Only the United States and India added CSP facilities to their grids in 2014. However, CSP activity continued in most regions, with South Africa and Morocco the most active markets in terms of construction and planning. Spain remained the global leader in existing capacity.

Stagnation of the Spanish market and an expected deceleration of the US market after a bumper year fuelled further industry consolidation.

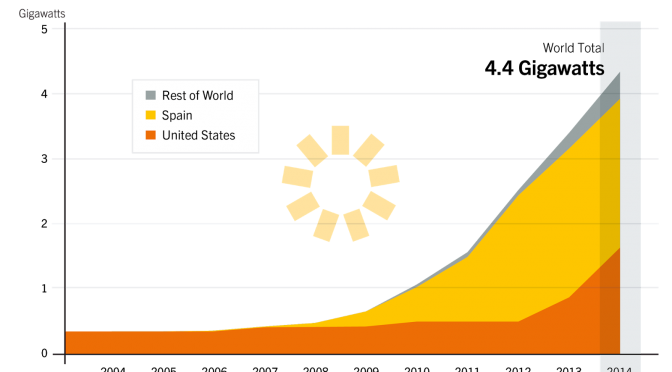

In 2014 the sector continued nearly a decade of strong growth. During the course of the year, four new projects totalling over 0.9 GW increased total global capacity by 27% to nearly 4.4 GW.

In the five years from end-2009 to end-2014, global operating capacity rose by an annual average of 46%. The United States was the global market leader for the second consecutive year, with India the only other country to bring new capacity into commercial operation during 2014.

South Africa continued to emerge as a major market, with further development and interest in CSP in other new markets with high direct normal irradiance (DNI). Although parabolic trough plants represent the bulk of existing capacity, 2014 was a notable year in terms of the diversification of the CSP technology landscape. Capacities of newly deployed parabolic trough and tower plants drew closer, with 46% of added capacity based on parabolic trough technology, and 41% based on tower technology. The increase in tower capacity was due to commissioning in the United States of the Ivanpah plant, the largest CSP plant in the world. The world’s largest linear Fresnel plant (125 MW), equivalent to 13% of global added capacity, came on line in India, further diversifying the mix of added technologies. By early 2015, parabolic trough plants accounted for just over half of the capacity under construction, while towers/central receivers represented approximately 40%.

The United States had a record year, increasing operating CSP capacity from 0.9 GW to just over 1.6 GW. Plants that came on line included the Ivanpah tower plant (377 MW) as well as

the Mojave plant (250 MW) and the second (125 MW) phase of the Genesis plant (total 250 MW), both using parabolic trough technology. The United States will see significantly less capacity added in 2015, with the Crescent Dunes parabolic trough project (100 MW) the only plant expected to come on line. India saw the opening of the Dhursar CSP plant (125 MW) and the Megha plant (50 MW), increasing the country’s installed capacity more than fourfold to 225 MW. The Dhursar plant

in Rajasthan is Asia’s largest CSP installation. The Megha plant, located in Andhra Pradesh, was the third CSP plant to be commissioned under the first phase of India’s Jawaharlal Nehru National Solar Mission. Spain remains the global leader in cumulative capacity with 2.3 GW of CSP, despite the fact that it added no new capacity in 2014. The paralysis of the Spanish market follows policy

changes implemented in recent years, including a 2012 moratorium on feed-in tariffs for new plants and the severe curtailment in 2014 of tariff rates for plants already in operation. The South African market continued to expand rapidly. At the end of 2014, four plants totalling 300 MW were under construction. These included a 100 MW facility which came on line in early 2015, two 50 MW plants expected later in the year, and a 100 MW plant expected on line in 2017. A range of other plants are under planning, with two 100 MW facilities expected to finalise funding for construction in late 2015. Morocco also was a centre of activity in 2014. Construction continued on Morocco’s Noor I plant (160 MW), which is expected to begin commercial operation in 2015. Contractors were selected in early 2015 for the further phases of the project, totalling an additional 350 MW.

Other countries with existing CSP capacity that did not bring new facilities on line in 2014 include the United Arab Emirates (100 MW), Algeria (25 MW), Egypt (20 MW), Morocco (20 MW), Australia (13 MW), and Thailand (5 MW). Several additional countries had small pilot plantsi in operation, including China, France, Germany, Israel, Italy, South Korea, and Turkey. The year saw tangible progress for CSP in new markets, including in Africa, Asia, Latin America, and the Middle East. China, for example, started construction on its first commercial CSP project: the 50 MW Qinghai Delingha plant, based on parabolic trough technology.

CSP activity continued in the Middle East where, in 2014, Kuwait selected preferred bidders for a 50 MW plant and advanced the development of further capacity based on Integrated Solar Combined Cycle technology (ISCC). An ISCC plant also was at an advanced planning stage in Saudi Arabia. In Israel, as of early 2015, a 121 MW plant was being planned, as was a 10 MW hybrid CSP-biomass plant with thermal storage. Farther south, in Namibia, CSP planning remains in a preliminary phase, while elsewhere in the Southern Hemisphere, construction commenced on Chile’s first gridscale CSP facility. The Cerro Dominador plant (110 MW) in Chile’s Atacama Desert is expected to be on line in 2017; with its 18 hours of thermal storage capacity, it is expected to provide baseload power to mining operations. Australia is home to a handful of potential CSP projects, although they faced an uncertain funding and policy landscape in 2014.

Further examples of hybridised CSP technologies appeared in 2014, including the planned ISCC plants in Kuwait and Saudi Arabia. In the United States, construction is under way on the world’s first CSP-geothermal plant, while construction of the Cogan Creek Solar Boost project in Australia (which will supplement existing coal-based power generation capacity) continues to advance, although on a delayed schedule. A small pilot CSP-biomass hybrid system came on line in Italy, and another was under planning in India. Hybridisation of CSP is being driven by a range of motivations, including the reduction of emissions at fossil fuel plants and the improved economics and reduced variability provided by CSP with thermal energy storage.

The industrial consolidation experienced in 2013 continued in 2014, fuelled in part by the ongoing stagnation of the previously dominant Spanish market and by an expected deceleration in the United States after a bumper year. French linear Fresnel specialist AREVA confirmed plans to close its CSP business, after experiencing significant losses. The move was seen as a blow to the wider commercial advancement of linear Fresnel technology. Schott Solar announced a re-organisation of its production set-up and a halt in receiver manufacturing at its Mitterteich plant in Germany due to low demand; production of glass-metal seals at the facility will continue. The top companies in 2014 included Abengoa, Acciona, ACS Cobra, Elecnor, Sener/Torresol Energy and FCC (all Spain); Brightsource and Solar Reserve (both United States); ACWA Power International (Saudi Arabia); and Schott Solar (Germany). All were involved in either one or a combination of activities including project development, construction, ownership, operations and maintenance, and manufacturing. Abengoa Solar maintained the world’s largest portfolio of plants in operation or under construction, with equity in 25% of the capacity that was added in 2014, and in around 60% of the capacity under construction at year’s end. Swiss company ABB exited the CSP market in 2013 with the sale of its shares in Novotec Solar, but its French counterpart, Alstom, became increasingly involved in the sector during 2014. Also in 2014, the Saudi Arabian government and privately owned Saudi conglomerates continued a range of strategic acquisitions of international CSP companies and established strategic alliances with research organisations. Thermal energy storage (TES) using molten salt is in commercial use in Spain and the United States. Given the growth of variable solar PV and wind power, and the role that CSP with TES can play in grid reliability, CSP research continued to focus heavily on the improvement of TES systems, and on the evaluation of alternative heat transfer media. TES solutions under development and/or evaluation in 2014 included: solid-state concrete heat storage; high- and low-temperature metal hydride beds for low-pressure heat storage (potentially allowing longer material life cycles and avoiding freezing of the heat-transfer fluid); the use of sand in a fluidised bed for heat storage; and the use of phase-change materials to achieve higher energy densities. Solar forecasting also is becoming an increasingly important research focus at a number of laboratories and research institutes, which are developing and refining methodologies for predicting short- and medium-term weather patterns and operating plants accordingly. The development of cost effective methods for accurately measuring solar resources is also a high-priority research area.

CSP continued to face challenges from falling solar PV prices in 2014, and it remains more expensive than many other renewable power generation technologies. However, cost reduction and optimisation strategies (including a trend towards larger plants and greater economies of scale, as evidenced by the opening of two of the largest CSP plants in the world, Ivanpah and Mojave) are leading to improvements in overall costs of deployment. Abengoa reported an approximate halving in electricity costs at new plants in South Africa, relative to older plants operating in Spain, while ACS Cobra noted its experience that CSP with storage has the potential to compete with natural gas, given the right DNI levels. ACWA also reported competitive pricing for its parabolic trough and tower plants under under construction, or due to enter construction, in Morocco.