Due to the enormous potential of Colombia in the development of wind energy, the World Bank Group designed a roadmap that projects the potential role that this offshore wind power activity can play in the energy sector in the medium and long term in Colombia.

It provides recommendations on the next steps in terms of policy formulation, planning and development of bankable projects. Two possible deployment scenarios (high and low) have been envisaged and serve as the basis for supporting analyses.

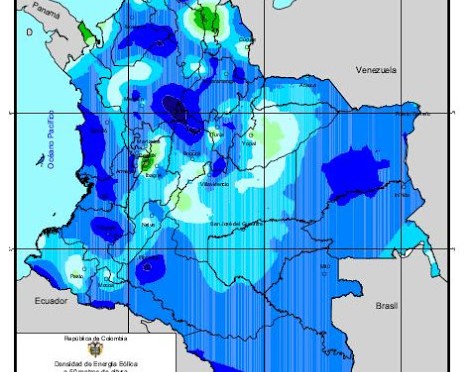

Currently the Caribbean coast of Colombia has abundant wind resources, in particular it has a total potential of approximately 109 GW of offshore wind energy. When considering various environmental, social and other constraints, the analysis reveals that there are development exploration areas of approximately 50 GW.

Estimated net capacity factors for representative project sites, which refers to the amount of electricity they could produce relative to their full theoretical potential, particularly in eastern La Guajira, approach 70% and are among the lowest. high in the world.

This roadmap was prepared by The Renewables Consulting Group (RCG), an ERM Group company, through a contract with the World Bank, and was commissioned and supervised by Mark Leybourne (World Bank Senior Energy Specialist), Claudia Inés Vásquez Suárez (Senior Energy Economist, World Bank) and Roberto Luis Estévez Magnasco (World Bank Energy Specialist).

Two possible deployment scenarios have been envisaged for the Colombian offshore wind industry:

The “low” scenario represents a hands-off approach by the government, in which offshore wind power is not incentivized and most of the growth in renewables comes from other technologies. In this scenario, it is unlikely that many of the challenges of the energy trilemma described above will not be solved by offshore wind energy and here Colombia would have to resort to other technologies to provide a solution.

Increase

The “high” scenario represents achievable but accelerated growth in offshore wind development, where the government has followed some of the key recommendations of this report and thus offshore wind is positioned as the technology for support your renewable energy ambitions. In this scenario, by 2050 many of the current challenges of the energy trilemma that Colombia faces are resolved with the large-scale deployment of offshore wind power.

One of the most challenging constraints for commercial-scale offshore wind power deployment in Colombia is the limited availability of high-voltage transmission capacity near the most important wind resource areas, that is, near La Guajira and El Magdalene.

In dialogue spaces with interest groups held in 2021, UPME reported that the existing capacity is very limited and there are no locations in the Caribbean Coast region, where the wind resource is located, that can currently accept scale injection volumes. commercial. In the medium term, this problem can be ameliorated by building a new high-voltage transmission, probably overland, and using existing rights-of-way. To unlock the high levels of offshore wind capacity envisioned in the high-case scenario, significant investments directed at the transmission system are expected to be required.

Financing

Offshore projects represent significant capital investments. For many emerging offshore markets, the first offshore projects will seek a mix of local and international lending. For debt financing, local banks can provide local knowledge and manage cash flows in local currency. International banks, on the other hand, provide insights into offshore wind projects, risk taking and loans at favorable rates. The bankability of offshore wind projects, that is, the willingness of banks to provide the necessary loans, depends on many factors.

Banks must assess the developer’s track record, political and regulatory stability over the life of the project, risk allocation and management, the business case for the project, and ensure that projects are fully aligned with international standards and best practices and comply with national regulations.

The complexity and scale of offshore wind projects is greater than onshore wind. As such, the banks will favor experienced international developers for developments, including demonstration and pilot projects. However, over time, collaboration between international and national developers can also help transfer the necessary knowledge and experience to local developers, particularly those gaining experience with onshore wind projects in Colombia.

Among the risks considered when opening new national markets for offshore wind power is the possibility that government support will be fickle across political divisions. This raises the possibility that construction investments may later be invalidated by a regulatory proceeding under a new government. It is reasonable for investors and lenders to make an in-depth assessment of the government’s stability and commitment to offshore wind power, and the longer and more favorable government policy, the better all round.

The study points out that government acts that affect the execution of the budget, the non-issuance of licenses or approvals to the developer, the nationalization of the developer’s property and other events of a political nature, must be included as an event of force majeure in the contract. power outlet.

These risks could be mitigated through the explicit inclusion of political acts and regulatory changes in the force majeure clause.

Risk allocation

The guiding principle has been that risk should be located where it can be best managed. There are some risks, such as higher operating costs, that investors will need to bear as they are well placed to manage them. If risks are assigned that are out of investors’ control, such as regulatory risks, they will require a higher rate of return to assume them or eventually, they will decide not to invest and allocate their capital to other international investment opportunities.

Business case

The main factor of bankability in a specific project will always be the business case. A well-documented feasibility study demonstrating sufficient cash flow to pay off debt and provide dividends to equity is a must. Among the many unknowns in a 25-30 year business case, a few stand out, including the cost of capital and foreign exchange risk.

The cost of capital for projects in emerging markets can be very high, particularly with local financing. An alternative is to finance in dollars or euros through international financial institutions. This could provide a significantly lower cost of capital, but at the same time increase the project’s exposure to foreign exchange risk.

On the other hand, receiving payment for electricity in Colombian pesos presents a higher cost and risk for international developers who must cover the exchange risk against liabilities denominated in other currencies, etc. This is a more acute challenge for a program on the scale of several GWs.

Colombia has financed a variety of major multibillion-dollar public infrastructure projects, such as those that have been part of 4G and 5G plans, which are comparable in cost to offshore wind plants, depending on the size of the project.

Colombia has been successful in attracting foreign capital from major institutions in the US, UK and China to support the financing of such projects, and the same is expected to be possible for offshore wind plants in the future. .

Equity structures will vary by developer/developer pool and by contract types and incentives offered. Minimizing counterparty risk and creating durable, long-term binding purchase agreements will reduce the cost of capital compared to riskier structures and reduce the cost of energy delivered to consumers.