In the last week of June, prices of European electricity markets fell after three consecutive weeks of increases. This behaviour was favoured by the increase in wind energy production in all markets. In addition, although prices of gas and CO2 registered an upward trend in the last days of the week, on average they were lower than those of the previous week. In Mainland Spain, the daily record solar photovoltaic energy production was registered on June 30.

Concentrated Solar Power, photovoltaic and wind energy production

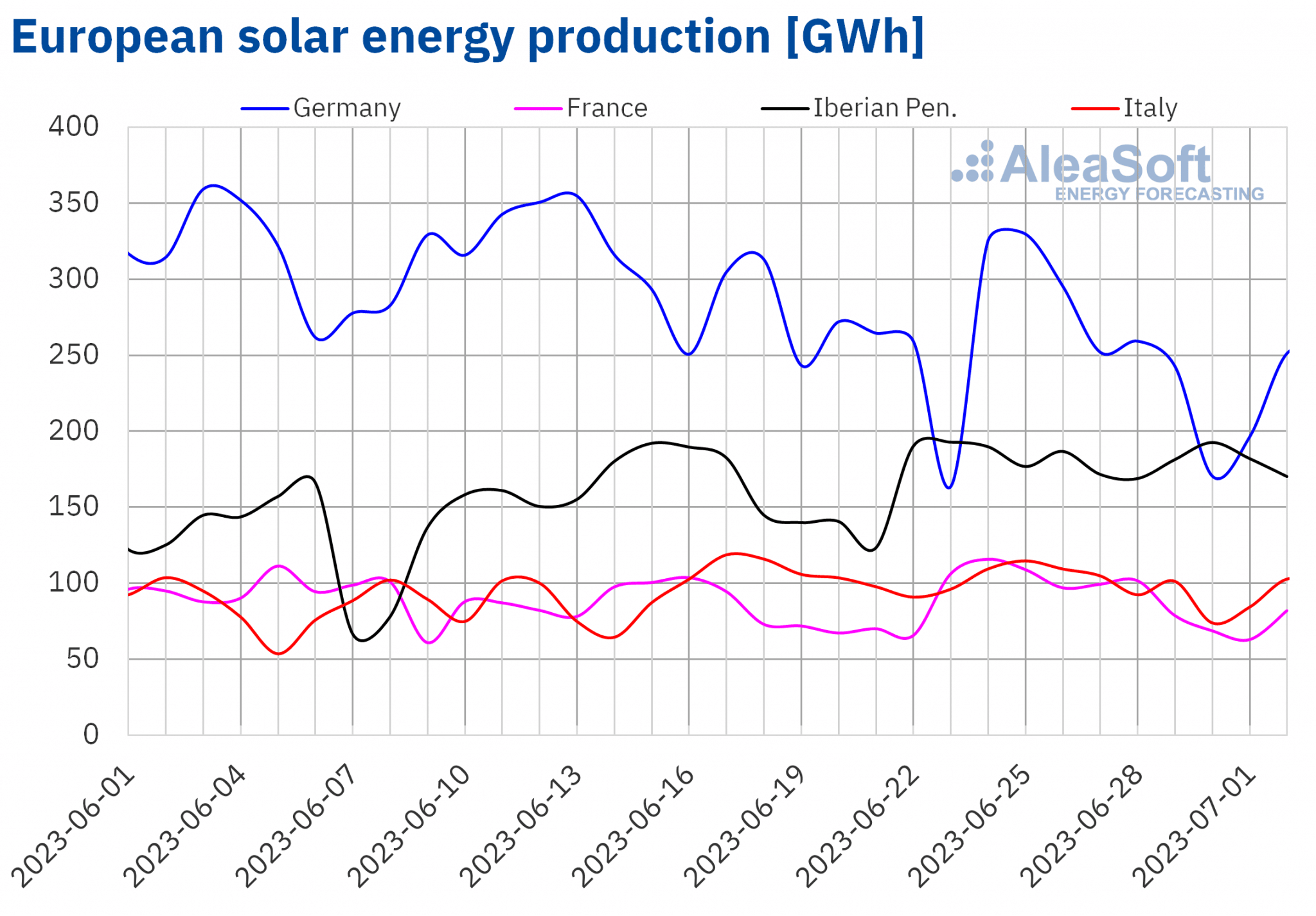

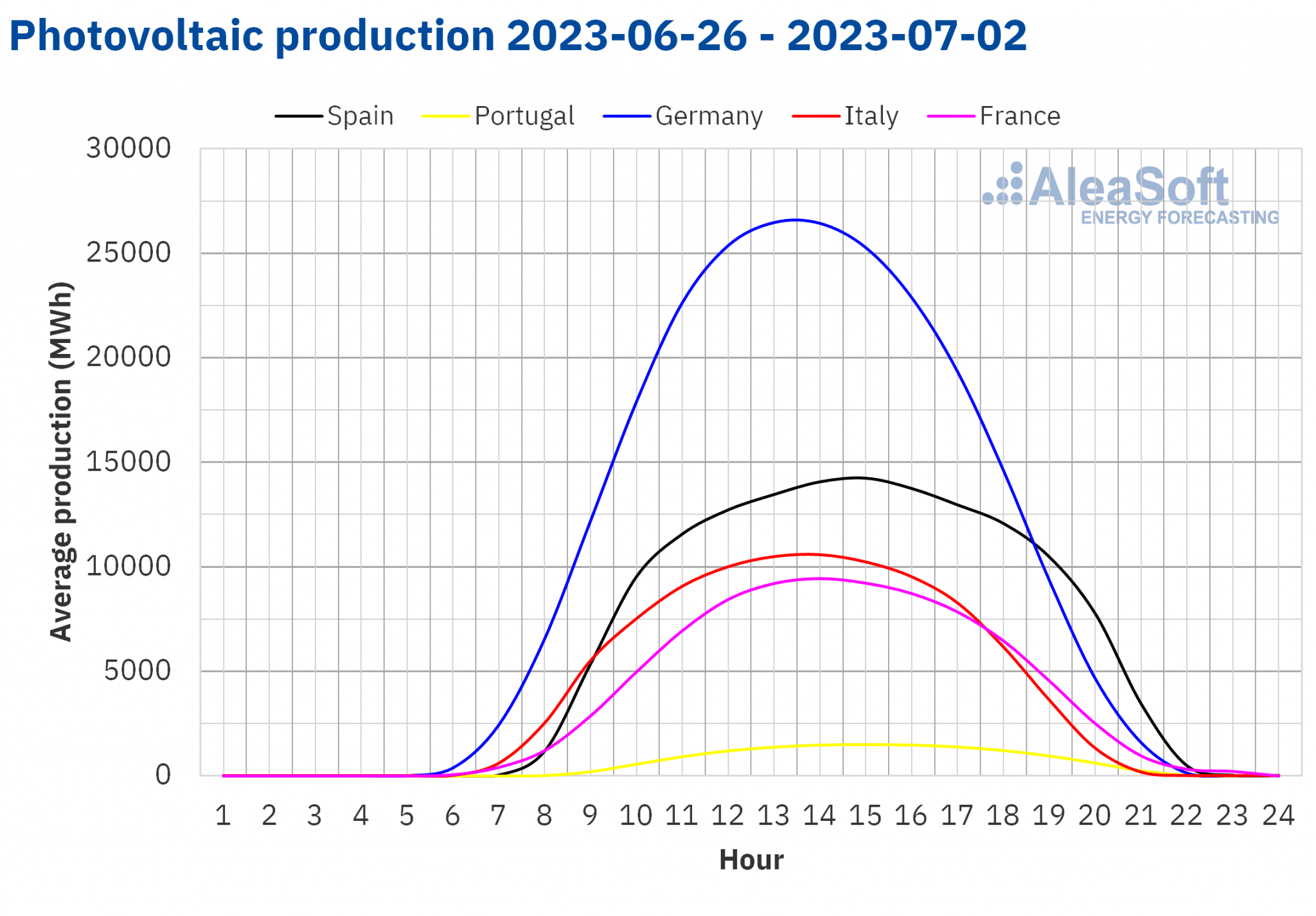

In the week of June 26, solar photovoltaic energy production broke the daily record in Mainland Spain with 156 GWh generated on Friday, June 30.

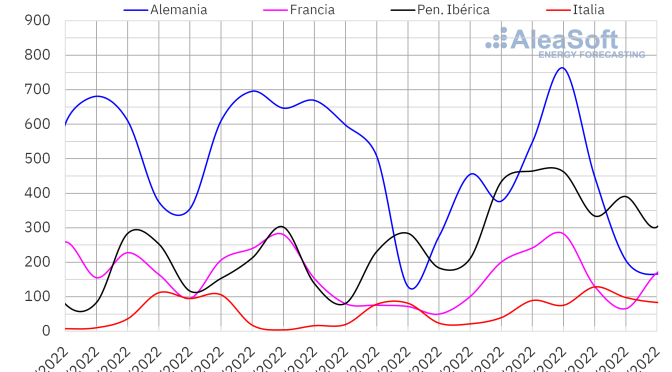

If solar energy production of the last week of June is compared with the previous week, the Spanish and Portuguese markets were the only ones in the main European markets analysed in which there was an increase, of 8.7% and 8.3% respectively. In the rest of the markets, a 10% and 6.9% fall were observed in the German and Italian markets, followed by a less pronounced decrease in France, of 2.5%.

For the week of July 3, the AleaSoft Energy Forecasting solar energy production forecasts indicate that production will increase in the analysed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

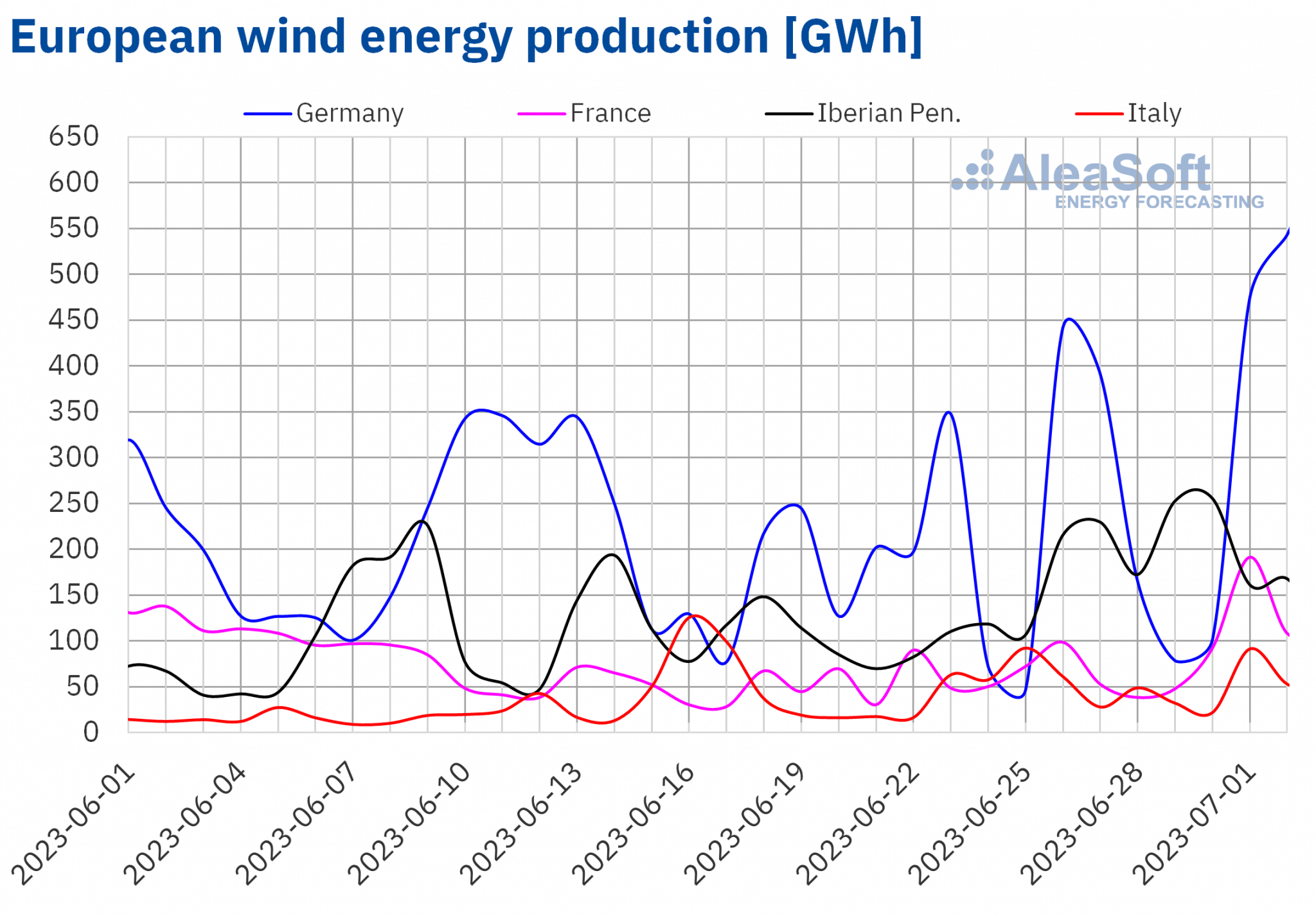

In the last week of June, wind energy production increased in all markets analysed compared to the previous week. The highest increases, 140% and 107%, were registered in Portugal and Spain, respectively, followed by increases of 77%, 55% and 19% in the German, French and Italian markets.

For the week of July 3, taking into account the wind energy production forecasts of AleaSoft Energy Forecasting, drops in wind energy production are expected in almost all the markets analysed except for the German market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

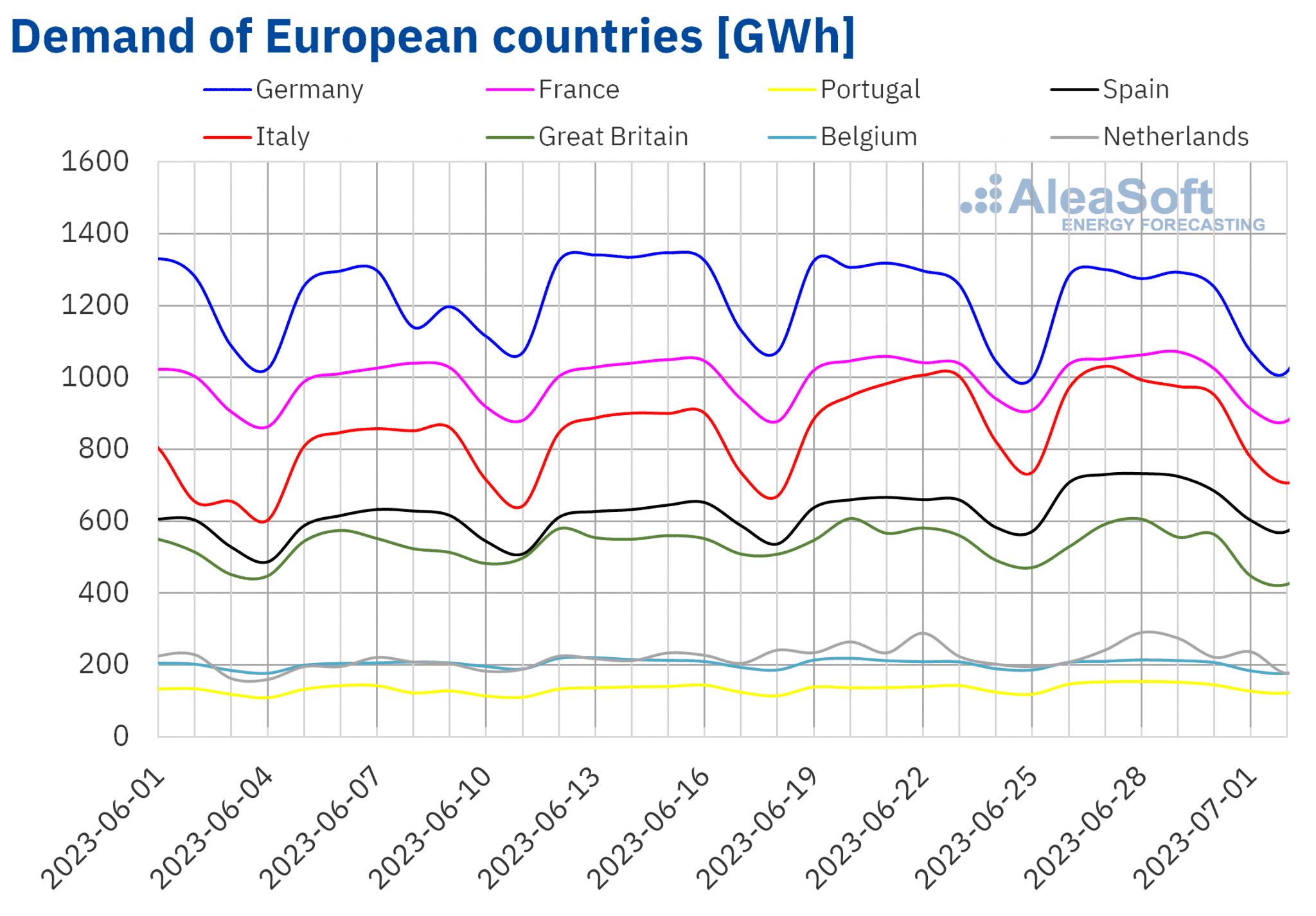

Electricity demand

In the week of June 26, electricity demand rose compared to the previous week in the markets of southern Europe and in the Netherlands. The largest increase, 7.1%, was registered in the Spanish market, followed by a rise of 6.7% in Portugal. The smallest increase, 0.3%, was registered in the Italian market.

On the other hand, the greatest drop in demand was observed in the Great Britain market, which was 2.8%, followed by that of Belgium, of 1.8%. The smallest decreases, of 0.6% and 0.2%, were registered in the German and French markets, respectively.

The rise in demand in Spain and Portugal coincided with an increase in average temperatures of 0.9 °C and 0.8 °C, respectively. In the rest of the analysed markets, the average temperature dropped compared to the previous week, between 0.8 °C in Italy and 2.9 °C in the Netherlands.

For the week of July 3, according to the demand forecasts made by AleaSoft Energy Forecasting, a drop in demand is expected in almost all the main European markets analysed except in the Portuguese and Italian markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

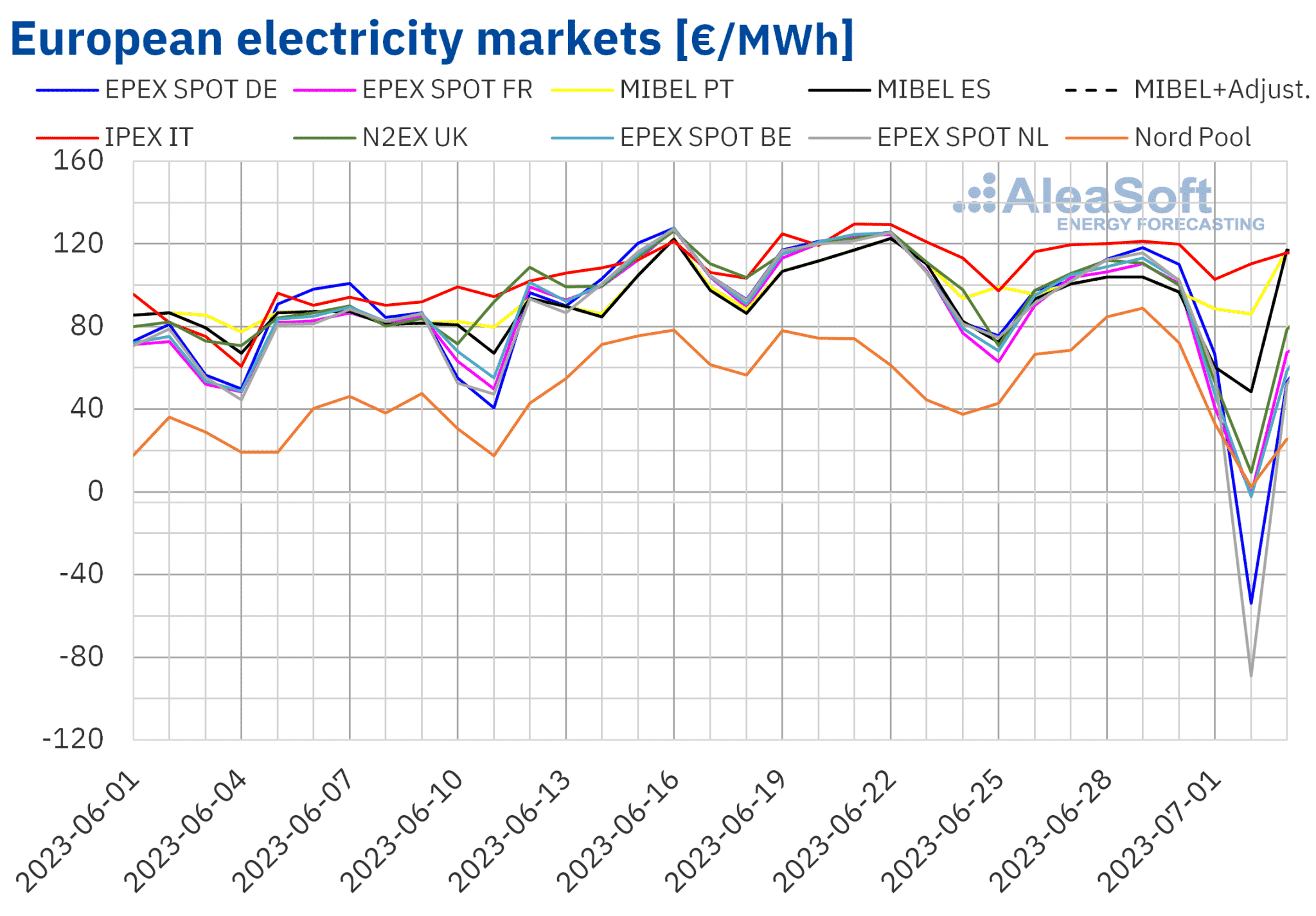

European electricity markets

In the week of June 26, prices of European electricity markets analysed at AleaSoft Energy Forecasting fell compared to the previous week. The exception was the Nord Pool market of the Nordic countries, whose price remained stable with a slight upward trend, registering an increase of 0.9%. On the other hand, the largest fall in prices was that of the EPEX SPOT market of the Netherlands, of 34%, while the smallest decrease was that of Italy’s IPEX market, of 2.9%. In the rest of the markets, prices fell between 11% of the MIBEL market of Portugal and 26% of the EPEX SPOT market of Germany.

In the last week of June, the weekly averages were below €90/MWh in almost all European electricity markets. The exceptions were the Italian market, with the highest average price, of €115.73/MWh, and the Portuguese market, with an average of €96.41/MWh. On the other hand, the lowest weekly average was that of the Nordic market, of €59.43/MWh. In the rest of the markets analysed, prices were between €70.32/MWh of the Dutch market and €86.67/MWh of the Spanish market.

Regarding hourly prices, on Saturday, July 1, there were two hours with zero price in the Spanish market and on Sunday, July 2, seven hours with this price. Also on Saturday, July 1, there were two hours with negative prices in the French market, while on Sunday there were negative hourly prices in the German, Belgian, British, French, Dutch and Nordic markets. In the case of the N2EX market of the United Kingdom, a price of -£40.85/MWh was reached, from 15:00 to 16:00, the lowest since December 2022, while on July 2, from 15:00 to 16:00, in France the price was ?€134.94/MWh, the lowest since June 2013 in this market. In that time period, the lowest price in the Belgian market was also registered, of ?€120.00/MWh, the lowest since June 2019. In Germany, from 14:00 to 15:00, the price was ?€500.00/MWh, the lowest since October 2009. This same price was registered from 13:00 to 16:00 in the Dutch market and was the lowest in its history. On Monday, July 3, negative prices were also registered in the German, Belgian and Dutch markets, and two hours with a zero price in the Nordic market.

During the week of June 26, the decrease in the average price of gas and CO2 emission rights, the significant increases in wind energy production, as well as the zero and negative prices registered in solar hours during the weekend, led to decreases in the average prices of the European electricity markets.

The AleaSoft Energy Forecasting price forecasts indicate that in the first week of July prices could increase in most of the European electricity markets, influenced by decreases in wind energy production.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

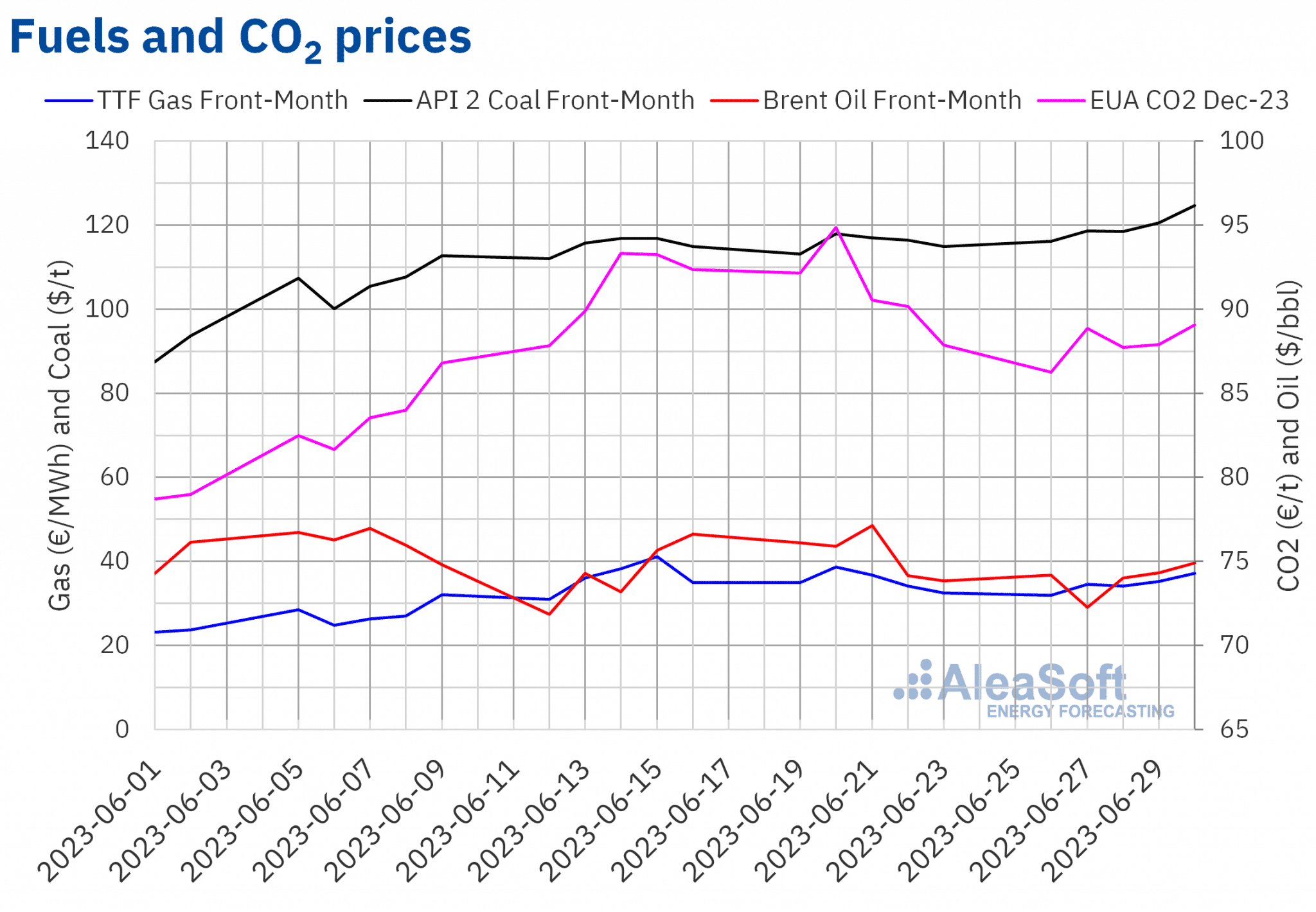

Brent, fuels and CO2

Brent oil futures for the Front?Month in the ICE market registered the weekly minimum settlement price, of $72.26/bbl, on Tuesday, June 27. This price was 4.8% lower than that of the previous Tuesday. Subsequently, prices increased slightly. As a result, on Friday, June 30, the weekly maximum settlement price, of $74.90/bbl, was reached, which was 1.4% higher than that of the previous Friday.

In the last week of June, concerns about the evolution of the world economy continued. However, the decline in crude oil reserves in the United States and the production cuts by OPEC+ and Saudi Arabia from July exerted an upward influence on prices.

Regarding the TTF gas futures in the ICE market for the Front?Month, on Monday, June 26, they reached the weekly minimum settlement price of €31.97/MWh. This price was 8.4% lower than that of the previous Monday. However, during the week there were price increases. Consequently, on Friday, June 30, the weekly maximum settlement price of €37.10/MWh was reached. This price was 14% higher than that of the previous Friday. Despite the upward trend registered during the week, the weekly average was 2.3% lower than that of the previous week.

In the last week of June, Norwegian gas supply problems and the prospect of closure of the largest European gas field continued to exert an upward influence on TTF gas futures prices. The prospects for temperatures above normal during the summer also contributed to the price increases.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2023, on Monday, June 26, they reached the weekly minimum settlement price of €86.25/t. This price was 6.4% lower than that of the previous Monday. The settlement prices remained below €90/t for the rest of the week. In addition, they were lower than those of the same days of the previous week, except on Friday. On Friday, June 30, the weekly maximum settlement price, of €89.08/t, was reached, which was 1.4% higher than that of the previous Friday. For the whole week, the average price was 3.5% below the average of the previous week.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

On Thursday, July 13, the next webinar of AleaSoft Energy Forecasting and AleaGreen monthly webinar series will be held. In addition to the evolution of the energy markets, the webinar will analyse the use of probabilistic metrics to obtain long?term electricity markets price forecasts, the main vectors of the energy transition and the financing of renewable energy projects. At the analysis table of the webinar in Spanish, there will be the participation of speakers from Banco Sabadell, Ecoener and Ben Oldman, who will contribute with their experience to the debate on financing of renewable energy projects.