China is just beginning to build Concentrated Solar Power (CSP), with its first 50 MW project announced this year, and now a joint US-China venture proposing two 135 MW tower CSP plants to be completed by 2017, as the first of six to supply power for China Power Investment Corporation (CPI).

The agreement would be part of China’s historic climate deal with the US in which it will build 1,000 GW of clean energy in 15 years, under the new US-China Framework for the Ten-Year Cooperation on Energy and Environment.

In 2016 China is launching what will be the world’s largest carbon market, covering 10 percent of all global emissions, and with a hefty $49 fine on each tonne of CO2 emitted over the permit limit. This limit will be ratcheted down each year.

After several years of pilot programs in various provinces, it is taking the lessons learned and going national – in the biggest carbon polluter nation in the world. Theirs has been designed to be readily plugged into other national carbon markets, potentially taking carbon markets global.

Given the nation’s resolve – and its legendary dispatch once the will is there – it’s clear that the CSP industry needs to be ready when this new market takes off. This could be sooner and happen faster than anyone might think.

Rapid deployment

Once China acts to solve a problem, radical change happens fast. From its http://social.csptoday.com/sites/default/files/tracker/reports/2471_CSP_Today_Markets_Report_2014.pdfdraconian one-child policy – that arguably has already done much to slow climate disaster – to its decision last year to simply soak up the global PV glut by deploying the surplus domestically – the country has the streamlined political structure needed to take care of mankind’s really big problems.

“When China wants to expedite things; it does expedite things. Man! Fantastic,” enthuses lawyer Dan Harris, of the China-based law firm Harris/Moure. “They’ll say they’re going to build an airport and all of a sudden it’s there.”

And China is probably the only country in the world that understands viscerally the urgency of leaving fossil energy behind.

“China’s five-year plan is a serious document showing where China wants to go. They are sick of pollution,” says Harris, who has a front row seat to China’s genuine commitment politically, as well as its rapid deployment once a commitment is made.

As a result, China specifically allows solar project development by foreigners in the Catalogue for the Guidance of Foreign Investment Industries. The Five Year Plan has the goal of 3 GW of CSP by decade’s end. Together with China’s unique political environment, the carbon market could be the final push needed.

SolarReserve has been in China for a couple of years now.

“We just had a team out there last week in discussions with some of the major players about what’s happening on the CSP side in China. It’s a pretty dynamic market so we will have to see how that plays out,” says SolarReserve CEO Kevin Smith.

“They’ve got a fair amount of wind and a lot of PV that’s going in now and that obviously doesn’t address all the peak periods that they need power. They seem to be making some moves to incorporate CSP into their plans – largely because of the storage capabilities.”

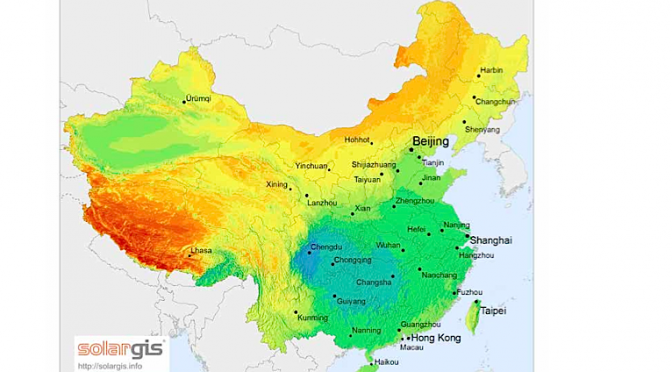

Despite its middling DNI, China is rated 7th globally by CSP Today Market Report 2014.

Long-term power contracts are the same as elsewhere; developers do need to have creditworthy off takers to attract financing, whether financing a project within China, or through international sources.

“Power contracts are pretty similar to those you’ll see across the world,” he explains. “To permit a project in China, versus permitting a project in say Nevada or California is obviously different, but largely you are looking at PPA’s with the largest generators.”

To do business in China and hire employees developers need to form a Chinese company, not necessarily a partnership, but a company of some sort, especially in order to lease property or land.

But permitting is relatively straightforward, taking as little as a year, and focused on pollution prevention, making it solar-friendly.

“In China, permitting mostly deals with protecting humans,” Harris says. “Worker safety is becoming huge. Water pollution. Waste disposal. Air pollution.”

But there are unique legal challenges for foreigners developing in China, especially for solar developers who would be selling to utilities, which are government-owned.

Different legal system

”The legal side is more challenging, certainly,” says Smith. “As you go into some of these markets, the key is how we put together a project financing structure that is financeable while dealing with the differences in the legal system. China’s legal system is significantly different than here in the US and it provides some different challenges from some of the other markets.”

In the US, and potentially in China, SolarReserve uses Baker & McKenzie, which also operates one of the largest international law firms in China, with five to six hundred lawyers, mostly Chinese.

“And there’s also some big local firms in China,” he says. “So there is strong international and local support from lawyers in China, and that’s what you have to depend on to work through the system that they have there.”

Don’t worry about trademark infringement

Despite widespread US reporting of trademark infringement, Harris says China is actually very good at trademark protection.

“There was a stretch in the US where every day reporters were talking about trademark problems in China. Americans are used to thinking we run the world. They didn’t get their trademark stolen, they just never owned it. They just have to register their trademark in China,” Harris points out.

“In the United States the first to use the trademark owns it. In China the first to register it owns it.”

Avoid murky ethical issues

A reputation for corruption in the provinces distant from the big cities has been a huge problem for foreigners who routinely fall afoul of China’s now very strict rules.

Chinese anti-corruption law goes further than US bribery law, covering not just public officials but also private citizens and relatively murky situations. Would facilitating work in Los Angeles for a new Chinese partner’s son be just being helpful – or is that a bribe?

The new culture has developed rapidly.

“China has its own anticorruption laws. A CSP developer would be dealing with government officials. But you really have to know both laws.”

Clear communication pays

Harris recommends writing contracts in Chinese to ensure that everyone is on the same page, which is doubly important when you’re communicating in someone’s second language.

“There are plenty of contracts that will work for China. But you have to be super, super specific because to avoid problems,” he explains.

“A lot of the problem is Chinese courts are terrible in ‘lost profits.’ They are not used to it. If you say look, my Christmas lights were delivered late, and so I have lost profits – you’re never going to win that case. But if you say my contract says the product has to be delivered in X days and if not you pay X dollars every day it’s late; that’s clear. That’s how Chinese contracts work.”

“You have to understand dispute resolution and related activities; it’s not that different as you look at the different markets,” says Smith. “We have a group that we are working with in China. When we’re doing projects internationally we usually bring on local partners. They can help us with language issues and local politics and those kinds of activities.”

Gearing up

China is one of the easier countries for supply chains. And other than the control box and the drives for trackers, most components for CSP already lend themselves to domestic supply.

“One of the benefits of CSP versus PV on an international basis is that we can procure a large portion of the facility locally,” says Smith. “Almost the entire Heliostat field; mirrors, glass, foundations, cabling, all those kinds of things can be procured within the country.”

And China has recently been gearing up to supply a CSP industry. While there was little indication that China would move to deploy so much PV domestically, once it began, things have moved fast. Something similar could happen with CSP.