In the metals and mining industry, the top contributors to CO2 emissions are smelting and refining processes. To date, much of the industry’s decarbonisation efforts have been focused on electrification. However, we’re starting to see a shift towards hydrogen as a replacement for fossil fuels in metallurgical processes.

Our recent report, ‘Beyond electricity: Is hydrogen the key to greener smelting and refining?’, provides an analysis of ‘cradle-to-gate’ Scope 1 and 2 carbon dioxide equivalent (CO2e) emissions for 2023.

The analysis has been conducted using data from our Emissions Benchmarking Tool (EBT), covering emissions that originate from mining activities and primary smelting and refining operations.

The report outlines the key considerations that organisations need to be aware of in their decarbonisation efforts. Understanding the benefits of hydrogen in the iron, steel and non-ferrous value chains will also help investors make more informed decisions.

Today, we’ll share a few of the valuable insights from the report. To download a more detailed extract from the report, please fill out the form at the top of the page.

The emissions gap in metallurgical processes

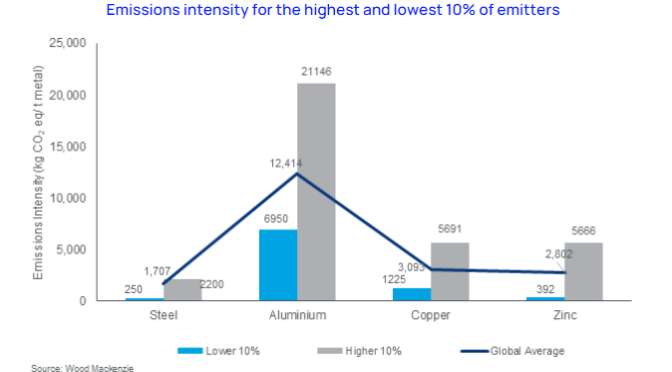

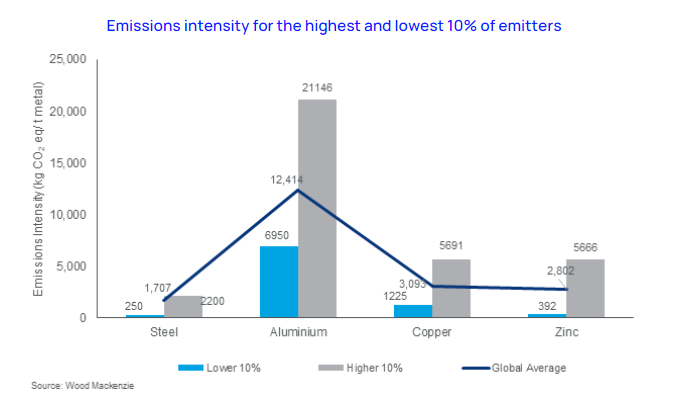

The smelting and refining processes that produce key metals account for a significant amount of greenhouse gases (GHGs). Together, steel, aluminium, copper, and zinc make up nearly 9.5% of global emissions.

The iron and steel industry is currently the highest emitter of GHGs amongst metals, contributing 7.0% of total global emissions. The aluminium sector is responsible for 2.0%, whereas copper and zinc account for 0.2% and 0.1%.

Given the range of differences between the higher and the lower 10% emitters in these emissions, it’s clear that each production value chain requires a unique approach to decarbonisation.

The need to transition from fossil fuels

Our report finds that iron and steel production accounts for 93% of GHGs in the metals and mining industry due to the use of coal in metallurgical reactions. By contrast, the production of non-ferrous metals accounts for 62% of emissions due to the onsite fuel mix in power plants or grid electricity.

Despite the need to decarbonise these processes, at present, most global efforts are focused on electrical consumption targets. In turn, fossil fuel emissions in the non-ferrous industry especially, remain largely unaddressed.

As such, there’s a clear need for organisations to look beyond green electricity measures and to also focus on technological innovations that address the wider power generation mix.

Hydrogen as a replacement fuel in iron and steelmaking

In iron and steel production, 93% of emissions originate from the smelting process, which includes the use of blast furnaces, coking, and sinter plants.

In refinery operations, steelmaking, and the use of casting plants account for another 5% of emissions. Overall, the carbon impact of steelmaking represents a significant 92% of emissions, largely from burning carbon-rich fuels.

The use of hydrogen as a replacement for blast furnaces has been investigated extensively. Research suggests that the fuel can act as a cleaner, making it an effective alternative to coal and coke due to its capabilities of reducing carbon in the direct reduction of iron (DRI) process.

The use of hydrogen in alumina refining

Our research finds that 78% of aluminium value chain emissions arise from the smelting process, the casthouse and electrolysis. The electrolysis emissions that arise from the reduction process ranges from 0 to 14 tonnes of CO2e/tonne of aluminium.

Breaking down the aluminium refining process further, 70% of emissions arise from steam during digestion and 30% comes from fossil fuel combustion in calcination.

Norwegian aluminium company Hydro has been conducting experiments at its Navarra plant, and has found that hydrogen could act as a replacement for natural gas at cast houses and in digestion processes.

Similarly, the Anglo-Australian mining group Rio Tinto and Japan’s Sumitomo corporation are currently working on a proposal for the construction of a hydrogen pilot plant that will trial lower-carbon alumina refining. The initiative will use a 2.5MW electrolyser with a production capacity of more than 250 tonnes of hydrogen annually, which could pave the way for hydrogen adoption across the industry.

Hydrogen as a replacement for natural gas in copper heating

In copper mining operations, 22% of emissions come from consumption in loading and hauling activities, and 10% is attributed to the smelting process.

Solvent extraction-electrowinning (SX-EW) processes represent 20% of global copper production, whereas the recycling of scrap copper accounts for approximately one third of the market.

In the copper industry, hydrogen can be used as an alternative to traditional fuels. Aurubis, a global supplier of non-ferrous metals, has been running trials that suggest hydrogen can replace natural gas in anode furnaces and replace ammonia in cathode shaft furnaces.

Hydrogen also has the potential to replace natural gas in the copper heating process and act as a reducing agent in slag-cleaning and anode furnaces.

Hydrogen use in zinc fuming processes

Zinc mining contributes 20% of the total CO2 emissions in the zinc value chain – mostly from electricity consumption during the crushing and grinding stages. Zinc smelting accounts for the other 80%.

In the smelting process, 80% of fossil fuel emissions come from the pyrometallurgical treatment of leach residues in the electrolytic process. Whereas imperial smelting furnace (ISF) and vertical retort (VR) processes, contribute 20%.

Hydrogen and ammonia are both promising alternatives to coal use, especially in the fuming process for zinc-contained residues. However, operational application is still in the trial stages and further kinetic studies are required in combination with large-scale experiments for validation.

Final thoughts

Hydrogen has the potential to play a key role in iron and steel decarbonisation and to contribute in part, to the decarbonisation of non-ferrous value chains. Moving forward, organisations need to take a strategic viewpoint on its inclusion in energy mixes and its use as an alternative fuel in metallurgic processes.

However, for hydrogen to be incorporated into metal and mining production chains, more research, collaboration and policy backing is needed. The progress of green hydrogen projects like Hydro’s Navarra, Aurubis’ trials, and Rio Tinto’s projects are promising and will undoubtedly provide positive results and learning points alike.

Learn more

To learn more about the factors that will impact decarbonisation in the metals and mining industry, fill out the form at the?top of the page?to download an extract from our recent report; ‘Beyond electricity: Is hydrogen the key to greener smelting and refining?’.

Daniel Carvalho

Global Research Director, Metals and Mining Processing

Daniel is a global operations, process and technology leader in the iron and steel industry.