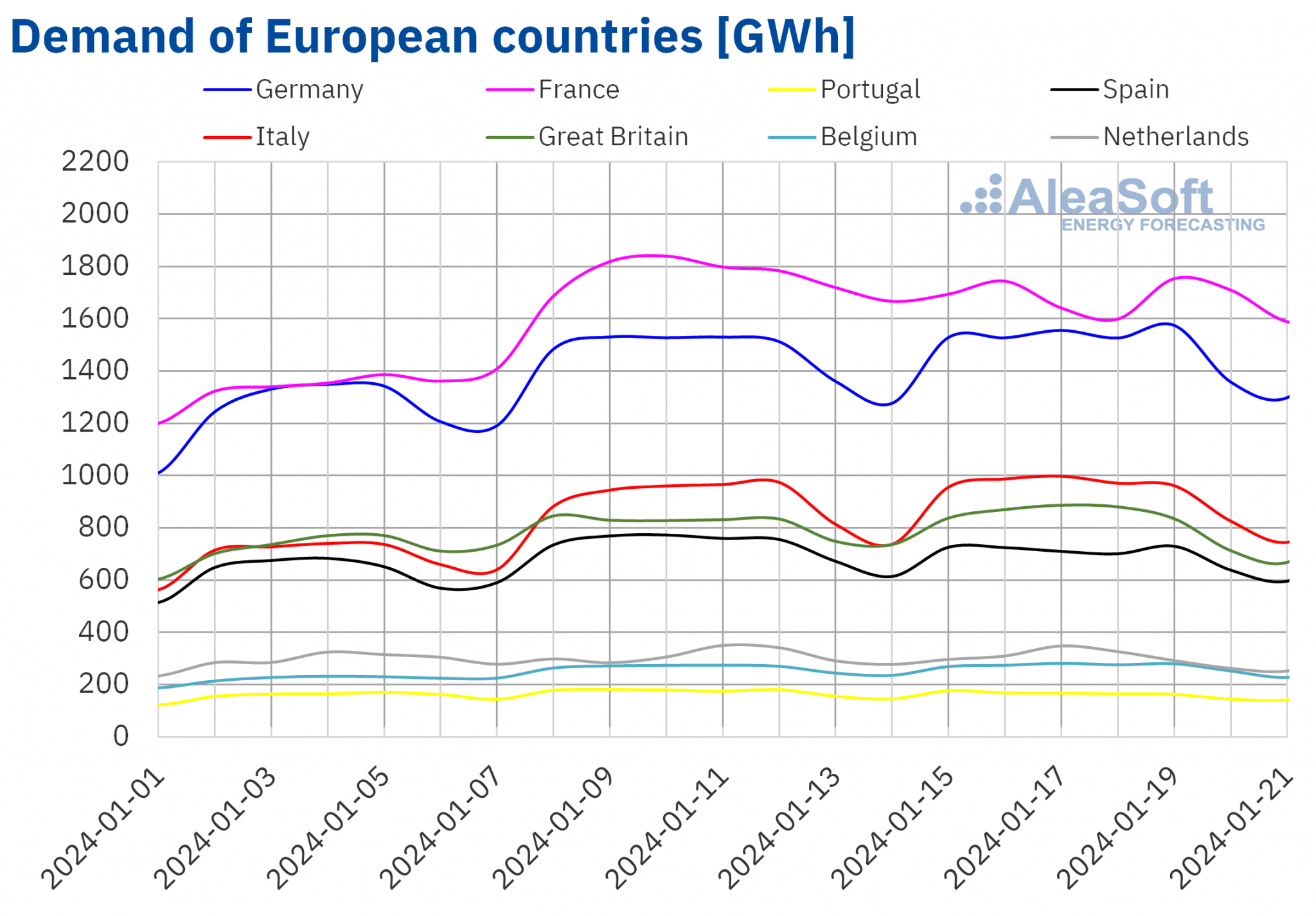

Electricity Demand

During the week of January 15, the main European electricity markets registered a level of electricity demand similar to that observed since the beginning of 2024. Demand increased in the markets of Germany, Belgium, Great Britain and Italy, with increases ranging from 0.7% in Great Britain to 2.7% in Italy. In contrast, there was a decrease in demand in the other analyzed markets, with the Portuguese market showing the largest decline, 5.8%. On the other hand, the Dutch market registered the smallest drop, with 2.8%.

At the same time, most analyzed markets registered an increase in average temperatures. Spain registered the highest increase, of 4.0 °C, while the Netherlands registered the lowest increase, of 0.3 °C. Only Great Britain registered a 0.8 °C decrease.

According to AleaSoft Energy Forecasting’s demand forecasts, electricity demand for the week of January 21 will remain at levels seen since the beginning of 2024. The markets of Portugal, Italy, Belgium and the Netherlands will register a week?on?week increase, while demand will decrease in Germany, France, Spain and Great Britain compared to the third week of the year.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

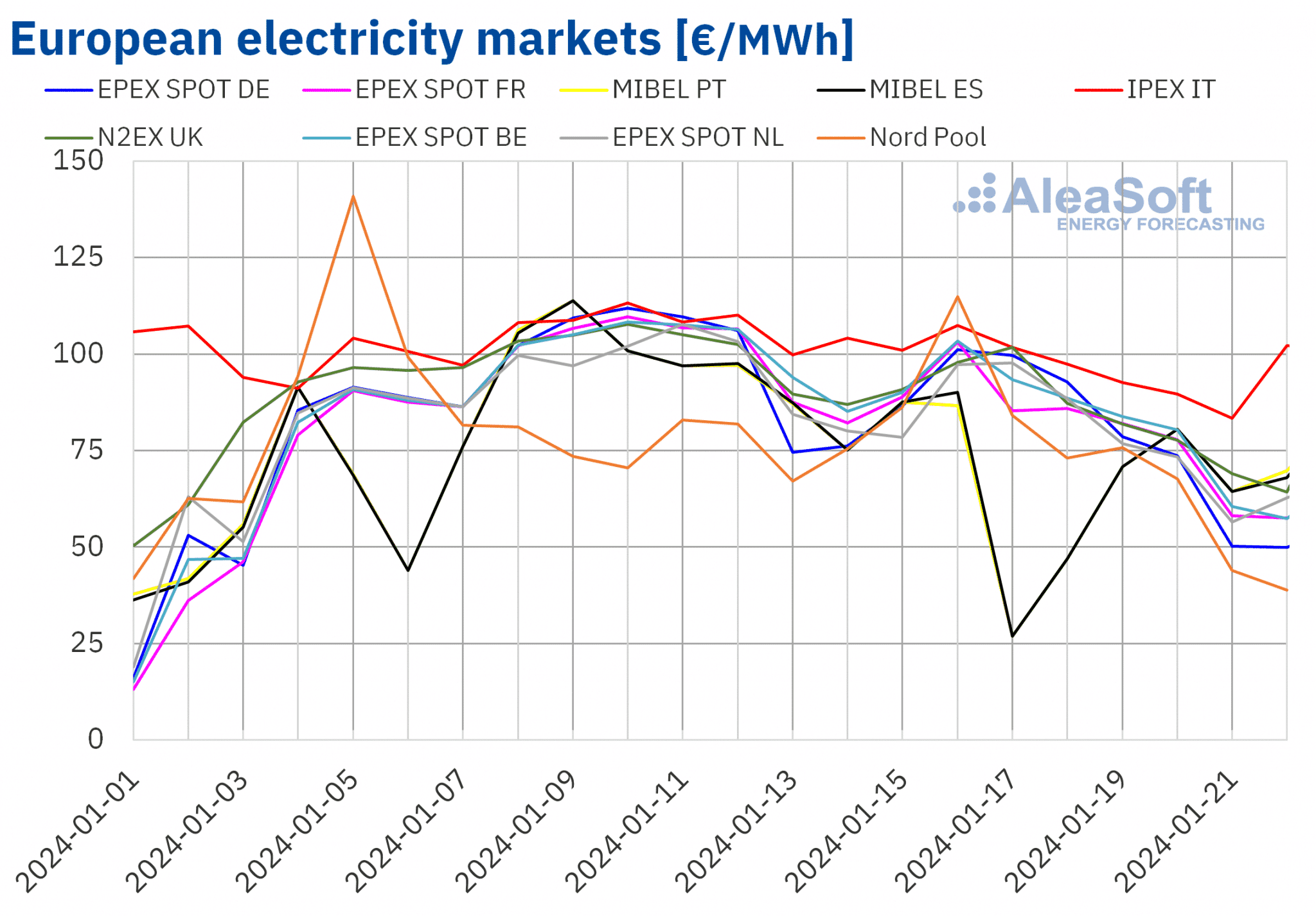

European electricity markets

After the rise in prices at the beginning of the year due to the low temperatures registered during the cold snap in northern Europe and low wind energy production, prices have fallen in the electricity markets. In the week of January 15, prices in almost all main European electricity markets fell compared to the previous week. This represented a reversal of the upward trend registered in most markets over the past two weeks. The exception was the Nord Pool market of the Nordic countries, with an increase of 2.5%. On the other hand, the MIBEL market of Spain and Portugal reached the largest percentage price declines, which were 31% and 32%, respectively. In contrast, the IPEX market of Italy registered the smallest decline, 11%. In the rest of the markets analyzed at AleaSoft Energy Forecasting, prices fell between 13% in the N2EX market of the United Kingdom and 17% in the EPEX SPOT market of France.

In the third week of January, weekly averages were below €90/MWh in almost all analyzed European electricity markets. The exception was the Italian market, which registered the highest average, €96.16/MWh. On the other hand, the Portuguese and Spanish markets had the lowest weekly prices, €66.25/MWh and €66.75/MWh, respectively. In the rest of analyzed markets, prices ranged from €77.93/MWh in the Nordic market to €86.56/MWh in the British market.

During the week of January 15, the decline in gas prices, whose weekly average has not stopped falling since November, exerted its downward influence on European electricity market prices. CO2 emission rights prices also continued the declines of previous weeks. The increase in wind energy production during the third week of January, as well as the decline in electricity demand in some markets, also contributed to the price declines in European electricity markets.

AleaSoft Energy Forecasting’s price forecasts indicate that in the fourth week of January prices might continue their downward trend in the EPEX SPOT market. Increases in wind energy production will continue in markets such as Germany and France, favoring this behavior. On the other hand, in the British, Iberian and Italian markets, prices might increase again.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

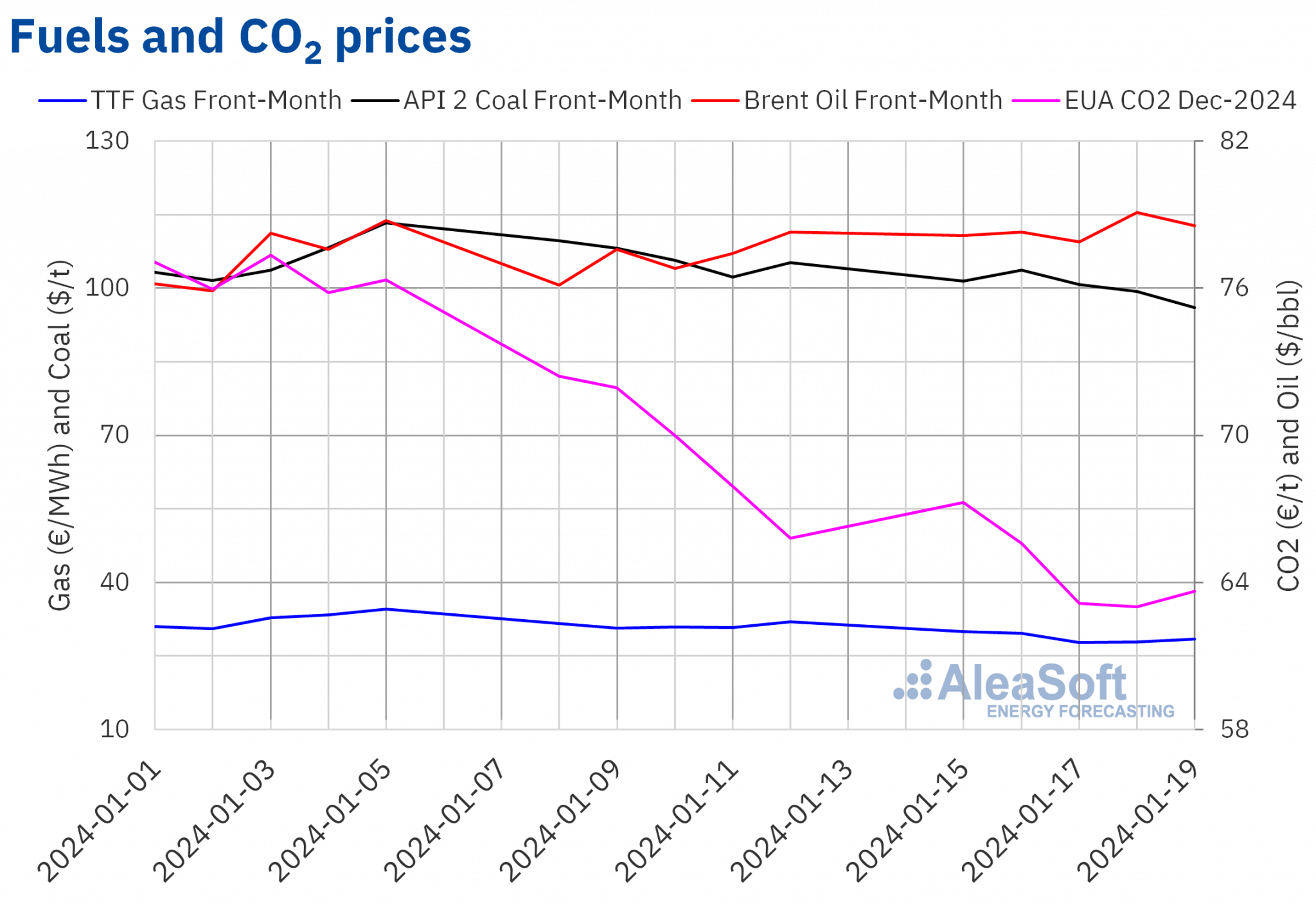

Brent, fuels and CO2

During the third week of January, Brent oil futures prices for the Front?Month in the ICE market continued to be stable. They were slightly higher in the last sessions of the week. As a result, on Friday, January 19, the settlement price was $78.56/bbl. This price was 0.3% higher than the previous Friday.

Concerns about demand evolution offset the upward influence of increased instability in the Middle East in the third week of January. On the other hand, extreme cold affected U.S. production in that week. In addition, the increase in the International Energy Agency’s 2024 demand forecast contributed to the slightly higher prices in the last sessions of the week.

News on economic evolution might influence the evolution of prices in the coming days, as there will be meetings of various central banks and the release of data such as US GDP. The impact on Russian exports due to the attack on a terminal in the Baltic Sea and the recovery of production in Libya might also exert their influence on Brent oil futures prices in the fourth week of January.

As for TTF gas futures in the ICE market for the Front?Month, after some stability during the second week of January, in the third week of January prices declined. According to data analyzed at AleaSoft Energy Forecasting, during the whole week prices remained below €30/MWh. On Wednesday, January 17, these futures reached the weekly minimum settlement price, €27.71/MWh. This price was the lowest since the beginning of August. In the last sessions of the week, prices recovered slightly. Still, on Friday, January 19, the settlement price was €28.43/MWh. This price was 11% lower than the previous Friday.

High European reserve levels continued to exert their downward influence on TTF gas futures prices in the third week of January. However, lower liquefied natural gas exports from the United States due to cold temperatures contributed to the increases registered in the last days of the week. Forecasts of cooler temperatures also supported these increases.

As for CO2 emission rights futures prices in the EEX market for the reference contract of December 2024, in the third week of January, they continued with the declines of previous weeks. On Thursday, January 18, these futures registered their weekly minimum settlement price, €63.01/t. This price was the lowest since March 8, 2022. After a slight recovery, the settlement price was €63.65/t on Friday, January 19. This represents a 3.3% drop from the last session of the previous week. Low levels of demand at the start of the auctions contributed to the decline in prices of these futures.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the energy transition

AleaSoft Energy Forecasting and AleaGreen held their first webinar of 2024 on January 18. This webinar was the fortieth in their monthly webinar series. On this occasion, speakers from PwC Spain participated for the fourth time. The topics discussed in the webinar were the evolution and prospects of European energy markets, as well as the current state of regulation on renewable energy and PPA, with a special focus on virtual PPA and cross?border PPA.

The next webinar of AleaSoft Energy Forecasting and AleaGreen will take place on February 15. This webinar will feature the participation of JLL to analyze the context and trends of the energy storage market in Spain, the revenue stack and technical aspects of battery energy storage systems, as well as financial considerations. As usual, the webinar will also discuss the evolution and prospects of European energy markets.