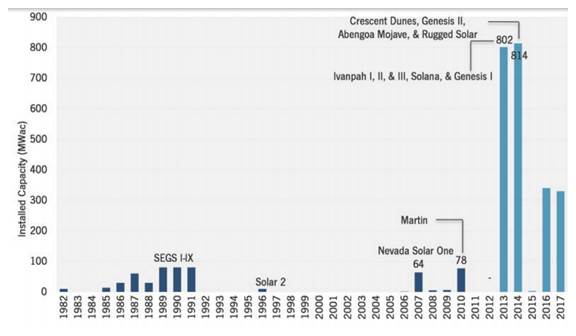

The GTM Research forecasts 802 megawatts of Concentrating Solar Power for 2013, including Abengoa’s 280-megawatt Solana Generating Station with storage.

The GTM Research Q3 2013 U.S. Solar Market Insight report, which will be released at next week’s Greentech Media U.S. Solar Market Insight conference in San Diego, forecasts 802 megawatts of Concentrating Solar Thermal Ppwer for 2013, including Abengoa’s 280-megawatt Solana Generating Station with storage.

There will be 814 megawatts in 2014, including BrightSource Energy’s 372 megawatt Ivanpah facility, SolarReserve’s 110-megawatt Crescent Dunes tower project with storage, and NextEra Energy’s 250-megawatt Genesis Solar Energy Project.

Beyond that, the picture is less clear. GTM foresees 3 megawatts for 2015, and estimates 340 megawatts in 2016 and 330 megawatts in 2017.

Planning for new concentrated solar power (CSP) development in the U.S. almost disappeared in 2013 as developers turned to smaller, more achievable PV installations.

“The 2013 trend in CSP is that not much has happened,” said GTM Research Solar Analyst Cory Honeyman. “Demand across the country has turned from large-scale projects to those in the range of 1 megawatt to 20 megawatts.”

PV has the advantage in smaller projects because CSP doesn’t readily scale, Honeyman explained, and because “declines in PV module costs have undercut trough and tower technologies and put them at a significant cost disadvantage.”

Three factors enabled CSP’s U.S. growth, according to CSP Alliance Executive Director Tex Wilkins: “Aggressive portfolio standards, the 30 percent federal ITC, and the DOE’s loan guarantee program.” But utilities have filled their RPS portfolios, the ITC’s drop to 10 percent at the end of 2016 pushes the CSP development timeline, and the loan guarantee program isn’t available, he said. “As a result, financing big projects is difficult.”

“The question is what will happen after projects with signed PPAs are completed,” Honeyman said. “There will be another wave of already-contracted projects when the ITC drops. But the future of U.S. CSP outside the existing pipeline is murky.”

Source: GTM Research Q3 2013 U.S. Solar Market Insight report, which will be released at next week’s Greentech Media U.S. Solar Market Insight conference in San Diego

The future of CSP is linked to storage, and the Solana and Crescent Dunes projects will prove that capability, Wilkins said, but, meanwhile, developers are going to international markets and industrial applications.

BrightSource Energy recently signed an MOU to build CSP in China and has signaled it wants to build on the success of its pilot enhanced oil recovery project with Chevron in California.

“As much as 80 percent of our development activity,” SolarReserve CEO Kevin Smith said, “is now international.”

Despite the crash from Spain’s revision of its FIT program, the world market is still growing. India connected its first CSP project to the grid in 2013, projects are in construction in India and South Africa, and projects went into the pipeline this year in South Africa, Morocco, Kuwait, Israel, China, Brazil, and Saudi Arabia.

SolarReserve began exploring the mining market in the last two years, first in Chile and more recently in Australia, Smith said. “There are a couple of thousand mines around the world that are off-grid and depend on trucked-in diesel fuel. They are paying, according to mine operators, $0.30 per kilowatt-hour to $0.35 per kilowatt-hour. We can come in at half that price or less, without subsidies, and save them millions of dollars per year.”

Smith says he can beat the $0.135 per kilowatt-hour PPA price for the 110-megawatt Crescent Dunes project because of the solar resource. “The Crescent Dunes tower technology will generate about 500,000 megawatt-hours per year in Nevada. The exact same technology will generate about 700,000 megawatt-hours per year in Chile.”

Even without financial incentives and with the cost of remote construction, Smith said, “the value proposition still comes out better than $100-per-barrel diesel fuel. And there is the risk of diesel price volatility. The price of solar generation is fixed for twenty or more years.”

SolarReserve has also developed a 30- to 60-megawatt version of its tower technology to serve smaller mines’ along with designing a hybrid PV-CSP facility. “PV is more cost-effective, but CSP has storage. We can maximize the return on investment by using them together, with electricity during the day from PV and at night from the CSP storage.”

Smith is confident that Crescent Dunes will go on-line in 2014. “It will be the first large-scale tower project with molten salt storage. After that, there will be a lull in CSP development. But we are working to cut costs and get the price of the delivered electricity to below $0.10 per kilowatt-hour.”

The cost of CSP remains too high, Wilkins agreed, but it doesn’t have to be. “The DOE’s target for CSP is $0.06 per kilowatt-hour. Both wind and PV were expensive until public support drove market growth,” he said. “The CSP price could come down to near that of wind and PV. But not until more projects are built.”

Between 1981 and 1991, Wilkins recalled, public support allowed developers to build nine parabolic trough projects in California’s Mojave Desert. “The first Solar Energy Generating Station (SEGS) cost about $0.24 per kilowatt-hour, but the ninth SEGS came in at about $0.12 per kilowatt-hour.”

Both Wilkins and Smith said they have heard talk about starting a public-private initiative in the U.S. to grow CSP volume and get the price to $0.09 per kilowatt-hour.

“But what is critical is storage,” Smith said. “You have to have storage with CSP or there is no business opportunity. You look like a more expensive version of PV.”

Herman K. Trabish, www.greentechmedia.com

http://www.helioscsp.com/noticia.php?id_not=2173

Concentrated Solar Power, Concentrating Solar Power, CSP, Concentrated Solar Thermal Power, solar power, solar energy, Abengoa, U.S., BrightSource Energy, cost, crescent dunes, csp, enhanced oil recovery, itc, ivanpah, loan guarantee, mining, molten salt storage, NextEra Energy, SolarReserve,