In the first week of June, prices of most European electricity markets fell and some negative prices were registered, thanks to the decrease in demand and prices of gas and CO2, and to the increase of renewable energy production in some cases. However, prices rose in the Nord Pool and MIBEL markets, the latter being the highest weekly price, something that did not happen since the first week of November. A record photovoltaic energy production was registered in Germany on June 3.

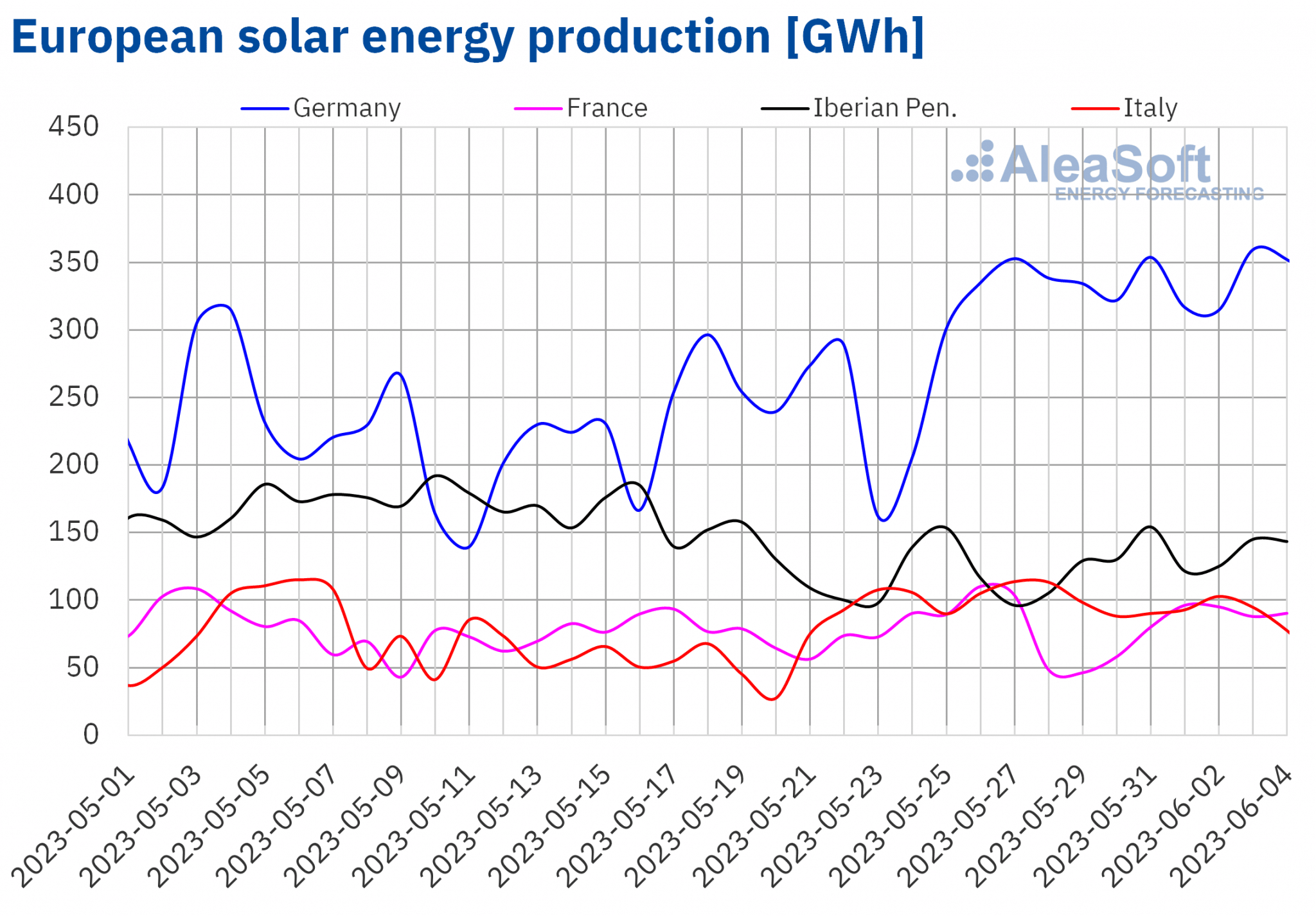

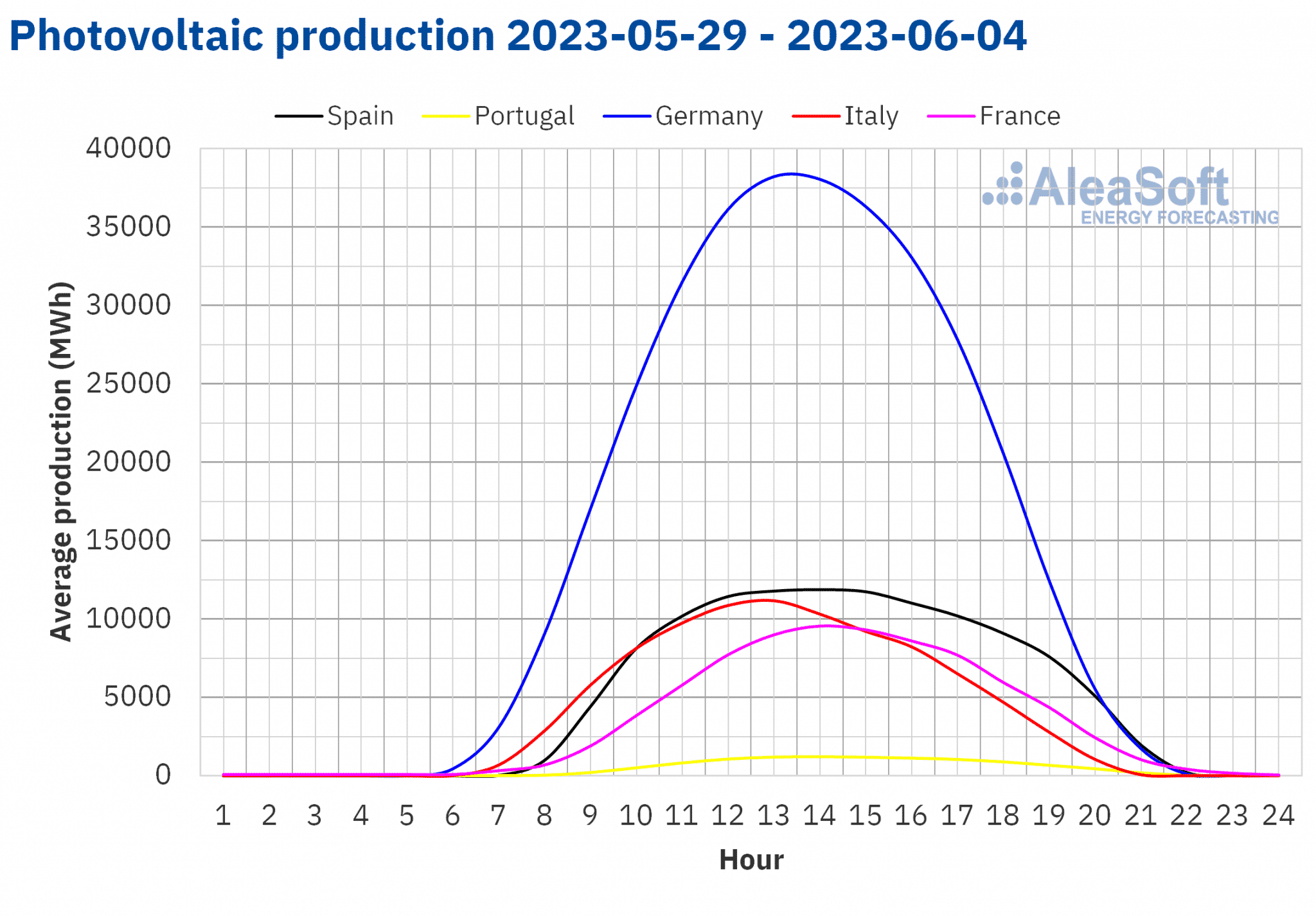

Solar photovoltaic and thermoelectric energy production and wind energy production

In the week of May 29, the solar photovoltaic energy production broke the daily record in the German market with 359 GWh generated on Saturday, June 3.

Compared to the previous week, solar energy production increased in three of the main European markets. The largest increase, of 29%, was registered in Spain, where solar photovoltaic and thermoelectric energy production as a whole is taken into account. In the German and Portuguese markets, the increase in solar generation was 19% and 9.9% in each case. On the other hand, in the French and Italian markets, production with this technology decreased by 5.9% and 11%, respectively. In the case of Italy, this decrease occurs after the weekly historical record registered during the previous week.

For the week of June 5, the solar energy production forecasts of AleaSoft Energy Forecasting indicate that production will increase in Spain but could decrease in Germany and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

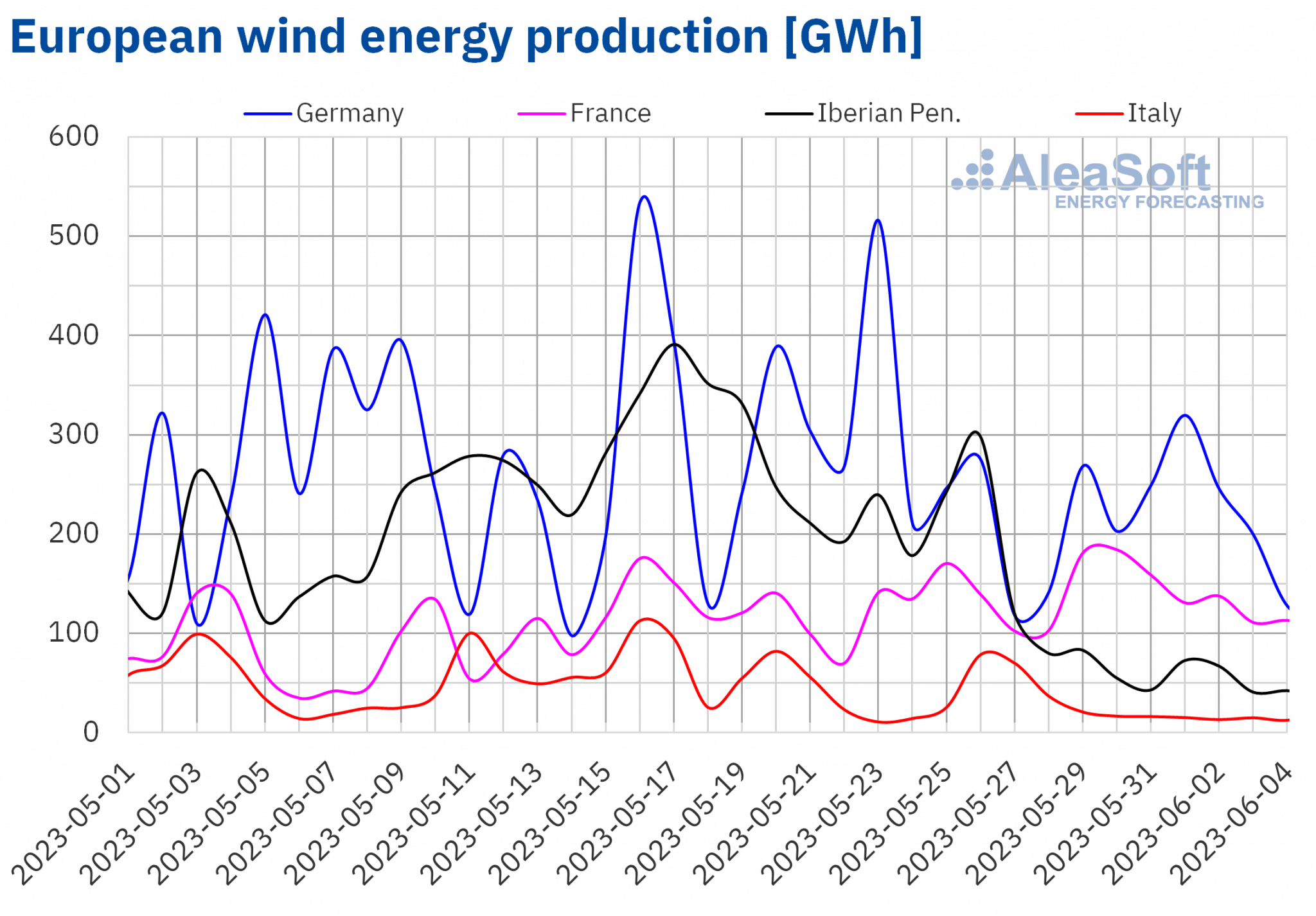

In the week of May 29, wind energy production decreased in most of the markets analysed at AleaSoft Energy Forecasting compared to the previous week. The most significant falls were registered in the southern European markets, led by the 70% drop registered in the Spanish market, followed by the 69% drop in Portugal and 58% in Italy. In the German market, the decrease was 9.2%. On the other hand, in the French market there was an 18% increase in the production with this technology.

For the week of June 5, the wind energy production forecasts of AleaSoft Energy Forecasting indicate that increases could be registered in the Iberian Peninsula and Italy, while decreases are expected in the German and French markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

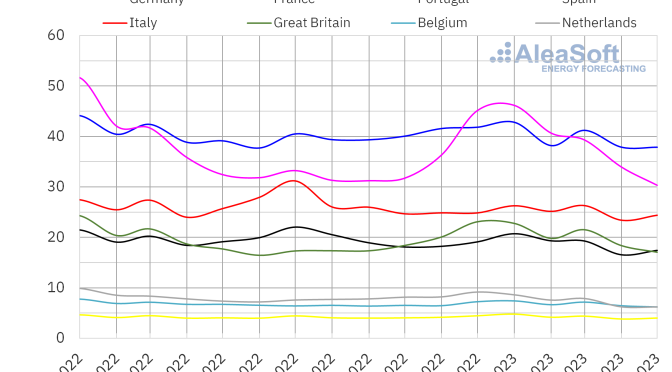

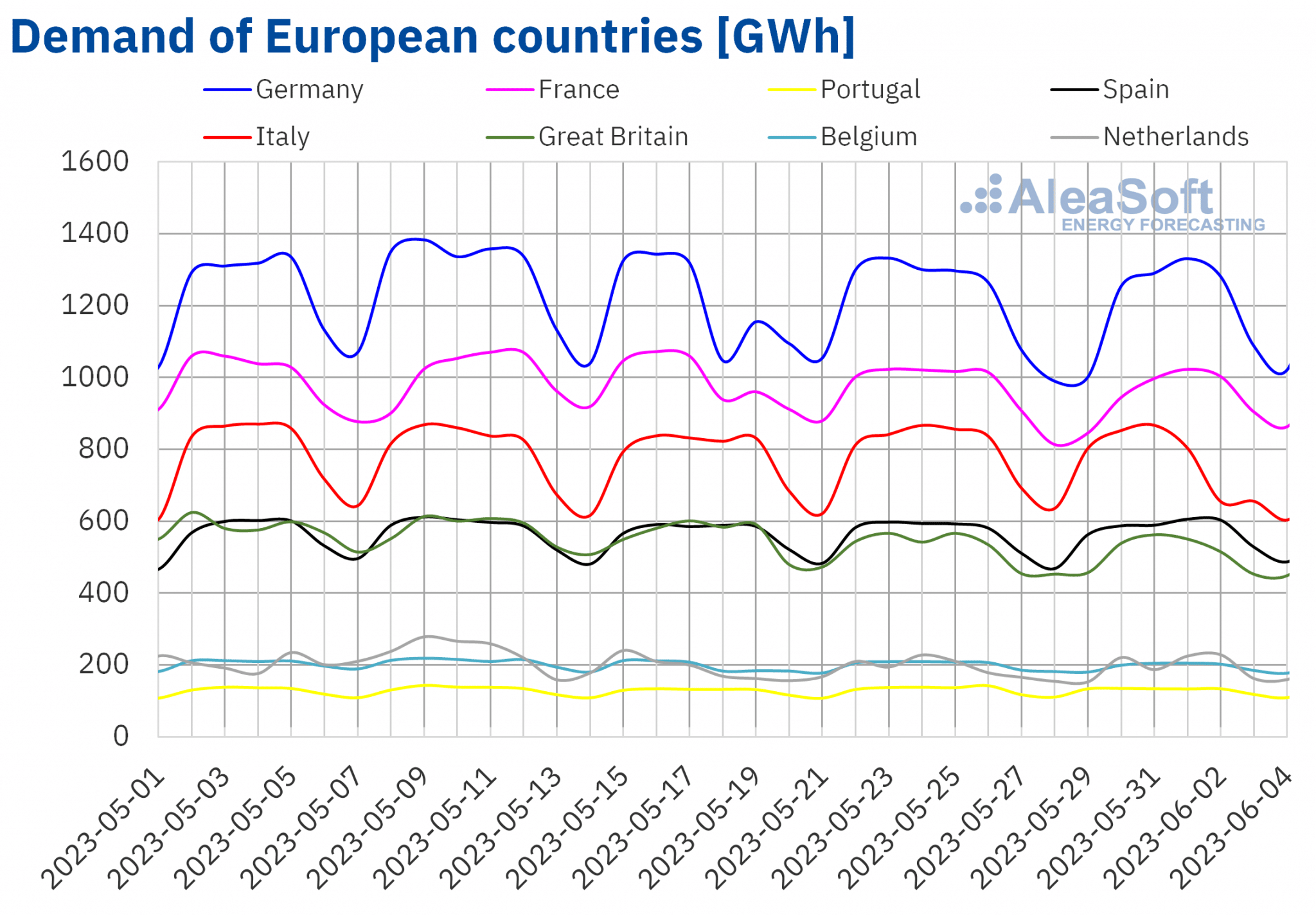

Electricity demand

The week of May 29 ended with a drop in electricity demand in almost all analysed European markets compared to the previous week, except in the Spanish market where an increase of 0.9% was registered. The largest fall, of 5.4%, was registered in the Italian market, where the Italian Republic Day was celebrated on June 2, followed by decreases of 3.7% in the markets of Great Britain and Belgium, and 3.4% and 3.2% of the German and French markets, respectively. On the other hand, the Dutch market registered the smallest fall, of 0.4%.

In the case of the markets of Germany, Belgium, France, Great Britain and the Netherlands, the fall in demand was favoured by the holiday of May 29, Whit Monday.

Regarding average temperatures, there were increases compared to the previous week in all analysed markets except Great Britain, where a drop of 0.2 °C was registered.

For the week of June 5, according to the demand forecasts of AleaSoft Energy Forecasting, a recovery in demand is expected in all the main European markets analysed.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

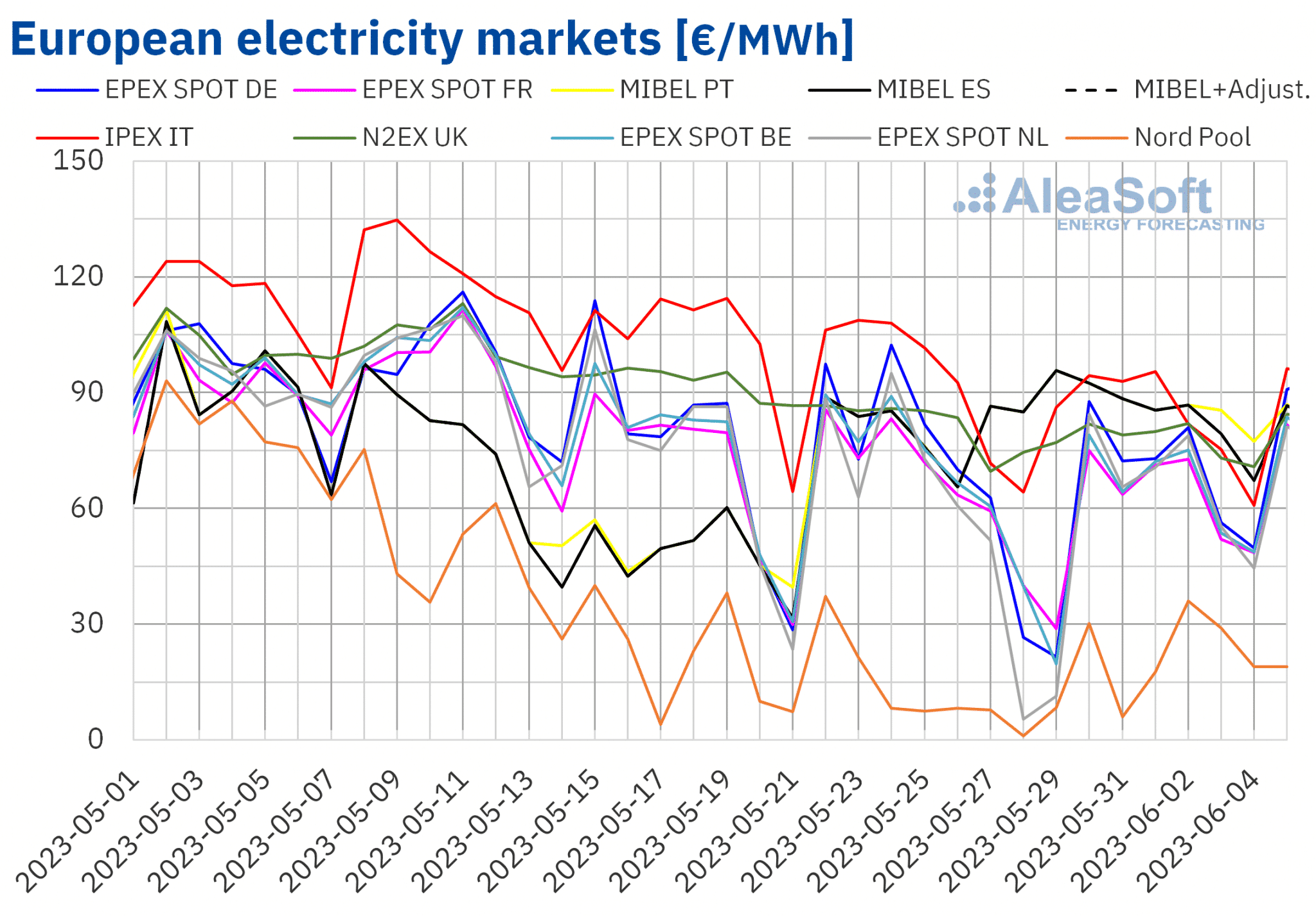

European electricity markets

In the week of May 29, prices of most European electricity markets analysed at AleaSoft Energy Forecasting decreased compared to the previous week. The exceptions were the MIBEL market of Spain and Portugal and the Nord Pool market of the Nordic countries, with increases of 4.4%, 7.1% and 60%, respectively. On the other hand, the most significant drop in prices, of 17%, was registered in the EPEX SPOT market of Belgium. In the rest of the markets, prices fell between 4.7% of the N2EX market of the United Kingdom and 14% of the EPEX SPOT market of Germany.

In the first week of June, European markets’ weekly average prices remained below €90/MWh. The highest average price, €87.38/MWh, was that of the Portuguese market, followed by the average of the Spanish market, of €85.07/MWh. The weekly price of the MIBEL market (including the adjustment price that some consumers must pay due to the limitation of the gas price in this market) is the highest among the primary European markets, and this has not taken place since the week of October 31, 2022. On the other hand, the lowest weekly average was that of the Nordic market, of €20.86/MWh. In the rest of the analysed markets, prices were between €58.68/MWh of the Dutch market and €83.85/MWh of the IPEX market of Italy.

Regarding hourly prices, negative prices were registered in the Belgian and French markets on Monday, May 29, and on June 3 and 4. In the German and Dutch markets, in addition to these days, there were also hours with negative prices on May 31. In the case of the Nordic market, negative hourly prices were reached on May 29 and 31. The lowest hourly price of the first week of June, of ?€185.86/MWh, was registered on Monday, May 29, from 14:00 to 15:00, in the Dutch market.

During the week of May 29, the decrease in the average price of gas and CO2 emission rights, and the fall in demand, led to price decreases in most European electricity markets. In the case of the German market, the increase in solar energy production also contributed to this behaviour, and in the case of the French market, the increase in wind energy production. On the other hand, in the Iberian market, where the production with this technology registered a notable decrease, the highest average prices were registered.

Price forecasts of AleaSoft Energy Forecasting indicate that in the second week of June prices could increase in most European electricity markets, influenced by the increase in demand and the decrease in wind or solar energy production in some cases. But, in the MIBEL market, prices could fall influenced by the increase in wind energy production.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

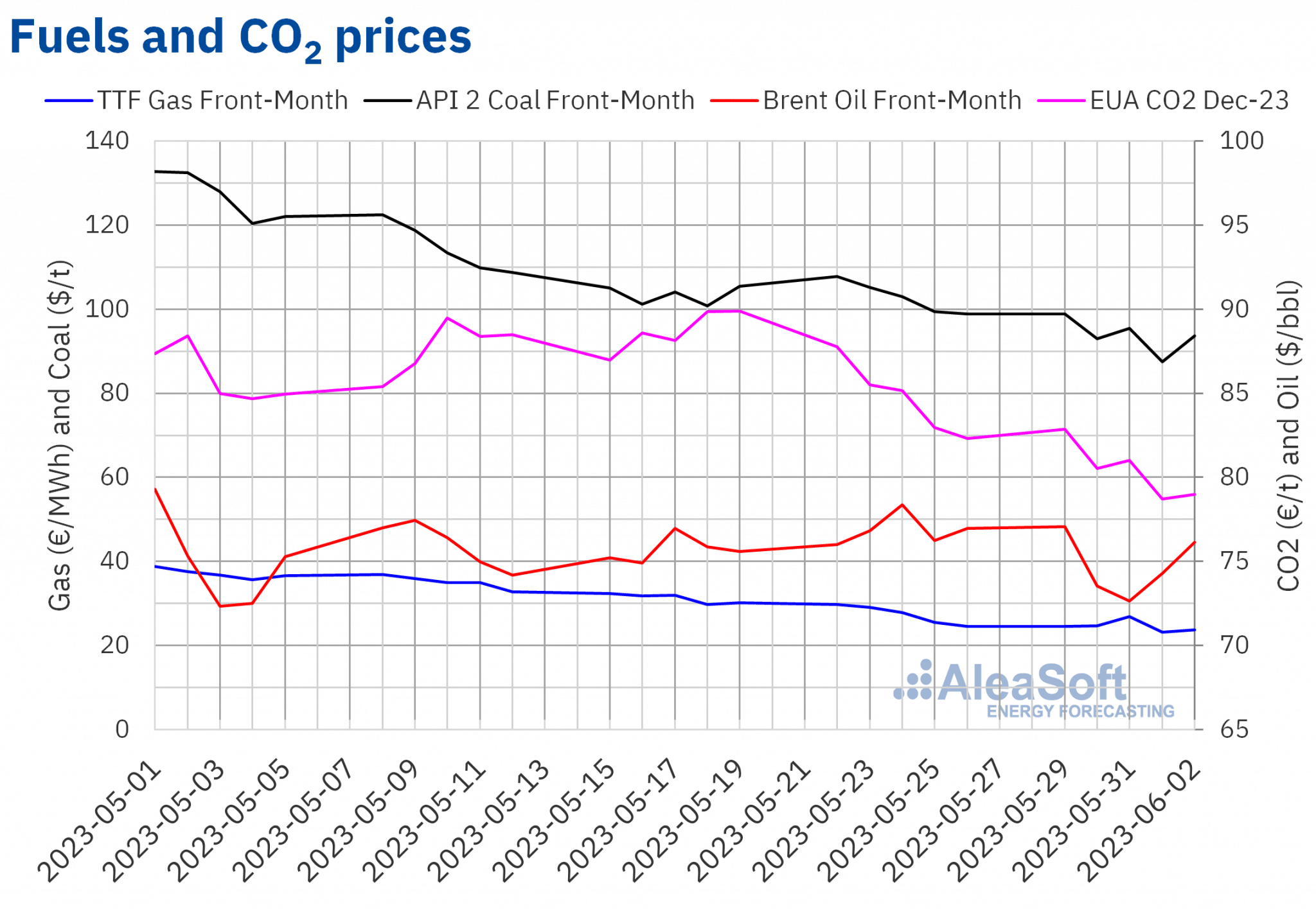

Brent, fuels and CO2

On Monday, May 29, Brent oil futures for the Front?Month in the ICE market reached their weekly maximum settlement price, of $77.07/bbl, which was 1.4% higher than that of the previous Monday. But, subsequently, prices fell until they reached the weekly minimum settlement price, of $72.66/bbl, on Wednesday, May 31. This price was 7.3% lower than that of the previous Wednesday. During the first two days of June, prices recovered and the settlement price of Friday, June 2, was $76.13/bbl, only 1.1% lower than that of the previous Friday.

In the first week of June, the negotiations on the US public debt ceiling continued to influence the evolution of Brent oil futures prices. The agreement reached led to the rise in prices of Friday, June 2, to which the May employment data of the United States also contributed.

On the other hand, in the meeting of Sunday, June 4, the OPEC+ agreed to maintain the current production cuts until the end of 2024. In addition, Saudi Arabia committed to an additional cut of one million barrels per day starting in July. This could exert an upward influence on prices.

Regarding the TTF gas futures in the ICE market for the Front?Month, after the decreases of the fourth week of May, during the week of May 29, settlement prices were lower than those of the same days of the previous week. Even so, the week began with an upward trend. Consequently, on Wednesday, May 31, the weekly maximum settlement price, of €26.85/MWh, was reached, which was only 3.4% lower than that of the previous Wednesday. However, on Thursday, June 1, prices fell by 14% compared to the previous day and the weekly minimum settlement price, of €23.10/MWh, was registered. This price was 9.2% lower than that of the previous Thursday and the lowest since May 2021. On Friday, June 2, the settlement price recovered to €23.69/MWh.

In the first week of June, TTF gas futures prices were influenced upwards by news of a failure at a liquefied natural gas plant in Norway. However, the high levels of European reserves kept prices below €30/MWh. On the other hand, the plant affected by the failure is expected to return to operation in the second week of June.

Regarding settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2023, during the first week of June, they were lower than those of the same days of the previous week. On Monday, May 29, the weekly maximum settlement price was reached, of €82.86/t, which was 5.6% lower than that of the previous Monday. However, this price was 0.7% higher than that of the last session of the previous week. On the other hand, the weekly minimum settlement price, of €78.72/t, was registered on Thursday, June 1. This price was 5.1% lower than that of the previous Thursday and the lowest since January of this year.

Lower gas prices support using this fuel for electricity generation instead of coal, which contributes to a lower demand for CO2 emission rights in the electricity sector.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

This Thursday, June 8, at 10:00 CET, will take place the next webinar of the monthly webinar series of AleaSoft Energy Forecasting and AleaGreen. Speakers from Engie Spain will participate in the webinar, who will contribute their experience in the analysis of the financing of renewable energy projects and PPA. In addition, on this occasion, the main regulatory issues of the Spanish electricity sector and the energy markets prospects in the second half of 2023 will also be analysed.

AleaSoft Energy Forecasting and AleaGreen offer long-term price forecast curves, necessary for financing both merchant projects and PPA, and for valuation of renewable assets. These forecasts use probabilistic metrics, which are essential for risk management allowing the use of a price forecast with a risk or an associated probability.