Danish wind turbine maker Vestas saw its mainland market share drop to 3.2 per cent last year from 23.6 per cent in 2006, while at Spain’s Gamesa it fell to 1.6 per cent from 15.9 per cent and at America’s GE it fell to 1.1 per cent from 12.7 per cent, according to China Wind Energy Association.

Despite joint ventures with local wind energy firms, overseas wind turbine makers have found the business environment tough on the mainland.

New production capacity has seen wind turbine prices fall from over six million yuan per megawatt to under four million yuan in the past few years.

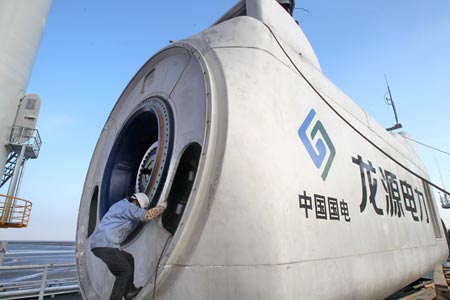

Overseas wind turbine makers have seen their market share on the mainland shrink and two Sino-foreign joint ventures have either ended in divorce or struggled to flourish in the world’s largest wind power market.

Industry executives said their troubles were partly due to aggressive capacity expansion by local firms that focused on short-term volume and market share gains at the expense of long-term, sustainable development.

“The biggest problem in the mainland market is the lack of a system [to ensure] quality development,” Liu Qi, the deputy general manager of Sino-foreign joint venture Shanghai Electric Wind Energy/Siemens, said at last week’s China Wind Power conference. “After a round of expansion speed and volume chasing, some producers lacking in product quality have already disappeared.”

He said the mainland market could draw on the experience of developed markets, where banks and insurance firms acted as key independent parties to help ensure wind power projects delivered on their power output and revenue targets.

On the mainland, many projects were based on relations between firms and governments, he said, without being subjected to stringent economic scrutiny.

The mainland’s product quality certification system also had a lot of catching up to do in terms of verifying compliance, Liu added.

New production capacity has seen wind turbine prices fall from over six million yuan (HK$7.6 million) per megawatt to under four million yuan in the past few years, resulting in low industry profits during 2012 and most of last year.

Two years ago, state-backed Shanghai Electric and Germany’s Siemens set up two joint ventures on turbine production and sales.

Liu said while the “marriage” still existed, their “married life has not been too happy”, adding the complex structure of the joint ventures resulted in great operating difficulties, high administrative costs and low efficiency.

“The top management of both firms have already taken notice … we will make some changes so that Siemens’ global advanced offshore turbine technology and international project management experience, and Shanghai Electric’s advantages in market localisation can be fully tapped,” he said.

The joint venture had won contracts to supply equipment for four of the eight offshore wind farm projects tendered this year, which would support its operation in the future, he added.

Harbin Electric and GE formed two joint ventures on the mainland about three years ago, one to produce offshore turbines and the other for onshore turbines. They were ended last year, with Harbin citing unfavourable market conditions and divergent development directions.

Li Feng, general manager of China renewable energy business at GE Power and Water, said: “A joint venture is not about the marriage but how you live your lives together … it is not only about the products, often it is about working out the partners’ differences in culture and philosophy.”

Justin Wu, head of Asia research at renewable energy consultancy Bloomberg New Energy Finance said, however, that some foreign makers of specialised components had thrived.

Foreign firms would also find opportunities in after-sales service, as wind farm operators would have to either deal with turbine maintenance in-house, contract out to service providers or buy warranty extensions.

http://www.scmp.com