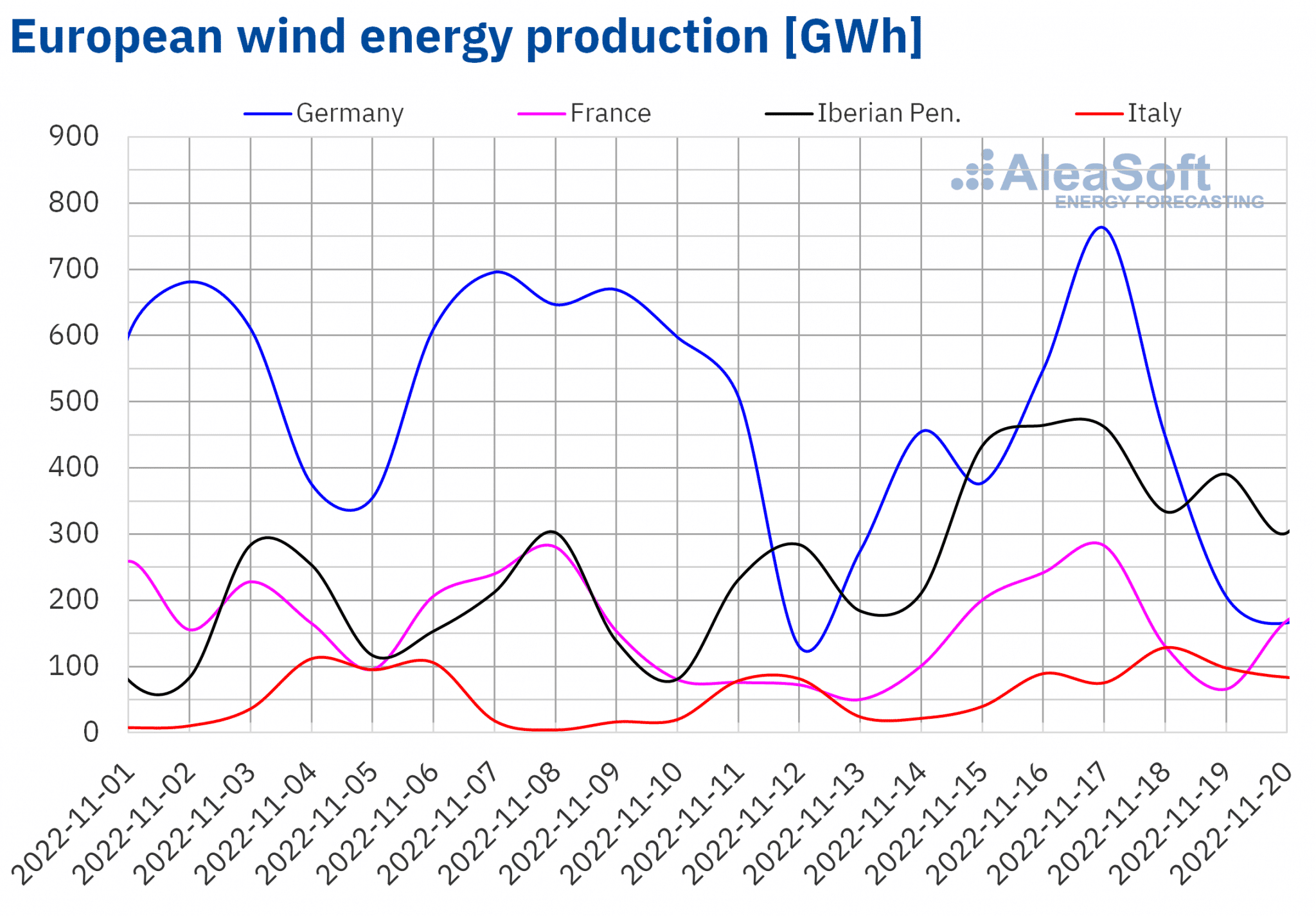

In the third week of November, prices of most European electricity markets rose as a result of the increase in gas prices, a higher electricity demand and the drop in solar energy production. However, in the MIBEL market, prices fell thanks to the increase in wind energy production, which allowed the lowest price since June 2021 to be reached on November 19. The wind energy production also increased in Italy, where it doubled the production of the previous week, and in France.

Solar photovoltaic and thermoelectric energy production and wind energy production

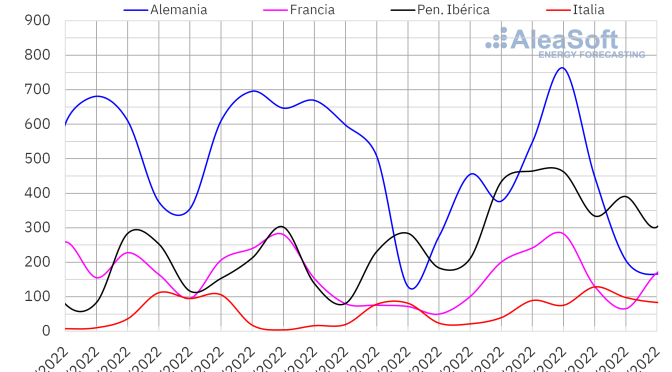

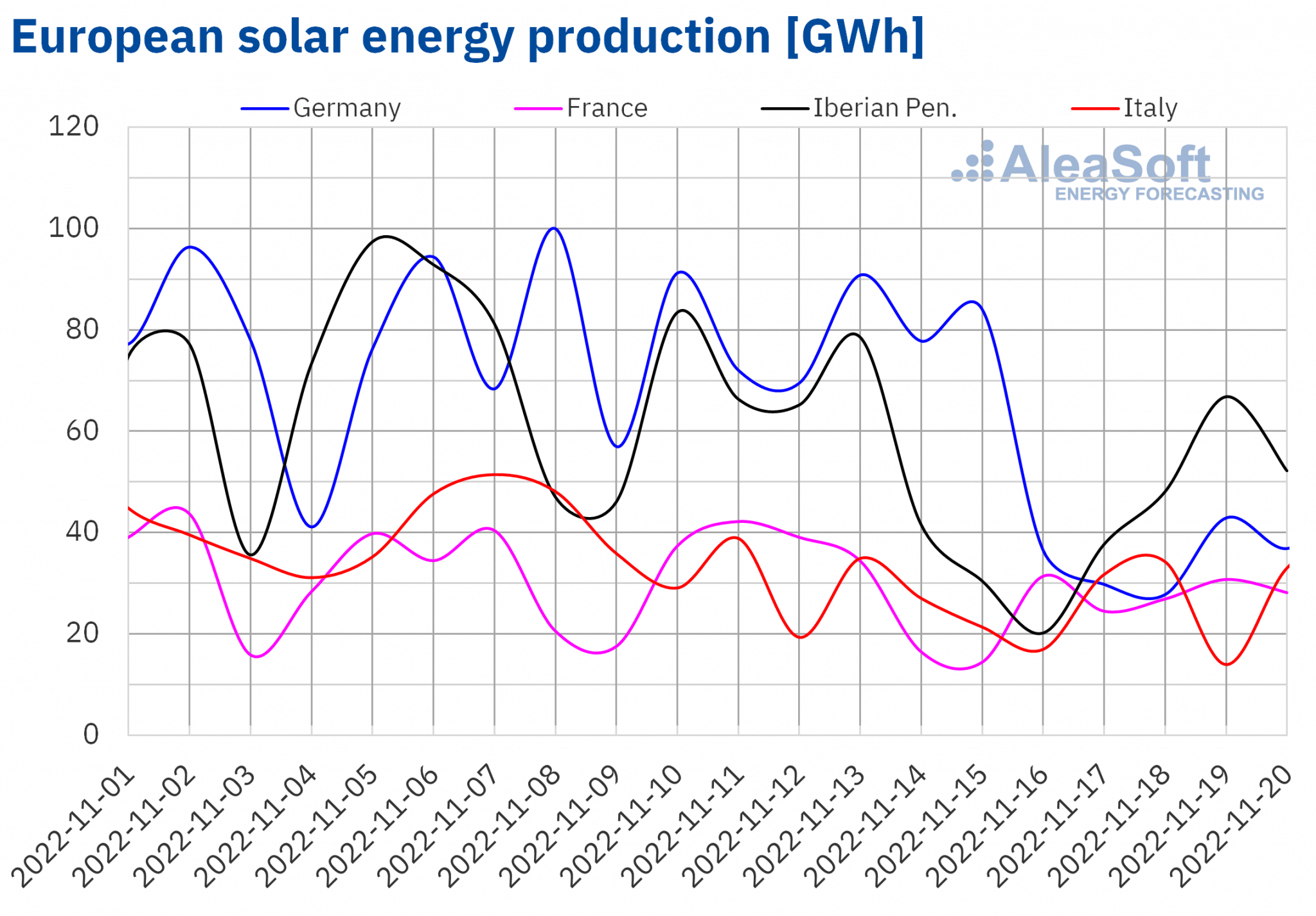

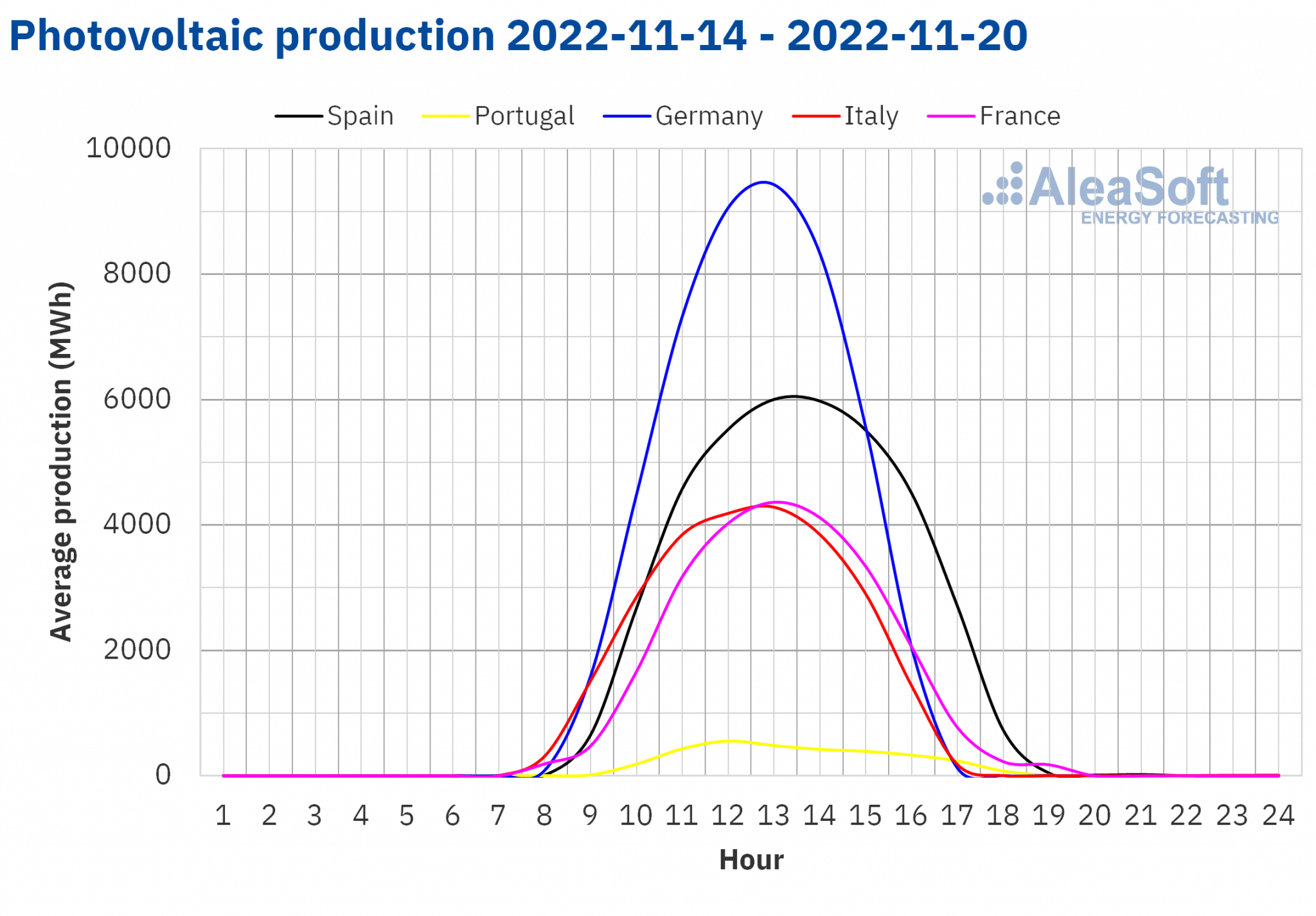

During the third week of November, the solar energy production decreased compared to the previous week in all markets analysed at AleaSoft Energy Forecasting. The smallest fall was registered in the French market and it was 26%. In the Italian market the production decreased by 31% while in the rest of the markets it fell between 36% and 46%.

For the week that began on November 21, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates a reduction in production in Spain while little variation is expected in the German market. On the other hand, an increase in solar energy production is expected in the Italian market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

During the week of November 14, the wind energy production increased compared to the previous week in most of the markets analysed at AleaSoft Energy Forecasting. In the Italian market, the production was more than double that registered the previous week, with an increase of 121%. On November 18, this market reached the highest daily production since September 17, of 129 GWh. In the Iberian Peninsula, the wind energy production rose by 81% compared to the second week of November, the production of November 16 in the Spanish market, of 388 GWh, which was the highest since March 17, and the production of November 15 in the Portuguese market, of 80 GWh, which was the highest since October 27, standing out. The French market also registered a significant increase of 25%, the production of November 17, of 282 GWh, the highest since April 7, 2022, standing out. The exception was the German market, where the production with this technology dropped by 16%.

For the week of November 21, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates a reduction in all analysed markets, except in the French market, where the production is expected to remain with little variation compared to the previous week.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

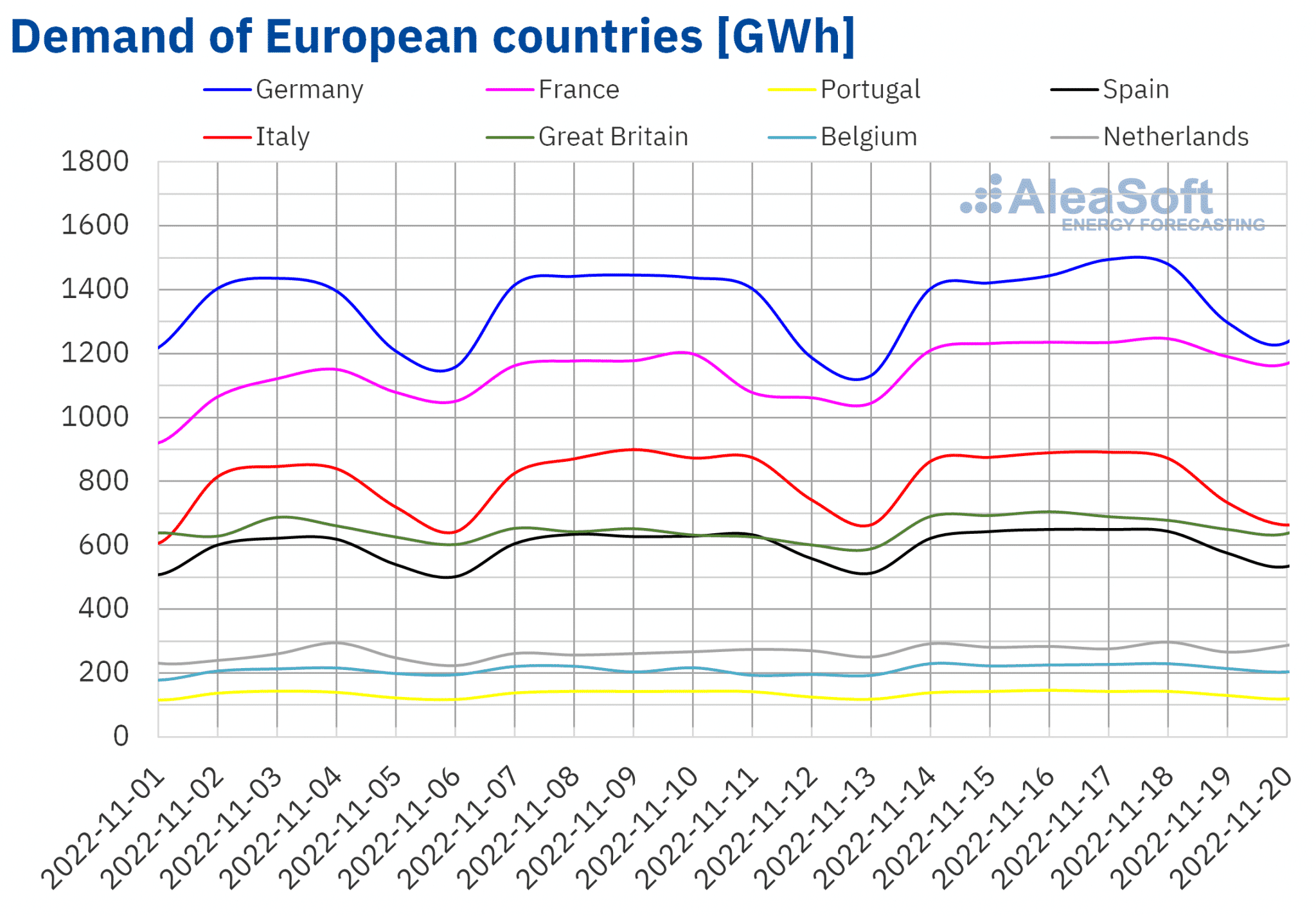

Electricity demand

In the week of November 14, the electricity demand increased in general in the analysed European electricity markets compared to the previous week. The largest increase was registered in the market of Great Britain, of 7.9%, followed by the rises of 7.8% in the market of France, 7.6% in the market of the Netherlands and 7.4% in the Belgian market. The lowest growth was that of the Italian market, of 0.7%. In the rest of the markets, the rises were between 1.1% of the Portuguese market and 3.3% of the German market. The increase in electricity demand during this period was favoured by the general drop in temperatures in European countries. In the case of France and Belgium, the recovery in demand after the holiday of November 11, Armistice Day, also had an influence.

For the week of November 21, according to the demand forecasting made by AleaSoft Energy Forecasting, it is expected to continue increasing in a large part of the European markets, mostly favoured by lower temperatures than those registered during the previous week. However, the demand is expected to decrease in the market of Belgium.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

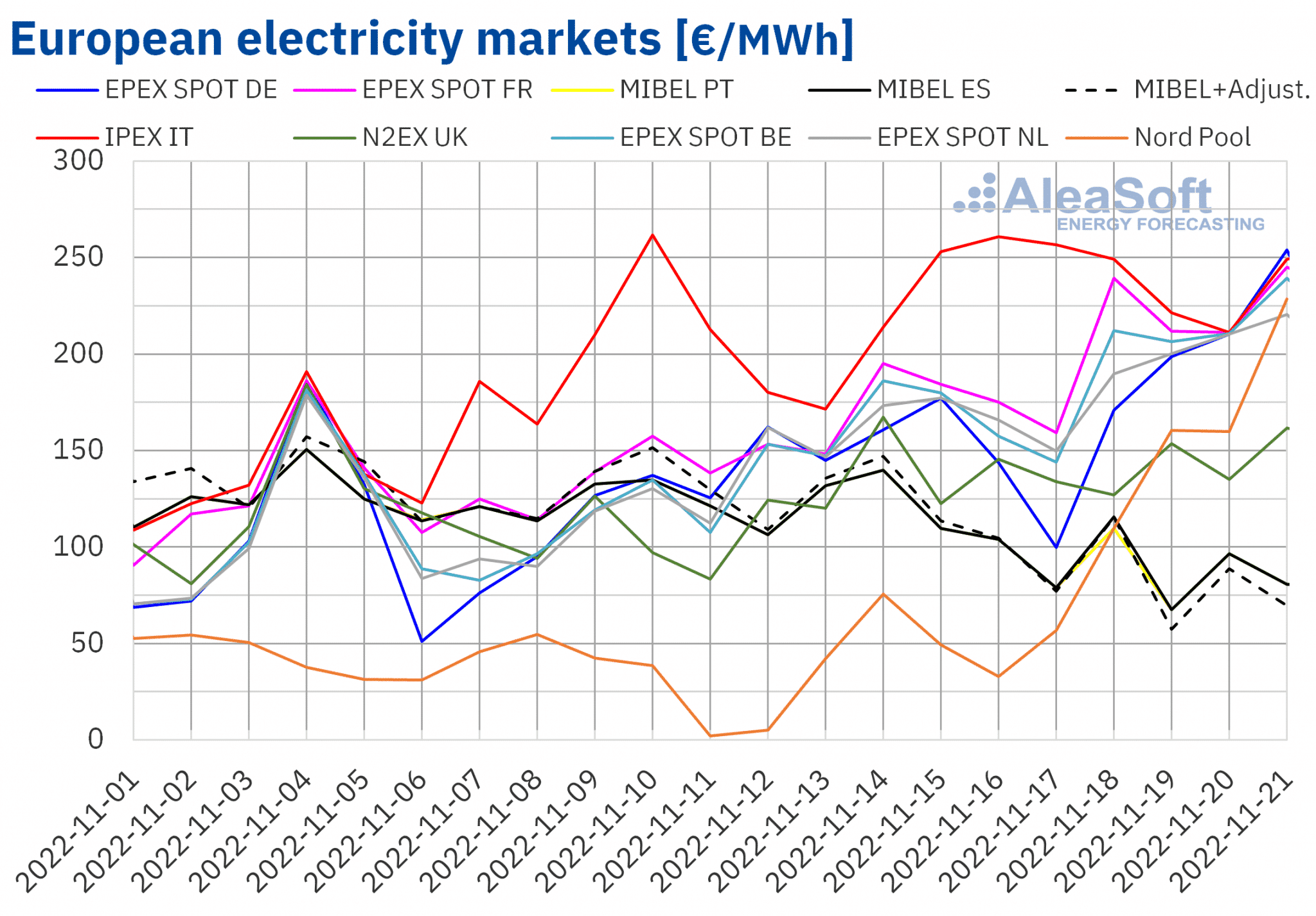

European electricity markets

In the week of November 14, prices of almost all European electricity markets analysed at AleaSoft Energy Forecasting increased compared to the previous week. However, the MIBEL market of Spain and Portugal registered decreases of 17% and 18% respectively. On the other hand, the highest percentage rise in prices, of 179%, was that of the Nord Pool market of the Nordic countries, while the smallest increase was that of the IPEX market of Italy, of 20%. In the rest of the markets, the increases were between 31% of the N2EX market of the United Kingdom and 54% of the EPEX SPOT market of Belgium.

In the third of November, the highest average price, of €238.00/MWh, was that of the Italian market. On the other hand, the lowest weekly average was that of the Nordic market, of €92.13/MWh. In the rest of the markets, prices were between €100.85/MWh of the Portuguese market and €196.58/MWh of the French market.

Regarding hourly prices, on November 21, between 17:00 and 18:00, a price of €335.88/MWh was reached in the Nord Pool market, the highest in that market since September 30. The daily price of Monday, November 21, of €228.58/MWh, was also the highest since September 30 in the Nordic market.

On the other hand, in the MIBEL market of Spain and Portugal, on Saturday, November 19, the lowest daily price since September 17, of €67.38/MWh, was registered. If the adjustment for the gas cap that some consumers have to pay in the MIBEL market is taken into account, the price of November 19 stood at €57.39/MWh, the lowest since June 20, 2021.

During the week of November 14, the 42% rise in the weekly average price of the TTF gas in the spot market compared to the previous week exerted its upward influence on European electricity markets prices. The general increase in electricity demand and the decrease in solar energy production also contributed to the registered price increases. In addition, in the case of the German market, the wind energy production decreased. On the other hand, the significant increase in production with this technology in the Iberian Peninsula allowed prices to fall in the MIBEL market.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the fourth week of November prices might continue to increase in most analysed markets, influenced by increases in demand and decreases in wind energy production in most markets. However, prices might fall in the Iberian and British markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

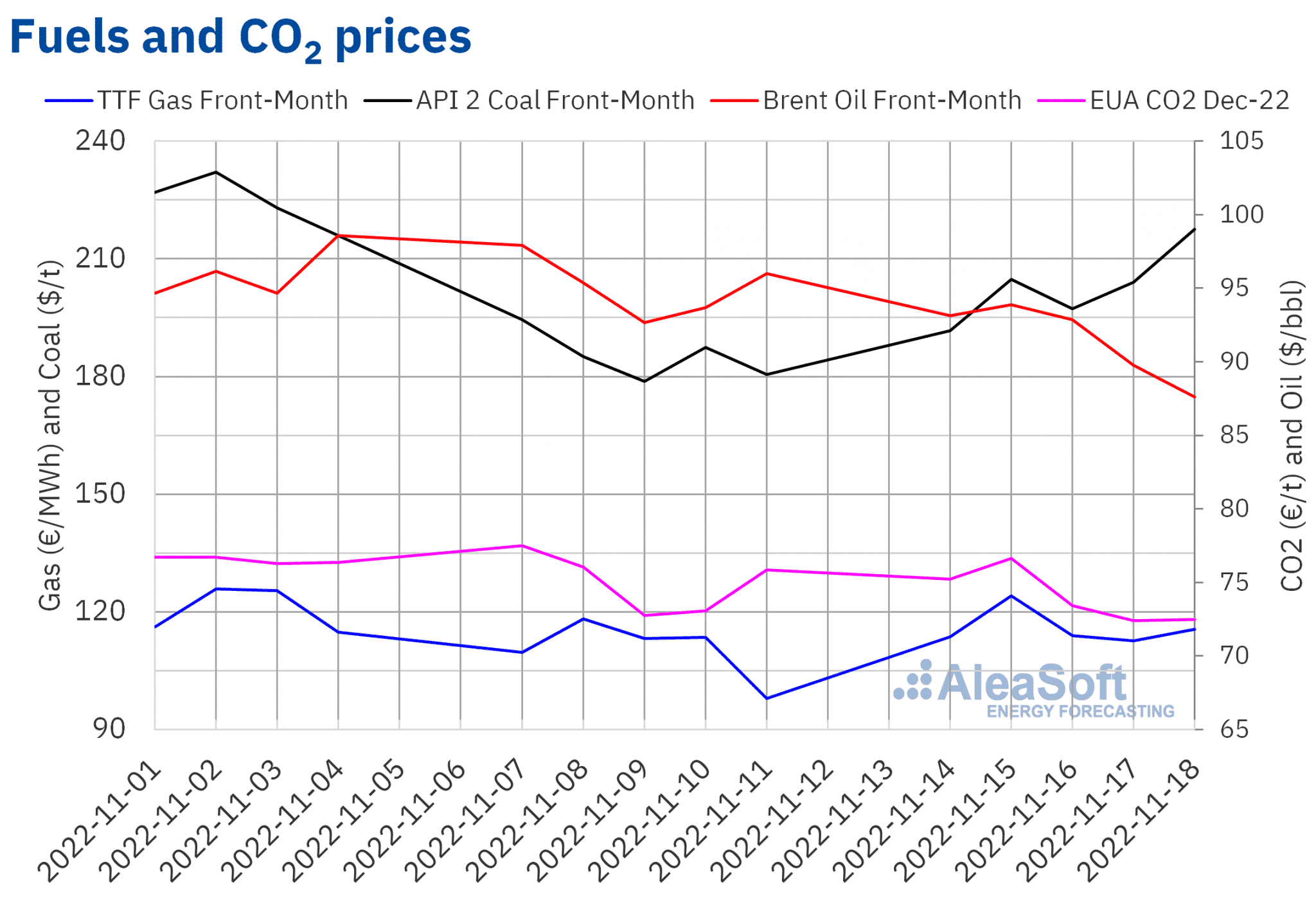

Brent, fuels and CO2

The settlement prices of the Brent oil futures for the Front?Month in the ICE market fell on most days of the third week of November. On Monday, the 14th, a settlement price of $93.14/bbl was registered, 4.9% lower than that of the previous Monday. As a consequence of the registered downward trend, the settlement price of Friday, November 18, of $87.62/bbl, was 8.7% lower than that of the previous Friday. This price was also the lowest since September 27.

Demand concerns due to the economic situation exerted their downward influence on Brent oil futures prices in the third week of November. On Monday, November 14, the OPEC lowered its oil demand growth forecast for 2022 and 2023. On November 15, the International Energy Agency also lowered its demand forecasts for 2023. In addition, the increase in cases of COVID?19 in China also contributed to concerns about the evolution of the crude oil demand and to the decline in prices in the last part of the week.

As for TTF gas futures in the ICE market for the Front?Month, after registering a settlement price of €97.85/MWh on Friday, November 11, the lowest since June 14, on Monday, November 14, they rose to €113.70/MWh. This price was 3.7% higher than that of the previous Monday. On Tuesday, prices continued to increase and the maximum settlement price for the week, of €124.10/MWh, was reached, 5.0% higher than that of the previous Tuesday. Subsequently, prices fell to €112.56/MWh of Thursday, November 17. But, on Friday prices recovered until reaching a settlement price of €115.51/MWh, which was 18% higher than that of the previous Friday.

The high levels of gas reserves favoured price declines in recent months. But the number of ships waiting to unload at the regasification plants is decreasing and the drop in temperatures might favour the increase in gas prices in the following weeks.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2022, they began the third week of November with a settlement price of Monday, November 14, of €75.23/t. This price was 2.9% lower than that of Monday of the previous week. From Tuesday to Thursday, the settlement prices registered variations lower than 1.0% compared to the prices of the same days of the previous week. However, on Friday, November 18, a settlement price of €72.47/t was registered, 4.4% lower than that of the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

On next Thursday, November 24, a new edition of the monthly webinars of AleaSoft Energy Forecasting and AleaGreen will be held. The speakers will be Oriol Saltó i Bauzà, Associate Partner at AleaGreen and Jaime Vázquez, Director, PPA & Finance at Soto Solar. Antonio Delgado Rigal, CEO of AleaSoft Energy Forecasting, and Tomás García, who works as Senior Director, Energy & Infrastructure Advisory at JLL, will join the analysis table of the Spanish version of the webinar. In the webinar, the usual analysis of the evolution of the European energy markets will be carried out. In addition, current affairs and trends in renewable energy projects financing will be analysed, comparing PPA with full merchant projects.