Total wind energy installations in India are expected to reach between 48 GW to 54 GW by 2020 – well short of the government’s 60GW target. This implies that new tenders issued will be between 2 GW to 3 GW per year after accounting for the pipeline already under construction. The sudden decline in the wind power market has taken all stakeholders by surprise as this range is 60 per cent lower than the range expected over the last two years.

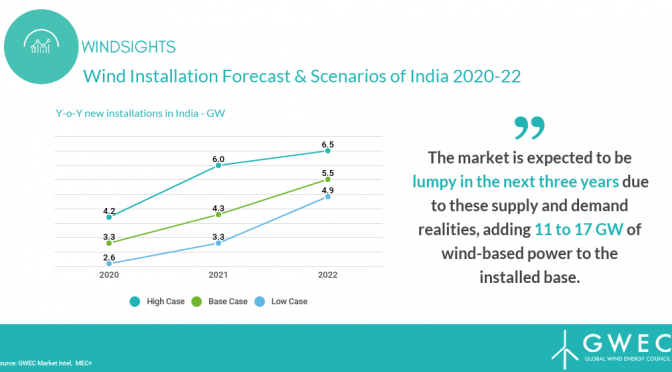

The sharp decline in expectations is driven by supply-side bottlenecks mainly attributed to sanctioning of grid and land. GWEC and MEC+ provide a scenario-based foundation for policy action by shedding light on the development of wind turbines installations in India. The report presents three scenarios exploring different development pathways of the India wind farm industry.

- Low Case = A business-as-usual scenario.

- As-if Case = A scenario that only certain pockets of constraints are resolved.

- High Case = A scenario whereby bottlenecks are opened in 2020 to drive installations during 2021-2022.

These three scenarios open up five realities for stakeholders to consider the thought of installation in India. The interplay of these realities will determine how market volume shapes up:

-

Demand projectionsThe

demand-supply outlooks in India neither take into account the current

low plant load factor for coal-based power plants nor does it account

for surplus availability of the non-performing power generation assets

due to lack of competitive fuel. A change in the economics of fuel cost

and suspension of the environmental regulations can severely impact the

demand for renewables as compared to coal in the short term. Moreover,

if renewables cost rise, due to the ending of waive offs on transmission

charges or due to the addition of the cost of balancing, coal-based

plants can become competitive. This could lead to some delays in issuing

new build orders as DISCOMs realise the most economical situation for

them.

Furthermore, unlike the markets in Europe and the US, where there is sizeable demand from corporate PPAs, the total contribution of corporate customers is low in India. This is primarily due to the high charges levied on consumers by DISCOMs to dis-incentivise them from switching. Hence, this market will remain muted or a niche. - Financing rate and tenureThe availability of finance to projects is a challenge both in terms of the amount available and the tenure for which it is lent. The average tenure for a bank loan ranges between 6 years to 10 years for a project of 25 years, creating a significant mismatch between asset and liability. At the same time, banks have become extremely cautious after facing twin setbacks of bad debts to infrastructure projects in the early 2000s and real estate firms in 2010s.

-

Tariffs realityDISCOMs

in India who buy the wind power have set their budgets at low tariffs.

Most utilities budget renewable energy procurement two years in advance –

wherein they budget both the number of units to be bought and the price

at which they are to be bought. These estimates are based on their

demand-supply situation, the average cost of procurement, and recent

market prices of renewables. Several DISCOMs have budgeted prices at the

lowest level (~INR 2.5/kWh) of renewable projects. This causes a

problem after auctions are held. If the prices discovered in auctions

are higher than the tariff budgeted for procurement, DISCOMS dither in

adopting the prices discovered during auctions. As of today, 20 – 30 per

cent of the projects auctioned in the last two years are awaiting

tariff adoption or the signing of a Power Supply Agreement.

Also, this situation is made complex by the central government’s intense focus on reducing the cost of power in auctions, subsequently leading to non-recognition of the real cost of energy – including the transmission costs and balancing costs – which are socialised as of now. These combined costs are nearly 120 per cent of the cost price for energy supply. This sudden increase in cost could shock the market expectations. - Payment delaysPayment delays on existing renewable energy projects create uncertainty for investors to further invest in the market. The total payment delay currently is small due to intermediary agencies guaranteeing payment in auctioned projects. However, it remains unclear if the agencies will be able to mitigate the risk as India nears its 100 GW renewable energy target.

- Access to wind quality sitesIndia has a large land base and a long coastline. However, the wind speeds available to most sites are low. The sites where wind speeds are suitable (above 6.5m/s) are usually remote and far away from the existing and planned grid (up to 100km). This increases the transmission costs as well as the complexity of securing the Right of Way, especially in states where local government is non-cooperative, consequently creating delays and lumpiness.

The government is aware of these realities and has done multiple consultations to resolve the bottlenecks. Some evidence is seen in the resolution of the supply side bottlenecks with the announcement of two new large renewable energy parks, removal of price caps in future auctions and strengthening its agencies to step-in for helping developers.

The future market volume will depend on the extent to which the realities are managed. Nevertheless, stakeholders must take market uncertainties into account while building their India business plans.