Solar thermal was the emblem of the take-off of renewables in Andalusia and the great international commitment of companies such as Abengoa, Sener or TSK. The cut that the Government of Rajoy had to apply in the premiums of renewables in 2012 – when Spain was on the verge of the rescue – short-circuited its development. A lethargy that may now come to an end. «We have a future, the National Integrated Energy and Climate Plan estimates that by 2030 there should be 5,000 new concentrated solar power megawatts, which shows that we are necessary,» says Sevillian engineer Gonzalo Martín, general secretary of Protermosolar (the employer’s association of this sector).

There are two great technologies that make it possible to convert light into energy. On the one hand there is photovoltaics, with panels made of silicon cells, which capture solar radiation (in the form of photons) and emit electrons (which, when captured, produce electric current). At the beginning of the green energy boom, photovoltaics were expensive and inefficient, and the projects that were developed were small in size, since the usual were plants of between three and seven megawatts (MW).

Faced with this, solar thermal or Concentrating solar power was then the great hope of the energy transition. It works with mirror fields that concentrate the sun’s rays at one point, thus generating temperatures of more than 1,000 degrees, with which a fluid is heated that, in turn, generates the heat necessary to move a turbine with steam (which finally produces electricity). It required high investments but its size was promising (some of these plants exceeded 100 MW). In Andalusia it had a special predicament, with the construction of 22 plants totaling 1,000 MW (almost half of the total installed in Spain). It was the flag with which Abengoa landed in the US, with two megaprojects in California and Arizona.

New stage

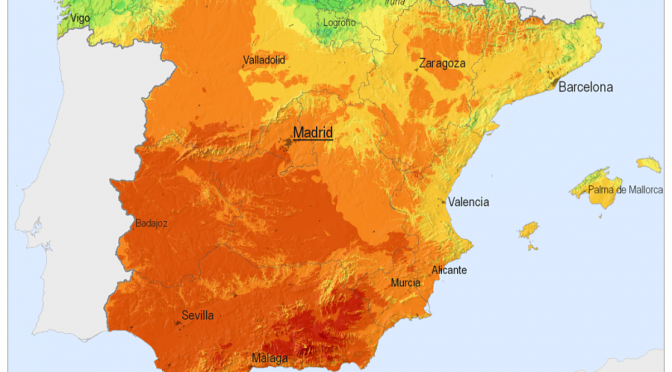

In the new energy transition that began in 2016, the tables have turned. The drastic reduction in the cost of the panels and the increase in their efficiency have made photovoltaics the king of the new renewable boom. «There are more than 26,000 MW in different stages of development in Andalusia and, of these, 91% is photovoltaic», says Fernando Aráuz de Robles, General Director of Energy of the Junta de Andalucía. Some of these initiatives add up, by themselves, almost 1,000 MW, with which also in the dimension of the projects this technology has taken the scepter of the business.

But solar thermal developers are also warming up engines. «We are not incompatible», remarks Martín, who stresses that «photovoltaics is the cheapest energy while the sun is shining, but the great advantage of solar thermal power is that it can store energy and pour it into the grid at night». They are not two comparable technologies, but «complementary». The higher cost of solar thermal (currently more than double the cost), is offset by the fact that it is «manageable» (it can save energy for weeks and supports the system when there is no wind for the wind and no radiation for panels).

This year has concluded a process that began in 2017: almost all the large solar thermal plants that were promoted between 2005 and 2013 have changed owners. One of the most recognized plants is Gemasolar, a large luminous tower in Fuentes de Andalucía, visible from the highway that connects Córdoba and Seville. Promoted by the Basque company Sener, last month it was acquired by the investment fund Q Energy, which has also bought the two plants that Sener had in Cádiz and one of TSK (called La Africana) in Córdoba. Also in 2020, the British fund Cúbico acquired Arenales Solar in Morón de la Frontera, and in 2017 it had already acquired two other plants in Granada (Andasol I and II).

The plants that Abengoa promoted in its day were owned by Atlántica Yield (whose main shareholder is the Canadian group Algonquin). And the English fund Contourglobal bought the five Acciona plants in 2018. «It is a natural process, these assets have passed from the hands of their industrial promoters to those of large investment funds specialized in asset management with a guaranteed return,» Gonzalo Martín recalls.

After the electricity reform, these projects have a profitability guaranteed by the Government of 7% (before the crisis it was 10%). «The interest of these funds confirms that solar thermal is already a very proven technology whose plants have an optimal operation, otherwise these operations would not have occurred.» There are also new developers who have opted for the sector: this is the case of Ence, a leader in biomass, which in 2019 bought the Iberdrola solar thermal plant in Puertollano.

The resurrection plan for this technology would have two phases. The 50 existing plants in Spain started their promotion in 2005 and were completed in 2013, when the technology was still maturing, hence only 40% of these plants were equipped with an infrastructure for energy storage. «Most left the facility prepared to put storage in the future, so if the regulatory framework allows it and the State recognizes the investment in the profitability of these plants, with a small outlay we could double the storage capacity.» Almost the entire industrial supply chain for this energy is in Andalusia and, after the 2013 stoppage, it has come to a halt. «These improvement projects would serve to gradually reactivate Andalusian suppliers, who could be preparing for future plants.»

Currently, thermal storage in molten salts in solar thermal plants reaches 7 GWhe in Spain and with the existing solar thermal plants that could install this system it is easily expandable to 12 GWhe. If the PNIEC (National Integrated Energy and Climate Plan) is complied with, solar thermal energy could contribute more than 60 GWhe of storage capacity to the system.

«It is necessary to recognize the current thermal storage capacity in molten salts in the solar thermal plants in Spain and put it in value before the risk that certain storage business models are not attractive if certain hypotheses are not fulfilled, such as the planned interconnections , that more nuclear power plants were kept in operation or that photovoltaic technology did not reach its penetration objectives, and as a result of all this, price arbitrage was not attractive for new storage investments «, explains Gonzalo Martín, general secretary of Protermosolar , which adds: «thermal storage will work in a completely complementary way to photovoltaics, capturing energy during the day, but dispatching it in the evening. This has several advantages, such as not cannibalizing the daytime price, mitigating the ‘duck curve’ at dusk, and providing firm, 100% renewable night backup capacity. »

The hope of the sector is that future power auctions will consider the award of solar thermal power, which must guarantee minimum prices (since its cost does not allow it to function in the free market). «There are national and international groups that are taking positions in this new stage of reactivation of the industry,» he remarks. If the PNIEC forecasts were met, the generation capacity would triple.

Advances

The sector has taken a leap in innovation. Future plants will be hybrid (they will combine photovoltaic and thermosolar) and operational improvements allow a drastic reduction in operating costs (according to the International Renewable Energy Agency, thermosolar has reduced costs by 50% since 2010). And technologies are being investigated (such as the H2020 InPower project) that would significantly reduce the current cost. Spanish companies have been responsible for the expansion of these plants to the USA, South Africa or the United Arab Emirates. Now it is China that is developing large investments to put itself at the forefront of the sector. In the sector they consider that if Spain returns to bet on solar thermal it will be an incentive to grow again in the international market.

The sector also trusts in the opening of new segments in which the solar thermal has a gap. There are large industries such as cement or mining that require the application of heat to their manufacturing processes, and that is what solar thermal power plants primarily produce. The heat generated by its mirrors can be used to supply this type of large companies directly. Along these lines, there are European research projects such as Solpart, which analyze how to apply this type of solution.