Between 2010 and 2021, the global weighted average levelised cost of electricity (LCOE) of concentrated solar power (CSP) plants fell by 68%, from USD 0.358/kilowatt hour (kWh) to USD 0.114/kWh.

Between 2010 and 2020, the global weighted average LCOE had declined by 70%, to

USD 0.107/kWh. This was primarily driven by reductions in total installed costs (down 64%), higher capacity factors (up 17%), lower operations and maintenance (O&M) costs (down 10%) and a reduction in the weighted average cost of capital (down 9%).

Between 2010 and 2020, CSP’s global average total installed costs declined by half, to USD 4 746/kilowatt (kW). This was achieved in a setting where project energy storage capacities were increasing continuously.

During 2021, however, these total installed costs increased to USD 9 090/kW – just

4% lower than in 2010. Yet, this value should be interpreted with care, as there was only one project worldwide that came online in 2021. Located in the Atacama Desert in Chile, the Cerro Dominador project boasts 17.5 hours of storage. This is the highest ever recorded storage capacity for a CSP project and is in part responsible for the high total installed costs of the project (though also the reason for its competitive LCOE).

The global weighted average capacity factor of newly-commissioned CSP plants increased from 30% in 2010 to 42% in 2020, as the technology improved, costs for thermal energy storage declined and the average number of hours of storage for commissioned projects increased.

The excellent solar resource in the location of the Cerro Dominador CSP project, meant a very high capacity factor value for 2021, at 80%.

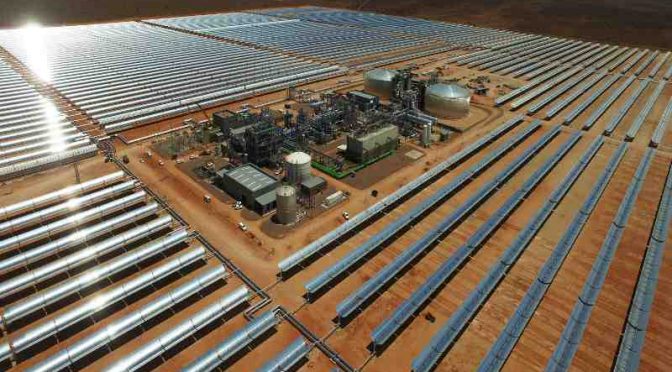

CSP systems work in areas with high (typically above 2 000 kW/m2/year) direct normal irradiance (DNI) by using mirrors to concentrate the sun’s rays to create heat. In most systems today, the heat created this way is transferred to a heat transfer medium – typically a thermal oil or molten salt. Electricity is then generated through a thermodynamic cycle – for example, by using the heat transfer fluid to create steam and then generate electricity, as in conventional Rankine-cycle thermal power plants.

Today, CSP plants almost exclusively include low-cost and long-duration thermal storage systems to.

This gives CSP greater flexibility in dispatch and the ability to target output in high cost periods of the electricity market. Indeed, this is also usually the route to lowest-cost and highest value electricity because thermal energy storage is now a cost-effective way to raise CSP capacity factors. Most commonly, a twotank, molten salt storage system is used, but designs vary.

It is possible to classify CSP systems according to the mechanism by which solar collectors concentrate solar irradiation. Such systems are either ‘line concentrating’ or ‘point concentrating’, with these terms referring to the arrangement of the concentrating mirrors.

Today, most CSP projects use line concentrating systems called parabolic trough collectors (PTCs). Typically, single PTCs consist of a holding structure with an individual line focusing curved mirrors, a heat receiver tube and a foundation with pylons. The collectors concentrate the solar radiation along the heat receiver

tube (also known as an absorber), which is a thermally efficient component placed in the collector’s focal line. Many PTCs are traditionally connected in ‘loops’ through which the heat transfer medium circulates and which help to achieve scale.

Line concentrating systems rely on single-axis trackers to maintain energy absorption across the day, increasing the yield by generating favourable incidence angles of the of the sun’s rays on the aperture area of the collector.

Specific PTC configurations must account for the solar resources at the location and the technical characteristics of the concentrators and heat transfer fluid. That fluid is passed through a heat exchange system to produce superheated steam, which drives a conventional Rankine-cycle turbine to generate electricity.

Another type of linear-focusing CSP plant, though much less deployed, uses Fresnel collectors. This type of plant relies on an array of almost flat mirrors that concentrate the sun’s rays onto an elevated linear receiver above the mirror array. Unlike parabolic trough systems, in Fresnel collector systems, the receivers are not

attached to the collectors, but situated in a fixed position several metres above the primary mirror field.

Solar towers (STs), sometimes known as ‘power towers’, are the most widely deployed point focus CSP technology, although such systems represented only around a fifth of total CSP deployment at the end of 2020 (SolarPACES, 2021). In ST systems, thousands of heliostats are arranged in a circular or semicircular

pattern around a large central receiver tower to redirect the sun rays towards it. Each heliostat is individually controlled to track the sun, orientating constantly on two axes to optimise the concentration of solar irradiation onto the receiver, which is located at the top of a tower. The central receiver absorbs the heat through a heat transfer medium, which turns it into electricity – typically through a water-steam

thermodynamic cycle. Some ST designs do away with the heat transfer medium, however, and steam is directly generated at the receiver.

STs can achieve very high solar concentration factors (above 1 000 suns) and therefore operate at higher temperatures than PTCs. This can give ST systems an advantage, as higher operating temperatures result in greater steam-cycle and power block efficiencies. Higher receiver temperatures also unlock higher power result in greater storage densities within the molten salt tanks, driven by a larger temperature difference between the cold and hot storage tanks. Both factors cut generation costs and allow for higher capacity factors.

Cumulative CSP installed capacity grew just over five-fold, globally, between 2010 and 2020, reaching around 6.5 gigawatts (GW) by the end of that period. Breaking the last five years of this down, after modest activity in 2016 and 2017 – with annual additions hovering around 100 megawatts (MW) per year – the global market for CSP grew in 2018 and 2019. In those years, an increasing number of projects came online in China, Morocco and South Africa. Yet, compared to other renewable power generation technologies, new capacity additions overall remained relatively low, at 860 MW per year in 2018 and 550 MW in 2019. In 2020, only 150 MW was commissioned globally, with all of this this coming online in China. Hopes for growth in 2021 did not materialise, though 110 MW (all from the Cerro Dominador project) was commissioned during that year in Chile. At the same time, about 265 MW from the Solar Energy Generating Systems (SEGS) plant in the USA – in operation since the late 1980s – was retired. This puts the cumulative global installed capacity of CSP at the end of 2021 at around 6.4 GW.

The sector was optimistic that China’s plans to scale up the technology domestically would provide a boost to the industry and take deployment to new levels. Yet, progress on China’s policy to build-out 20 commercial-scale plants to scale up a variety of technological solutions, develop supply chains and gain operating experience has proved more challenging than anticipated. Developers have struggled and some projects have been lagging, while others have found new developers and some projects appear unlikely to be completed.

The outlook for 2022/2023 is somewhat brighter, however, with the possibility that close to 1.4 GW of new capacity could be commissioned in China and the United Arab Emirates. Spain has launched an auction that includes 200 MW of CSP capacity, but the results are yet to be announced. The CSP project pipeline includes a 100 MW solar tower project with 12 hours of storage expected to come online by 2024 in South Africa. Botswana’s Ministry of Mineral Resources, Green Technology and Energy Security has initiated a pre-qualification process for participation in a 200 MW CSP tender, while Namibia has announced plans to launch a CSP tender in 2022 for between 50 MW and 130 MW of CSP capacity. In addition to this, a 300 MW project is planned to come online in 2025 in Qinghai, China.

National Energy and Climate Plans (NECPs) of some EU Member States show and indication of the potential development of the CSP project pipeline in the future. For example, Spain plans to add 5 GW and Italy 880 MW of new CSP capacity by 2030.

https://www.irena.org/publications/2022/Jul/Renewable-Power-Generation-Costs-in-2021