While the Inflation Reduction Act is set to catalyze clean energy growth, the industry continues to deal with policy and regulatory challenges hindering development and deployment of clean power. These challenges and more were apparent in ACP’s latest Clean Power Quarterly Market Report for the third quarter. ACP’s new market report shows that from July to September of 2022, 3.4 gigawatts (GW) of new utility-scale clean power capacity were installed. The third quarter is the slowest quarter since the same period back in 2019.

But a closer examination shows this tracks. Long-term policy is now in place thanks to the IRA, but regulatory and supply chain challenges abound. The solar market has faced repeated delays as companies struggle to obtain panels as a result of an opaque and slow-moving process at U.S. Customs and Border Protection. Policy uncertainty around tax incentives constrained wind development, underscoring the near-term need for clear guidance from the Treasury Department so the industry can deliver on the promise of the IRA.

Congress has yet to pass critical permitting reform that would enable clean energy development, interconnection queues to bring more clean power online continue to swell along with lead times, and transmission expansion remains inadequate. These issues will need to be resolved to realize the full benefit of the IRA.

That’s the context. Now, here are the top five takeaways from ACP’s Clean Power Quarterly Q3 2022 Market Report.

1. Third quarter shows slowest quarterly installs since Q3 2019

Roughly 3.4 GW of new clean power capacity was installed in the third quarter, down 22% compared to the third quarter of 2021. In fact, Q3 marked the slowest quarter the clean power industry has experienced since the third quarter of 2019. Year-to-date (YTD), 2022 installs are 14.2 GW, down 18% compared to the first three quarters of 2022. Difficulty sourcing solar panels and supply chain constraints have proven to be major barriers for clean power projects. Interconnection challenges and the previous phase-down schedule of the Production Tax Credit (PTC) are at work, as well. The PTC, which provides a tax credit per kilowatt hour of electricity generated for the first 10 years of generation, was previously only available to land-based wind projects that began construction by the end of 2021. Under the newly enacted IRA, the tax credit phase-out begins in latter half of 2032 or when U.S. emissions fall to 25% of 2022 levels.

By technology, 1,877 MW of new solar capacity was brought online last quarter, bringing 2022 solar installations to 7,071 MW. Battery storage, with 1,195 MW/ 2,774 Mega Watt hours (MWh) of new capacity deployed, delivered its second strongest quarter after the fourth quarter of 2021. Only two new wind projects with a total capacity of 356 MW were commissioned this quarter. Both solar and land-based wind had the lowest quarterly installs the industry has seen in several years. The third quarter was the lowest quarter for solar installs since the third quarter of 2020, and the lowest land-based wind quarter since the second quarter of 2017.

Cumulative and Annual Clean Power Capacity, 3Q 2022

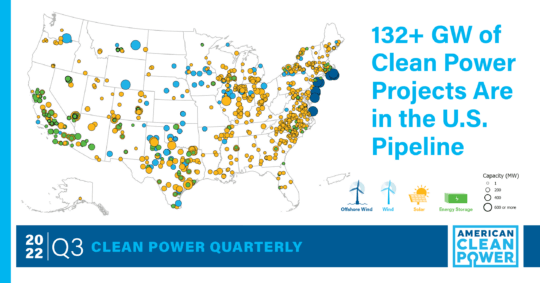

2. U.S. clean power pipeline remains stalled

At the close of the third quarter, there were 132 GW of clean power capacity in development. That is the clean energy equivalent of powering 34 million American homes. The pipeline grew just 3% last quarter, on par with the 3-4% growth experienced over the past two quarters. This is a far cry, however, from the 12% average quarterly growth the industry experienced in 2021.

The majority, 69%, of the U.S. clean power pipeline is solar capacity. Land-based wind constitutes 17% of the pipeline, offshore wind 13%, and battery storage the remaining 11%. Texas leads the nation with 23.8 GW in development, accounting for almost a fifth of the total pipeline. California sits in second with 12.8 GW in development, 98% of which is solar or battery storage. New York rounds out the top three U.S. states with 10.8 GW in the clean power pipeline, thanks in part to 4.4 GW of offshore wind capacity being developed off of the Golden State’s coastline.

3. Project delays continue to mount

Clean power project delays continued to stack up in the third quarter. Nearly 14.2 GW of clean power capacity was delayed last quarter, of which more than half had already experienced earlier delays. In total, ACP is tracking 36.2 GW of delayed projects plus a further 3.5 GW that have terminated. Projects that failed to come online in the third quarter have an expected delay of half a year, though many of these projects have been pushed back several years. Less than half of the delayed clean power capacity is expected online by the end of the year. Solar accounts for the majority of the delayed capacity at 63%. This is primarily due to an inability to obtain panels to complete projects as a result of trade restrictions. Causes of wind delays, which make up 23% of total delays, range from on-going supply chain constraints to grid interconnection delays. Battery storage projects are seeing the least amount of these effects. least, with just 14% of delays. Most delayed storage projects in the United States are co-located with delayed solar projects.

Delayed Clean Power Capacity

4. Procurement activity slows

Announcements of new contracts by clean power buyers also decelerated this quarter, though not to the same extent as clean power installations. Buyers and developers of wind, solar, and energy storage projects announced 7.2 GW of new power purchase agreements (PPAs) this quarter, down 31% from the same period last year. Year to date, PPA announcements are down just 3% compared to 2021 thanks to a strong second quarter for announcements. Commercial and industrial (C&I) purchases accounted for 43% of announcements, and utilities an additional 25%. Amazon was the largest purchaser of the quarter after announcing another 2 GW of clean power procurement in the U.S.

Q3 PPA Announcement Comparison, 2021 and 2022

5. Passage of the IRA shines light on a bright clean energy future

Supply chain issues have constrained the clean power industry in the short term. Long term, however, the recently enacted and historic IRA will boost clean power deployment to unprecedented levels. ACP’s preliminary assessment of the IRA is that the bill’s policies will deliver an estimated 525 to 550 GW of new, utility-scale clean power from 2022-2030. As a result, we now expect there will be roughly 750 GW of operating clean power capacity in 2030, enough clean energy to to supply the nine largest electricity consuming states in America. With stable policies in place, we expect annual wind, solar, and energy storage capacity installations to grow to over 90 GW by the end of the decade, more than tripling the 28 GW installed in 2021.

With the IRA’s provisions now intact, the pace of clean energy installations is expected to quicken over the course of the decade. By mid-decade, annual clean power installations are expected to reach more than 50 GW before climbing further to over 90 GW by decade’s end. For comparison, the average clean energy industry forecasts under business-as-usual conditions anticipate 335 GW of new clean power additions, with the most prolific year clocking just under 50 GW installed.

Building 525-550 GW of new clean power capacity will generate $550 to $600 billion in capital investment. More broadly, construction of these projects is expected to generate over $900 billion in economic activity and add nearly $500 billion to U.S. GDP across the decade. After construction, ongoing maintenance and operations will contribute over $14 billion to U.S. GDP each year while generating nearly $29 billion in annual economic activity.

To learn more top takeaways from the third quarter download a copy of the Clean Power Quarterly Market Report for Q3 2022 . ACP members have full access to the data from the third quarter. Not an ACP member? Inquire about joining today.

Author:

Vice President, Research & Analytics