During the month of November, many European electricity markets set record prices, and those that did not, continued at October levels that were also record at the time. The arrival of low temperatures together with high gas prices and CO2 record prices were the main drivers of these electricity prices. On the other hand, records of renewable energy, both wind and photovoltaic energy, continue in the Iberian Peninsula with large increases compared to November 2020.

Photovoltaic and solar thermal energy production and wind energy production

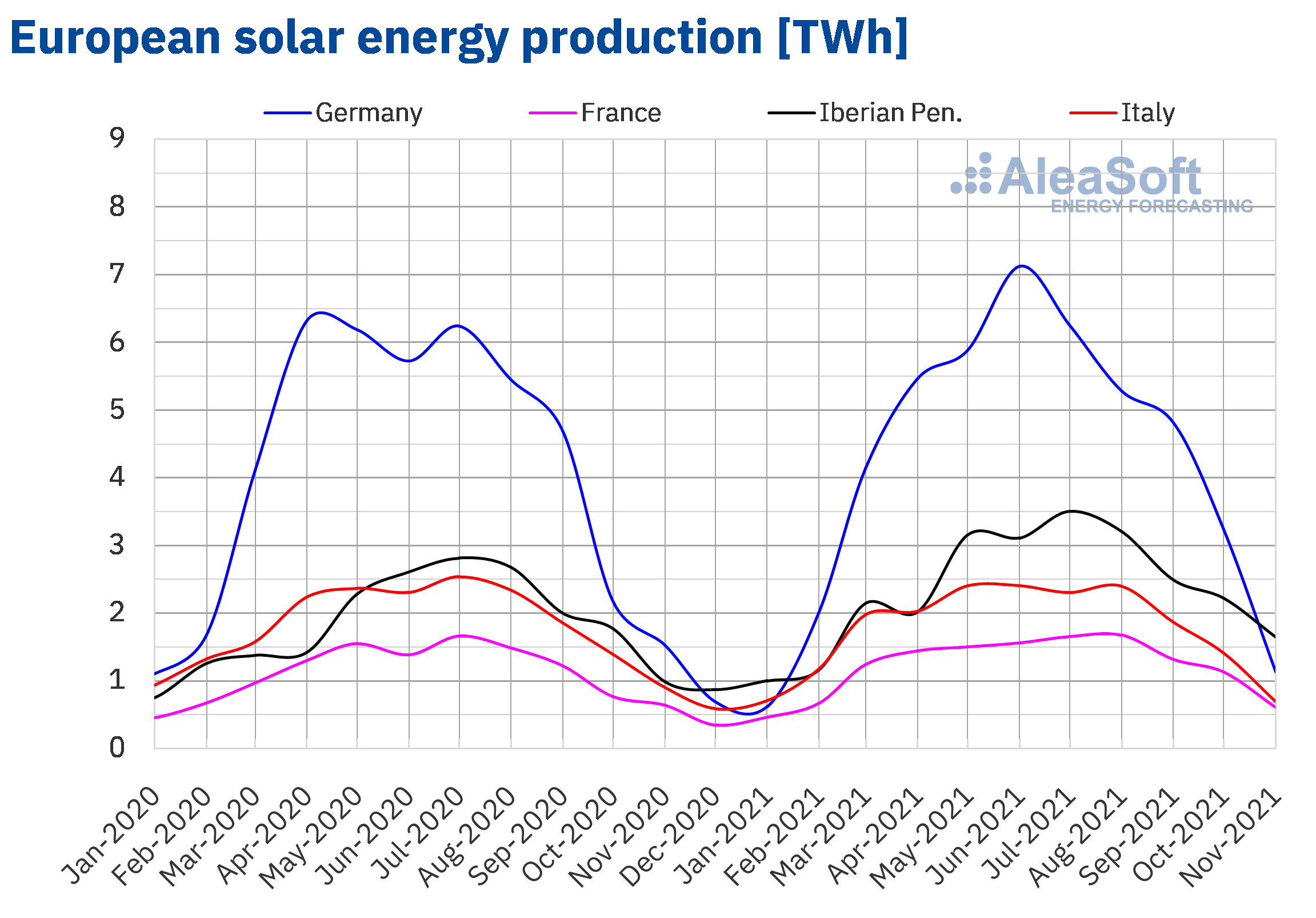

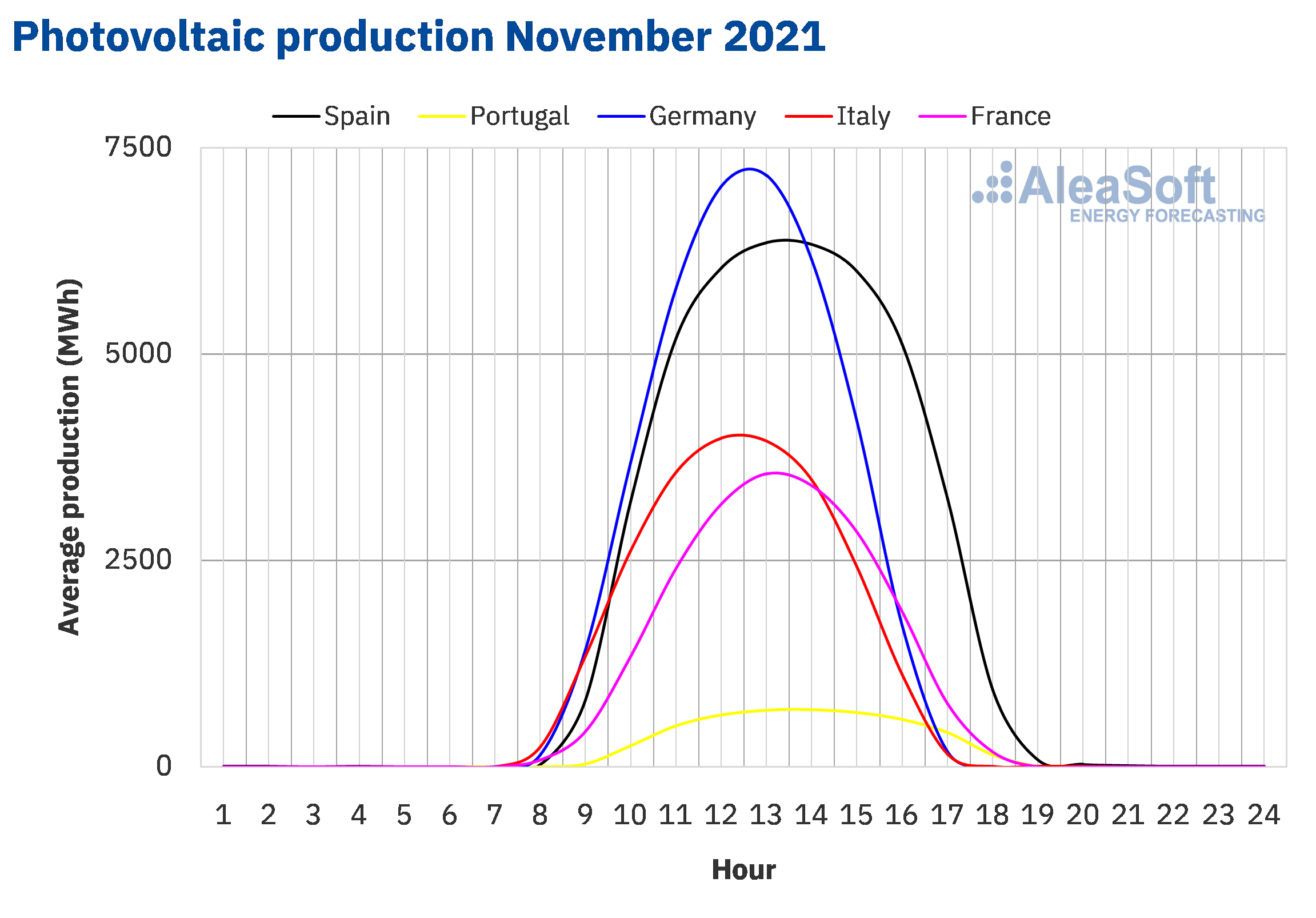

In November 2021, the solar energy production increased considerably in the Iberian Peninsula compared to that registered in November 2020, by 91% in Portugal and 67% in Spain. According to data from REN, the Portuguese system operator, between November 2020 and October 2021 the installed solar energy capacity increased by 250 MW, which represents an increase of 29%. In the case of Mainland Spain, the solar photovoltaic energy capacity increased by 2453 MW, 22%, between November 2020 and November 2021, while the solar thermal energy capacity did not change, according to data from the Spanish operator REE. In the rest of the main European markets, the production with this technology decreased year?on?year in the eleventh month of 2021, by 26% in Germany, 23% in Italy and 5.2% in France.

If the solar energy production of November 2021 is compared with that of October of this year, there was a fall in all markets that corresponds to the decrease in hours of sunshine and solar radiation. Decreases were between 13% of the Portuguese market and 64% of the German market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

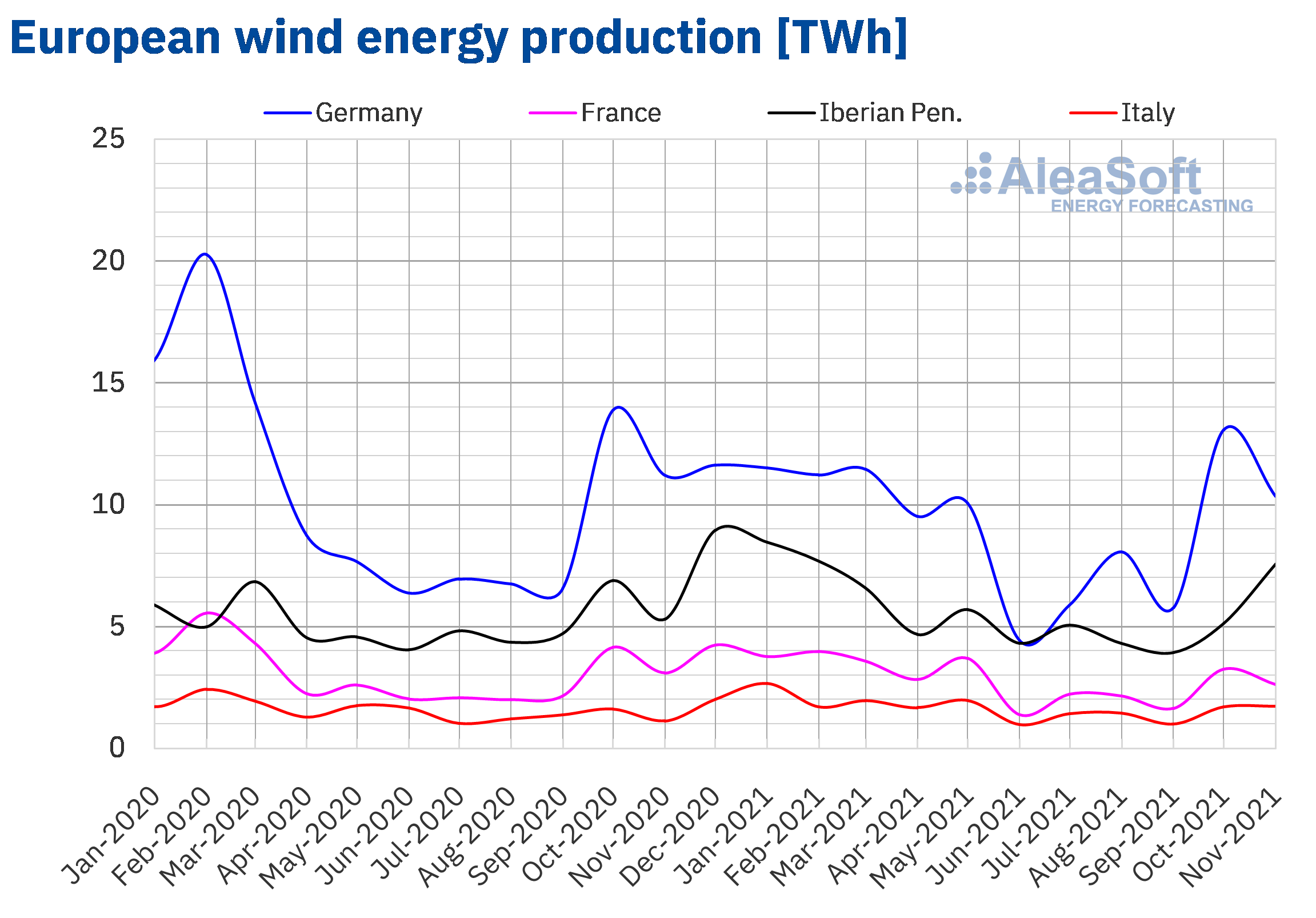

In the case of the wind energy production, in November 2021 the highest year?on?year increase was registered in the Italian market and was 57%. According to data of November 30 from Terna, during 2021 the wind energy capacity increased by 230 MW, 2.1%. There were also increases in production with this renewable energy technology in the markets of the Iberian Peninsula. In Mainland Spain, where the installed capacity increased by 589 MW, 2.2%, between November 2020 and the same month of 2021, the production increased by 52%. In Portugal, the production increased by 7.5% year?on?year while the installed capacity of this technology remained almost unchanged. On the other hand, in the markets of France and Germany, the wind energy production fell by 16% and 7.8%, respectively.

When comparing the production of November 2021 with that of the previous month, there were also increases in the markets of Italy, Portugal and Spain, in this case of 5.1%, 40% and 55%, in each case. In Germany and France, as in the year?on?year comparison, there were also falls with respect to the wind energy production of October 2021, of 18% and 17%, respectively.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

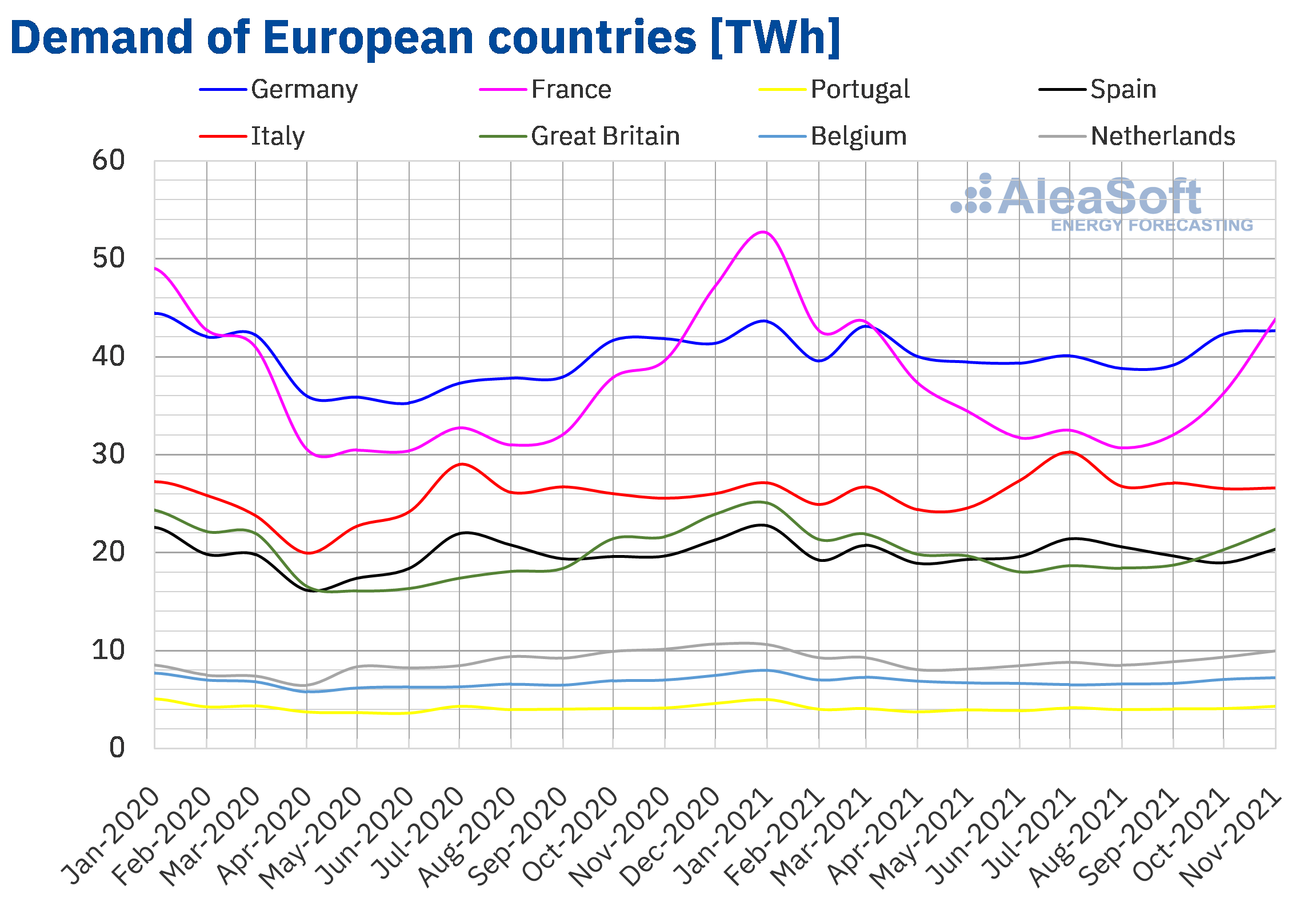

Electricity demand

The electricity demand rose in a generalised way in all European markets during November 2021, in year?on?year terms. Average temperatures in November were lower in all markets compared to the same month of the previous year, with differences of up to more than 2.0 °C in several of them. The French market had the highest year?on?year rise among European markets, registering +11%, due to the 2.6 °C drop in average temperatures. In the rest of the markets the increases were between 3.6% and 4.1%, except in Germany where the increase was 1.9%.

In the comparison with the month of October 2021, the behaviour was also upward during the month of November. As it might be expected, temperatures were much cooler in November, dropping from 4.4 °C in the British market to 6.5 °C in the Portuguese market. Electricity demand increases in the markets of France, Great Britain and Spain stand out, which were 25%, 14% and 11%, respectively. In the Portuguese market there was an increase of 9.9% and in the rest of the markets there were increases of less than 6%.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

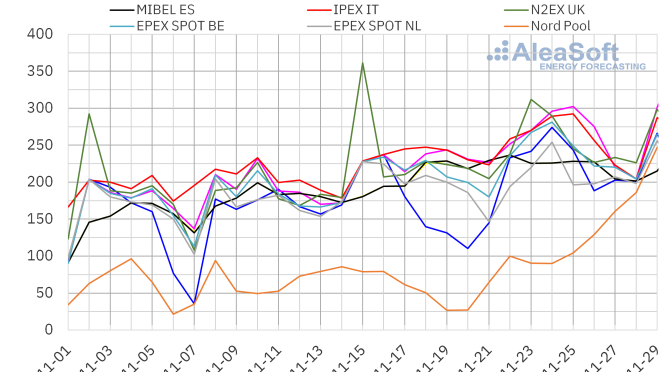

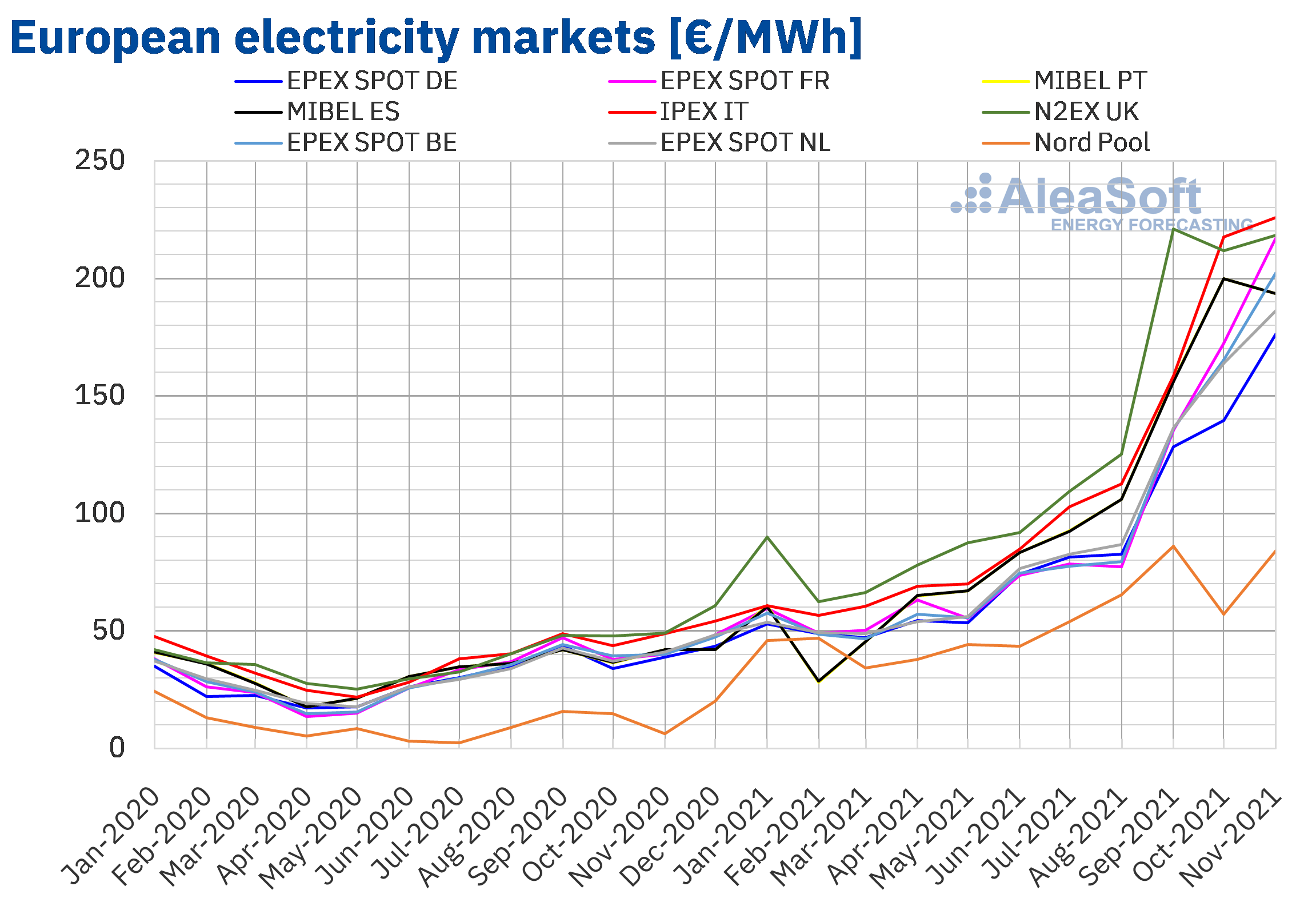

European electricity markets

In November 2021, the monthly average price was above €175/MWh in almost all European electricity markets analysed at AleaSoft Energy Forecasting, reaching over €215/MWh in some cases. The exception was the Nord Pool market of the Nordic countries, with an average of €84.05/MWh. On the other hand, the highest monthly average price, of €225.95/MWh, was that of the IPEX market of Italy, followed by those of the N2EX market of the United Kingdom and the EPEX SPOT market of France, of €218.33/MWh and €217.06/MWh respectively. In the rest of the markets, averages were between €176.15/MWh of the EPEX SPOT market of Germany and €202.15/MWh of the EPEX SPOT market of Belgium.

Compared to the month of October 2021, in November average prices rose in almost all European electricity markets analysed at AleaSoft Energy Forecasting. The exception was the MIBEL market of Spain and Portugal, with a decrease of 3.2%. On the other hand, the largest rise, of 47%, was registered in the Nord Pool market, while the smallest increases, of 3.1% and 3.8%, were those of the British and Italian markets, respectively. The rest of the markets had price increases between 14% of the market of the Netherlands and 26% of the markets of Germany and France.

If average prices of the month of November are compared with those registered in the same month of 2020, prices increased significantly in all markets. The largest price rise was that of the Nord Pool market, of 1230%. In the rest of the markets, the price increases were between 345% of the British market and 441% of the French market.

As a consequence of these increases, in November 2021, monthly prices reached historical maximums in the markets of Germany, Belgium, France, Italy and the Netherlands. In the Nord Pool and N2EX markets, prices of November were the second highest after those registered in September 2021. In the case of the MIBEL market of Spain and Portugal, where prices decreased compared to those of the previous month, monthly averages were the second highest in the history after those of October.

Regarding daily prices, the lowest daily price of the month of November, of €21.59/MWh, was registered on November 6 in the Nord Pool market. On the contrary, the highest daily price of the month, of €361.30/MWh, was reached on Monday, November 15, in the British market. Prices also exceeded €300/MWh on two occasions in the French market. In France, on Thursday, November 25, a daily price of €302.14/MWh was reached, the highest in this market since February 2012. On the other hand, the Nord Pool market, despite registering the lowest daily prices during almost the entire month, on November 29, it reached a daily price of €246.86/MWh, the highest since at least January 2011.

Regarding hourly prices of the month of November, it should be noted that on Monday, November 15, in the N2EX market, a price of £2000.05/MWh was reached at 18:00 CET. This hourly price was the highest since September 15 and the second highest in the history of the British market.

In November, the high gas and CO2 emission rights prices continued to favour the upward trend in European electricity markets prices. In addition, the generalised increase in demand both with respect to the previous month and with respect to the same month of 2020 also favoured the rise in prices during this month. In the case of the German and French markets, the decline in wind and solar renewable energy production also contributed to the increases.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

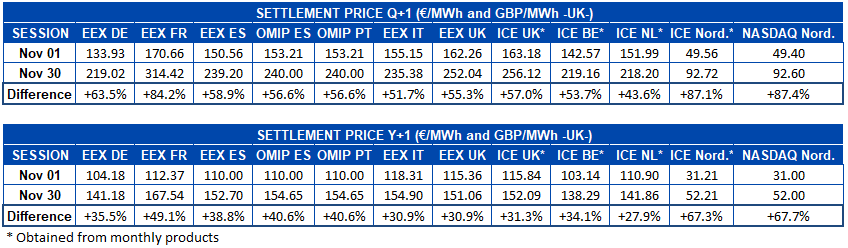

Electricity futures

During the month of November, electricity futures prices for the first quarter of 2022 registered an upward trend in general terms. In percentage terms, the NASDAQ market of the Nordic countries led these rises, with a difference between the first and last sessions of the month of more than 87%, closely followed by the price increases of the ICE market also of the Nordic region. However, the EEX market of France is where these rises were more pronounced in absolute terms, the price increased by €143.76/MWh, which corresponds to an increase of approximately 84% of its price at the beginning of the month.

A similar situation occurred with futures for next year. Rises were present in all markets analysed at AleaSoft Energy Forecasting. Also in this case, the Nordic region registered the highest percentage increases, of approximately 67% in the ICE market and 68% in the NASDAQ market. But the greatest increase in absolute terms also occurred in the EEX market of France, with an increase of 49%, rising €55.17/MWh.

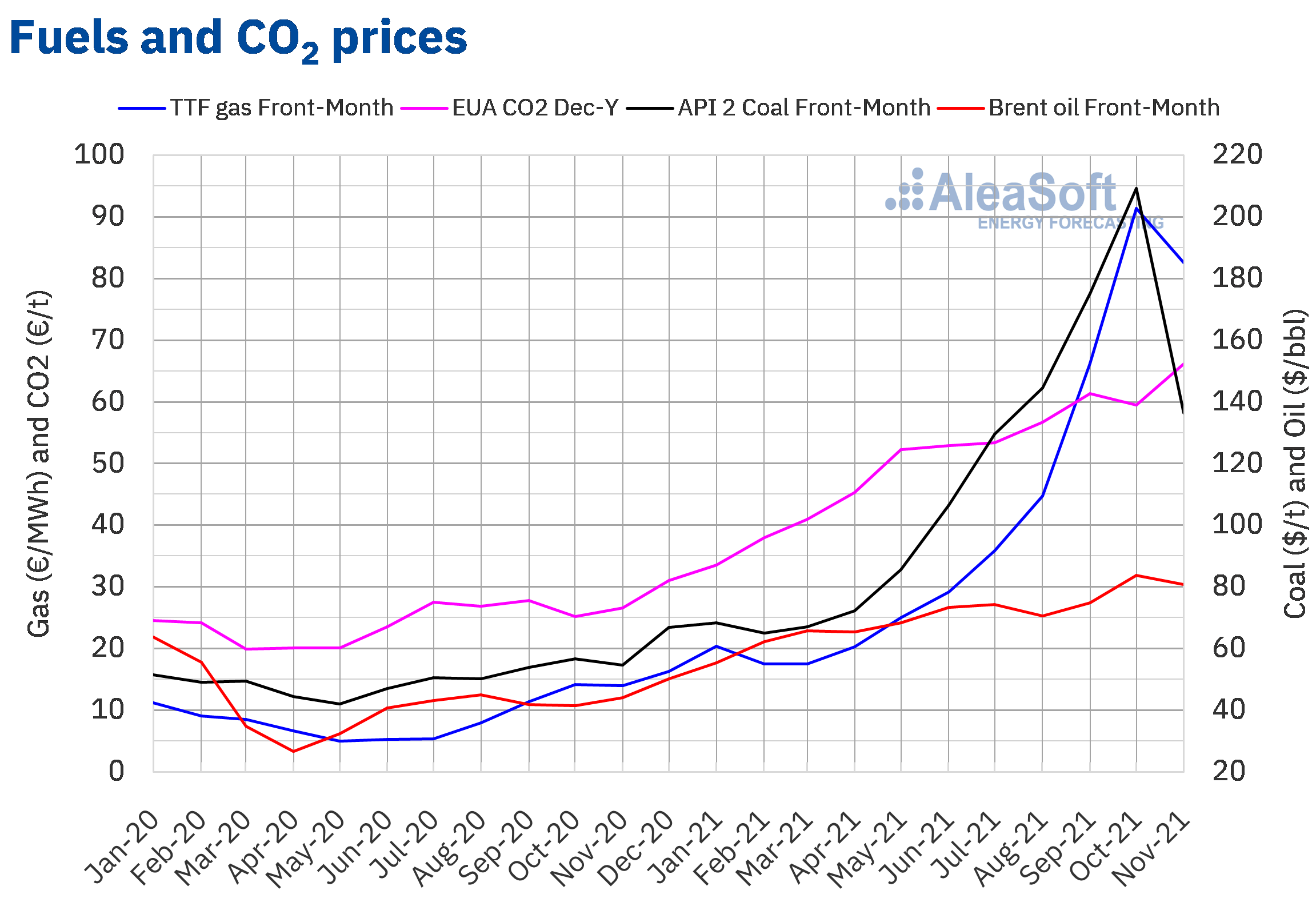

Brent, fuels and CO2

Brent oil futures for the Front?Month in the ICE market registered a monthly average price of $80.79/bbl in the month of November. This value is 3.5% lower than that reached by Front?Month futures in October 2021, of $83.75/bbl, but it is 84% higher than Front?Month futures traded in November 2020, of $43.98/bbl.

During the month of November, the progressive increase in the number of coronavirus infections in Europe and the consequent increase in confinement measures on the continent had a downward influence on Brent oil futures prices. The announcements by some countries of the possibility of using their reserves to avoid oil prices increases and the downward revision of the demand forecast for 2021 by the OPEC also contributed in this regard.

In the last days of the month, the appearance of the new variant of the coronavirus, Omicron, led to the imposition of mobility restrictions in many countries around the world. This led to the month of November ending with declines. In the last session of the month, the settlement price was below $70/bbl. The evolution of the COVID?19 pandemic and the measures adopted to try to contain the expansion of the new variant might continue to exert their influence on the evolution of prices in December.

On the other hand, the next OPEC+ meeting is scheduled for Thursday, December 2. Measures adopted at this meeting might also affect the evolution of Brent oil futures prices.

As for TTF gas futures in the ICE market for the Front?Month, the average value registered during the month of November for these futures was €82.56/MWh. Compared to that of Front?Month futures traded in October 2021, of €91.33/MWh, the average decreased by 9.6%. If compared with Front?Month futures traded in November 2020, when the average price was €13.94/MWh, there was a 492% increase.

Expectations of sufficient levels of gas from Russia in winter favoured the month of November to start with prices below €70/MWh. But during the month, various factors contributed to the recovery in prices, such as Belarus’ threats to cut off gas supplies from Russia, decreases in the gas flow from Norway, or problems in the certification process of the new Nord Stream 2 gas pipeline.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2021, these reached an average price in November of €66.12/t, 11% higher than that of the month of October 2021, of €59.48/t. If compared to the average of the month of November 2020 for the reference contract of December of that year, of €26.57/t, the average of November 2021 was 149% higher. These futures registered a generally upward trend during the month of November, reaching in the last session of the month a historical maximum of €75.38/t.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

To analyse the prospects for energy markets in Europe for the year 2022, AleaSoft Energy Forecasting is already organising the first webinar of 2022 of the monthly webinars series. The webinar will take place on January 13 and it will feature the participation of speakers from PwC Spain, who will analyse how the regulatory and electricity market situation impacts the development of PPA, both off?site and on?site.

AleaSoft Energy Forecasting offers studies and analysis of all aspects that may influence and have an impact on the energy markets: from market price forecasting in all horizons to analysis and estimates for hybridisation projects, mainly of solar photovoltaic energy with batteries, but also of solar photovoltaic energy with wind energy, and of the three, solar photovoltaic energy, wind energy and batteries.