Interview with Dr Emelly Mutambatsere, Principal Regional Economist, African Development Bank, and a speaker at the upcoming Clean Power Africa.

You are the co-author of a comprehensive document on Africa’s wind energy market – can we start with a short summary of how it has evolved over the years?

The harnessing of wind energy for electricity production on commercial scale started in Africa in the late 1990s. Our study shows that the first commercial scale wind farms were commissioned in 2000/2001 in Egypt, Morocco and Tunisia. This was after over a decade of pilot testing with Egypt as the trail blazer.

Between 1990 and 2010, wind energy installed capacity increased twelve fold to reach 1.1 Gigawatts (GW) in 2011. While the annual growth rate of Africa’s installed capacity was almost twice the growth of global capacity during the same period, it remains similar to the growth rate reported for global capacity when wind took-off on the global market. This growth followed a phased approach, whereby countries lacking familiarity with the technology and having limited geo-referenced data started with pilot projects, migrating to semi-commercial projects, before reaching full-fledged commercial scale. The average project size has also increased over time, while the lead time achieving commercial scale has decreased.

But overall, wind energy markets in Africa remains small in absolute terms and the importance of wind in the energy mix is limited, at less than 1% of continent’s total installed generation capacity. This is not expected to significantly change in the medium term given the significant concurrent development of installed capacity from conventional energy sources.

Which structural characteristics affected the development of wind energy projects?

Taking the presence of wind energy potential as given, four key factors affect the uptake of wind energy. Firstly, the physical attributes of wind – in particular its intermittency which translates into variable electricity output – affect the role that wind can effectively play in the generation mix, and add complexity to the integration of wind-based power plants into conventional electricity grids, including the need for back-up capacity.

Secondly, the level of electrification observed in African countries with strong wind energy potential matters. Those countries that have reached high electrification rates are more amiable to adopting wind energy which they use to increase available electricity generation capacity in both peak and off-peak periods, thus improve reliability of service. On the other hand, countries trying to reach access objectives, and cannot rely solely on wind to achieve this objective given its aforementioned physical attributes, have opted for conventional energy resources which a provide a stable base-load capacity.

Third, the business environment is important. We observe that fast growing wind energy markets have benefited from strong political will, supported by strategic policy direction and an enabling business environment, including industry specific legislation. Finally, while harnessing wind energy improves the environmental footprint of African power systems, we do not see climate change benefits being an overriding driver of market development on the continent. Other factors such as achieving energy security, by improving diversity of the electricity generation mix and/or increasing use of locally available energy resources, appear to take precedence. This is because Africa still makes a meager contribution to global greenhouse gas emissions. Moreover, an underdeveloped market for carbon tips the scale against wind in simple economic and financial comparisons with conventional energy resources.

The paper provides the first mapping of the continent’s wind energy market – can you give us a summary of this, where are the most developed markets, which areas have most potential etc.?

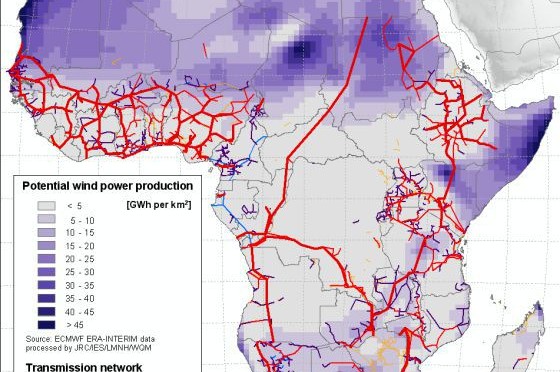

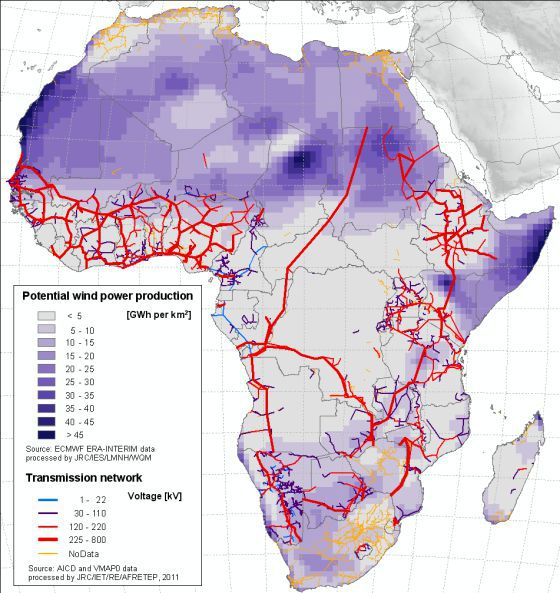

A wind energy potential mapping exercise conducted by the African Development Bank in 2004 shows that coastal countries have the best wind from a wind speed perspective. This includes (in no particular order) Algeria, Egypt, Morocco, Tunisia and Mauritania in North Africa; Djibouti, Eretria, Seychelles and Somalia in the East; and South Africa, Lesotho and Madagascar in the South. Another study we reference in the paper identifies Kenya and Chad as also having large inland wind energy potential. Central and West Africa are shown to have limited potential.

We observed in conducting this study that wind energy potential is a dynamic concept which evolves with the industry’s technology advancement. It is also important in discussing this concept to clearly define the type of potential being measured: whether on-shore or off-shore, whether the physical upper limit of the energy resource or the convertible potential considering technological, structural and ecological constraints. The ranking of countries by potential follows suite. For example, a study which evaluates technical potential ranks Somalia, Sudan, Libya, Egypt, Madagascar, Kenya and Chad as being among the top 30 countries on global scale.

Looking at the developed potential at end-2011, we see strong concentration of wind energy capacity in three North African countries – Egypt, Morocco and Tunisia. Egypt held half of the continent’s total installed capacity, followed by Morocco with 40% and Tunisia with 5%. Outside of North Africa, there is commercial capacity in Cape Verde, and limited capacity in South Africa, Kenya, Mauritius, Eritrea and Mozambique.

The market’s outlook is also noteworthy. Our survey produced a comprehensive sample of about 60 ongoing and planned wind energy projects on the continent. This places South and East African markets in the lead in terms of market growth. South Africa alone is expected to contribute a third of the wind energy capacity currently under developed or planned in Africa; and Kenya is making significant strides toward developing what is poised to be the continent’s largest wind power project. This trend is attributed to increased strategic focus on wind in these regions, whilst in the North market development has been stalled by socio-economic instability.

What do African countries need to take into consideration when developing wind projects?

First, there is need to develop a national champion to promote the industry, offering a single focal point for regulation, financing and oversight. In Egypt, the New and Renewable Energy Agency (NREA) was specifically established to play this role. Elsewhere, the existing power utility or a division therein was used.

Second, the wind energy market is attractive to private developers provided clear legislation exists to support the market. This includes rebalancing the scale in cases where subsidies exist on fossil fuels in order to improve competitiveness of renewable technologies. In addition to legislative support, the state should focus on kick-starting market development by supporting research and development, developing comprehensive geo-referenced datasets required for feasibility studies, and funding pilot projects.

It is important for countries to choose an industry development model which serves the country’s energy sector needs best. Country experiences have thus far been different among market leaders: while some countries opted for a state utility sponsored market development path (e.g. Egypt), others have used a blend of public and private sponsorship of projects including by industrial users (e.g. Morocco) and still others, a competitive private sector led path (e.g. South Africa). The same is true for choice of pricing model (whether a predetermined feed-in tariff, direct negotiation or price competition). The different approaches reflect different priorities and local preferences.

Finally, most African countries developing renewable energy markets are hoping for farther reaching results including industrialisation and job creation. Countries pursing this secondary goal should support local linkages, including local manufacturing of turbines and turbine components, as an integral part of their wind sector strategy. Examples of best practice in the respect are still limited.

What did you find regarding funding of such projects?

In each market where wind energy is being developed, the state is a big player in the initial stages of industry development; and is often the sponsor of pilot projects. Donor financing is also very visible in these initial stages. As the market matures, we see the profile of both sponsors and financiers evolving, from public entities and grant financing, to public-private / private entities and non-concessional financing. However, the market has not yet developed to the point where it can be fully funded by the private sector, therefore development finance institutions remain major players.

What will be your main message at Clean Power Africa?

Africa’s wind energy market has developed at a pace similar to that observed in leading markets at the early stages of their industry development. Despite this progress and the presence of significant potential on the continent, we should not expect wind to take over conventional energy resources in terms of share in the electricity generation mix, as key structural characteristics of the market affect both efficacy in addressing the energy access challenge, and competitiveness of wind, relative to non-renewable energy resources. Countries seeking to develop this market should do so deliberately and be intent on supporting early market development. However given the urgency with which most governments must deal with the more pressing access needs, conventional solutions will more likely be adopted ahead of, or concurrently with, wind energy.

What are you most looking forward to at the event in Cape Town?

I always look forward to interacting with practitioners and policy makers in these forums. It is an opportunity to learn from them how institutions such as AfDB can best serve as a partner in Africa’s development.